-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CLOSING FI ANALYSIS: Ballot Count Grinds On, Electoral Count Stalls

US TSY SUMMARY

Tsy futures traded weaker after the bell, tempering the week's presidential election uncertainty amid improving poll count in favor of VP Biden. Ranges and volumes much more subdued Friday as ballot counting continues in swing states: AZ, GA, NC, NV and PA.

- Much better than expected October employment figures, +638k vs. +593k est, added to the sell-off in rates. Tsys scale back about a third of Thursday's sharp rally as markets calm down despite ongoing election uncertainty. Yld curves bear steepen, paring appr half Thursday's move.

- Spurious morning headline generated some early vol: "DONALD TRUMP TO ADMIT DEFEAT AFTER RECEIVING ADVICE FROM HIS ADVISERS - FOX NEWS" roiled markets before Fox News blog now says: Trump has no immediate plans to concede.

- VP Biden is expected to speak to the nation tonight, time TBA.

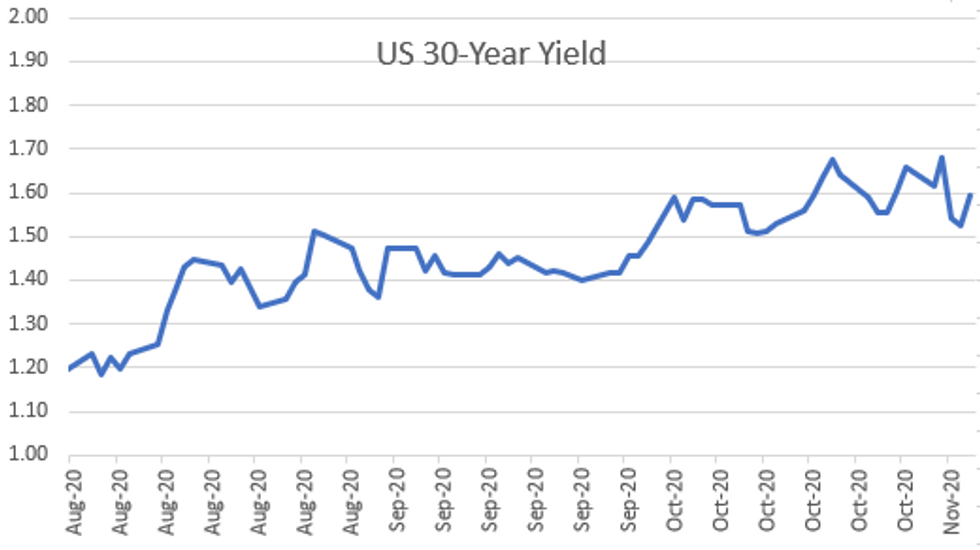

- Mixed flow across the curve saw better selling in intermediates to long end midmorning to noon, activity tapered off in the second half. The 2-Yr yield is up 0.4bps at 0.1488%, 5-Yr is up 3.2bps at 0.3578%, 10-Yr is up 5.2bps at 0.8151%, and 30-Yr is up 6.7bps at 1.5905%.

