-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CLOSING FI ANALYSIS: Rosengren Favors Longer Duration

US TSY SUMMARY: Tsy Bounce Off Boston Fed Rosengren Duration Comments

Another heavy volume session (TYZ near 2mm), Tsys only marginally mixed, however, long end bounced off late session lows on Boston Fed Rosengren exclusive interview comments after the bell: MNI: FED'S ROSENGREN: PREFER TO LENGTHEN DURATION OF TSY BUYS; ADDITIONAL QE MAY BE NEEDED WITH WEAK 6 MOS AHEAD.

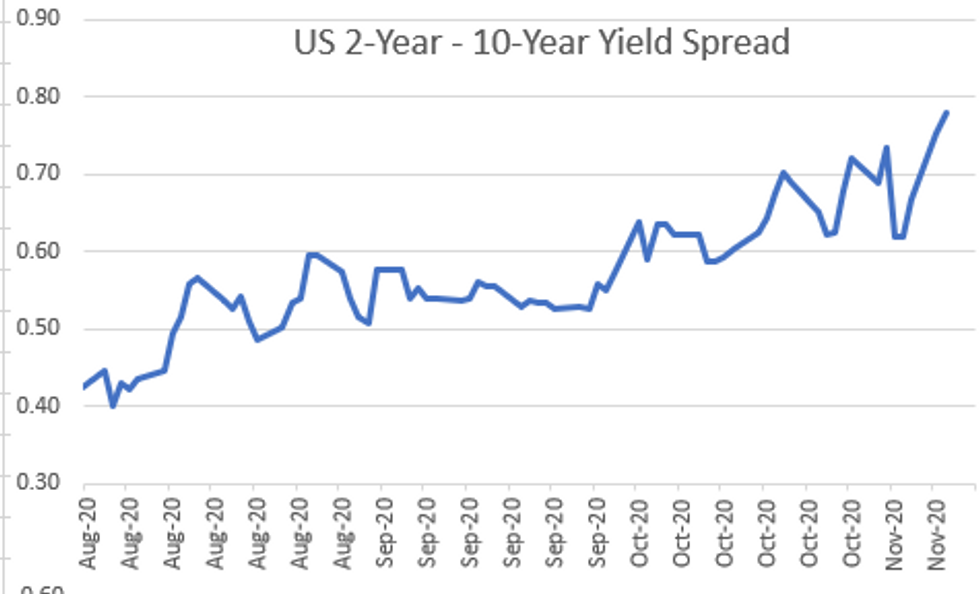

- Yield curves in shorts to intermediates held steeper profiles even as long end futures outperformed. Myriad other Fed speakers issued more prosaic statements (Dal Fed Kaplan: lack of fiscal stimulus to hurt economy, next 2 quarters to be "very difficult".

- Second day of decent high-grade corporate issuance, $12B Verizon 5pt lion's share.

- Massive selling short end Eurodollar futures from EDH1 to EDU3, Mar'21 volume over 360k after the bell, over 3.5x 20D avg.

- Another modest stop-through, US Tsy $41B 10Y note auction (91282CAV3) awarded 0.960% rate (0.765% last month) vs. 0.962% WI; 2.47 bid/cover (2.32 previous). The 2-Yr yield is up 1.2bps at 0.1827%, 5-Yr is up 2.6bps at 0.4538%, 10-Yr is up 3.6bps at 0.9595%, and 30-Yr is up 3.9bps at 1.7479%.

