-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing: Inflation Data In Focus

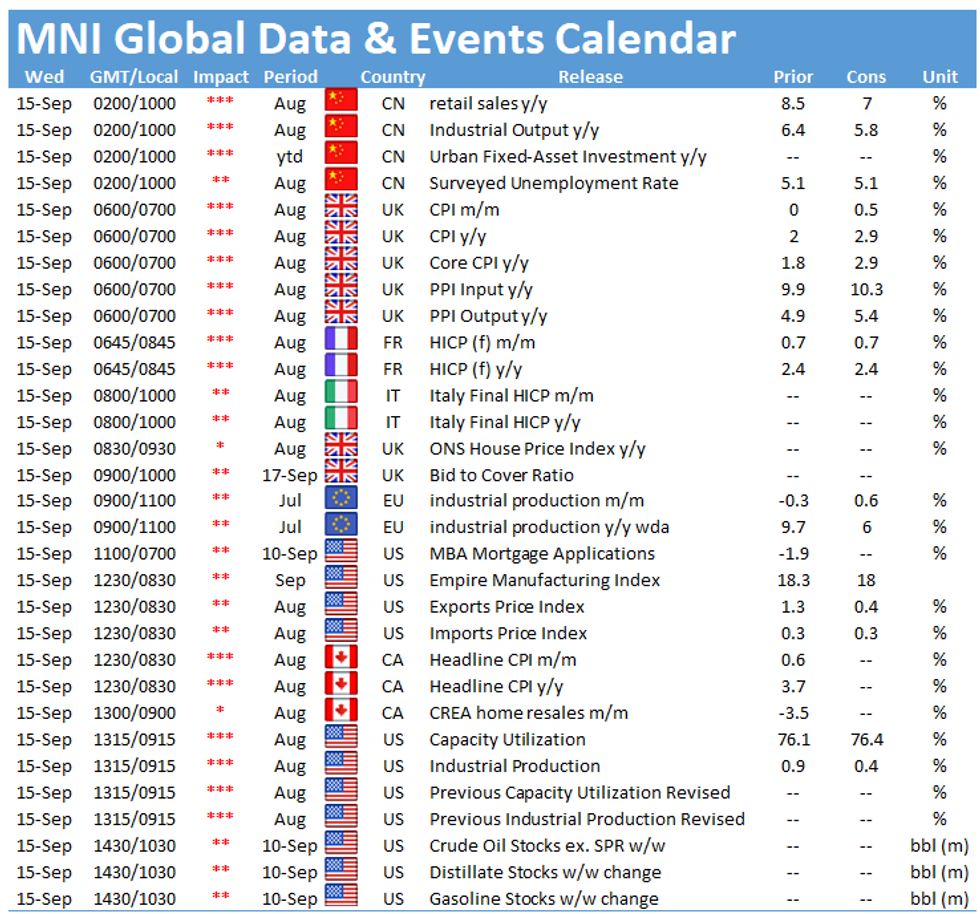

Inflation data is to the fore Tuesday, with data expected for the UK, France, Italy and Canada.Other data of note includes US and EZ industrial production.

UK inflation to skyrocket to near 4-yr high (0700BST)

UK consumer price inflation likely rose to an annual rate of 2.9% in August taking the index to its highest level since early 2018, from an unexpectedly-low 2.0% pace in July, data due at 0700 will show.

The forecast August burst partially stems from difficult comparisons with the same month of 2020, when the Eat Out to Help Out Scheme and reduced value-added taxes significantly reduced the price of eating out. The Office for National Statistics estimated that the two schemes shaved 0.8 percentage points from the monthly change in CPI last year, taking the annual August 2020 increase to just 0.2%. At least some of that will be unwound in the 2021 data.

Forecasters also point to rising commodities prices and supply bottlenecks, with some predicting a rise to 3.0%, matching a level not hit since January 2018. A record-high 17.2% surge in used car prices in August is also likely to exert upward influence on inflation. Prices increased by 14.4% July, adding 0.14 percentage points to the change in CPI (which overall declined by 0.5 percentage points).

Close attention will be paid to factory gate prices, which which have surged over the past several months. Output prices jumped by 4.9% in July, the fastest pace since April 2005, Input prices ebbed slightly in July to 9.9%, but growth remains well below the sub-2% pace recorded at the start of the year.

Canada CPI seen accelerating (1330 BST)

Canada's inflation rate likely rose at the fastest since 2003 in August on gasoline and housing analysts say, quickening to 3.9% from July's 3.7%. The result would be a fourth straight month of CPI gains above the Bank of Canada's 1%-3% target range, and raise questions over the central bank's view it's mostly a temporary spike compared with weakness following last year's Covid downturn.

The gains go beyond a narrow range of items-- in July the average of the BOC's three core measures was the fastest since 2009 at 2.5%, Statistics Canada reported.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.