-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Stimulus Deal Remains Elusive

EXECUTIVE SUMMARY

- MNI BRIEF: Fed To Discuss Better QE Communications- Quarles

- MNI POLICY: BOE's Ramsden-Time Not Right For Negative Rates

- MNI POLICY: China Must Watch Global Easing Spillover Effects

- MNI POLICY: EU To Set Up Debt Office For Covid Borrowing

- MNI BRIEF: Further EU-UK Talks From Oct. 22-25

- CANADA: BOC Could Taper QE Next Week: NBF

- BREXIT TALKS SET TO RESTART, AIMING FOR DEAL BY MID-NOVEMBER, Bbg

- Fed Brainard: Sees "INFLATION BELOW 2% GOAL FOR NEXT FEW YEARS" Rtrs

US

FED: The Federal Reserve will discuss the path of its asset purchases at upcoming meetings because markets appear confused about future plans, Vice Chair Randal Quarles said Wednesday.

- "We are sensitive as well to the point that there is confusion, at least on clarity, about how we are thinking about asset purchases going forward. As the FOMC meets over the next few meetings I expect that we will have discussions about our communication policy around asset purchases," Quarles said when asked about tapering in 2021. Quarles said QE has been an effective tool that will be used more in an era with interest rates more likely to be around zero.

- The Fed's 13(3) facilities will stay in place until the crisis is over, he said. "Having these facilities out there and ready to take up more will be valuable," serving as a backstop in case Covid takes an adverse turn, he said.

ASIA

CHINA: China should be aware of the spillover effects of global monetary easing as past experience shows financial crises in emerging markets are often related to a tightening of policy in developed countries, Zhang Xiaohui, the dean of PBC School of Finance at Tsinghua University and former assistant governor of the People's Bank of China said Wednesday. For more see 10/21 main wire at 1116ET.

EUROPE

BOE: Bank of England Deputy Governor Dave Ramsden said the time was not right for the introduction of negative rates but he stood ready to use them in future and argued that headroom remained for more quantitative easing. For more see 10/21 main wire at 0841ET.

BREXIT: Further talks between the EU and the UK will take place from Oct. 22-25, in an initial phase. Intensified talks will take place across all negotiating tables concurrently, working every day including weekends, with lead negotiators in each of the workstreams seeking to identify areas of convergence, but nothing will be agreed until there is an overall agreement, the Commission said.

EU: The EU Commission has begun setting up its own debt management office to plan and coordinate bond issuance for its Covid-19 emergency relief programmes, it said on Wednesday, confirming an earlier MNI report. For more see 10/21 main wire at 1032ET.

CANADA

BOC: "To us, an announcement at next week's monetary policy meeting wouldn't come as a huge surprise," National Bank Financial's Warren Lovely and Taylor Schleich write in research note.

- QE of at least C5b a week of federal bonds is much faster than the Fed, and sets pace to own 45% of those securities in 6m.

- Scaling back shorter-end purchases would make more sense in terms of ensuring market liquidity.

- QE could be scaled back to CAD2-3b and still be meaningful.

- BOC may also wish to wait on any taper until govt presents a new fiscal plan with a sense of how much longer-term debt is coming, NBF report says.

- Other provincial bond program may be kept in place and not phased out like recent moves on mortgage bonds/BAs, given unclear macro outlook and financing needs.

OVERNIGHT DATA

- US MBA: MARKET COMPOSITE -0.6% SA THRU OCT 16 WK

- US MBA: REFIS +0.2% SA; PURCH INDEX -2% SA THRU OCT 16 WK

- US MBA: UNADJ PURCHASE INDEX +26% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.02% VS 3.00% PREV

MARKET SNAPSHOT

- DJIA down 0.77 points (0%) at 28337.42

- S&P E-Mini Future up 10.25 points (0.3%) at 3447

- Nasdaq up 30.1 points (0.3%) at 11563.11

- US 10-Yr yield is up 2.9 bps at 0.8142%

- US Dec 10Y are down 4.5/32 at 138-18

- EURUSD up 0.004 (0.34%) at 1.1863

- USDJPY down 0.96 (-0.91%) at 104.56

- WTI Crude Oil (front-month) down $1.63 (-3.91%) at $40.09

- Gold is up $15.56 (0.82%) at $1923.25

- European bourses closing levels:

- EuroStoxx 50 down 47.17 points (-1.46%) at 3201.33

- FTSE 100 down 112.72 points (-1.91%) at 5826.96

- German DAX down 179.31 points (-1.41%) at 12644.84

- French CAC 40 down 75.33 points (-1.53%) at 4885.65

US TSY SUMMARY: Stimulus Staus-Quo

Tsys continued to trade lower Wednesday, Eurodollar futures steady to marginally mixed, equities modestly higher, rates and stocks holding to an inside-range by the close. Appears markets are becoming a little more inured to stimulus-related headlines that have buffeted markets the last few sessions.

- Stimulus status-quo: while House Speaker Pelosi remains optimistic a deal can be reached before the election on Nov 3, Republicans widely pan the prospect of passing a deal even if one is agreed upon in the WH.

