-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Trump Warns BRICS Over Moving Away From USD

MNI BRIEF: Japan Q3 GDP To Be Slightly Revised Down

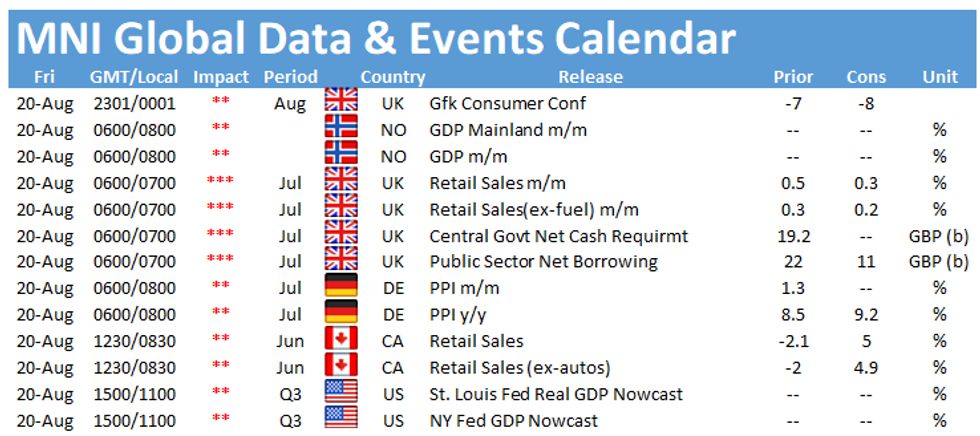

MNI Global Morning Briefing: UK Public Finances In Focus

Friday sees a quiet end to the week, with the early UK data the session's highlight.

UK borrowing seen lower (Friday, 0700 BST)

UK public sector borrowing may have slipped as low as GBP 11.5 bn in July, the smallest since since January, when self-assessment tax receipts pushed borrowing to just GBP1.5 bn, and the second lowest level since March 2020. That would leave borrowing well below the OBR's GBP15.6 bn forecast, continuing a pattern of below-expected borrowing numbers.

June PSNB-ex banks of GBP22.754 bn was elevated by a 223% annual rise in index-linked Gilt interest payments by GBP6 bn to GBP8.7 bn, a sum unlikely to be replicated in July. June interest payments were derived from the change in RPI between March and April, when the index nearly doubled to 2.9% from 1.5%. RPI rose to 3.9% in June, translating into increased interest payments of just GBP1.6 bn more than a year ago.

Borrowing will again be inflated by a GBP 800 mn Brexit payment to the EU following a bill received in April. Last month, ONS officials warned of similar disbursements in August and September, when a new bill will be issued. Economists will also keep an eye on revisions to June borrowing, originally reported at GBP 22.754 bn, as data have been revised lower in every month of the calendar year, by GBP3.7 bn in June and GBP5.6 bn in May.

UK retail sales seen modestly higher (Friday 0700 BST)

UK retail sales likely rose modestly in July, extending a marginal increase seen in June, with clothing sales reviving as social events return to the summer calendar, key industry leaders told MNI.

Helen Dickinson, the CEO at the British Retail Consortium said July continues to see strong sales, albeit at a slower pace as lifting restrictions didn't bring an anticipated in-store boost. However, "with social events back on for the summer calendar, formalwear and beauty all began to see notable improvement," she said.

City analysts forecast a 0.3% gain between June and July, after a higher-than-expected 0.5% m/m improvement in June, and a 1.4% decline in May.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.