-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI Global Morning Briefing: German ZEW Seen Higher In March

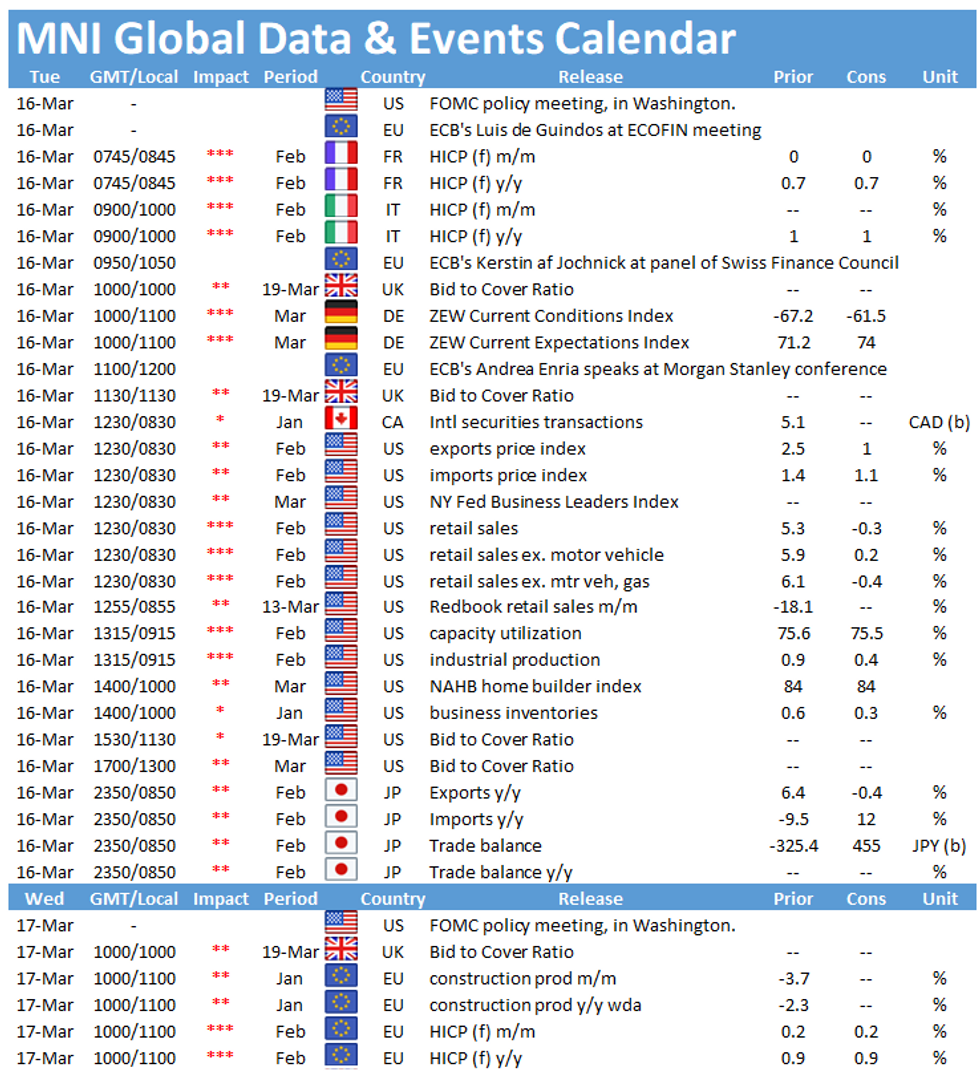

Tuesday kicks off with the publication of final French inflation figures at 0745GMT, followed by the ZEW survey at 1000GMT. At 1230 the publication of US retail sales figures will be closely watched.

Final French inflation see at flash estimate

The final print of French inflation is expected to register in line with the flash result, showing a small dip to 0.7% of annual HICP in February, while the monthly rate registered at -0.1%. Inflation accelerated to 0.8% in January after having recorded rates between 0.0% and 0.2% for several months. According to the flash estimate, February's deceleration was mainly due to a downturn in prices for manufactured goods, services and food. February's manufacturing PMI noted another decline of prices charged, although at a slower pace than in January.

