-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY14.2 Bln via OMO Friday

MNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI EUROPEAN MARKETS ANALYSIS: U.S. Fiscal Matters Allow Equities To Go Bid Ahead Of Big Tech Earnings

- Confirmation that the U.S. Democrats will use reconciliation measures to force through the COVID support bill came as no surprise (even with Biden's preference for bipartisan support), but supported risk. Focus now falls on musings from the moderate wing of the party.

- U.S. Tsys tight in Asia, with further TYJ1 downside exposure added.

- DXY a touch lower into Europe.

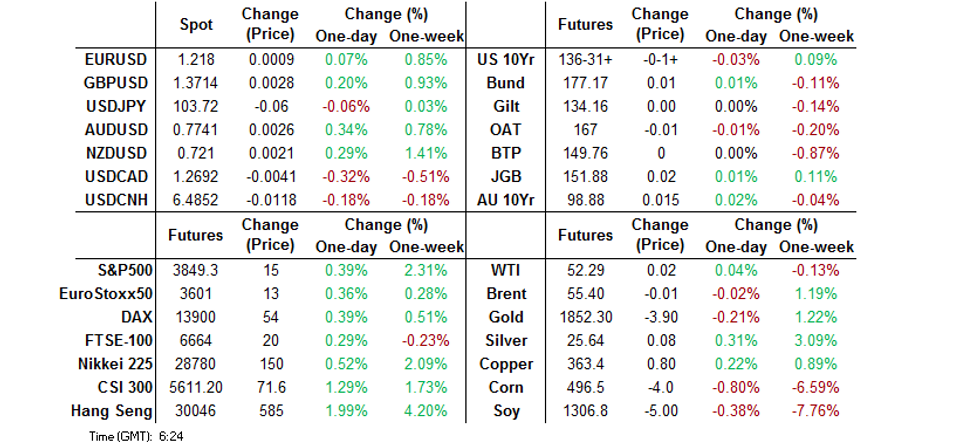

BOND SUMMARY: Tight Overnight Trade For Core FI

T-Notes have stuck to a narrow range in Asia-Pac trading, even with e-minis bid (NASDAQ 100 futures have tagged fresh all-time highs ahead of this week's earnings slate, which includes quarterly results from Apple, Microsoft & Facebook). The contract last deals -0-01+ at 136-31+, sticking to a 0-03+ range. Cash trade has seen some light bear steepening, with 30s sitting around 1.0bp cheaper than Friday's closing levels. On the flow side, further fresh TYJ1 downside exposure was seen, once again via a 10K block of the 138.00/133.50 risk reversal (this time hedged with 5.0K FV futures), with 30.0K lots of new Asia-Pac downside exposure via TYJ1 risk reversals established over the last week or so. Elsewhere, BBG sources pointed to a potential multi-tranche round of issuance from 7-Eleven, which could total ~$11bn. Looking ahead, Monday will see 2-Year Tsy supply and an address from U.S. President Biden, which will be supplemented by the release of a couple of regional Fed economic activity indicators.

- JGB futures consolidated within their overnight range during Tokyo trade, operating in familiar territory, closing +2, drifting lower in the afternoon with global equities bid. Cash trade generally saw a light bid across the curve, with 5- & 10-Year JGBs seeing some modest outperformance, although the super long end softened in afternoon trade, with 30s and 40s going out a little cheaper on the day (likely linked to the aforementioned uptick in global equity markets and/or representing some concession ahead of tomorrow's 40-Year JGB supply). There was little to go off for the space, with the size of the latest round of BoJ 1-10 Year Rinban operations left unchanged, while the offer to cover ratios of the operations provided nothing in the way of market moving impetus.

- In Australia, the broader round of muted core FI trade observed during Asia-Pac hours was compounded by the impending Australia Day holiday (which will be observed on Tuesday), leaving local bond futures to stick to the ranges that were established in the final overnight trading session of last week. YM unch., XM +1.5 at the bell. Cash ACGB trade saw some light bull flattening, with swaps generally wider across the curve. Looking ahead, local Q4 CPI data (due Wednesday), headlines the local docket this week, while Friday's A$2.5bn ACGB 0.25% 21 November 2024 supply presents the only round of ACGB issuance this week (although it should be easily digested owing to the relatively low weekly DV01 risk offering).

