-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI RBI Preview - February 2025: New Regime to Cut.

MNI GLOBAL WEEK AHEAD: ECB & BOC Meets & Eurozone CPI Data in Focus

The coming week is data packed, with focus on consumer sentiment indexes, preliminary PMIs and eurozone flash CPI and GDP estimates. The advance US GDP data for Q3 is also due and both the BOC and ECB are expected to deliver 75bp hikes.

Monday

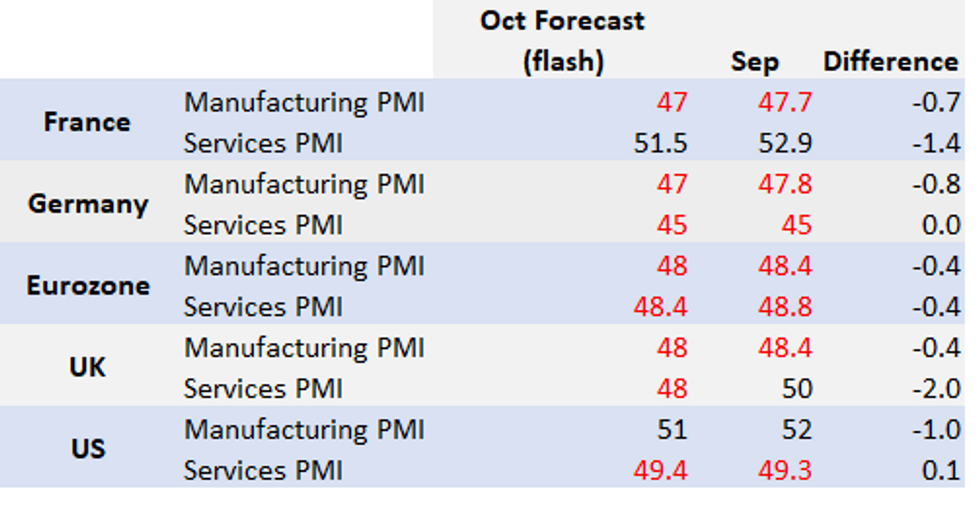

Flash PMIs for October: European PMIs are forecasted to edge down across the region for both manufacturing and services in the October flash release.

Below are the consensus expectations for October, which indicate a weak start to Q4 for major economies, as many anticipate negative growth into year-end. Uncertain global economic outlooks, soaring inflation and rising interest rates continue to suppress demand in both services and manufacturing.

Steep contractions in output and/or slowing employment will be closely watched for, as well as signals of easing price pressures being sustained. Political turmoil will likely drag confidence lower for the UK and add to recessionary risks.

Source: S&P Global / MNI

Tuesday

Germany IFO: Another (albeit modest) deterioration of economic outlooks to fresh early 2020 lows is on the cards in the October IFO survey. Both indexes have contracted sharply since the onset of the Ukraine war and were last optimistic last summer. Acute concerns regarding inflation and gas/energy supply shortages persist.

US Consumer Confidence: The Conference Board consumer sentiment indicator is projected to see a 2.5-point decline to 105.5. Eyes will be on shifts in inflation expectations and purchasing intentions.

Wednesday

Australia CPI: Australian Q3 CPI will show a continued upwards trend, as prices are estimated to have accelerated by +1.6% q/q and +7.0% y/y (vs +6.1% y/y in Q2). This would be the highest annualised quarterly reading since 1990. The RBA unexpectedly raised rates by a more modest 25bp to 2.60% at its October meeting, following four consecutive 50bp moves. The monthly meeting frequency has allowed it to slow its tightening, however a large upside surprise to Q3 CPI may see this slowing reconsidered.

France Consumer Confidence: A one-point moderation to 78 is expected in the October consumer sentiment index for France, which would drive the index to a fresh series low (the survey began in 1972). Despite remaining modest, a notable sharp increase in unemployment fears was recorded in September as consumers begin to fear recessionary outlooks could impact their employment.

BOC Meeting: The consensus is largely split between a 50/75bp hike for the October Bank of Canada meeting. Markets are pricing around 70bp. Core inflation has moderated slightly since the Bank last met but it may well be too slow a moderation for the Bank's liking. Combined with shorter-term consumer inflation expectations rising, an increasingly highlighted weaker Canadian dollar and an expected further 75bp hike from the Fed the following week, the BoC could easily opt for another 75bp hike to avoid disappointing the market. Clues on the rate path ahead will be highly significant as the policy rate will be firmly into restrictive territory.

