-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI GLOBAL WEEK AHEAD: UK CPI Close to Peak

UK inflation and labour market data, along with the Autumn fiscal report headline what is an otherwise quiet docket. US retail sales and IP will also be closely watched.

MONDAY

Eurozone Industrial Production: September euro area IP is anticipated to have expanded by a moderate +0.4% m/m, boosted by Germany’s upbeat consumer and capital goods production. This represents a slowdown from slowing from +1.5% m/m in August, which will largely be on the back of Italy and France’s September contractions.

TUESDAY

UK Labour Report: The September employment report will likely see the labour market remain tight, with unemployment remaining at the 1974-low of 3.5%.

The employment rate remained 1% below pre-pandemic levels in the August report and employment is forecast to decrease by 30k following 109k in August. Low employment has underpinned market tightness pushing up wage growth.

Consensus is looking for average weekly earnings growth of +5.9%, close to the hot +6.0% recorded in August which was the strongest growth outside of the pandemic period.

France/Spain Final CPI: Final prints for October CPI are expected to confirm +1.3% m/m and +7.1% y/y for France and +0.1% m/m and +7.3% y/y for Spain. Despite hovering at similar year-on-year levels, this reading constitutes a fresh euro-high for France, but the third consecutive month of decelerating prices for Spain. The ECB faces the challenge of unified policy-making for diverging inflationary growth.

Germany ZEW Survey: The German ZEW survey is expected to signal improvements again in November, with expectations to improve substantially by over 9 points to -50.0, and the current situation index by around 4 points to -68.0.

Whether this improvement materialises is not a given, following the October surge in inflation to +11.6% y/y (HICP). With prices yet to see any cooling, this remains the downward driver for the German industry. Pessimistic outlooks regarding global demand and weak growth in China will likely see production weaken into year-end.

Eurozone Flash Q3 GDP: The second Q3 GDP estimate is due on Wednesday, to confirm that the bloc slowed to +0.2% q/q, the weakest growth since the Q2 2021 lockdown rebound.

US PPI: Final demand PPI will quicken marginally from September, anticipated to expand by +0.5% m/m in October (+0.4% q/q ex. Food and energy). Downside risks to this data has been flagged by the ISM report, which saw raw material prices decrease for the first time in over two years.

Headline year-on-year growth will likely slow by 0.2pp to +8.3% y/y, easing further from the March peak of +11.3% y/y.

Factory-gate inflation remains substantially softer higher in the euro area, which recorded +41.9% y/y in September. High economic exposure to the Ukraine war has deepened the eurozone energy crisis and severely hampered supply chains which are only recently seeing some relief.

Canada Manufacturing: Canadian manufacturing is forecasted to contract for the fifth consecutive month in September, albeit less sharply at -0.5% m/m following the -2.0% m/m slide in August.

