-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI GLOBAL WEEK AHEAD: Riksbank & RBA to Hike, German CPI Due

After a heavy data week across Europe and the US as well as Fed, BOE and ECB rate hikes, this coming week’s data schedule is lighter, topped by UK GDP, EZ industrial production/retail, and supplemented with the RBA and Riksbank meetings.

MONDAY

Germany Factory Orders: Factory orders are seen expanding again by 2.0% m/m in December, after the 5.3% m/m contraction recorded in December. Compared to December 2021, factory orders are expected to be down -11.8% y/y. The November collapse in demand was largely driven by foreign orders, as global demand declined due to tighter financial conditions and weak growth outlooks. China’s recent reopening measures will lift export orders, signalling a more robust start to 2023 in data to come.

Eurozone Retail Trade: December retail data is projected to confirm a weak finish to a contractive quarter, with forecasts looking for -2.5% m/m and -2.7% y/y falls. The second prelim GDP print due on Feb 14 will provide more detail on the anticipated considerable drag to eurozone consumption.

TUESDAY

RBA Rate Decision: The Reserve Bank of Australia is expected to deliver another 25bp hike on Tuesday, bringing their cash rate target by 25bp to 3.35%, after CPI surprised to the upside in Q4. Updated forecasts due this week are set to shape market pricing of the peak rate.

Germany Industrial Production: Following Friday’s French industrial production print, which saw a stronger-than-anticipated end to the year in December, outlooks for neighbouring Germany remain contractive at -0.6% m/m and -1.7% y/y in December. This will likely cancel out the French boost to the Eurozone aggregate print.

Despite remaining contractionary for a seventh consecutive month in the January PMI data, conditions moderated for a third month as easing cost pressures, supply bottlenecks and more muted recessionary fears feed into improved optimism going forward.

Spain Industrial Production: Spanish IP will also likely be a downside driver on the eurozone aggregate, with forecasts pencilling in a more muted -0.1% m/m decline in a fourth month of contraction.

US Trade Balance: The December US trade deficit is projected to deepen by around $7b to -$68.5b after having narrowed to a September 2020 low, as imports fall in the back of domestic demand declines.

WEDNESDAY

No data of note.

THURSDAY

Germany CPI: After delaying data due to technical issues, the German January HICP print is anticipated to accelerate by +1.4% m/m, after having fallen by -1.2% m/m due to substantial energy-bill subsidies. On the year, HICP is projected to accelerate by 0.5pp to +10.1% y/y, breaking a two-month streak of slowing inflation. Note: this release will be at 0700 GMT (rather than the usual prelim release time of 1300).

This data will have substantial implications for the euro area aggregate print, which cooled by 0.7pp to +8.5% y/y in the January flash estimate, calculated using a Eurostat estimate for Germany. MNI estimates the German HICP number supplied by Eurostat is likely to have been between +7.9% and +8.6% y/y in January. As such, an upside surprise to this estimate will lead to substantial revisions in the euro area final aggregate print.

Riksbank Rate Decision: The Riksbank is expected to hike rates by 50bp in the February meet, slowing the pace from the 75bp hike delivered in November. This would bring the Repo Rate to 3.00%, in line with the Riksbank’s November guidance: "the forecast shows that the policy rate will probably be raised further at the beginning of next year and then be just below 3 per cent."

FRIDAY

UK Q4 GDP / Industrial Production / Services / Trade: The December round of UK data is projected to show a contractionary end to Q4, with GDP at -0.3% m/m, IP at a modest +0.1% m/m, manufacturing down -0.2% m/m and services falling -0.3% m/m.

