-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

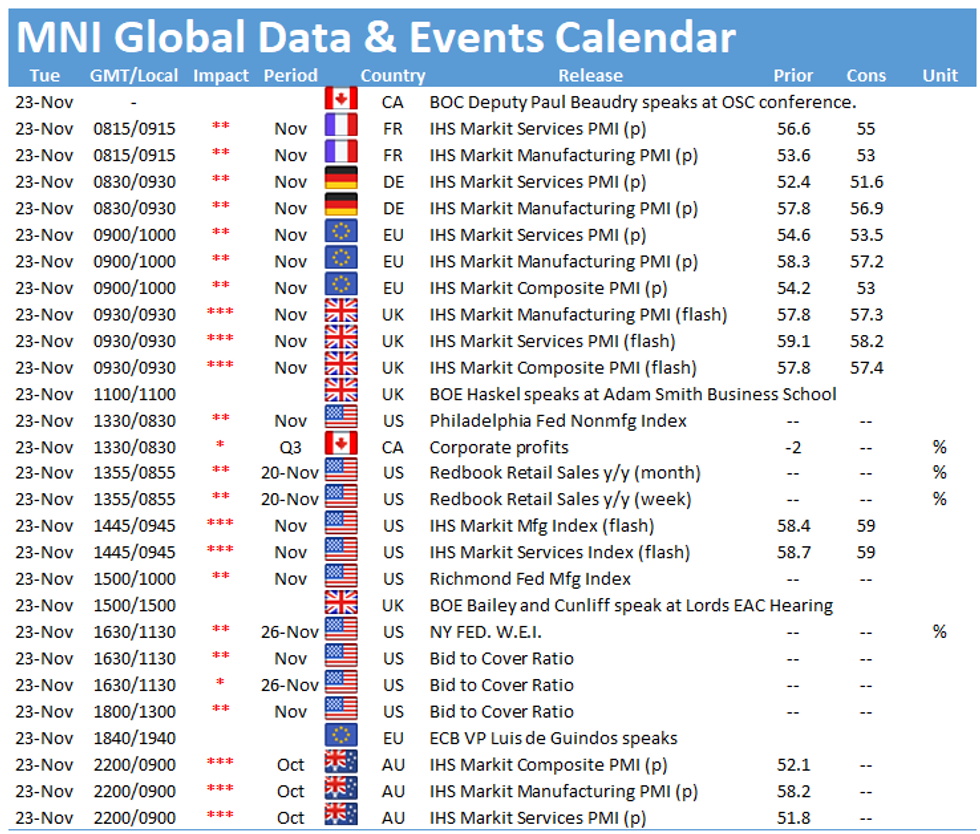

Free AccessMNI GLOBAL MORNING BRIEFING: PMI Tuesday

Tuesday is a big morning for flash PMI data across the UK, Eurozone and US. Markets expect the flash PMIs to reflect readings remaining above the break-even mark of 50, however exhibiting declining confidence across the board. Across the region, inflationary pressures on prices as well as uncertainty surrounding further covid restrictions are being felt by consumers. Further supply bottlenecks and high energy prices continue to hinder manufacturing, particularly in Germany. Last week's annual Eurozone inflation came in at 4.1% for October, with Lagarde commenting on Friday that premature tightening will be avoided. US inflation is currently running above 6%

With flash PMI readings across the UK and Eurozone trending lower, focus will be centred on government decisions regarding potential lockdowns across the Eurozone in the upcoming weeks and months.

France flash PMI (0815GMT)

French headline manufacturing PMI is seen marginally lower on October's reading of 53.6 to 53.0 for November. Consensus expects France's services PMI to come in at 55.5 for November, down just over one point from 56.6 in the previous month.

Germany flash PMI (0830GMT)

Following suit, the flash estimates for German PMI see forecasted declines of around one percentage point on all three indexes.

German manufacturing PMI is expected to be 56.8 for November, following an October reading of 57.8, due largely to persistent supply shortages and rising input prices hampering industrial production. This was reflected in Friday's producer prices surpassing forecasts, with October's yearly PPI reading reaching 18.4%. Germany's services PMI is also set to slow down, projected to reduce slightly less than manufacturing, coming in at 51.5, down from 52.4 in October.

Eurozone flash PMI (0900GMT)

For the Eurozone as a whole, flash PMI estimates for November are forecasted to drop by 1 to 1.2 points for services, manufacturing and the composite reading.

Manufacturing and services flash PMI readings are forecasted to dampen to 57.3 and 53.5 for November, down from October with 58.3 and 54.6 respectively. It is worth noting that the recent surge in Covid cases across the region implies the possibility of substantial downside risks with Austria, Belgium and the Netherlands entering lockdowns.

The composite flash forecast highlights a slightly stronger dampening to 53.0 for November compared to October's index of 54.2.

UK flash PMI (0930GMT)

The UK flash estimates are geared towards slightly milder reductions, with manufacturing and services expected to go down by about half a point and the composite index by a less pessimistic 0.3 of a point.

This translates to the flash PMI reading for manufacturing forecasted to come in at 57.3 and services at 58.5 for November, compared to October readings of 57.8 and 59.1 respectively. Input supply constraints continue to impact the UK manufacturing sector, highlighted by last week's yearly PPI input reading coming in at 13%.

Following BOE Pill's comments on Friday of being unsure which way to vote, a December rate hike and its magnitude remain somewhat ambiguous. Further clues could be forthcoming Tuesday as Governor Andrew Bailey and Deputy Governor Jon Cunliffe and MPC member Jonathan Haskell speak

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.