-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI POLITICAL RISK ANALYSIS – Global COVID-19 Tracker – Jul 27

by Tom Lake

Today's Major COVID-19 Headlines And Latest Data

- Speaking at a press conference in Geneva on July 27, World Health Organization Director-General Dr Tedros Ghebreyesus stated that the COVID-19 pandemic was "easily the most severe" global health emergency the WHO had ever faced. He also confirmed that "the pandemic continues to accelerate", and that "in the past six weeks the total number of cases has roughly doubled."

- A number of European countries have recorded spikes in cases, with the Spanish region of Aragón holding the highest infection rate on the continent of 238 cases per 100k residents. In Belgium, the city of Antwerp has an infection rate of 67.9 per 100k inhabitants, well above the 26.9 national average. In Austria, an outbreak in the resort of St Wolfgang is being closely monitored after the confirmation of 56 new cases in the village.

- Following a record-high number of new cases in Hong Kong (145 on July 27), authorities have announced further restrictions on social distancing. People will only be able to meet in groups of two, eating in restaurants is banned, and face masks are compulsory outside. The restrictions apply from July 29 to August 5. The outbreak has centred mainly on community transmission, sparking the rapid escalation in lockdown measures.

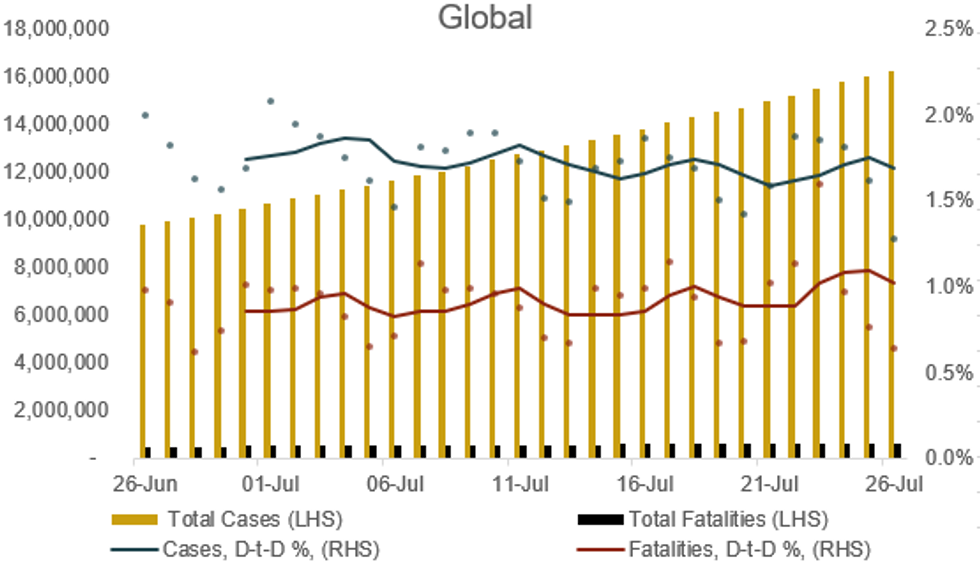

- Global increase in cases (daily) – Yesterday: 1.3%. Seven-day average: 1.6%

- Global increase in fatalities (daily) – Yesterday: 0.6%. Seven-day average: 1.0%

MNI EXCLUSIVE: PBOC Eyes Easy Policy Risks As Economy Recovers - The People's Bank of China is growing more concerned by the prospect of rising bad loans and a resurgence in shadow banking, but will hold off from any move to tighten policy while the economy continues to recover from the Covid-19 pandemic and could still introduce some additional targeted stimulus, policy advisors and sources told MNI. On MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com

Chart 1. COVID-19 Cases and Fatalities, Nominal and % Chg Day-to-Day (5dma)

Source: JHU, MNI. As of 0600BST July 27. N.b. Each dot represents a single day's figures, data for past month

Source: JHU, MNI. As of 0600BST July 27. N.b. Each dot represents a single day's figures, data for past month

Please find full article PDF attached below:

MNI POLITICAL RISK ANALYSIS – Global COVID-19 Tracker – Jul 27.pdf

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.