-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI SARB Preview - July 2023: Nearing End Of Hiking Cycle

Executive Summary

- Consensus looks for a 25bp rate hike from the SARB this week.

- Governor Kganyago remains determined to anchor inflation at the target mid-point.

- The SARB will publish new forecasts based on revamped projection model.

MNI SARB Preview - July 2023.pdf

The South African Reserve Bank is approaching the end of its tightening cycle, with this week’s decision between a 25bp rate hike and a hold seen as a virtual coin toss. We think that the risks are tilted in favour of a hike, which would allow the SARB to demonstrate its continued determination in chasing the inflation mandate before potentially pivoting to a wait-and-see stance. The updated macroeconomic forecasts are expected to show a slightly lower inflation path after the SARB adopted a new Quarterly Projection Model (QPM), which implies a smaller pass-through from the exchange rate to domestic price dynamics.

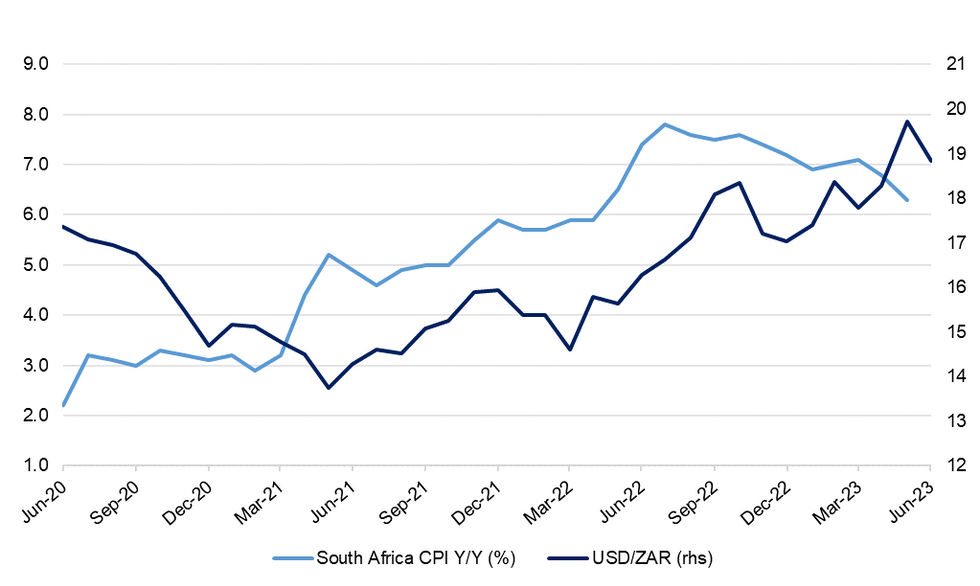

Data since the previous monetary policy meeting have mostly fallen on the dovish side. Headline CPI inflation eased to +6.3% Y/Y in May, undershooting expectations for the second consecutive month. Core inflation eased only marginally to +5.2% Y/Y but is already in the +3%-6% Y/Y target range. As per usual, we will not know the inflation figures for last month until the day before the SARB’s monetary decision. We reserve some scope for the latest inflation print to affect the SARB’s decision-making process if it happens to provide a spectacular surprise, but in principle a single data point should not factor into the calculus surrounding the structural drivers of inflation.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

However, Governor Lesetja Kganyago repeatedly emphasised that the central bank wants to anchor inflation and inflation expectations at the mid-point of the target range, suggesting that a mere return to the +3%-6% Y/Y band would not be sufficient to declare victory. From this perspective, both current and forward-looking measures of price dynamics are yet to reach acceptable levels. The Bureau for Economic Research’s most recent Inflation Expectations Survey showed that anticipated 2023 price growth increased to +6.5% Y/Y in Q2 from +6.3% previously, with the 2024 figure up to +5.9% from +5.8%, as expectations of heightened price growth remain firmly entrenched.

We think that the risks are tilted towards a 25bp hike, which may conclude this tightening cycle. On more than one occasion, the Governor said that he was less worried about overtightening than about tightening too little and having to catch up later on. Raising the policy rate by another 25bp would allow the SARB to reaffirm its hawkish credentials and pre-empt another flare-up in dovish market bets. On the other hand, if the Monetary Policy Committee chooses to stand pat on interest rates, the Governor will likely frame such non-decision as a hawkish hold, arguing that monetary tightening delivered to date keeps filtering through into the economy.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.