-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI INTERVIEW: U.S. Sentiment Turns Up On Disinflation - UMich

Decreased worries about inflation are making consumers more optimistic about the economy, a sign that the Federal Reserve's monetary tightening campaign is having its desired effect, the head of the University of Michigan's Survey of Consumers told MNI.

"We had a pretty strong increase in sentiment from last month to this month and we saw it across every demographic and this improvement in short run inflation expectations is also across the board. This isn't usually the case," said Joanne Hsu in a phone interview Friday. "It's a consensus on improved expectations over the economy as well as improvements in inflation."

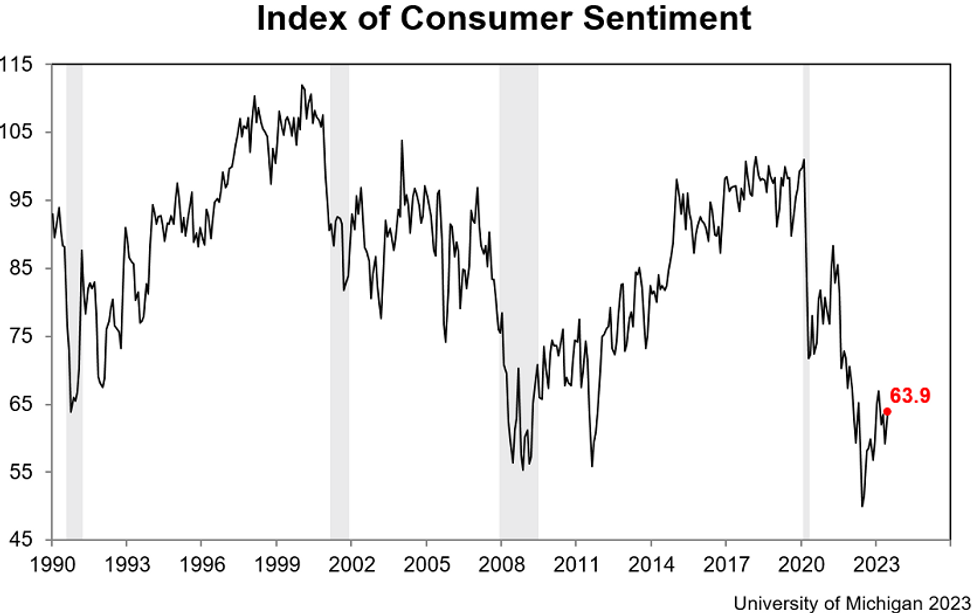

The University of Michigan's preliminary June reading on the overall index of consumer sentiment came in at 63.9 up 7.9% on the month and above expectations for 60. The perception of current conditions increased 4.8% to 68.0 and the expected index increased 10.6% to 61.3.

"The main story here is that consumers are feeling a bit less uneasy about the economy," Hsu said, pointing to the resolution of the debt ceiling crisis and inflation. "When it comes to fundamentals in the economy, they are noticing a slowdown in inflation in a number of areas, not just gas, and they have folded that into their expectations and their sentiment."

HEARTENED FED

The University of Michigan survey's reading of one-year inflation expectations receded for the second consecutive month, falling to 3.3% in June from 4.2% in May, the lowest since March 2021. Still, the measure of five-year inflation expectations was little changed from May at 3.0%.

Fed officials "should be heartened by what they're seeing. Two consecutive months of sharp declines in inflation expectations is really a great sign. Caution should come from the fact that long-run expectations haven't budged at all," said Hsu, a former principal economist at the Fed board's division of research and statistics. (See: MNI INTERVIEW: Inflation Drop Warrants Fed Pause - Ex IMF Econ)

LABOR CONCERNS

One caveat to the positive news was increased concern from consumers about their income expectations and possible signs of weakening in the labor market.

"Across the board consumers have downgraded their income expectations, both in nominal terms as well as in real terms. Younger consumers in particular had the smallest increase in sentiment this month and are expecting unemployment rates to rise in the year ahead," Hsu said.

"This is something to watch very carefully in the months ahead because of the strong labor market and strong incomes. That's been the primary thing supporting consumer spending and if consumers feel less confident about that, it could lead to a less a lower willingness to spend," she added.

Another reason for worry: the UMich survey director emphasized "sentiment remains extremely low from a historical standpoint," she said.

"Prices still remain really high. The share of consumers telling us that high prices are weighing down their living standards is basically unmoved and actually higher now than it was in the beginning of the year."

Still, Hsu expects ongoing disinflation to keep consumer sentiment on an upward trajectory. "I don't expect them to continue climbing at the same rate going forward but if inflation continues to slow consumer sentiment will continue to improve."

Source: University of Michigan Survey of Consumers

Source: University of Michigan Survey of Consumers

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.