-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI NBP Preview - April 2023: Standing Ground

Executive Summary:

- We align with consensus in calling for another on-hold monetary policy decision from the NBP.

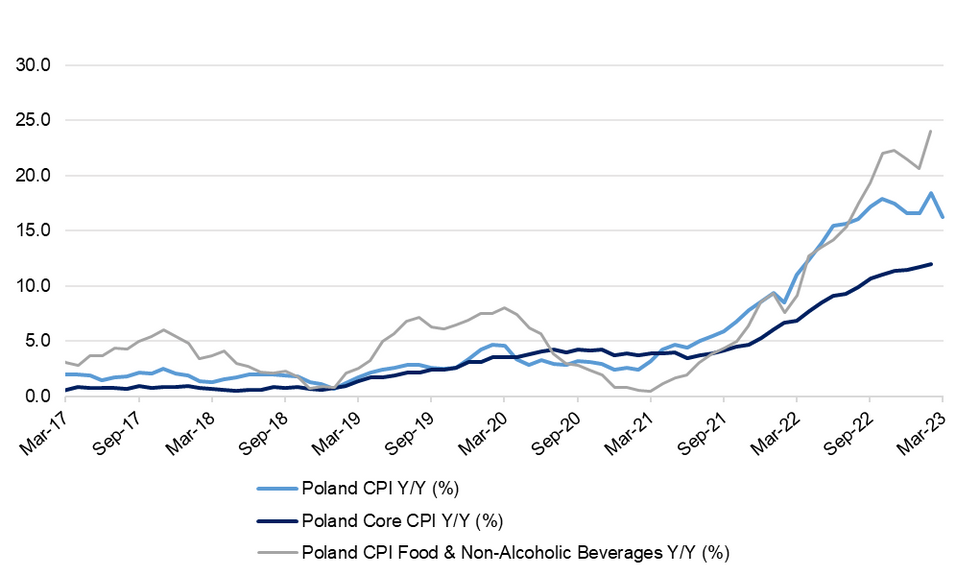

- Inflation likely peaked in February but underlying price pressures remain stubborn.

- Governor Glapinski's press conference is unlikely to bring any major shift in rhetoric.

MNI NBP Preview - April 2023.pdf

The NBP are expected to keep interest rates unchanged after another placeholder monetary policy review this week, with little pointing to any material shift in the sentiment of a dovish-leaning majority in the MPC. Against this backdrop, the subsequent press conference with Governor Adam Glapinski will yet again steal the limelight. We do not expect the Governor to depart from his familiar rhetoric to any significant extent, as he expects to see more signs of disinflation as the year progresses and remains wary of the socioeconomic costs of any renewed monetary tightening. At the same time, the central bank is unlikely to formally end its rate-hike cycle as the breakdown of the latest inflation data pointed to stubborn underlying price pressures.

Fig. 1: Polish CPI Inflation Measures Y/Y (%)

Fig. 1: Polish CPI Inflation Measures Y/Y (%)

The market continues to price the beginning of the rate-cut cycle by the end of 2023, with Poland’s 9x12 FRA contracts trading at a 54bp discount to benchmark 3-month WIBOR. Sell-side analysts are divided as to whether monetary easing could commence by the turn of the year, with core inflation proving sticky and underlying price pressures still strong. Inflation data will remain under close scrutiny going forward and will be critical for determining the NBP’s course of action. Raising the risk of a dovish misstep is the upcoming general election, as even a token rate cut could boost the electoral chances of the incumbent administration, which appointed seven out of ten MPC members. This week’s rate review may shed some light on the MPC’s readiness to follow that path.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.