-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Global Morning Briefing: UK Q1 GDP Seen Contracting

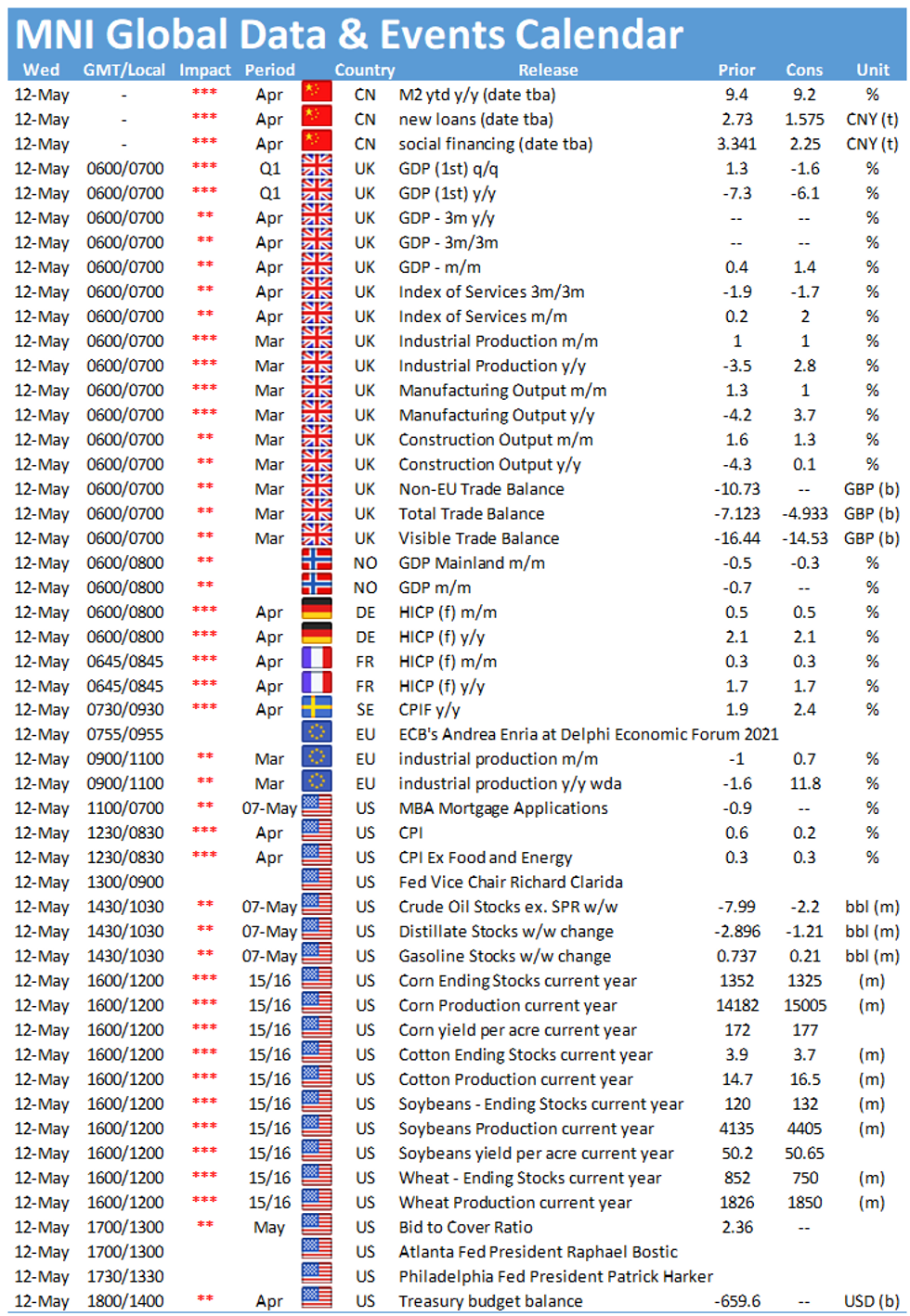

Wednesday starts with the publication of the first estimate of UK Q1 GDP and the UK's short-term monthly indicators at 0700BST, followed by EZ industrial production at 1000BST. The highlight in the US is the publication of the consumer price index at 1330BST.