WEDNESDAY

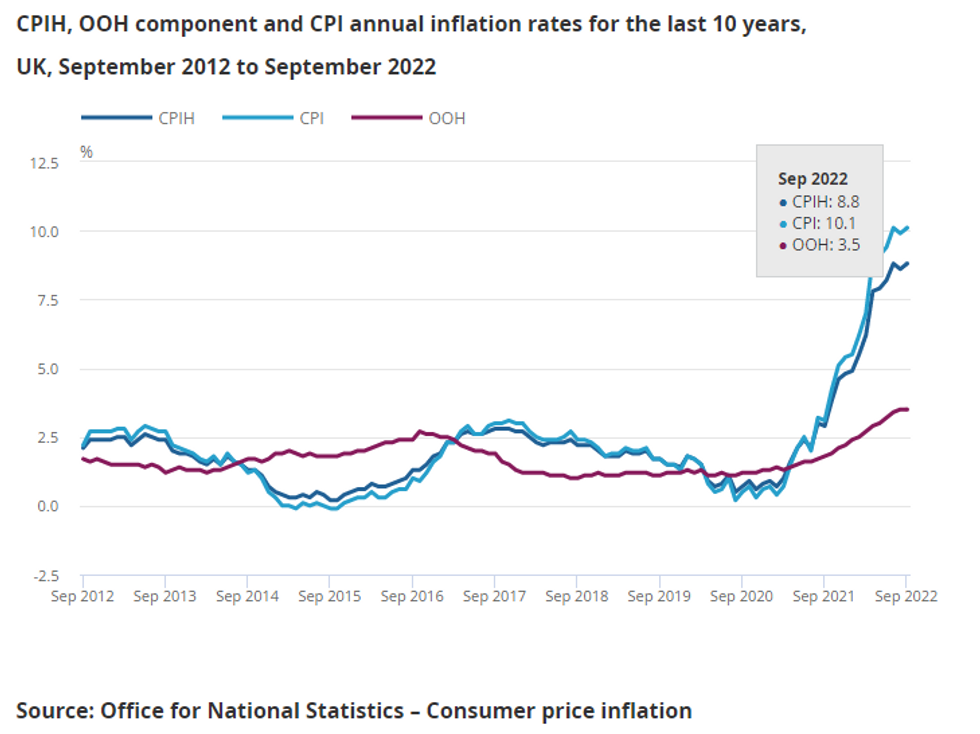

UK Inflation Report: October UK inflation is forecast to reach +10.7% y/y (up from +10.1% y/y in Sep), with prices accelerating by +1.7% m/m alone. This is largely anticipated to be the peak inflation rate, and core could inch down by 0.1pp to +6.4% y/y implying a September peak. Markets are anticipating a 50bp hike at the December meeting, which will unlikely be shifted by an upside inflation print as the MPC looks to slow the pace.

Canada CPI: Canadian inflation is projected to edge down by 0.1pp in October to +6.8% y/y, whilst prices are expected to expand by +0.7% m/m following +0.1% m/m in September. Fiscal support at the gas pump has largely underpinned the slowdown, yet food and shelter continue to expand.

Core CPI is seen cooling to +5.9% y/y (from +6.0%). Following the downside surprise to US October CPI, a lower Canadian reading suggests the BoC could look to slow to 25bp in December.

US Retail Trade / Industrial Production: October retail sales should improve to +0.9% m/m after flatlining in September. Survey data has pointed towards stronger auto and gas sales in October, which will boost the headline print.

IP looks to see only modest +0.2% m/m growth (versus +0.4% in Sep), in line with the ISM manufacturing survey which slowed to 50.2 in October, hovering just above the breakeven point of 50. New orders have now contracted for two consecutive months as demand wanes.

THURSDAY

UK Autumn Statement with New OBR forecasts / Updated DMO Remit: The market will be watching where tax rises/ spending cuts are focused on in the Autumn fiscal statement, and key focus will be on the OBR's updated forecasts. The DMO will also update its remit.

Eurozone Final CPI / Construction: Eurozone inflation is set to be confirmed at a fresh high of +10.7% y/y in October, having surprised substantially to the upside in the prelim print. Construction data for the bloc is also due on Thursday, likely to contract again in September and deepening the downturn. The S&P Global PMI has continued to signal contraction since May.

FRIDAY

UK GfK Consumer Confidence / Retail Sales: UK consumer confidence is unlikely to see much relief in November, anticipated to hold steady at -47, just two points above the September record low. Disposable incomes are feeling the squeeze of higher food, fuel, energy and mortgage prices. This data underlines the concerns at the BOE over a slowing economy.

Retail sales are forecast to see a modest recovery to +0.6% m/m from the September contraction, whilst remaining deeply contractive at -6.5% y/y compared to 2021.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/11/2022 | 0001/0001 | * |  | UK | Rightmove House Prices Index |

| 14/11/2022 | 1000/1100 |  | EU | ECB Panetta Speech at CEPR-EABCN Conference | |

| 14/11/2022 | 1000/1100 | ** |  | EU | Industrial Production |

| 14/11/2022 | - |  | UK | House of Commons Returns | |

| 14/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 14/11/2022 | 1345/0845 |  | CA | BOC's Macklem opening remarks at diversity conference | |

| 14/11/2022 | 1600/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 14/11/2022 | 1615/1715 |  | EU | ECB de Guindos Speech at Euro Finance Week | |

| 14/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 14/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 14/11/2022 | 1630/1130 |  | US | Fed Vice Chair Lael Brainard | |

| 14/11/2022 | 2330/1830 |  | US | New York Fed's John Williams | |

| 15/11/2022 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/11/2022 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/11/2022 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/11/2022 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 15/11/2022 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 15/11/2022 | 0700/0800 | *** |  | SE | Inflation report |

| 15/11/2022 | 0745/0845 | *** |  | FR | HICP (f) |

| 15/11/2022 | 0800/0900 | *** |  | ES | HICP (f) |

| 15/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 15/11/2022 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 15/11/2022 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 15/11/2022 | 1000/1100 | * |  | EU | Trade Balance |

| 15/11/2022 | 1000/1100 | * |  | EU | Employment |

| 15/11/2022 | 1000/1100 | *** |  | EU | GDP First Estimates |

| 15/11/2022 | 1130/1130 | ** |  | UK | Gilt Outright Auction Result |

| 15/11/2022 | - |  | ID | G20 Summit in Indonesia | |

| 15/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 15/11/2022 | 1330/0830 | *** |  | US | PPI |