Thursday

Germany GfK Consumer Confidence: A one-point improvement is expected in November consumer confidence outlooks, indicating sentiment having already hit rock bottom rather than a notable turnaround in outlooks. Soaring energy and food costs and worsening geopolitical tensions have supplied little ground for improved consumer outlooks

Italy Consumer/Business Confidence: Italian business and consumer confidence is anticipated to add to a slew of extremely negative sentiment in the October eurozone data, yet should remain above European debt crisis lows.

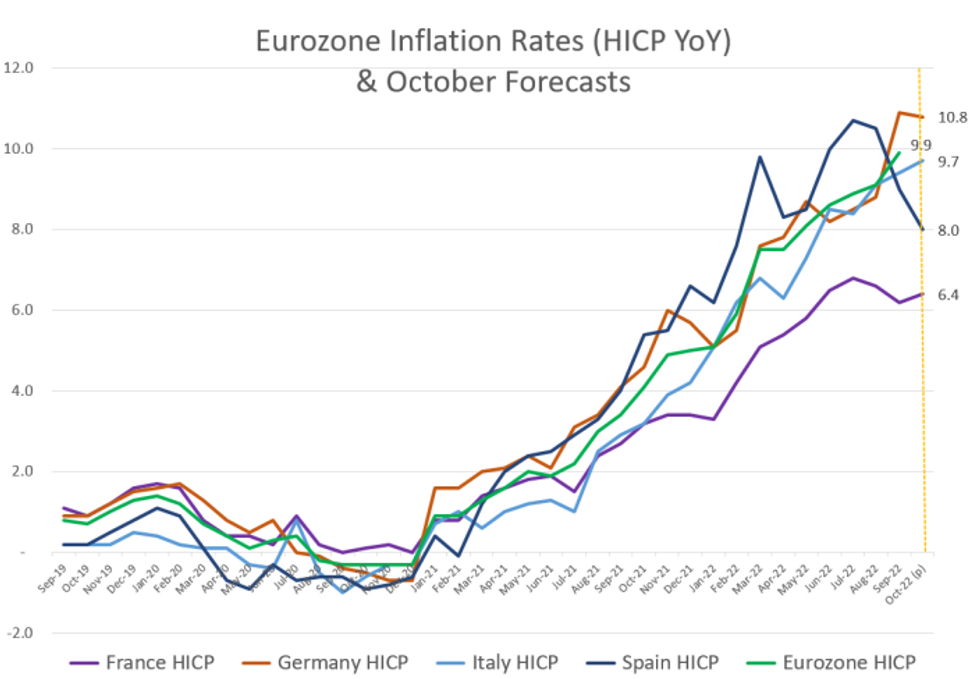

ECB Meeting: Another 75bp hike is largely expected at the ECB’s October meeting, with markets currently pricing around 72bp. This decision comes ahead of the October flash CPI estimate, which will likely push headline inflation back above 10.0% following September’s downwards revision to +9.9% y/y. Markets will be closely watching for indications of timelines for quantitative tightening, changes to TLTRO conditions or tiering and an outside risk of information regarding a possible new interest rate mechanism following recent rumours.

US GDP: Following contractions in Q1 and Q2 constituting a technical recession for the US, the Q3 advance GDP reading is anticipated to bounce back to around +2.3% q/q growth. Strong energy exports lifted by the hot US dollar alongside inventory growth will have provided a substantial boost to US headline GDP, however, this data will likely veil slowing private consumption and waning demand in the economy.

Friday

France/Spain/Italy & Germany Flash HICP: The October flash inflation estimates will highlight the divergence between key eurozone economies. Consensus forecasts for October are in the graph below. September saw the eurozone aggregate, Germany and Italy hit euro-area highs. Both Italy and France are expected to see price growth quicken again in October, whilst Germany will be closely watched for initial signs of having peaked last month.

