-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: South Korea Deals With Martial Law Fallout

MNI: PBOC Net Drains CNY227 Bln via OMO Wednesday

MNI NBP Preview - June 2023: Waiting For July Forecasts

Executive Summary:

- The NBP are widely expected to keep interest rates unchanged.

- Recent weeks brought positive CPI & GDP data as well as dovish comments from MPC members.

- Next opportunity for a notable revision to official communications may come with July forecasts.

MNI NBP Preview - June 2023.pdf

The National Bank of Poland are universally expected to keep interest rates unchanged, but this time around there is potential for a dovish shift in communications. Macroeconomic data have developed roughly in line with the central bank’s projections, with price pressures easing faster than expected. This bolstered the dovish wing of the Monetary Policy Council, encouraging them to flag potential for rate cuts being delivered by the end of this year. Given the NBP’s relatively dovish bias, we expect Governor Adam Glapinski to take note of positive signals on disinflation and reaffirm his hope for monetary loosening as soon as in Q4.

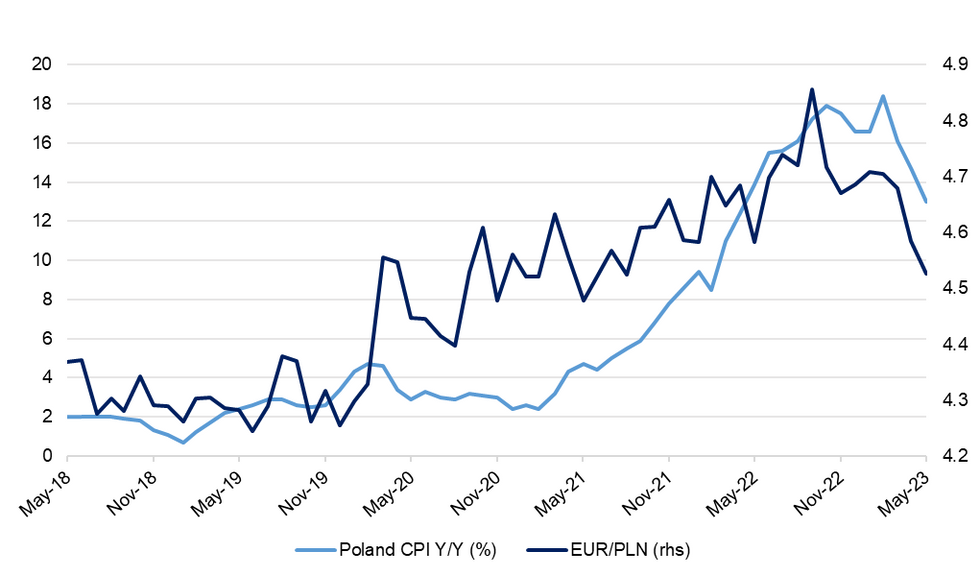

Fig. 1: Poland CPI Y/Y (%) vs. EUR/PLN

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

The next turning point for the NBP will be July, when the next edition of quarterly macroeconomic forecasts is due to be published. In fact, this week’s meeting may well turn out to be a mere placeholder ahead of the next one. A couple of policymakers signalled that the next set of projections will inform a potential debate on loosening monetary settings, which could commence as soon as this autumn if inflation falls to single-digit territory. However, the coming months may see fiscal matters come to the fore, posing one of the key risks for NBP expectations. The election campaign is only gaining steam and it is likely that both the incumbents and opposition parties will unveil more fiscal commitments in a bid to sway undecided voters ahead of a highly polarised poll.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.