-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI BRIEF: RBA Details Hypothetical Monetary Policy Paths

MNI POLITICAL RISK ANALYSIS – Global COVID-19 Tracker – Jul 28

by Tom Lake

Today's Major COVID-19 Headlines And Latest Data

- The Republican leadership in the US Senate has put forward an additional USD1trn economic support package to mitigate the damage caused by COVID-19. The proposal includes a second USD1,200 cash payment to most Americans, and a replacement to the USD600/week boost to unemployment benefits with the amount reduced to USD200/week. The plan will be negotiated with Congressional Democrats, who have called the plan "totally inadequate".

- The German government has issued official advice to its citizens warning against "unnecessary trips" to the Spanish regions of Aragon, Catalonia, and Navarra following a spike in cases in recent days. This follows on from the UK government's introduction of a quarantine of those returning from Spain from last Saturday. Spanish PM Pedro Sanchez called the UK move "unjust", while the local government of Aragon said the German advice was "discriminatory".

- On July 27 the White House confirmed that National Security Adviser Robert O'Brien had tested positive for COVID-19, making him the most senior administration official to fall victim to the virus. O'Brien is said to have mild symptoms and is self-isolating. The White House sought to stress President Trump and Vice-President Pence were not at risk, saying Trump had not met the NSA for "several days". The two were pictured together two weeks ago in Miami, Florida.

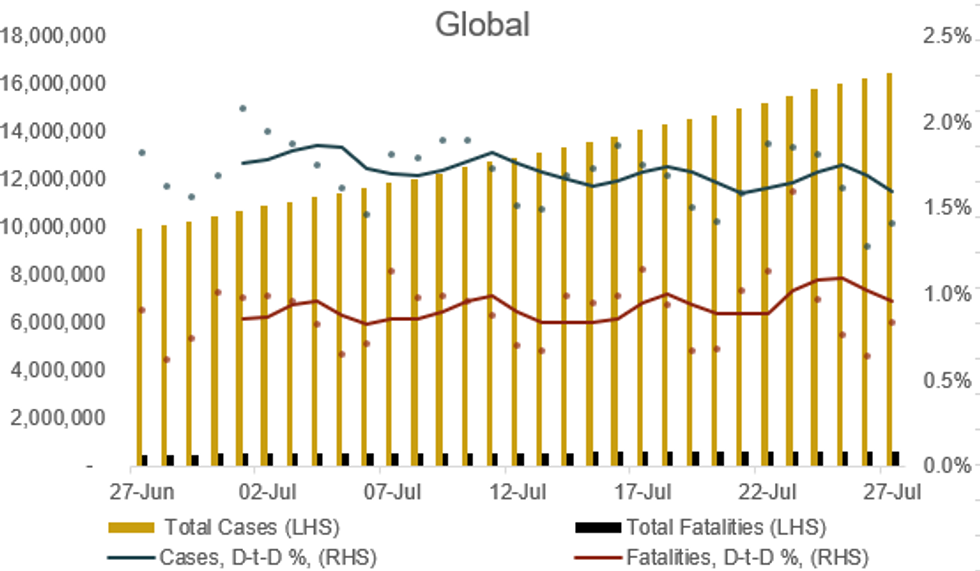

- Global increase in cases (daily) – Yesterday: 1.4%. Seven-day average: 1.6%

- Global increase in fatalities (daily) – Yesterday: 0.8%. Seven-day average: 1.0%

MNI INTERVIEW: Millions More US Jobs Lost if Govt Aid Falters - Millions more U.S. jobs will be lost in coming months if a federal relief package fails to support struggling households and businesses, labor market experts told MNI. On MNI Policy Main Wire and email now - for more details please contact sales@marketnews.com

Chart 1. COVID-19 Cases and Fatalities, Nominal and % Chg Day-to-Day (5dma)

Source: JHU, MNI. As of 0600BST July 28. N.b. Each dot represents a single day's figures, data for past month

Source: JHU, MNI. As of 0600BST July 28. N.b. Each dot represents a single day's figures, data for past month

Full article PDF attached below:

MNI POLITICAL RISK ANALYSIS – Global COVID-19 Tracker – Jul 28.pdf

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.