TECHNICALS

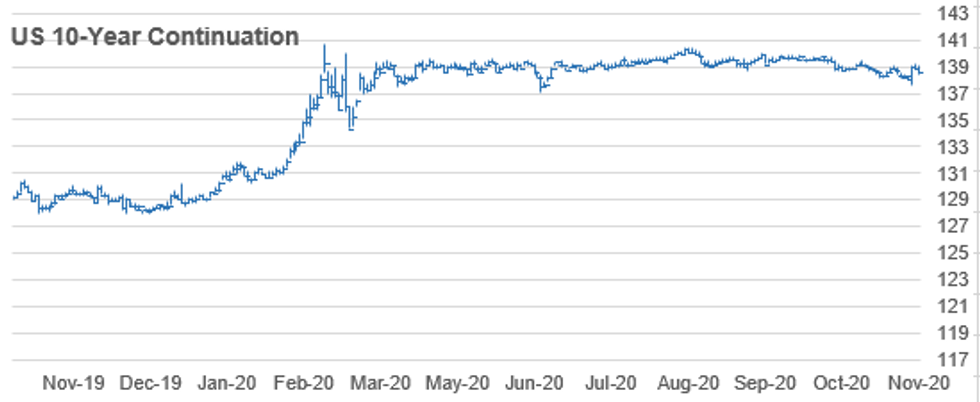

US 10YR FUTURE TECHS: (Z0) Bullish Reversal Reversal

- RES 4: 139-30 1.0% 10-dma envelope

- RES 3: 139-26 High Sep 29 and a key resistance

- RES 2: 139-14 Bear channel top drawn off the Aug 4 high

- RES 1: 139-08+ High Nov 5

- PRICE: 138-17 @17:04 GMT Nov 6

- SUP 1: 138-12+ Low Nov 6

- SUP 2: 137-20+ Low Nov 4 and key support

- SUP 3: 137-15 1.382 proj of Aug 4 - 28 decline from Sep 3 high

- SUP 4: 137-08 1.500 proj of Aug 4 - 28 decline from Sep 3 high

Treasuries remain bullish following Wednesday's rally off 137-20+. Price has cleared trendline resistance at 138-29, drawn off the Oct 2 high. The break of the trendline was confirmed by a breach of resistance at 139-03, Oct 28 high and the recent bull trigger. The strong rally signals a more significant reversal of the entire decline since early August and attention turns to 139-14, the top of a bear channel drawn off the Aug 4 high. 137-20+ marks key support

AUSSIE 3Y

AUSSIE 3-YR TECHS: (Z0) Strong on RBA Support

- RES 3: 100.00 - Psychological round number

- RES 2: 99.886 - 3.0% Upper Bollinger Band

- RES 1: 99.860 - All time High Nov 3 and the bull trigger

- PRICE: 99.845 @ 17:07 BST Nov 6

- SUP 1: 99.760 - Low Oct 1 and 2

- SUP 2: 99.705 - Low Sep 18, 21 and 22

- SUP 3: 99.675 - Low Sep 7 and key support

Aussie 3yr futures got further support Tuesday as the RBA cut their 3-yr yield target, boosting prices to new alltime highs up at 99.860. This further confirms bullish trend conditions, leaving the downside argument particularly fractious. A break of 99.860, the Nov 3 high opens 99.889. Support is at 99.760.

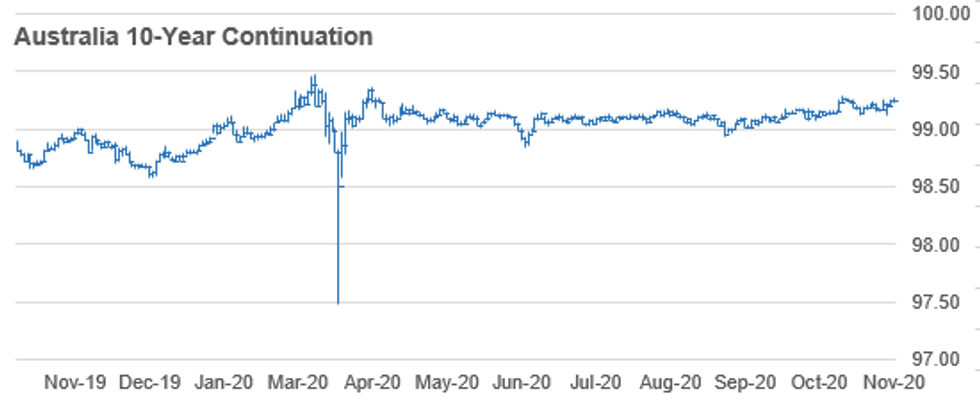

AUSSIE 10Y

AUSSIE 10-YR TECHS: (Z0) Rallies Remain Sold

- RES 3: 99.480 - High Mar 10 and the all-time high

- RES 2: 99.360 - High Apr 2 (cont)

- RES 1: 99.290 - High Oct 16

- PRICE: 99.205 @ 17:08 BST Nov 6

- SUP 1: 99.116 - 50-dma

- SUP 2: 99.055 - Low Sep 18 and 21

- SUP 3: 98.970 - Low Sep 8

Aussie 10y futures remain bullish despite the pullback earlier last week. The break above 99.180, an area of congestion reflecting highs in Sep and early October confirmed a resumption of the uptrend that started on Aug 28. Attention turns to 99.300 and 99.360. The latter is the Apr 2 high (cont). The near-term bull trigger is 99.290, Oct 16 high. On the downside, firm trend support is at 99.075, Oct 5 low.

