-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing: Turkey Voting For Rate Cuts

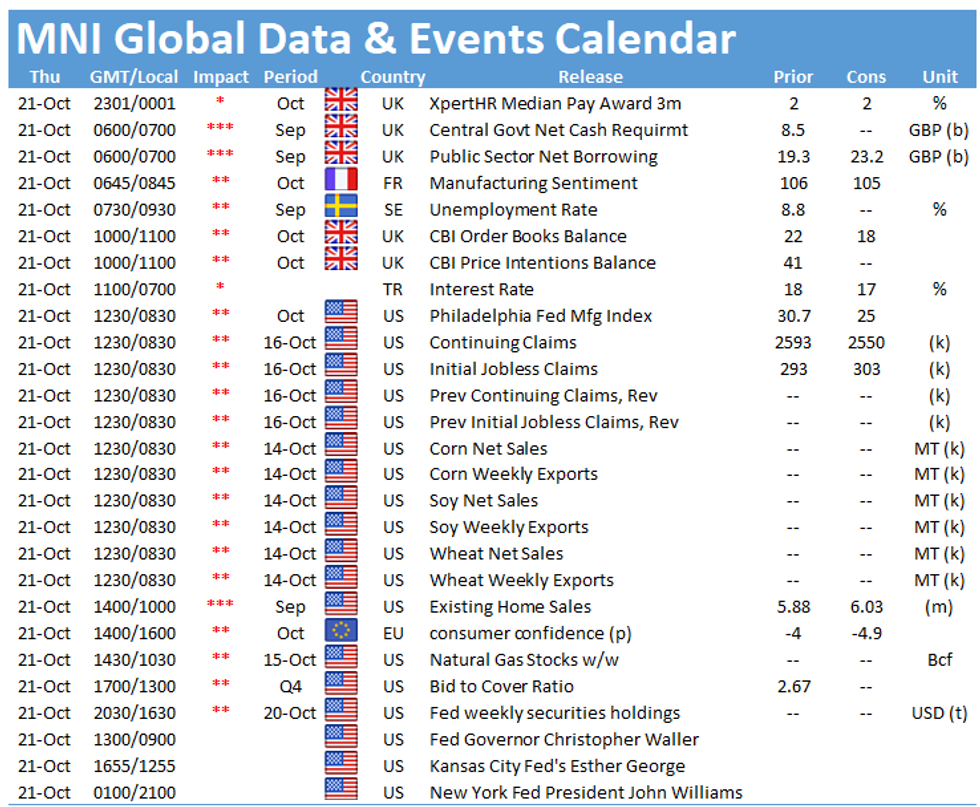

A full data calendar expected Thursday, with UK public finances -- the last series before next Tuesday's Budget -- the early highlight.

UK Sept Borrowing Set To Widen Ahead of Budget (0700BST)

UK public sector borrowing is set to widen in September, according to City analysts, but downward revisions to back data have left government finances in better shape than anticipated during the depths of the recession. Borrowing rose to GBP22.6 billion from GBP20.014 billion in August, a figure revised downward by GBP500 million from the original release in September. If forecasts are confirmed, borrowing would remain significantly below the GBP25.673 billion recorded a year earlier.

The data are the last official assessment of public finances ahead of Chancellor of the Exchequer Rishi Sunak's budget on 27 October. While the pandemic has ravaged the government's financial position, borrowing estimates remain well below OBR predictions when the recession began. Borrowing numbers have been revised downward in every month since April of 2020, with revisions averaging GBP3.8 billion over the course of this year.

Government interest payments are likely to have declined significantly from the GBP6.3 billion disbursed in August. RPI decreased by 0.1 percentage point between June and July, the reference period for September payments, compared to a 0.6 percent point jump between May and June, the reference period for August.

Borrowing will be inflation by a GBP800 million divorce instalment payment to the European Union, following similar-sized outflows in July and August. A new EU invoice for the fourth quarter was due for issue in September.

Turkey Central Bank set for cut (1200BST)

The CBRT are broadly expected to reduce its one-week repo rate by 50-100bps this week with visible signs of frustration from Erdogan bolstering the political influence component of the bank's 'revisionist' stance on policy, our emerging markets desk write. This comes against a backdrop of rising inflationary pressures on a global scale as the CBRT loosens its policy setting into oncoming CPI tailwinds.

Both headline and core CPI rose in September, printing y/y at 19.58% & 16.98% respectively (vs 19.25% & 16.62% prior), while PPI dipped slightly to 43.96% vs 45.52% prior. Food prices and supply-induced factors were highlighted as the key drivers of the higher print but were labelled as transitory in numerous statements by CBRT governor Kavcioglu. Here, we see pricing data being a less dominant driver in the decision-making process under the bank's new 'revisionist' framework, with rising core metrics doing little to deter policymakers from easing directly into more pronounced domestic and global inflationary headwinds.

Fed speakers are to the fore Thursday, with comments expected from Board Governor Christopher Waller, KC Fed President Esther George and NY Fed President John Williams.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.