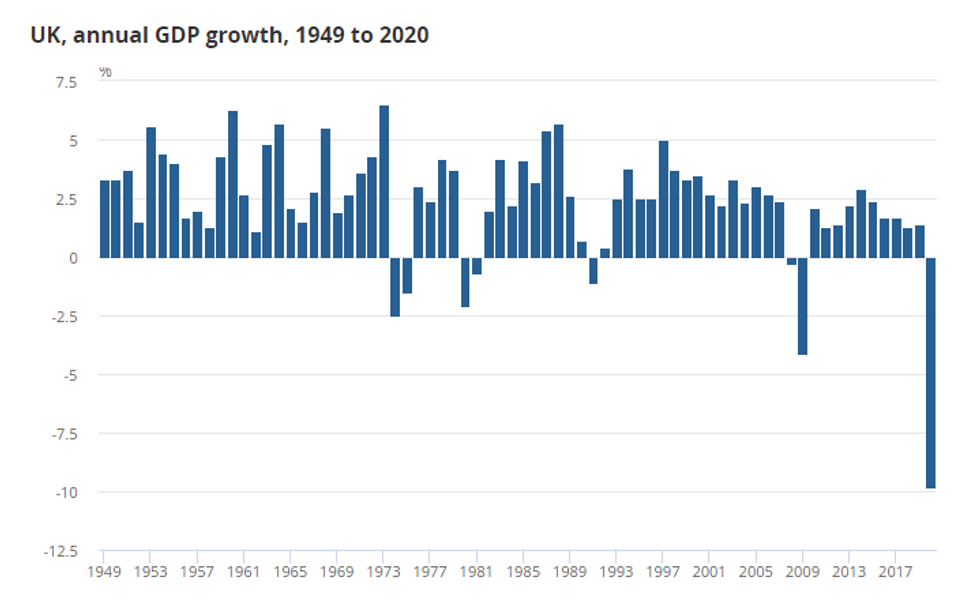

UK GDP forecast to decline in first quarter

Markets are looking for a 1.6% contraction of UK GDP in in the first quarter as the country remained in lockdown throughout the period. However, the contraction is forecast to be less severe than in the Q2 2020 as the industrial sector remained open and businesses adjusted to the new situation. Annual GDP is projected to fall by 6.1% in Q1, an improvement on the 7.3% decline seen in Q4. All major categories are expected to decrease in Q1 with Exports forecast to show the largest fall of 7.6%, followed by imports down -7.0%. Household consumption is seen lower at -1.8%, while government spending is expected to tick down by 0.4%, after rising by 6.7% in Q4. Looking ahead, growth also now looks set to pick up strongly as the economy reopens, with the Bank of England seeing 7.25% growth for the year.

For monthly GDP, markets are looking for an increase in March by 1.4%, following a small uptick of 0.4% in February. The index of services is expected to rise by 2.0% in March, following a small increase of 0.2% in the previous month. Education is likely to be a main driver of March's anticipated uptick as schools reopened at the beginning of the month. Looking ahead, April is set to record another increase of services output as the economy gradually reopened. The BRC retail sales monitor already showed positive signs with total sales rising by 7.3% and like-for-like sales growing by 46.3% compared to April 2019.

Source: Office for National Statistics

EZ industrial production seen rising

Industrial production in the eurozone is projected to increase by 0.7% in March, following a 1.0% drop in February. February's decline was broad-based with every category posting a monthly decline, led by capital goods output. Annual output was 1.6% lower than in February 2020 before the crisis began. For March, markets expect year-on-year output to surge by 11.8%, reflecting the sharp decline seen in March 2020. Available state-level data is in line with market forecasts. German industrial output (ex. construction) rose by 0.8%, as did the French production index. While Spanish industrial production ticked up 0.4%, Italian output eased by 0.1% in March.

US CPI expected to decelerate

Prices should increase 0.2% through April, according to Bloomberg, following a 0.6% gain in March. Supply chain disruptions and strong demand are pushing up the CPI. Wage pressures driven by a labor shortage should also add temporary upward pressure to inflation. Excluding food and energy, CPI should increase 0.3%, the same as March.

The main events to follow on Wednesday include speeches by ECB's Andrea Enria, Fed's Richard Clarida, Atlanta Fed's Raphael Bostic and Philadelphia Fed's Patrick Harker.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.