-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI NBP Review - February 2024: Rates Will Remain Fixed For Now

Executive Summary:

- The NBP kept interest rates unchanged for the four consecutive time.

- The tone of the statement arguably turned more hawkish.

- Governor Glapiński said that he does not expect any moves in rates in 2024.

Full review document including a summary of sell-side views here:

MNI NBP Review - February 2024.pdf

The National Bank of Poland (NBP) kept interest rates unchanged for the fourth consecutive meeting, revisiting all the familiar tropes from the January statement. The language used to describe the macroeconomic situation and interest-rate outlook was slightly more hawkish, even as the shift boiled down to just a few subtle adjustments to the statement. During his press conference, Governor Adam Glapiński reiterated that inflation will approach the +2.5% Y/Y +/- 1pp target in March before rebounding, with much uncertainty around the medium-term outlook. The official guided that interest rates are unlikely to change through the remainder of this year.

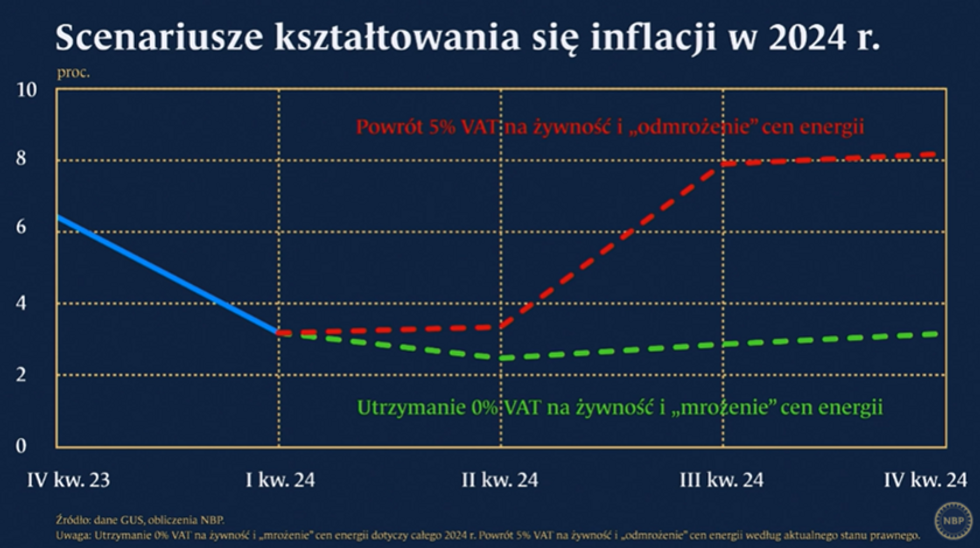

Fig. 1: Inflation scenarios for 2024. The red line shows a scenario in which the 5% VAT on food is reinstated and the energy price freeze is lifted. The green line shows a scenario in which both anti-inflationary measures remain in force. The slide was retrieved from Governor Glapinski's presentation (8th February 2024) delivered during his press conference, with a video recording available on the NBP’s website.

Fig. 1: Inflation scenarios for 2024. The red line shows a scenario in which the 5% VAT on food is reinstated and the energy price freeze is lifted. The green line shows a scenario in which both anti-inflationary measures remain in force. The slide was retrieved from Governor Glapinski's presentation (8th February 2024) delivered during his press conference, with a video recording available on the NBP’s website.

Overall, the statement and the presser confirmed that the NBP’s reaction function has evolved and now puts more weight on medium-term inflation and less weight on near-term fluctuations. The Governor’s forward guidance, framed as his personal assessment of sentiment within the MPC, was interpreted as a hawkish surprise, prompting the PLN to rally and pushing market rates higher. We now expect the NBP to stand pat on rates at least through the rest of 2024, with little potential for the central bank to change tack, with policymakers looking to anchor inflation near its target over a longer horizon. The release of the next macroeconomic projection in March will be an occasion to revisit interest-rate forecasts.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.