France/Spain/Germany Flash GDP: The prelim estimates for Q3 growth are expected to see major euro area economies close to stalling, whilst Germany dips into a contraction. French GDP is expected to weaken to +0.1% q/q (vs +0.5% q/q in Q2), Spain to see a larger slide to +0.3% q/q (from +1.5% q/q in Q2), whilst German GDP is forecast at -0.2% q/q after almost stalling at +0.1% q/q in Q2. Downside surprises will feed into the aggregate reading for the Eurozone due on the following Monday, which was projected to have slowed to +0.1% q/q in the ECB’s September forecasts.

US Personal Income/Consumption: September personal income and spending are estimated to remain robust, keeping pace with August at +0.3% and +0.4% respectively. Signs of cooling consumption will be closely watched as consumers grapple with lower disposable income. Also due Friday are the Q3 Employment Cost Index which Fed Chair Powell has cited as a wage pressure signal that they pay close attention to; also the final Michigan inflation expectations following the upside surprise in the prelim. The Fed will be closely monitoring this data ahead of the November 2 rate decision.

Source: MNI / Bloomberg

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/10/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 24/10/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/10/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 24/10/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 24/10/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 24/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 24/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 24/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 24/10/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 24/10/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 24/10/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 24/10/2022 | 1300/1400 |  | UK | Deadline for MPs to nominate next Cons leader | |

| 24/10/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/10/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 24/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/10/2022 | 1700/1800 |  | UK | Result of 1st round of MP voting for next Cons leader | |

| 24/10/2022 | 2000/2100 |  | UK | Result of 2nd round of MP voting for next Cons leader | |

| 25/10/2022 | 0600/0800 | ** |  | SE | PPI |

| 25/10/2022 | 0700/0900 | ** |  | ES | PPI |

| 25/10/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/10/2022 | 0855/0955 |  | UK | BOE Pill at ONS ‘Understanding the cost of living through statistics’ | |

| 25/10/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 25/10/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/10/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/10/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/10/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/10/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/10/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/10/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/10/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 25/10/2022 | 1755/1355 |  | US | Fed Governor Christopher Waller | |

| 26/10/2022 | 0030/1130 | *** |  | AU | CPI inflation |

| 26/10/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 26/10/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/10/2022 | 0800/1000 | ** |  | EU | M3 |

| 26/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 26/10/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/10/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/10/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 26/10/2022 | 1400/1000 |  | CA | BOC Monetary Policy Report | |

| 26/10/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 26/10/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 26/10/2022 | 1500/1100 |  | CA | BOC Governor Press Conference | |

| 26/10/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/10/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 27/10/2022 | 0030/1130 | ** |  | AU | Trade price indexes |

| 27/10/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 27/10/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 27/10/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/10/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/10/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 27/10/2022 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 27/10/2022 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 27/10/2022 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 27/10/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 27/10/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 27/10/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 27/10/2022 | 1230/0830 | *** |  | US | GDP (adv) |

| 27/10/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 27/10/2022 | 1245/1445 |  | EU | ECB post-policy decision press conference | |

| 27/10/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 27/10/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/10/2022 | 0430/0630 | *** |  | DE | North Rhine Westphalia CPI |

| 28/10/2022 | 0530/0730 | ** |  | FR | Consumer Spending |

| 28/10/2022 | 0530/0730 | *** |  | FR | GDP (p) |

| 28/10/2022 | 0600/0800 | *** |  | SE | GDP |

| 28/10/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/10/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 28/10/2022 | 0645/0845 | ** |  | FR | PPI |

| 28/10/2022 | 0700/0900 | *** |  | ES | GDP (p) |

| 28/10/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 28/10/2022 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 28/10/2022 | 0800/1000 | *** |  | DE | GDP (p) |

| 28/10/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 28/10/2022 | 0800/1000 | ** |  | IT | PPI |

| 28/10/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 28/10/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 28/10/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 28/10/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 28/10/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 28/10/2022 | 1030/1330 |  | RU | Russia Central Bank Key Rate Decision | |

| 28/10/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/10/2022 | - | *** |  | JP | BOJ policy announcement |

| 28/10/2022 | - |  | UK | Result of Cons members' vote for next Cons leader | |

| 28/10/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 28/10/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 28/10/2022 | 1230/0830 | ** |  | US | Employment Cost Index |

| 28/10/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 28/10/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 28/10/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.