-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI Global Morning Briefing: US Inflation Eyed

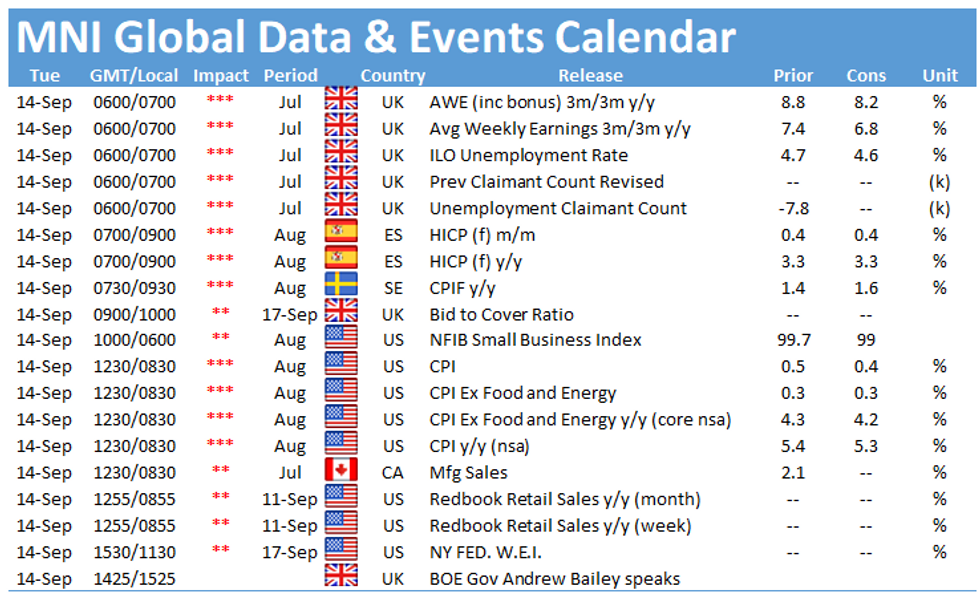

UK employment data will dominate the early part of Tuesday's session, but the U.S. inflation report will undoubtedly be the highlight of the day.

UK May-July Earnings To Decelerate Modestly From Record High (0700BST)

UK earnings growth decelerated slightly in the three months to July, but likely remained at highly-elevated levels, while employment continued to improve over the period. Total earnings rose by an annual rate of 8.2% between May and July, according to City analysts, a rate previously regarded as astronomical, but below the record-high 8.8% pace hit in the second quarter.

Earnings were elevated by a 41.1% surge in bonuses in the latest three months, a combination of incentives and benchmark effects that could be repeated between May and July. Regular earnings are likely to decelerate to 6.8% from 7.4% in the second quarter. Meanwhile, anecdotal reports of a tight jobs market are likely to be reflected in a fall in the jobless rate to 4.6%, say forecasters, from 4.7% in the second quarter. However, analysts will be eyeing the inactivity rate, which has recovered only slowly, to 21.1% in the three months to July from 20.2% in the three months to February of 2020.

Vacancies will also be in focus after rising by 290,000 in the three months to July over the February-to-April period, taking the number of advertised jobs to 953,000, above pre-pandemic levels. Vacancies rise by 50,000 between June and July to a record-high 1.034 million.

U.S. CPI likely slowed in August (1330BST)

CPI growth slowed marginally in August, with Bloomberg predicting a monthly gain of 0.4% following a 0.5% increase in July. From a year earlier, CPI is expected to be up 5.3% compared to 5.4% in July. August's increase is likely to be driven by rising gasoline and food prices, and analysts say previous wage increases and supply bottlenecks could have also translated through consumer prices.

Excluding food and energy prices, CPI should increase 0.3% m/m, according to Bloomberg, and 4.2% y/y.

Among policymakers due to speak Thursday is Bank of England governor Andrew Bailey.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.