-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing: Its all about Inflation

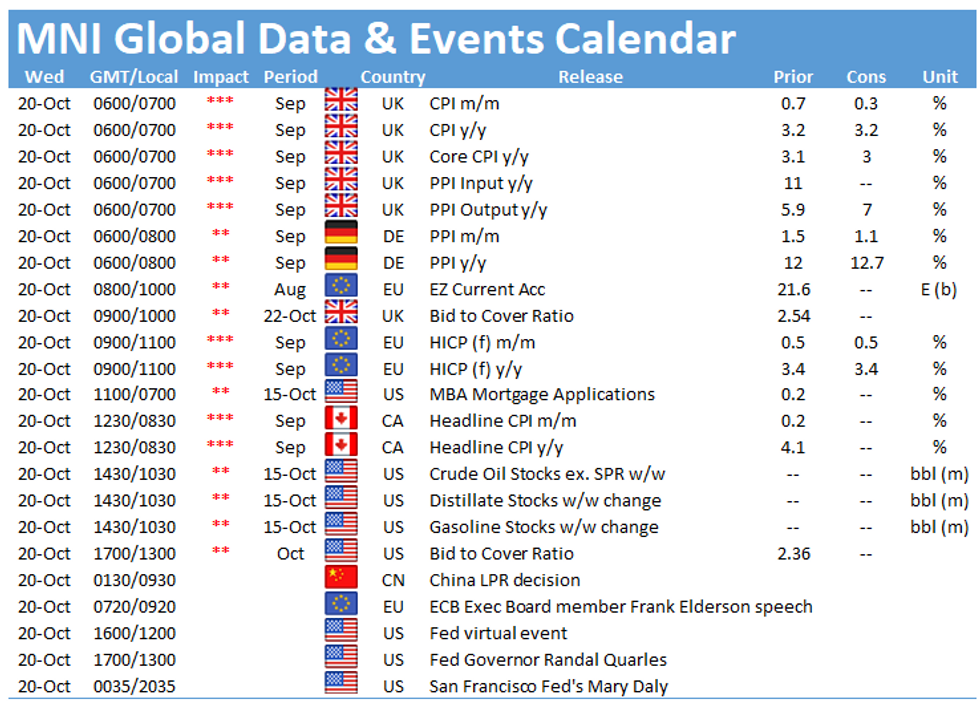

Inflation data will be the prime watch Wednesday, with releases expected from the UK, Euro Zone and Canada.

UK Sept CPI Seen Steady at 6-Year High ((0700 BST)

UK consumer price inflation likely steadied at an annual rate of 3.2% in September, according to City analysts, matching the biggest rise since March 2012, although that would obscure rising price pressures across the economy, as August data were artificially lifted by the Eat Out to Help Out scheme, which reduced the price of food and drink a year earlier. Distortions from the programme, designed to help hospitality businesses ravaged by Covid, accounted for 0.69 percentage points of the record-high 1.22pp increase in CPI between July and August.

Statistical anomalies arising from the EOHO scheme were likely to exert "a temporary effect" on inflation, according to ONS officials last month. However, prices rose in nine out of the 12 major CPI divisions in August, suggesting economy-wide pressures. Used car prices are likely to lift the index again, after rising by an annual rate of 21.4% in August, according to Autotrader, after a 17.2% jump in September (the ONS estimated the rise in second-hand cars at 18.3%). The surging price of used cars added 0.06 percentage points to the change in CPI in August.

Core CPI fell slightly, to 3.0% in September, according to forecasters, from a near-decade high of 3.1% in August.

Policy makers will also focus on surging producer price inflation, with the price of a range of commodities soaring over the past several months. Analysts believe output PPI rose by an annual rate of 6.8% last month, from 5.9% in August, the fastest pace since November of 2011. Input PPI is expected to rise to an annual rate of 11.8% in September, up from 11.0% in August, the highest level since October of 2008

Eurozone final inflation seen in line with flash (1000BST)

Eurozone September inflation is expected to be unchanged on flash readings, with the m/m data seen at 0.5%, with the Y/Y reading confirmed at 3.4%.

Canadian Inflation set for near two-decade high (1330BST)

Canadian consumer prices are seen advancing at the fastest pace since 2003 in the report for September due Wednesday at 830EST, on supply bottlenecks, food costs and base effects around last year's plunge in gasoline prices.

The CPI will rise 4.3% in September from a year ago according to an economist consensus, faster than August's 4.1% pace. It would be the sixth month where inflation exceeds the top of the central bank's 1%-3% target band, and Governor Tiff Macklem told reporters last week most price pressures appear narrow and temporary, though he could act if needed to contain things.

That view of a narrow price gain will be tested if the average of the BOC's three core rates advances further-- it was 2.6% in August, well ahead of the Bank's 2% target for total inflation. The headline inflation rate peaked at 4.7% in 2003. The BOC's July projection was for a 3.9% quarterly average in the third quarter before slowing to 3.5% in the fourth quarter.

After Tuesday's flood of policymaker comments, Wednesday slows significantly. ECB executive board member Frank Elderson speaks, as do Fed Governor Randy Quarles and SF Fed President Mary Daly.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.