-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASI OPEN: Fed Bostic Still Confident of Waning Inflation

MNI ASIA MARKETS ANALYSIS: Tsy Curves Twist Flatter

PIPELINE: $2.2B Nigeria 2Pt Kicks Off December Issuance

MNI US CLOSING FI ANALYSIS: Big Stim Deal Line In Sand For GOP

US TSY SUMMARY: Big Stim Deal Line In Sand For GOP

Dueling headlines over a stimulus deal continued to drive market speculation, but still no closer to a deal after the bell. Rates opened with a strong risk-off tone Thursday, but followed a steady pace as gains given back through the close.

Salient headlines:

- MNUCHIN: WE'RE GOING TO KEEP TRYING TO GET STIMULUS DEAL

- WHITEHOUSE: THERE'S A CHANCE `SERIOUS' STIMULUS BILL MAY EMERGE

- MCCONNELL REJECTS `HIGHER AMOUNT' FOR STIMULUS: REUTERS

- TRUMP: WILLING TO RAISE STIMULUS OFFER ABOVE $1.8 TRILLION, Bbg

- HOUSE DEMS: WILL ADDRESS NEEDS IF NO DEAL SOON, Bbg

- STIMULUS RELIEF WON'T WAIT UNTIL JANUARY, Bbg

- The 2-Yr yield is unchanged at 0.139%, 5-Yr is up 0.8bps at 0.312%, 10-Yr is up 0.8bps at 0.7339%, and 30-Yr is up 0.8bps at 1.5134%.

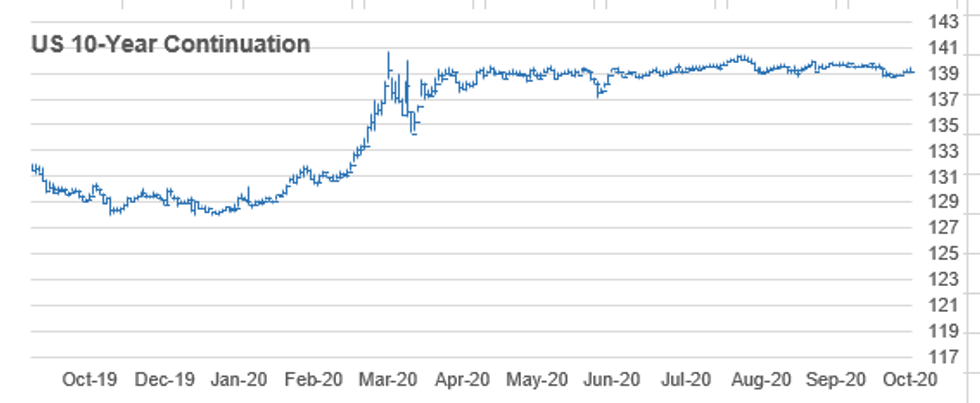

TECHNICALS: US 10YR FUTURE TECHS: (Z0) Gives Back Its Winnings

US 10YR FUTURE TECHS: (Z0) Gives Back Its Winnings

- RES 4: 139-26 High Sep 29 and a key resistance

- RES 3: 139-25 High Oct 2

- RES 2: 139-17 76.4% retracement of the Sep 29 - Oct 7 sell-off

- RES 1: 139-14 High Oct 15

- PRICE: 139-04+ @ 18:46 BST Oct 15

- SUP 1: 139-00 Round number support

- SUP 2: 138-28+ Low Oct 13

- SUP 3: 138-20+ Low Oct 7 and the bull trigger

- SUP 4: 138-18+ Low Aug 28 and bear trigger

AUSSIE 3-YR TECHS: (Z0) Broader Bullish Theme Intact

AUSSIE 3-YR TECHS: (Z0) Broader Bullish Theme Intact

- RES 3: 100.00 - Psychological round number

- RES 2: 99.889 - 3.0% Upper Bollinger Band

- RES 1: 99.840 - All time High Oct 6, 15 and the bull trigger

- PRICE: 99.830 @ 18:51 BST Oct 15

- SUP 1: 99.760 - Low Oct 1 and 2

- SUP 2: 99.705 - Low Sep 18, 21 and 22

- SUP 3: 99.675 - Low Sep 7 and key support

AUSSIE 10-YR TECHS: (Z0) Uptrend Resumes

AUSSIE 10-YR TECHS: (Z0) Uptrend Resumes

- RES 3: 99.480 - High Mar 10 and the all-time high

- RES 2: 99.360 - High Apr 2 (cont)