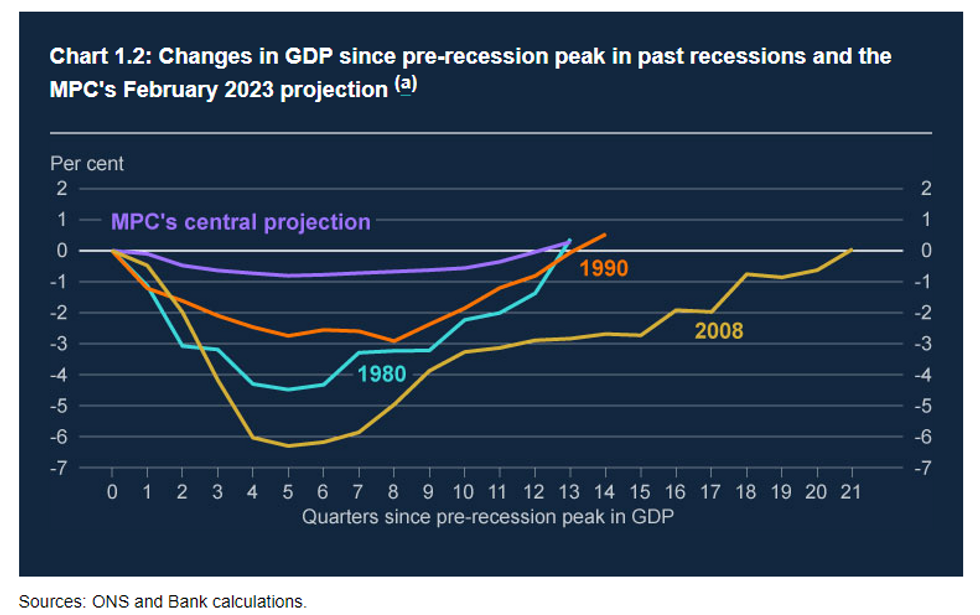

The Q4 preliminary GDP data due will be the main focus, whereby consensus is expecting the UK economy to stagnate at 0.0% q/q, after -0.3% q/q in Q3. The BOE’s February forecasts continue to anticipate five quarters of negative growth commencing in Q1 2023. Growth outlooks were largely seen as more stable in the short term, expected to fall -0.7% in Q1 2024 (vs -1.97% in Nov estimate) and more stagnant in the longer term as 2025 outlooks were downgraded to a meagre +0.25% (vs +0.5% in Nov).

Canada Labour Force Survey: The January Canadian labour data will likely signal continued robustness. The unemployment rate could tick up marginally from 5.0%, remaining near historic lows, whilst the change in employment will be substantially softer than the bumper +104k jobs seen in December.

Prelim Michigan Sentiment Index: The U Michigan sentiment index is forecasted to hold steady at 64.9 in the February estimate, having jumped over five points in December. Sentiment remains below the long-term average. Markets will be watching for shifts in inflation expectations, which softened by 0.5pp to +3.9% (1-year), whilst remaining sticky at +2.9% for the 5-10year outlook.

The BOE's 2023 Recession Forecast vs Previous Recessions:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/02/2023 | 0030/1130 | ** |  | AU | Retail Trade |

| 06/02/2023 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 06/02/2023 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/02/2023 | 0840/0840 |  | UK | BOE Mann at Lamfalussy Lectures Conference | |

| 06/02/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/02/2023 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/02/2023 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 06/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 06/02/2023 | 1700/1700 |  | UK | BOE Pill Monetary Policy Report Live Q&A | |

| 07/02/2023 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 07/02/2023 | 0030/1130 | ** |  | AU | Trade Balance |

| 07/02/2023 | 0330/1430 | *** |  | AU | RBA Rate Decision |

| 07/02/2023 | 0645/0745 | ** |  | CH | Unemployment |

| 07/02/2023 | 0700/0800 | ** |  | DE | Industrial Production |

| 07/02/2023 | 0745/0845 | * |  | FR | Foreign Trade |

| 07/02/2023 | 0800/0900 | ** |  | ES | Industrial Production |

| 07/02/2023 | 0900/0900 |  | UK | BOE Ramsden Intro at UK Women in Economics Event | |

| 07/02/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/02/2023 | 1015/1015 |  | UK | BOE Pill Chairs UK Women in Economics Panel | |

