-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

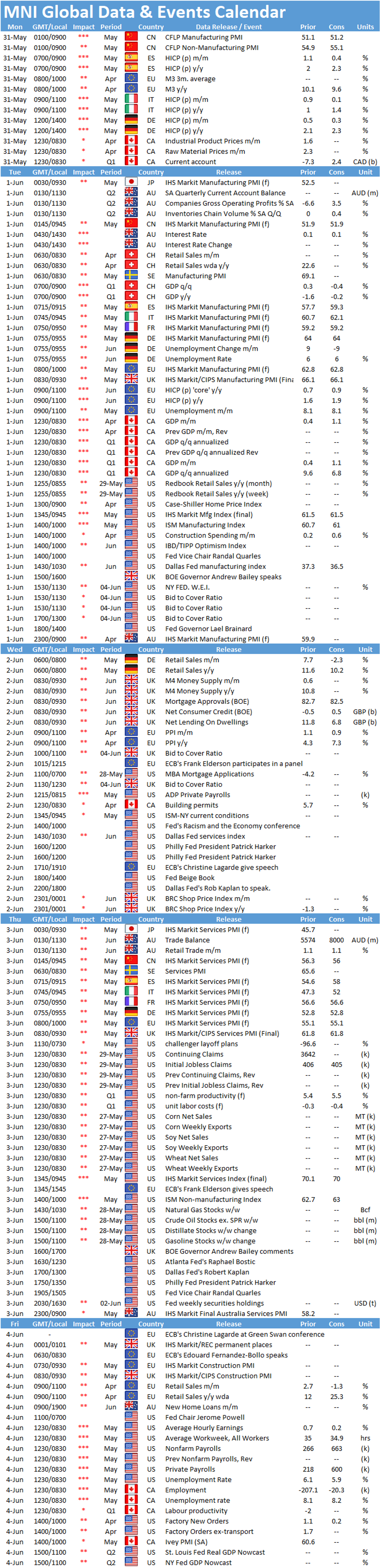

Free AccessMNI Global Week Ahead May 31 – June 4

Key Things to Watch:

- Tuesday, June 1 – Reserve Bank of Australia Meeting

- The Reserve Bank of Australia meets Tuesday with little to no action expected after the bank said it would address key decisions on its bond buying program in July.

- At the May meeting, the central bank said it would wait until July to consider whether to retain the April 2024 bond as the target bond for the 3-year yield target or to shift to the next maturity, the November 2024 bond. The bank said the July meeting would also consider future bond purchases following the completion in September of the second AUD100 billion of purchases under the AUD200 billion government bond purchase program.

- With no move expected on interest rates, currently at a record low of 0.10%, the RBA continues to be in a holding pattern as it waits for more evidence on the strength of the domestic recovery. Unemployment and inflation are the key factors in determining any change in monetary policy, and while the signs are encouraging the RBA has said that conditions for an interest rate rise are "unlikely until 2024 at the earliest."

- Thursday, June 3 – U.S. Jobless Claims

- U.S. jobless claims filed through May 29 should hold relatively steady, with Bloomberg forecasting a modest decline to 405,000 from 406,000 through May 22, a new pandemic low.

- Analysts say both initial and continuing claims could see a sharp decline in mid-June, when many states plan to opt out of enhanced federal UI benefits.

- Friday, June 4 – U.S. Nonfarm Payrolls

- U.S. employers likely added 663,000 jobs through May, according to Bloomberg, more than doubling April's disappointing 266,000 gain.

- The same factors that kept workers at home in April, like childcare issues, enhanced unemployment benefits, and virus fears, likely extended into May, though analysts say high wages have probably enticed some to reenter the labor force.

- Average hourly earnings should increase 0.2% after spiking 0.7% in April, according to Bloomberg.

- Meanwhile, the unemployment rate in May should dip down to 5.9% after ticking up to 6.1% in April.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.