- RES 1: 99.290 - High Oct 16

- PRICE: 99.250 @ 19:03 BST Oct 15

- SUP 1: 99.075 - Low Oct and the key support

- SUP 2: 99.055 - Low Sep 18 and 21

- SUP 3: 98.970 - Low Sep 8

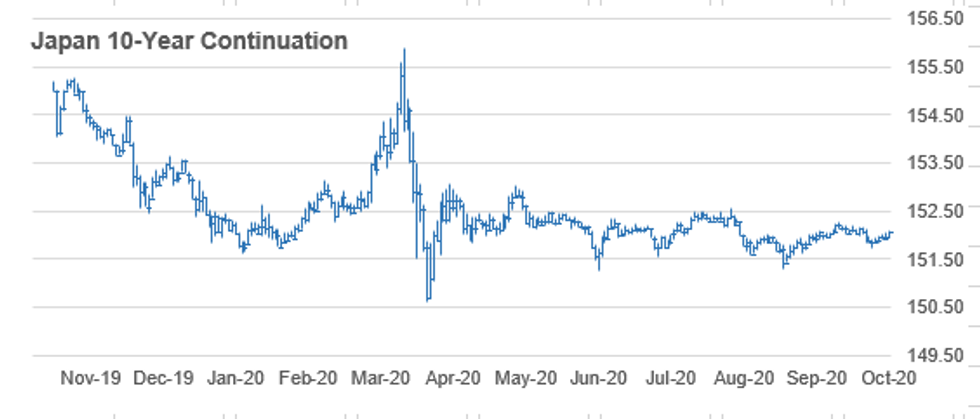

JGB TECHS: (Z0) Bullish Focus

JGB TECHS: (Z0) Bullish Focus

- RES 3: 152.55 - High Aug 5 (cont)

- RES 2: 152.34 - 3.0% Upper Bollinger Band

- RES 1: 152.29 - High Sep 24 and the bull trigger

- PRICE: 152.18 @ 19:00 BST Oct 15

- SUP 1: 151.75 - Low Oct 08 and trend support

- SUP 2: 151.54 - Low Sep 7

- SUP 3: 151.43 - Low Sep 1

US TSY FUTURES CLOSE: Risk-Off Unwound, Extend Lows Late

After a stronger open, Tsy futures ground steadily lower through the day, apparently over hopes of a stimulus deal in the near term despite the lack of progress over the last few weeks. Yld curves mixed, well off early flatter levels, update:

- 3M10Y +1.34, 63.249 (L: 58.513 / H: 63.581)

- 2Y10Y +1.03, 59.29 (L: 55.42 / H: 59.622)

- 2Y30Y +1.063, 137.304 (L: 132.158 / H: 137.637)

- 5Y30Y +0.067, 120.045 (L: 116.752 / H: 120.429)

- Current futures levels:

- Dec 2Y down 0.12/32 at 110-13.8 (L: 110-13.87 / H: 110-14.5)

- Dec 5Y down 1.75/32 at 125-26.75 (L: 125-26.5 / H: 125-31)

- Dec 10Y down 3.5/32 at 139-3.5 (L: 139-02 / H: 139-14)

- Dec 30Y down 8/32 at 175-4 (L: 175-01 / H: 176-10)

- Dec Ultra 30Y down 21/32 at 219-16 (L: 219-11 / H: 222-02)

