-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS-Israel Vote Offers No Clear Answer

The 23 March legislative election, the fourth in two years, delivered another fragmented result that could set Israel on the path to a fifth election in the coming months.

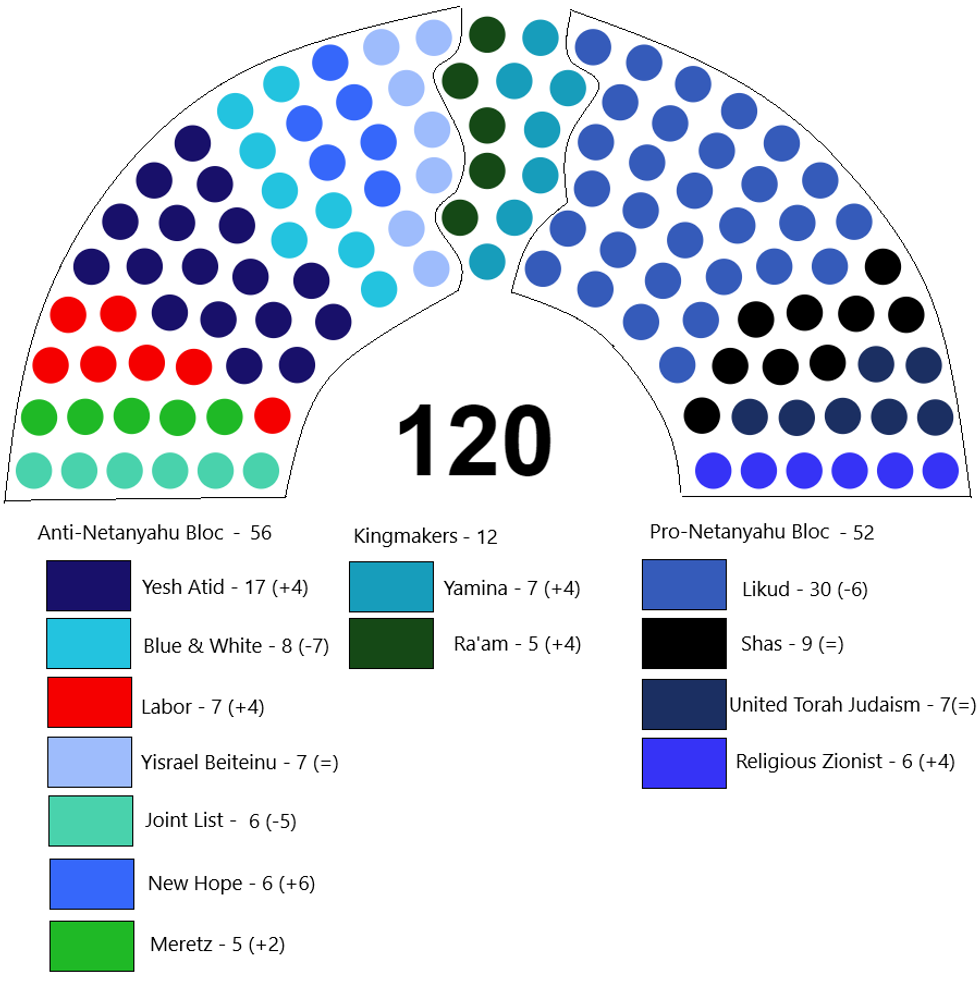

- Neither the bloc of parties supportive of incumbent Prime Minister Benjamin Netanyahu, nor the opposition bloc won a clear majority in the 120-member Knesset (see chart below). Instead, two parties that have yet to declare their allegiance will sit as kingmakers, either to another Netanyahu gov't, an opposition-led coalition, or if no agreement can be reached then they could force another snap election.

- According to preliminary results, Netanyahu's conservative Zionist Likud Party won 30 seats, a loss of six that represents the part's lowest seat total since 2015. The other big losers from the election were former Chief of the General Staff Benny Gantz's centrist Blue and White (B&W) alliance, which lost seven seats down to a total of eight. B&W lost support as prior to the 2020 election, Gantz had fought the election on the basis of removing Netanyahu from office, only to support him in a coalition. The left-wing Arab-interest Joint List also suffered losses, with its total falling to six from 11 previously as the pre-election splintering of the group split the Arab vote.

Chart 1. 2021 Israel Election, Preliminary Results (87% of Votes Counted), Seats

Source: Israeli Election Commission, MNI

Source: Israeli Election Commission, MNI

- The winners from the evening in the opposition bloc were the liberal Yesh Atid, gaining four seats up to 17. Yesh Atid's Yair Lapid is hoping to replace Netanyahu as PM, but his path to office is obscured by Yamina, whose leader signed a pledge before the election not to support a government led by Lapid. The centre-left Labor Party won an additional four seats (up to seven), while the environmentalist Meretz increased its total by two to five. A new right-wing party opposed to Netanyahu, New Hope, entered the Knesset with six seats. Given its strong support for Israeli settlements in the West Bank it is hard to see how it might work alongside the more liberal parties in the opposition bloc.

- In the Netanyahu bloc there was only one winner, with the Religious Zionist Party gaining four seats, lifting its total to six. The party is the most extreme right-wing party in parliament, with factions including the Otzma Yehudit party, which advocates for a theocratic state and the removal of all Arabs from Israel.

- Focus will inevitably turn to the two kingmaker parties, Yamina and Ra'am.

- Yamina is a right-wing Zionist, economic liberal party led by former economy and defence minister Naftali Bennett. His conditions for supporting Netanyahu are likely to involve a rotating premiership in a similar deal to that struck between Netanyahu and B&W leader Benny Gantz in 2020.

- Ra'am is an Islamist party that split from the Arab-interest Joint List shortly before the election. While the party that advocates a two-state solution and increased rights for Palestinians seems an unlikely supporter of a right-wing Zionist Netanyahu government, Ra'am is the most hardline socially conservative of the Arab parties, and could support the Netanyahu bloc on the basis of avoiding a socially liberal coalition coming in under Yesh Atid and its leader Yair Lapid.

- Over the coming hours, days, and weeks the parties will engage in political horse-trading to try to cobble together a workable coalition, meaning political paralysis. This state could extend for several months should no workable government prove forthcoming.

- In terms of Israel's foreign relations, this could dampen the prospect of any further normalisation of ties with GCC countries as the political focus turns inwards. It could also see Israel's voice marginalised should talks begin on the Iran nuclear deal, the annulment of which Netanyahu has vociferously called for since its implementation in 2016.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.