-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS – Global COVID-19 Tracker - Oct 30

COVID-19 Trends and Developments

- We have replaced Hong Kong and Singapore with the Netherlands and Switzerland in our table of selected nations and our chartpack. While both Hong Kong and Singapore have recorded new caseloads in the single/low double-digits for some months, both the Netherlands and Switzerland have recorded a rapid spike in cases in recent weeks. Switzerland's average daily increase in cases across the past week stands at 6,861 per day, up from an average of 370 new cases per day over the month of September. In the Netherlands the same metrics show numbers of 9.693 over the past week from 1,673 in September.

- The United States recorded 88,521 new cases on October 29, the highest 24 hour new caseload of the pandemic so far. A number of mid-Western and Plains states have been hit with high numbers on a per capita basis, while all of Illinois, Indiana, Maine, Michigan, Minnesota, Missouri, Nebraska, New Mexico, North Carolina, North Dakota, Ohio and Oregon recorded their highest new caseloads on October 29.

- France's average number of fatalities from COVID-19 across the past week stood at an average of 260 per day on October 29, the highest seven-day average since May 5. The spike in fatalities comes weeks after a spike in cases that has prompted the government to impose a new month-long nationwide lockdown that came into force at midnight. The lockdown sparked a mass exodus from the capital Paris on Thursday evening as roads became congested with individuals seeking to ride out lockdown in more rural areas. Travel between different regions is prohibited during lockdown except for specific reasons.

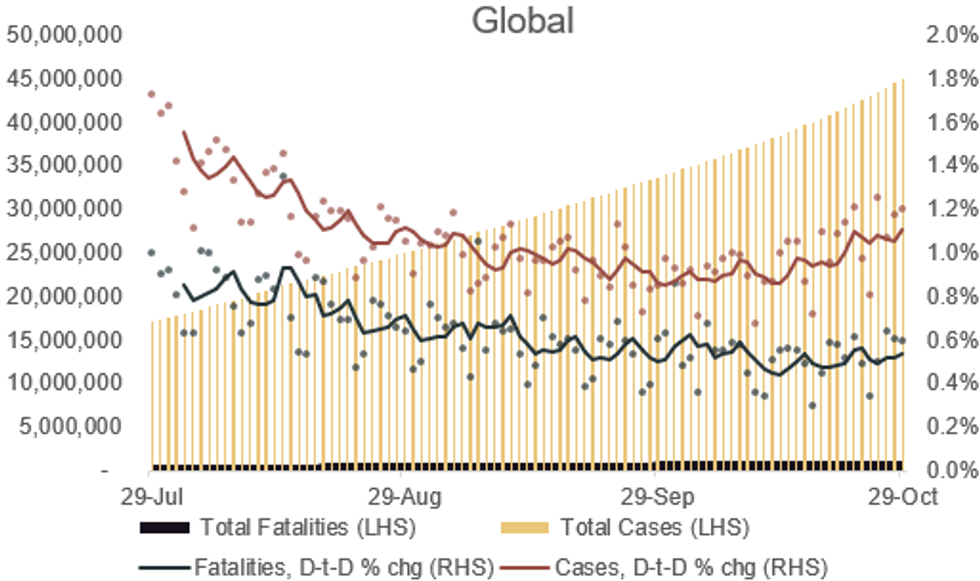

Source: JHU, MNI. As of 0700BST October 30. N.b. Each dot represents a single day's figures, data for past three months

Source: JHU, MNI. As of 0700BST October 30. N.b. Each dot represents a single day's figures, data for past three months

Full article PDF attached below:

MNI POLITICAL RISK ANALYSIS – Global COVID-19 Tracker - Oct 30.pdf

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.