-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI POLITICAL RISK ANALYSIS – Netherlands Election Preview

The Netherlands is holding its general election, with polls closing and results to be announced on 17 March. Prime Minister Mark Rutte is seeking to become the first-ever Dutch PM to win four consecutive elections. The outcome of the election has received relatively little international focus, with eyes in Europe largely trained on the machinations of Italian politics and the German federal election due in September. The vagaries of the Dutch electoral system and fractured party-political landscape makes it difficult to predict the composition of the next governing coalition.

PM Rutte's party is almost certain to win a plurality. However, the potential coalition partners he invites into government are likely to have a notable impact on the Dutch government's domestic economic policy, as well as government attitudes towards the European Union, encompassing immigration, Brexit, and crucially EU finances.

Full article PDF attached below:

MNI POLITICAL RISK ANALYSIS – Netherlands Election Preview.pdf

Main Takeaways

- PM Mark Rutte very likely to lead the next government, with his centre-right VVD party on course to win a plurality of seats. This would make Rutte the first Dutch PM to lead win four general elections.

- Forming a government could take a considerable amount of time, given that four or more parties are set to be required to reach a majority in the House of Representatives. Last government took 225 days to be officially agreed.

- The prospect of the populist, Eurosceptic right entering or supporting a government coalition is very small. The potential coalition allies for Geert Wilders' PVV or Thierry Baudet's FvD are few and far between, while Rutte's VVD has ruled-out working with either party.

- The formation of the coalition will have significant implications for EU politics in the coming years. Another centre-right/centrist coalition would likely see a continued hard-line stance against fiscal transfers and greater Commission debt issuance. Meanwhile, a stronger bias towards the centre-left could see a more conciliatory Dutch government as talks on the Growth and Stability pact approach.

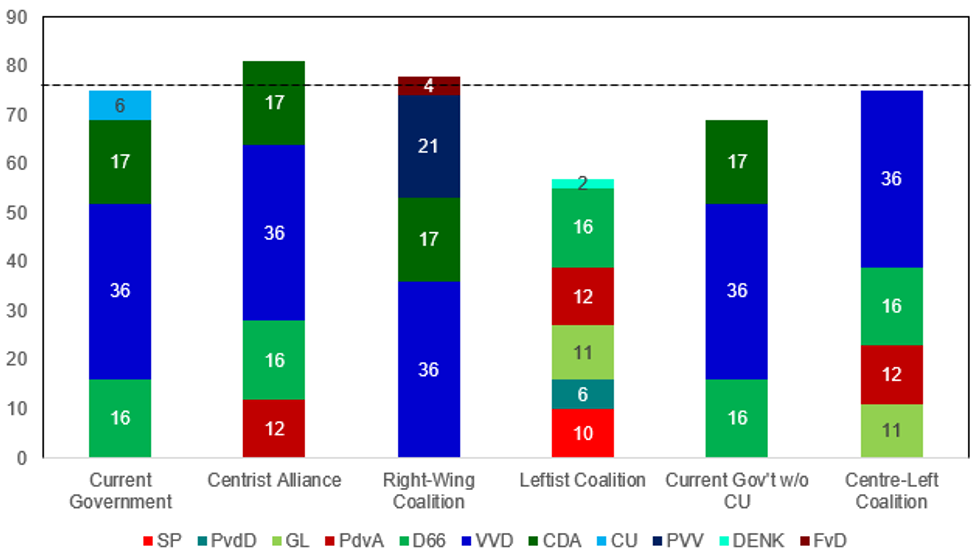

Source: I&O Research, Peil.nl, Ipsos, Kantar Public, MNI. N.b. Party seat totals based on average March opinion polling, Dashed line sits at 76 seats, the number required for a majority in the House of Representatives.

Source: I&O Research, Peil.nl, Ipsos, Kantar Public, MNI. N.b. Party seat totals based on average March opinion polling, Dashed line sits at 76 seats, the number required for a majority in the House of Representatives.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.