| 15/11/2022 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/11/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 15/11/2022 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 15/11/2022 | 1400/0900 |  | US | Philadelphia Fed's Patrick Harker | |

| 15/11/2022 | 1400/0900 |  | CA | BOC Deputy Kozicki moderates panel on diversity | |

| 15/11/2022 | 1400/0900 |  | US | Fed Governor Lisa Cook | |

| 15/11/2022 | 1500/1000 |  | US | Fed Vice Chair for Supervision Michael Barr | |

| 15/11/2022 | 1730/1830 |  | EU | ECB Elderson Speech at Euro Finance Week | |

| 16/11/2022 | 0030/1130 | *** |  | AU | Quarterly wage price index |

| 16/11/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 16/11/2022 | 0700/0700 | *** |  | UK | Producer Prices |

| 16/11/2022 | 0900/1000 | *** |  | IT | HICP (f) |

| 16/11/2022 | 0930/0930 | * |  | UK | ONS House Price Index |

| 16/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 16/11/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 16/11/2022 | - |  | ID | G20 Summit in Indonesia | |

| 16/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 16/11/2022 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 16/11/2022 | 1330/0830 | *** |  | CA | CPI |

| 16/11/2022 | 1330/0830 | *** |  | US | Retail Sales |

| 16/11/2022 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 16/11/2022 | 1415/0915 | *** |  | US | Industrial Production |

| 16/11/2022 | 1415/1415 |  | UK | BOE Treasury Select Committee hearing on Nov Monetary Policy Report | |

| 16/11/2022 | 1450/0950 |  | US | New York Fed's John Williams | |

| 16/11/2022 | 1500/1000 | * |  | US | Business Inventories |

| 16/11/2022 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 16/11/2022 | 1500/1600 |  | EU | ECB Lagarde Speech at European School Frankfurt Anniversary | |

| 16/11/2022 | 1500/1600 |  | EU | ECB Panetta at ABI's Executive Committee Meeting | |

| 16/11/2022 | 1500/1000 |  | US | Fed Vice chair for Supervision Michael Barr | |

| 16/11/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 16/11/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 16/11/2022 | 1935/1435 |  | US | Fed Governor Christopher Waller | |

| 16/11/2022 | 2100/1600 | ** |  | US | TICS |

| 17/11/2022 | 0030/1130 | *** |  | AU | Labor force survey |

| 17/11/2022 | 0720/0220 |  | ID | Bank of Indonesia Rate Decision | |

| 17/11/2022 | 1000/1100 | ** |  | EU | Construction Production |

| 17/11/2022 | 1000/1100 | *** |  | EU | HICP (f) |

| 17/11/2022 | 1230/0730 |  | US | Atlanta Fed's Raphael Bostic | |

| 17/11/2022 | 1230/1230 |  | UK | BOE Pill Speech at the Bristol Festival of Economics | |

| 17/11/2022 | - |  | UK | Autumn Statement with New OBR forecasts / Updated DMO Remit | |

| 17/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 17/11/2022 | 1300/0800 |  | US | St. Louis Fed's James Bullard | |

| 17/11/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 17/11/2022 | 1330/0830 | *** |  | US | Housing Starts |

| 17/11/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 17/11/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 17/11/2022 | 1415/0915 |  | US | Fed Governor Michelle Bowman | |

| 17/11/2022 | 1430/1430 |  | UK | BOE Tenreyro Speech at Asociacion Argentina de Economia Politica | |

| 17/11/2022 | 1440/0940 |  | US | Cleveland Fed's Loretta Mester | |

| 17/11/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 17/11/2022 | 1540/1040 |  | US | Minneapolis Fed's Neel Kashkari | |

| 17/11/2022 | 1540/1040 |  | US | Fed Governor Philip Jefferson | |

| 17/11/2022 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 17/11/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 17/11/2022 | 1845/1345 |  | US | Minneapolis Fed's Neel Kashkari | |

| 18/11/2022 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 18/11/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 18/11/2022 | 0700/0800 | ** |  | SE | Unemployment |

| 18/11/2022 | 0700/0800 | ** |  | NO | Norway GDP |

| 18/11/2022 | 0830/0930 |  | EU | ECB Lagarde Speech at European Banking Congress | |

| 18/11/2022 | - |  | EU | COP 27 Ends | |

| 18/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 18/11/2022 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/11/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 18/11/2022 | 1500/1000 | * |  | US | Services Revenues |

| 18/11/2022 | 1715/1715 |  | UK | BOE Haskel Panels Ditchley Economics Conference | |

| 19/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 19/11/2022 | 1345/1345 |  | UK | BOE Dhingra Panels Ditchley Economics Conference | |

| 19/11/2022 | 1845/1345 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.