ZEW expectations seen higher

The ZEW expectations index is forecast to rise further in March to 74, after increasing to 71.2 in February. February's reading was the highest since August, indicating that financial experts are more optimistic regarding the outlook. On the other hand, the current situations index eased slightly to -67.2 in February. The index remains in deep negative territory since the beginning of the crisis and only improved marginally around autumn. In March, markets expect an increase to -61.5. The divergence of the expectations index and the current conditions index persisted throughout the pandemic. Expectations got boosted by the vaccine rollout, while the assessment of the current situation highly depends on the development of the pandemic, which continues to remain uncertain.

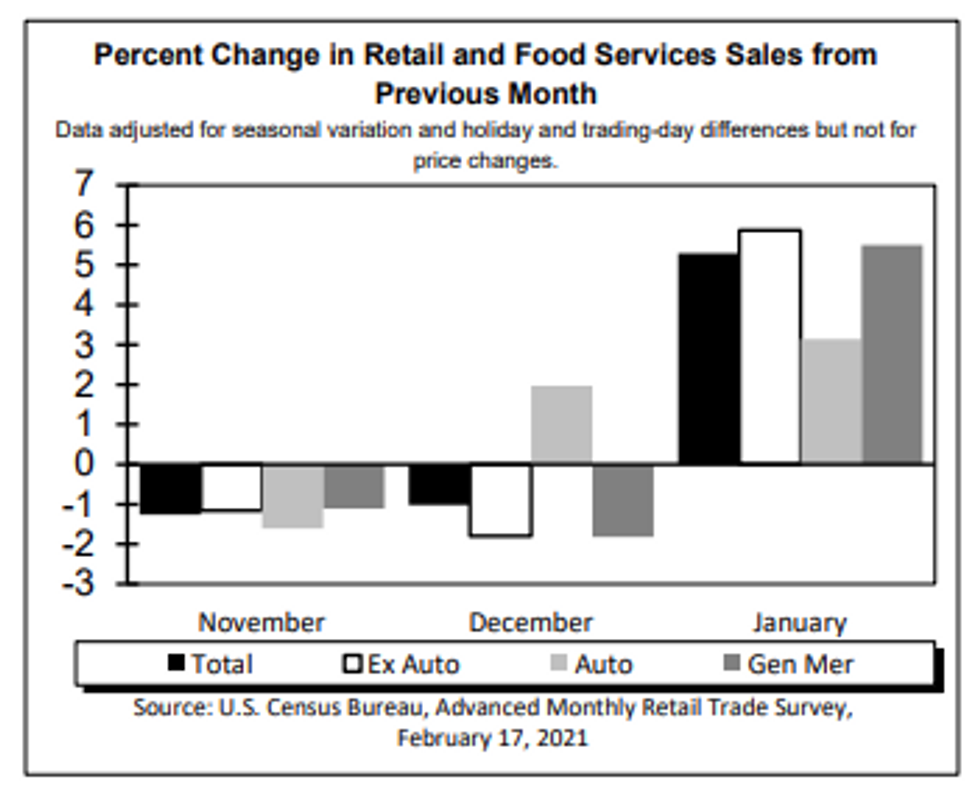

US retail sales projected to fall

US retail sales rebounded sharply in January, rising by 5.3% after falling by 1.0% in December. Excluding motor vehicles, retail sales surged by 5.9% in January. January's rise was broad-based with positive rates seen in every category, but especially electronics and furniture stores as well as non-store retailers posted significant increases in January. In February, markets are looking for a renewed decline in sales by 0.3%, while excluding motor vehicles sales are seen at 0.2%. This is in line with MNI's reality check, stating that the severe winter storms in Texas kept retail sales in check in February.

Source: US Department of Commerce

The main data events to look out for on Tuesday include speeches by ECB's Luis de Guindos and Andrea Enria.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.