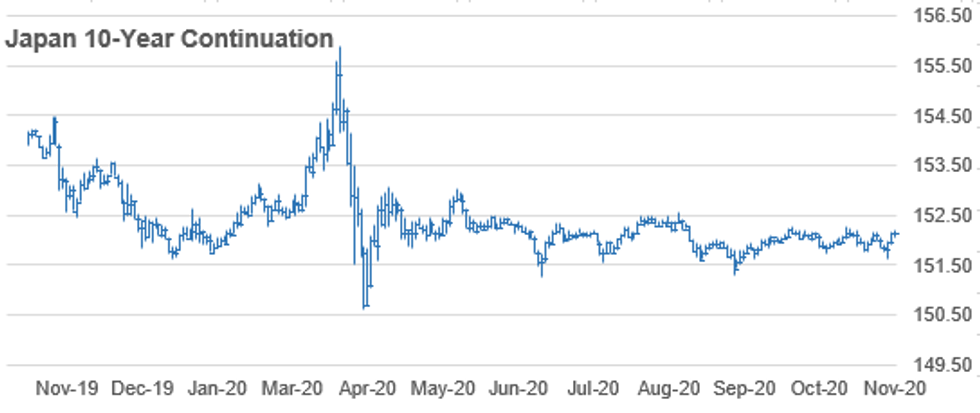

YEN 10Y

JGB TECHS: (Z0) Bouncing with Global Bonds

- RES 3: 152.55 - High Aug 5 (cont)

- RES 2: 152.36- 3.0% Upper Bollinger Band

- RES 1: 152.29 - High Sep 24 and the bull trigger

- PRICE: 152.03 @ 17:09 BST Nov 6

- SUP 1: 151.75 - Low Oct 08 and trend support

- SUP 2: 151.54 - Low Sep 7

- SUP 3: 151.43 - Low Sep 1

On the US election results, JGBs rallied sharply alongside global bond markets. Having topped 152.00 last week, reestablishing the recent positive outlook, JGBs faded slightly earlier in the week, but the Wednesday rally helps provide some support from here. Attention remains on 152.29, Sep 4 high, a key resistance and the bull trigger. A break of this level would confirm a resumption of the uptrend and open 152.36, a Bollinger band objective and 152.55, Aug 5 high (cont).

US TSY FUTURES CLOSE: Tempering Election Uncertainty

Weaker across the board, but off late morning lows, Tsys scale back about a third of Thursday's sharp rally as markets calm down despite ongoing election uncertainty. Yld curves bear steepen, paring appr half Thursday's move. Update:

- 3M10Y +5.893, 72.551 (L: 65.827 / H: 74.405)

- 2Y10Y +4.781, 66.206 (L: 60.955 / H: 67.862)

- 2Y30Y +6.286, 143.778 (L: 136.753 / H: 146.111)

- 5Y30Y +3.54, 123.149 (L: 118.706 / H: 124.654)

- Current futures levels:

- Dec 2Y -0.37/32 at 110-13 (L: 110-12.75 / H: 110-13.75)

- Dec 5Y -3.75/32 at 125-21.5 (L: 125-18.75 / H: 125-27.25)

- Dec 10Y down 9/32 at 138-19 (L: 138-12.5 / H: 139-01)

- Dec 30Y down 1-0/32 at 173-11 (L: 172-29 / H: 174-31)

- Dec Ultra 30Y down 1-30/32 at 217-6 (L: 216-02 / H: 220-19)

US EURODOLLAR FUTURES CLOSE: Near Session Lows

Futures mostly weaker, long end of the strip underperforming. Lead quarterly holding steady after 3 Month LIBOR set' -0.00987 to a new record low of 0.20588% (-0.00275/wk).