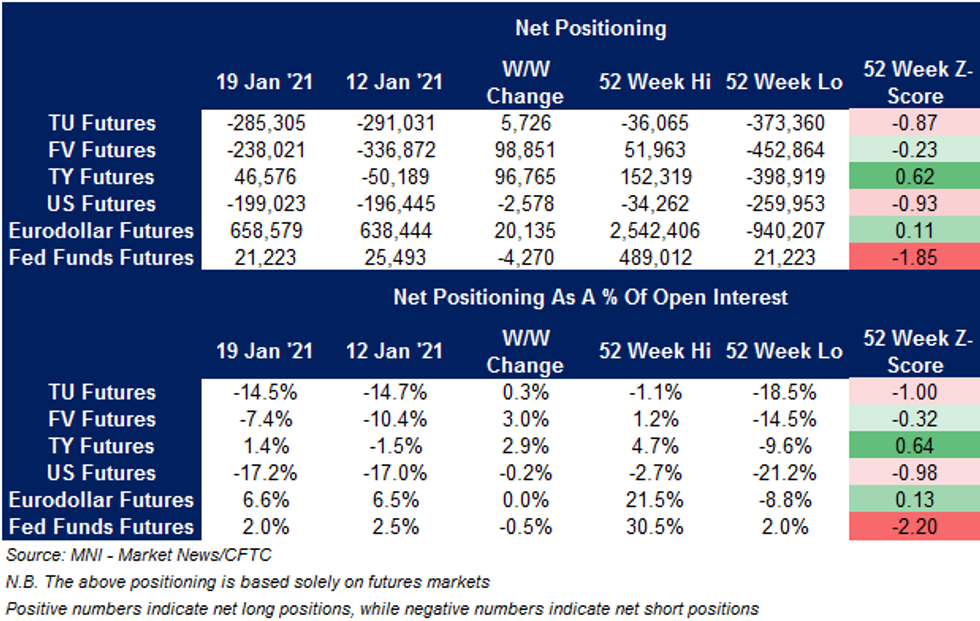

US TSYS: No Standout Moves In Latest CFTC CoT Positioning

Little in the way of decisive movement in overall net positioning for the U.S. FI space in the latest weekly CFTC CoT report, with the re-establishment of overall net long TY exposure (after one week of residing in net short territory) and trimming of FV net shorts providing the highlights. Still, neither of the metrics witnessed jumps outside of their respective established ranges.

FOREX: Risk Sentiment Turns Positive, Commodity-Tied FX Firm Up

Asia-Pac equity benchmarks firmed up at the start to the week, with commodity-tied FX rising in tandem. Sentiment was aided by the relaxation of Hong Kong's partial lockdown and weekend comments from U.S. Senator Sanders, who suggested that Democratic lawmakers may pass the Covid-19 relief package via the reconciliation approach (using a simple majority).

- NZD/USD shook off its initial weakness, seen after New Zealand reported its first community case of Covid-19 in two months, and returned onto the $0.7200 handle. AUD/NZD was trapped within a familiar range, as both Antipodean currencies sat atop the G10 pile.

- Safe havens cheapened amid broader appetite for riskier FX. USD/JPY crept higher into the Tokyo fix, perhaps on the back of Gotobi day demand, before easing off later in the session. The DXY faltered but last Friday's low remained intact.

- PBOC fixed USD/CNY at 6.4816, in line with sell-side estimates.

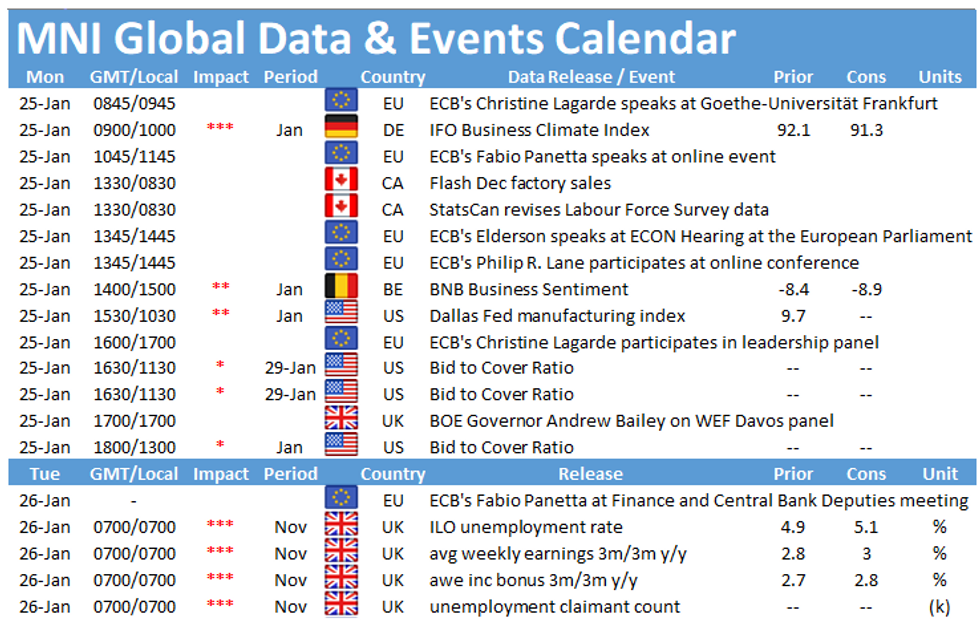

- Coming up today we have German IFO Survey and a speech from EU Justice Commissioner on the rule-of-law mechanism. As a reminder, the World Economic Forum kicks off, adding to the central bank speaker slate. Remarks are due from ECB's Lagarde, Panetta, Lane, Mahklouf & Weidmann, PBoC Gov Yi and BoE Gov Bailey.