| 07/02/2023 | 1330/0830 | ** |  | US | Trade Balance |

| 07/02/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/02/2023 | 1430/1430 |  | UK | BOE Cunliffe Speech at UK Finance | |

| 07/02/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 07/02/2023 | 1700/1800 |  | EU | ECB Schnabel in Finanzwende e.V. Webinar | |

| 07/02/2023 | 1730/1230 |  | CA | BOC Governor Macklem speech/press conference in Quebec City | |

| 07/02/2023 | 1740/1240 |  | US | Fed Chair Jerome Powell | |

| 07/02/2023 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/02/2023 | 1900/1400 |  | US | Fed Vice Chair Michael Barr | |

| 07/02/2023 | 2000/1500 | * |  | US | Consumer Credit |

| 08/02/2023 | 0700/0800 | ** |  | SE | Private Sector Production |

| 08/02/2023 | 0900/1000 | * |  | IT | Retail Sales |

| 08/02/2023 | 0900/1000 |  | EU | ECB Elderson Hosts Banking Supervision Press Conf on SREP | |

| 08/02/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 08/02/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 08/02/2023 | - |  | EU | ECB Lagarde at European Council meeting | |

| 08/02/2023 | 1315/0815 |  | US | Fed Vice Chair Michael Barr | |

| 08/02/2023 | 1420/0920 |  | US | New York Fed's John Williams | |

| 08/02/2023 | 1430/0930 |  | US | Fed Governor Lisa Cook | |

| 08/02/2023 | 1500/1000 | ** |  | US | Wholesale Trade |

| 08/02/2023 | 1500/1000 |  | US | Atlanta Fed's Raphael Bostic | |

| 08/02/2023 | 1500/1000 |  | NL | DNB President Klaas Knot speaks at MNI event | |

| 08/02/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 08/02/2023 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/02/2023 | 1730/1230 |  | US | Minneapolis Fed's Neel Kashkari | |

| 08/02/2023 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 08/02/2023 | 1830/1330 |  | CA | BOC minutes from last rate meeting | |

| 08/02/2023 | 1845/1345 |  | US | Fed Governor Christopher Waller | |

| 09/02/2023 | 0700/0800 | *** |  | DE | HICP (p) |

| 09/02/2023 | 0830/0930 | ** |  | SE | Riksbank Interest Rate |

| 09/02/2023 | 0945/0945 |  | UK | BOE Bailey, Pill, Tenreyro & Haskel at Treasury Select Committee Hearing | |

| 09/02/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 09/02/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 09/02/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 09/02/2023 | 1800/1900 |  | EU | ECB de Guindos Speech at Foro Economia y Humanismo | |

| 09/02/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 10/02/2023 | 0130/0930 | *** |  | CN | CPI |

| 10/02/2023 | 0130/0930 | *** |  | CN | Producer Price Index |

| 10/02/2023 | 0700/0700 | *** |  | UK | GDP First Estimate |

| 10/02/2023 | 0700/0700 | ** |  | UK | Index of Services |

| 10/02/2023 | 0700/0700 | *** |  | UK | Index of Production |

| 10/02/2023 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 10/02/2023 | 0700/0700 | ** |  | UK | Trade Balance |

| 10/02/2023 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 10/02/2023 | 0700/0800 | * |  | NO | CPI Norway |

| 10/02/2023 | 0900/1000 | * |  | IT | Industrial Production |

| 10/02/2023 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 10/02/2023 | 1400/1400 |  | UK | BOE Pill Panellist at BIS SUERF Workshop | |

| 10/02/2023 | 1400/1500 |  | EU | ECB Schnabel Twitter Q&A | |

| 10/02/2023 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 10/02/2023 | 1730/1230 |  | US | Fed Governor Christopher Waller | |

| 10/02/2023 | 1900/1400 | ** |  | US | Treasury Budget |

| 10/02/2023 | 2100/1600 |  | US | Philadelphia Fed's Pat Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.