-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI INTERVIEW: High Prices Key Driver of Weak Sentiment- UMich

High inflation is a major reason Americans feel even worse about the economy than they did at the start of the pandemic, the head of the University of Michigan's Survey of Consumers told MNI, despite some tentative signs consumers expect prices to come down.

"They continue to hold pretty pessimistic views about the general state of the economy going forward and the common theme is inflation," said Joanne Hsu said in a phone interview Friday. "They are very concerned. They're worried about inflation. They're worried about their fellow Americans."

While nearly 90% of people expect the Fed to continue to raise interest rates, Hsu said, Americans confidence in government policies to fight inflation is at its lowest level since 2014. "People really are not confident about about government policies to fight inflation."

Still, Hsu cited some hints inflation expectations may be starting to soften as monetary policy tightens. Median inflation expectations one-year out edged lower to 5.3% in May, dipping for the first time since December, while five-year-ahead expectations have remained flat at 3.0% since the start of the year, still the highest since 2011.

"The signs we're seeing so far are promising, but it's too early to tell," she said, noting increased dispersion and uncertainty around the war in Ukraine and impacts from China. Hsu is a former principal economist at the Fed board's division of research and statistics.

In addition to inflation worries, the Michigan survey director suggested sentiment levels are so low because of the deterioration in buying conditions for cars, houses and durables.

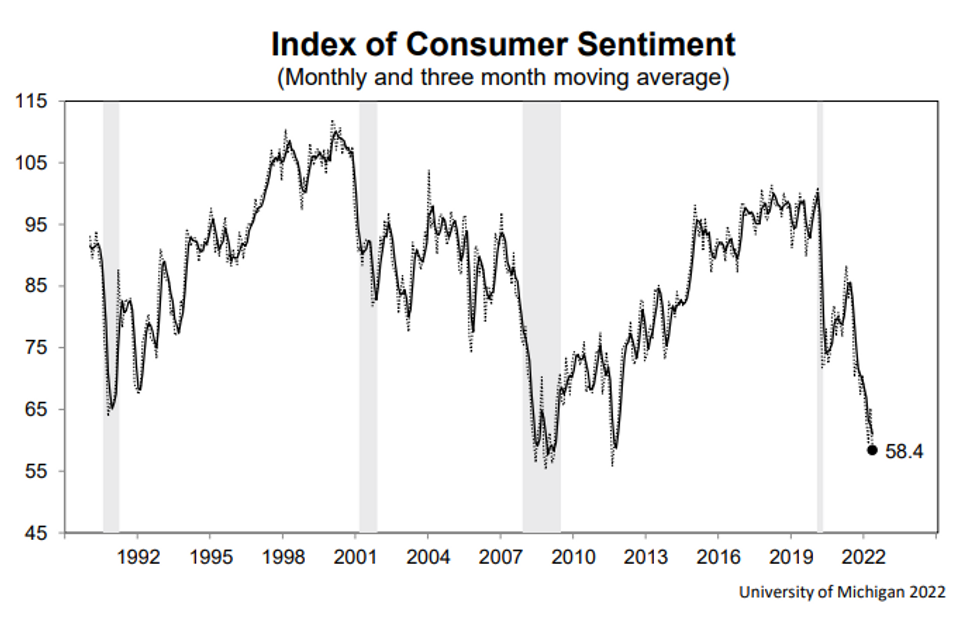

The University of Michigan consumer sentiment index fell to 58.4 in May, down from a post-Covid high of 88.3 touched in April 2020, and the lowest since August 2011. The perception of current conditions fell to 63.3, the lowest since November 2008 when it hit a low of 57.5.

CONSUMER RESILIENCE

Hsu pushed back on the notion that the poor sentiment figures portend a coming recession. "Not every single drop in sentiment leads to a recession," she said, pointing to 2011.

For one thing, individual Americans feel more secure about their own future relative to peers and expect their finances to improve and for incomes to increase, particularly younger respondents.

"The way to square our low sentiment numbers with continuing consumption is that even though people feel really terribly about the economy, they feel okay about their own personal, individual situations," she said. "That will be consistent with supporting consumption behavior right now."

There continues to be a record gap with the separate Conference Board measure, which is more optimistic and puts more weight on the labor market. (See: MNI INTERVIEW: Consumers Can Take Fed Hikes - Conference Board)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.