FOREX OPTIONS: Expiries for Jan25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1975(E556mln), $1.2000(E563mln), $1.2050-70(E658mln), $1.2090-1.2100(E519mln), $1.2230-40(E1.2bln-EUR puts),

$1.2245-55(E936mln) - USD/JPY: Y103.25-35($601mln-USD puts)

- GBP/USD: $1.3370-80(Gbp689mln)

- AUD/USD: $0.7550(A$2.8bln), $0.7650(A$1.4bln), $0.7690-0.7700(A$700mln), $0.7750(A$768mln), $0.7800(A$711mln)

- USD/CAD: C$1.2700($603mln-USD puts), C$1.2900($536mln-USD puts)

- USD/CNY: Cny6.5700($1bln)

- USD/MXN: Mxn19.50($550mln), Mxn20.00-01($543mln)

ASIA FX: Risk Sentiment Reverses

Most Asia FX started the session on the back foot as global concerns surrounding the pandemic sapped kept risk appetite subdued, but hopes for a US stimulus package helped turn risk sentiment around and saw most Asia FX get into positive territory for the day.

- CNH: Yuan has strengthened as the greenback pulls back. PBOC fixed USD/CNY at 6.4816, in line with sell-side estimates. The pair is lower on the session but remains within Friday's range after a sizable jump from 6.4650 to just shy of the 6.50 handle.

- SGD: CPI was flat on the year against expectations for -0.1%, core was weaker than expected at -0.3%. Market looks ahead to further data later in the week.

- TWD: Taiwan dollar is one of the few Asia EM FX that has retreated against the greenback after Chinese military aircraft made incursions into Taiwan airspace.

- KRW: The won managed to change its fortunes during the session, clawing back losses to head into the close in positive territory. There were reports that the South Korean ruling party were seeking cash handouts to citizens as a stimulus effort, and would compensate SME's for their losses.

- IDR: Rupiah gained, data showed that Q4 foreign direct investment rose 5.5% Y/Y, BOI officials pledged to keep rates low and said they planned more transparency to improve policy transmission.

- MYR: Ringgitt is the worst performer in Asia after reports that the government is preparing to shut down most of its economy if coronavirus cases continue to rise.

- PHP: USD/PHP re-opened higher and came into contact with its 50-DMA for the first time since mid-Nov, but a failure to stage a clean breach of the aforementioned moving average was followed by a pullback.

- THB: Baht strengthens modestly on the session, data showed foreign tourist arrivals slumped to 6.7mn from 39.9mn recorded in 2019, with Dec arrivals printing at just 6,556. Meanwhile the AstraZeneca jab was approved by the local regulator.

EQUITIES: US Stimulus Hope Boosts Stocks

A positive start to the week for equity indices; most Asia-Pac bourses are in the green and US/European futures have taken the hint with major bourses in the green.

- The early uptick in e-minis/Asia-Pac equities is being linked to weekend comments from US Senator Bernie Sanders (who will chair the Senate Budget Committee). Sanders noted that the Democrats will push through the Covid-19 relief package via the reconciliation approach (simple majority vote, with VP Harris casting the deciding vote in the case of a tie), if required. This stance is broadly in line with expectations, while President Biden has indicated his preference for bipartisan agreement re: the matter we have stressed that the Democrats would likely use reconciliation measures to push through this leg of fiscal support, and as such, only rely on the backing of all of the party's own Senators.

- Elsewhere, news that Hong Kong's partial lockdown (covering some of the district of Kowloon) only unearthed 13 positive Covid cases and has now been relaxed, as scheduled, supported the Hang Seng which gained ~2%. The KOSPI also saw strong gains.

- NASDAQ 100 futures have tagged fresh all-time highs ahead of this week's earnings slate, which include quarterly results from Apple, Microsoft & Facebook

GOLD: Narrow

Bullion has steadied in Asia, with U.S. yields rangebound and the broader DXY a touch lower on the day, allowing participants to step back and assess matters after Friday's recovery from intraday lows. Spot last deals little changed around the $1,855/oz mark, with the broader technical picture unchanged from Friday.

OIL: Demand Concerns Vs. Supply Issues

WTI & Brent hover around unchanged levels. Data released on Friday showed headline crude inventories rose 4.35m bbls against expectations of a decline, the increase was the first gain since early December.

- Signs of potentially weaker demand are weighing on markets as coronavirus cases surge. Fresh lockdowns are being imposed around the world and many countries are considering or implementing travel bans.

- Supporting oil prices is the announcement from Iraq that it would reduce January and February output to make up for exceeding its OPEC+ quota last year. Also supporting prices were reports that members of a Libya's oil guards, the paramilitary force responsible for safeguarding oil ports, ordered a halt in crude exports at three eastern terminals during a pay dispute.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.