-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Crude Oil Imports Accelerate In November

MNI BRIEF: RBA Holds, Notes Declining Inflation Risk

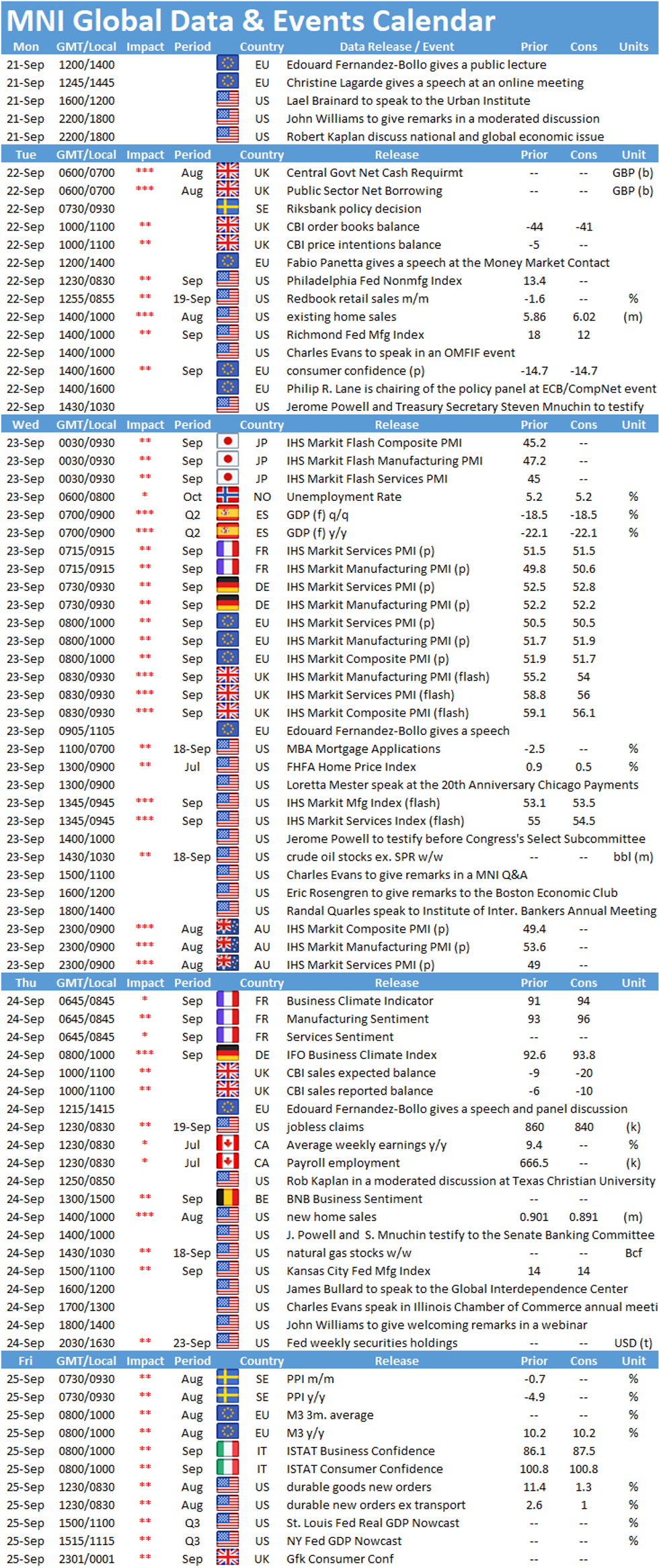

MNI Global Week Ahead September 21 - 25

Key Things to Watch For:

- Tuesday, September 22 – Riksbank Policy Decision

- With Sweden's economy faring better than initial worst expectations, the Riksbank looks set to leave policy unchanged at its September meeting, focusing on continued liquidity for the real economy, having already front-loaded its bond buying envelope through until summer 2021.

- With rates at 0% and the already announced total SEK500 billion of potential bond buys spread across the range of fixed-income assets, the Riksbank has provided reassurance that it is committed to its easing program for many months to come.

- This has left policymakers to focus on its main priorities for now – ensuring liquidity flows to the corporate sector and households, whilst underpinning stability across the financial markets.

- "The main focus is to get … out liquidity in the economy so that the market functions well," rather than focus on the policy rate which has been left at zero, Deputy Governor Henry Ohlsson said in an MNI interview published last week.

- Thursday, September 24 – U.S. Weekly Jobless

Claims

- U.S. initial jobless claims should reach 840,000 through September 1 after falling to 860,000 through September 12.

- The labor market continues to recover, though job gains have slowed since rebounding more strongly earlier in the summer. The latest Census Bureau Small Business Pulse Survey indicated that only 4.7% of small businesses rehired laid off or furloughed workers in the latest week

- Friday, September 25 – U.S. Durable Goods

Orders

- U.S. durable goods new orders should increase 1.3% in August after a stronger-than-expected 11.4% gain in July.

- That will likely be driven by a further deterioration in commercial aircraft orders as the travel industry continues to reel from Covid-19, though some strength in orders of motor vehicles and parts could offset some of at weakness.

- Excluding transportation orders, durable goods new orders likely rose 1.0% in August following a 2.6% increase in July.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.