US TSYS/SUPPLY: Preview Next Wk's Auctions

| DATE | TIME | AMT | SECURITY | CUSIP |

| 19-Oct | 1130ET | $54B | 13W-Bill | (9127963V9) |

| 19-Oct | 1130ET | $51B | 26W-Bill | (9127962Q1) |

| 20-Oct | 1130ET | $30B | 42D-Bill CMB | (912796TU3) |

| 20-Oct | 1130ET | $30B | 119D-Bill CMB | (9127964D8) |

| 21-Oct | 1130ET | TBA | 105D-Bill CMB | 20-Oct |

| 21-Oct | 1130ET | TBA | 154D-Bill CMB | 20-Oct |

| 21-Oct | 1300ET | $22B | 20Y-bond/R/O | (912810SQ2) |

| 22-Oct | 1130ET | TBA | 4W-Bill | 20-Oct |

| 22-Oct | 1130ET | TBA | 8W-Bill | 20-Oct |

| 22-Oct | 1300ET | $17B | 5Y-TIPS | (91282CAQ4) |

US EURODLR FUTURES CLOSE: Lead Qtrly EDZ0 Bid After 3M LIBOR All-Time Low Set'

Mostly steady in the short end to moderately weaker out the strip. Lead quarterly holds bid since 3M LIBOR fell to new all-time low: set' -0.01238 to 0.21775%** (-0.00638/wk). Latest lvls:

- Dec 20 +0.005 at 99.760

- Mar 21 steady at 99.795

- Jun 21 steady at 99.805

- Sep 21 steady at 99.805

- Red Pack (Dec 21-Sep 22) -0.015 to steady

- Green Pack (Dec 22-Sep 23) -0.02 to -0.01

- Blue Pack (Dec 23-Sep 24) -0.025 to -0.02

- Gold Pack (Dec 24-Sep 25) -0.035 to -0.03

USD LIBOR FIX

- O/N 0.08125 (0.00037)

- 1W 0.10150 (0.00162)

- 1M 0.14725 (0.0015)

- 2M 0.18550 (-0.00113)

- 3M 0.21775** (-0.01238)

- 6M 0.25325 (0)

- 12M 0.34775 (0.00375)

STIR/US TSYS

FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $54B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $163B

- Secured Overnight Financing Rate (SOFR): 0.09%, $885B

- Broad General Collateral Rate (BGCR): 0.06%, $34B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $326B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $2.401B accepted of $4.728B submission

- Next scheduled purchase:

- Fri 10/16 1010-1030ET: Tsy 0Y-2.25Y, appr $12.825B

OUTLOOK: US Data/Speaker Calendar (prior, estimate)

- 16-Oct 0830 Oct NY Fed Business Leaders Index

- 16-Oct 0830 Sep retail sales (0.6%, 0.8%)

- 16-Oct 0830 Sep retail sales ex. motor vehicle (0.7%, 0.4%)

- 16-Oct 0830 Sep retail sales ex. mtr veh, gas (0.7%, 0.5%)

- 16-Oct 0915 Sep capacity utilization (71.4%, 71.8%)

- 16-Oct 0915 Sep industrial production (0.4%, 0.6%)

- 16-Oct 0935 StL Fed Bullard, mon-pol IMF panel

- 16-Oct 0945 NY Fed Williams, moderated discussion Ford Foundation

- 16-Oct 1000 Oct Michigan sentiment index (p) (80.4, 80.5)

- 16-Oct 1000 Aug business inventories (0.1%, 0.4%)

- 16-Oct 1100 Q4 St. Louis Fed Real GDP Nowcast

- 16-Oct 1115 Q4 NY Fed GDP Nowcast

- 16-Oct 1600 Aug long term TICS flows ($10.8B, --)

- 16-Oct 1600 Aug net TICS flows (-$88.7B, --)

PIPELINE: Supra-Sovereigns Focus

Waiting for Ag Bank of China to price, otherwise it appears issuance is done for the day. Denmark short duration issue likely next week.

- Date $MM Issuer (Priced *, Launch #)

- 10/15 $900M *Bank of China Group Inv $400M 5Y +125, $500M 10Y +160

- 10/15 $850M #Ag Bank of China, $500M 3Y +90, $350M 5Y +100

- 10/15 $300M *Union Bank of Philippines 5Y +195

- 10/15 $500M *COFCO (HK) 10Y +150

- 10/?? $Benchmark Denmark short duration bond

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.