- Meanwhile, Covid-19 case counts continue to rise globally (new one-day jump for Italy by 15,199).

- Little to no react to another deluge of Fed speakers, VC Quarles stated late "FED EMERGENCY LOAN FACILITIES OFFER BACKSTOP IF NEEDED" a "GOOD THING THAT EMERGENCY PROGRAMS STILL HAVE FUNDS".

- Decent US Tsy $22B 20Y bond auction re-open (912810SQ2) draws high yield of 1.370% (1.213% last month) vs. 1.375% WI, on a bid/cover 2.43 (2.39 previous).

- The 2-Yr yield is up 0.4bps at 0.1472%, 5-Yr is up 1.5bps at 0.349%, 10-Yr is up 2.7bps at 0.8125%, and 30-Yr is up 3bps at 1.6216%.

US TSY FUTURES CLOSE: Yld Curves Continue Bear Steepening

Weaker after the bell, near middle of session range with level receding late. Yld curves continue to bear steepen, update:

- 3M10Y +3.443, 71.363 (L: 68.583 / H: 72.523)

- 2Y10Y +2.274, 66.329 (L: 64.654 / H: 68.104)

- 2Y30Y +2.465, 147.102 (L: 144.573 / H: 149.733)

- 5Y30Y +1.494, 126.964 (L: 124.799 / H: 128.49)

- Current futures levels:

- Dec 2Y down 0.125/32 at 110-13.5 (L: 110-13 / H: 110-13.875)

- Dec 5Y down 1.5/32 at 125-21.5 (L: 125-19 / H: 125-23.75)

- Dec 10Y down 4/32 at 138-18.5 (L: 138-13 / H: 138-24.5)

- Dec 30Y down 12/32 at 173-4 (L: 172-17 / H: 173-24)

- Dec Ultra 30Y down 18/32 at 215-8 (L: 213-27 / H: 216-09)

US EURODOLLAR FUTURES CLOSE: EDZ0 Dips Despite 3M LIBOR Decline

Steady/mixed in the short end, Reds-Greens posting marginal gains while long end of strip inched off lows. After holding steady much of the session the lead quarterly EDZ0 is mildly weaker despite 3M LIBOR drop of -0.00662 to 0.20913% (-0.00925/wk).

- Dec 20 -0.005 at 99.760

- Mar 21 steady at 99.795

- Jun 21 steady at 99.805

- Sep 21 +0.005 at 99.810

- Red Pack (Dec 21-Sep 22) +0.005 to +0.010

- Green Pack (Dec 22-Sep 23) +0.005

- Blue Pack (Dec 23-Sep 24) steady

- Gold Pack (Dec 24-Sep 25) -0.01 to -0.005

US DOLLAR LIBOR: Latest settles

- O/N +0.00025 at 0.08063% (-0.00050/wk)

- 1 Month +0.00213 to 0.14788% (-0.00350/wk)

- 3 Month -0.00662 to 0.20913% (-0.00925/wk)

- 6 Month -0.00588 to 0.24600% (-0.01150/wk)

- 1 Year -0.00225 to 0.33488% (-0.00012/wk)

US TSYS SHORT TERM RATES, OPERATIONAL PURCHASES

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $54B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $155B

- Secured Overnight Financing Rate (SOFR): 0.08%, $918B

- Broad General Collateral Rate (BGCR): 0.06%, $347B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $323B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.201B accepted vs. $1.980B submission

- Next scheduled purchase:

- Thu 10/22 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

PIPELINE: RBC LAUNCHED

- Date $MM Issuer (Priced *, Launch #)

- 10/21 $6B *World Bank (IBRD) 5Y +10

- 10/21 $2.25B #RBC $1.25B 3Y +33, $1B 3Y FRN SOFR+45

- 10/21 $2B #Sultanate of Oman $1.25B 7Y 6.75%, $750M 12Y 7.375%

- 10/21 $1B *FHLBanks 2Y global +4

- 10/21 $Benchmark Meituan 5Y +180, 10Y +225

- 10/21 $750M Arab National Bank 10NC5 Sukuk +290

- 10/21 $750M *Qatar Islamic Bank 5Y Sukuk +155

- 10/21 $600M *Inv Corp Dubai (ICD) +5.5Y +275

FOREX: Sterling Surge is Best in Months

By a comfortable distance, GBP was the outperformer Wednesday, with markets rushing to price in a more favourable Brexit outcome with talks due to formally resume Thursday, with the EU formally recognising UK sovereignty - a key tenet for future talks. GBP/USD rallied sharply, adding over 2 points to hit 1.3177 in the strongest session for the pair since late March. This opens the Sep highs as the longer-term target at 1.3482.

