-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI South Africa Medium Term Budget Preview: November 2021

Executive Summary:

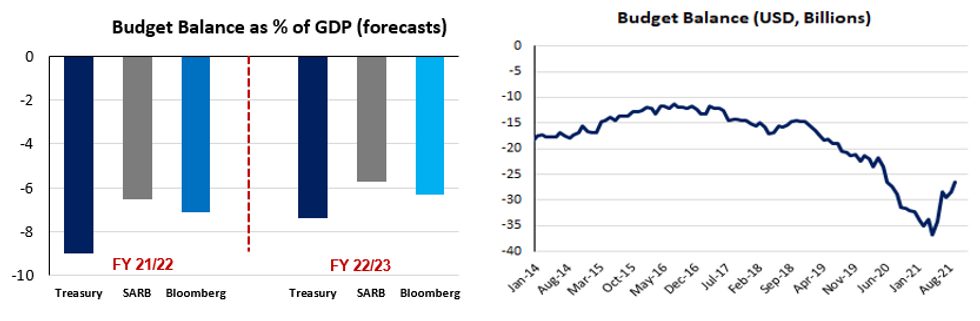

- MTBPS to reflect a rosier fiscal picture than previously anticipated

- Surplus mining profits are expected deliver a R140-169bn tax windfall, supporting a narrowing of the deficit to 6.5-7.1% vs 9.3% forecasts in Feb

- Grants will be the core focus of the meeting with markets concerned about the permanence of a basic or 'family grant' framework

- We see FinMin Godongwana favouring a targeted job-seekers grant (R30-35bn) and keeping SOE bailouts to a minimum (R13-15bn

Full preview here:

This week, Finance minister Godongwana will produce his maiden MTBPS against a far rosier fiscal backdrop than in recent meetings, but don't let that fool you into thinking the purse strings will be any looser. Aided by windfall profits in the mining sector on the back of a commodity super cycle, the Treasury is set to see some reprieve after years of deteriorating fiscal metrics - providing the new Finmin with a more robust platform to (hopefully), in his own words, "not let this opportunity go to waste."

Godongwana will report back on progress made on the Feb 2021 objectives, while guiding towards the next set of changes that will inform the updated budget framework in 2022. The market's focus will likely be on discussion surrounding the feasibility of a basic income/targeted jobseekers grant, potential growth-inducing reforms, slightly narrower issuance targets, public sector wage frugality, limited SOE bailout packages and discussion of Eskom just transition & debt management strategies.

Overall, markets anticipate the budget to be a well-balanced affair under Godongwana, who has thus far followed a similar trajectory to his predecessor Mboweni. Since taking office, Godongwana has kept a firm hand on the fiscal reins, showing limited appetite for unaffordable populist expenditure strategies, and instead favouring a growth-inducing structural reforms approach that fits well with SA's constrained budget parameters.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.