- Dec 20 steady at 99.765

- Mar 21 steady at 99.795

- Jun 21 steady at 99.80

- Sep 21 steady at 99.80

- Red Pack (Dec 21-Sep 22) -0.01 to -0.005

- Green Pack (Dec 22-Sep 23) -0.025 to -0.01

- Blue Pack (Dec 23-Sep 24) -0.04 to -0.025

- Gold Pack (Dec 24-Sep 25) -0.045 to -0.04

US DOLLAR LIBOR, 3M New Record Low

- Latest settles

- O/N +0.00125 at 0.08263% (+0.00125/wk)

- 1 Month +0.00112 to 0.12775% (-0.01250/wk)

- 3 Month -0.00987** to 0.20588% (-0.00275/wk)

- ** 3M New record Low 0.20588% on 11/6/20 ** (prior 0.20863% on 10/19/20)

- 6 Month -0.00287 to 0.24338% (+0.00125/wk)

- 1 Year -0.00037 to 0.33338% (+0.00325/wk)

US TSY: Short Term Rates

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $64B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $165B

- Secured Overnight Financing Rate (SOFR): 0.11%, $938B

- Broad General Collateral Rate (BGCR): 0.08%, $348B

- Tri-Party General Collateral Rate (TGCR): 0.08%, $319B

- (rate, volume levels reflect prior session)

- Fri 11/06 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

- Next week's purchase schedule:

- Mon 11/09 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Tue 11/10 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Thu 11/12 1010-1030ET: Tsys 7Y-20Y, appr $3.625B

- Fri 11/13 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Fri 11/13 Next forward schedule release at 1500ET

OUTLOOK: Monday Look Ahead, Multiple Bills, 3Y Note Auction

- US Data/Speaker Calendar (prior, estimate)

- 09-Nov 1000 US Tsy $54B 13W-Bill auction (9127965B1)

- 09-Nov 1000 US Tsy $51B 26W-Bill auction (912796A58)

- 09-Nov 1100 Nov NY Fed expectations survey

- 09-Nov 1130 US Tsy $30B 42D Bill CMB auction (9127963L1)

- 09-Nov 1130 US Tsy $30B 119D Bill CMB auction (9127964M8)

- 09-Nov 1300 US Tsy $54B 3Y Note auction (91282CAW1)

- 09-Nov 1330 Clev Fed Pres Mester, fintech conf

PIPELINE: Waste Management Breaks Ground

Sidelined issuers due to US Presidential Election uncertainty finally broke ground with Waste Management 4-part on Thursday. No new issuance Friday

- Date $MM Issuer (Priced *, Launch #

- 11/05 $2.5B *Waste Management $500M 55Y +45, $500M +7K +60, $1B +10Y +75, $500M 30Y +100

EURODOLLAR/TREASURY OPTIONS

Eurodollar Options:

- +6,000 Blue Mar 97/98 call spds 0.0 over 90/91 put spd, closer w/appr 40k to go

- +6,000 Blue Mar 93 puts, 6.0

- -4,000 Dec 97/98 1x2 call spds, 2.25

- +2,000 Jun 97/98 1x2 call spds, 2.75

- -10,000 Jun 97 puts 1.0 over 98/100 call spds

- -3,250 Nov/Dec 97 call spds, 0.5

- -4,000 short Mar 97 calls, 2.5

- Over 26,000 FVF 126.25/126.5/126.75 call flys, 2.5 -- ongoing, adds to +30k Thu at 3.5/64

- -10,000 FVZ 125.5 calls, 13.5-14

- 2,500 TYF 136.5/140.5 call over risk reversals, 1/64

- +1,500 TYF 136.5/137.5 2x1 put spds, 2/64

- -1,900 TYZ 138.5 calls, 23/64

- 5,000 USZ 174/178 1x2 call spds, 50-45

- over 2,000 USZ 178 calls, 3/64

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.