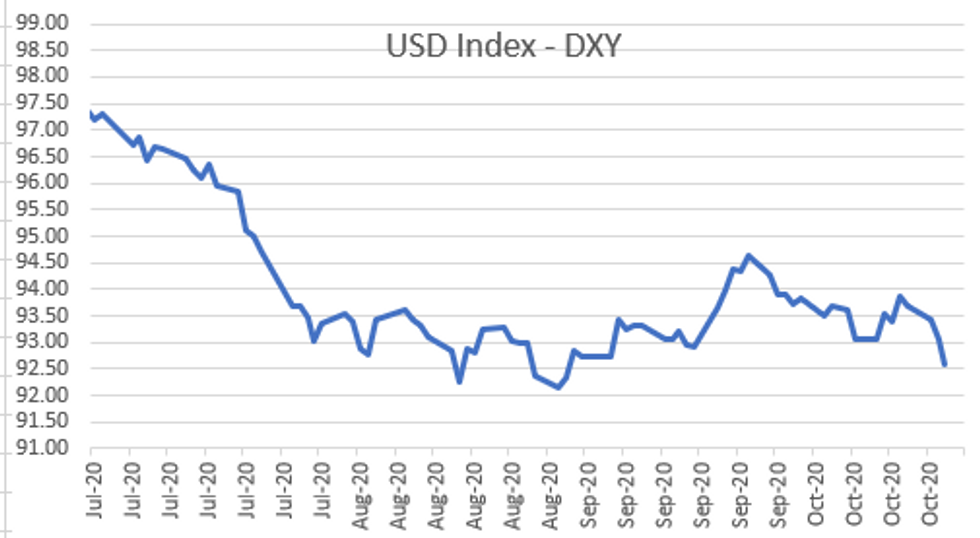

- Deal making in the US also took focus, with market sentiment still clearly hinged on the will-they-won't-they nature of a COVID aid package. Reports in US outlets seem to be suggesting the most likely timeframe for a package will come after the election, with the lame duck period between election and inauguration being most commonly cited. The USD responded negatively, pressing the USD index to the lowest levels since early September.

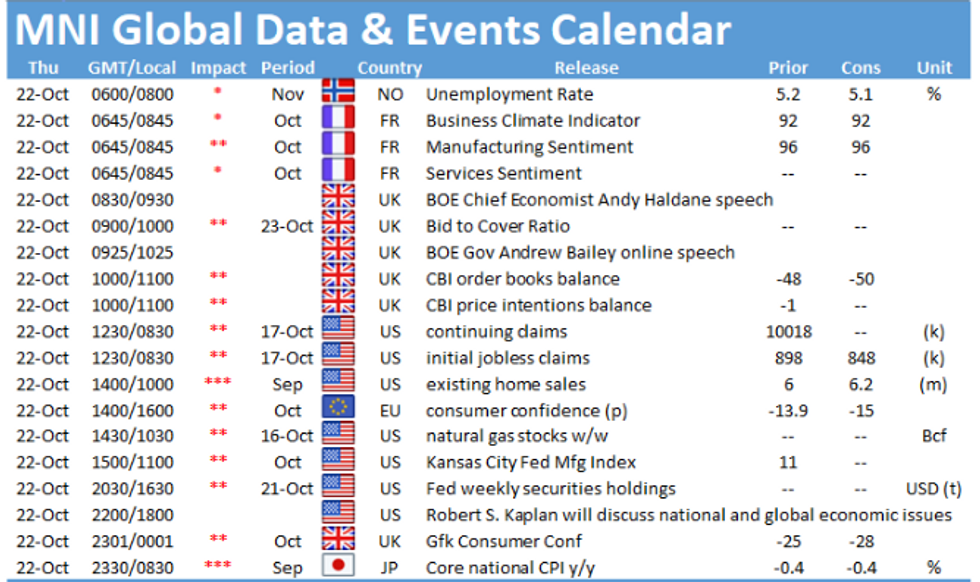

- Focus Thursday turns to weekly US jobless data and existing home sales as well as Eurozone consumer confidence. BoE's Bailey & Haldane, Fed's Barkin & Kaplan and ECB's Panetta are due to speak.

EGB: EGBs-GILTS CASH CLOSE: Brexit Deal Hopes Sink Gilt Long-End

Gilts weakened over the session with bear steepening as Brexit deal optimism brightened (UK and EU to intensify talks), shrugging off late equity weakness. Bund yields ended down on the day but well off session lows.

- * Peripheries largely followed supply news: GGB spds widened after EUR2B syndicated 15-year tap, while BTPs widened after the MEF announced a syndication for new 30-year BTP. Closing Levels / 10-Yr Periphery EGB Spreads:

- * Germany: The 2-Yr yield is up 0.8bps at -0.773%, 5-Yr is up 1.4bps at -0.788%, 10-Yr is up 1.8bps at -0.588%, and 30-Yr is up 2.1bps at -0.174%.

- * UK: The 2-Yr yield is up 1.7bps at -0.048%, 5-Yr is up 3.3bps at -0.05%, 10-Yr is up 5.5bps at 0.242%, and 30-Yr is up 6.8bps at 0.81%.

- * Italian BTP spread up 3.6bps at 137bps

- * Spanish bond spread up 0.3bps at 79.2bps

- * Portuguese PGB spread up 0.4bps at 77.2bps

- * Greek bond spread up 4.8bps at 150.5bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.