TECHNICALS

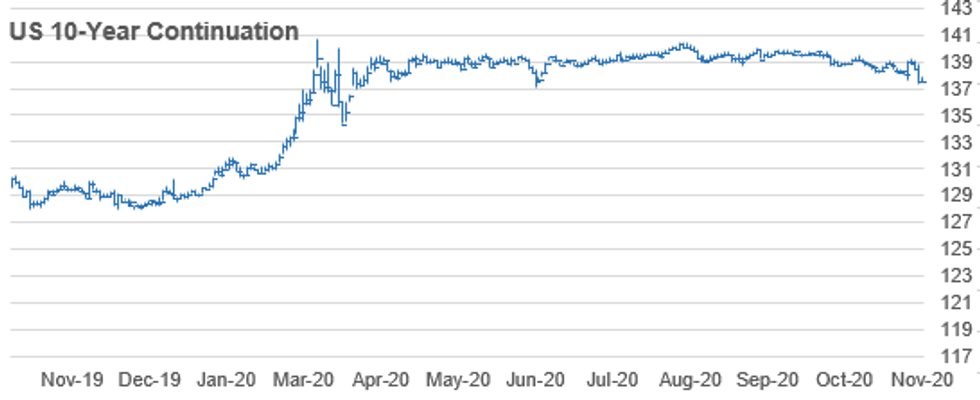

US 10YR FUTURE TECHS: (Z0) Bears Return

- RES 4: 139-13 Bear channel top drawn off the Aug 4 high

- RES 3: 139-08+ High Nov 5

- RES 2: 138-24+ High Nov 9

- RES 1: 137-29+ High Nov 10

- PRICE: 137-18+ @16:00 GMT Nov 10

- SUP 1: 137-13 Low Nov 9

- SUP 2: 137-08 1.500 proj of Aug 4 - 28 decline from Sep 3 high

- SUP 3: 137-01+ 1.618 proj of Aug 4 - 28 decline from Sep 3 high

- SUP 4: 137-00 Round number support

Treasuries sold off sharply Monday. The break lower resulted in a move through key support at 137-20+, Nov 4 low and negated the Nov 4 bullish - a bullish engulfing candle. The break lower instead confirms a resumption of the downtrend that has been in place since early August and maintains the bearish price sequence of lower lows and lower highs. The focus is on 137-08 next, a Fibonacci projection. Resistance is at 138-24+.

AUSSIE 3Y

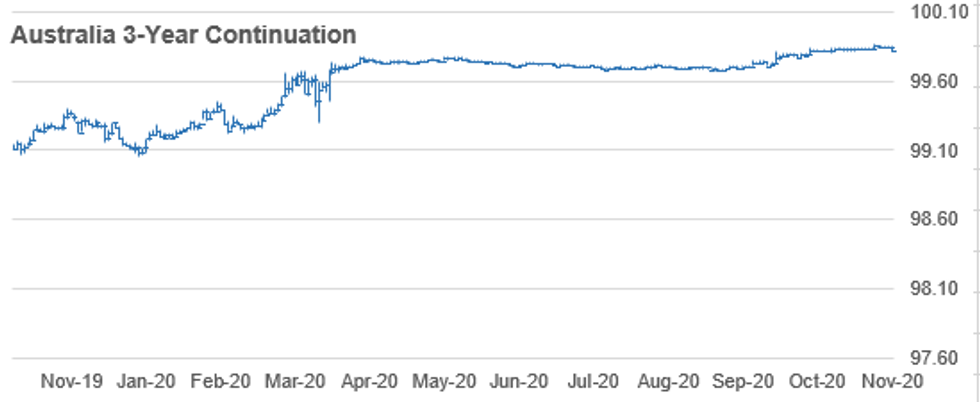

AUSSIE 3-YR TECHS: (Z0) Remains Strong on RBA Support

- RES 3: 100.00 - Psychological round number

- RES 2: 99.886 - 3.0% Upper Bollinger Band

- RES 1: 99.860 - All time High Nov 3 and the bull trigger

- PRICE: 99.815 @ 16:10 BST Nov 10

- SUP 1: 99.760 - Low Oct 1 and 2

- SUP 2: 99.705 - Low Sep 18, 21 and 22

- SUP 3: 99.675 - Low Sep 7 and key support

Aussie 3yr futures got further support last week as the RBA cut their 3-yr yield target, boosting prices to new alltime highs up at 99.860. This further confirms bullish trend conditions, leaving the downside argument particularly fractious. A break of 99.860, the Nov 3 high opens 99.889. Support is at 99.760

AUSSIE 10Y

AUSSIE 10-YR TECHS: (Z0) Extends Weakness

- RES 3: 99.480 - High Mar 10 and the all-time high

- RES 2: 99.360 - High Apr 2 (cont)

- RES 1: 99.290 - High Oct 16

- PRICE: 99.055 @ 16:12 BST Nov 10

- SUP 1: 99.035 - Low Nov 10

- SUP 2: 98.970 - Low Sep 8

- SUP 3: 98.935 - Low Sep 18 and 21

Aussie 10y futures fell further Tuesday after the sharp decline at the beginning of the week alongside the broader global bond market. Overall, markets remain bullish despite the pullback this week. The break above 99.180, an area of congestion reflecting highs in Sep and early October confirmed a resumption of the uptrend that started on Aug 28. Attention turns to 99.300 and 99.360. The latter is the Apr 2 high (cont). The near-term bull trigger is 99.290, Oct 16 high.

YEN 10Y

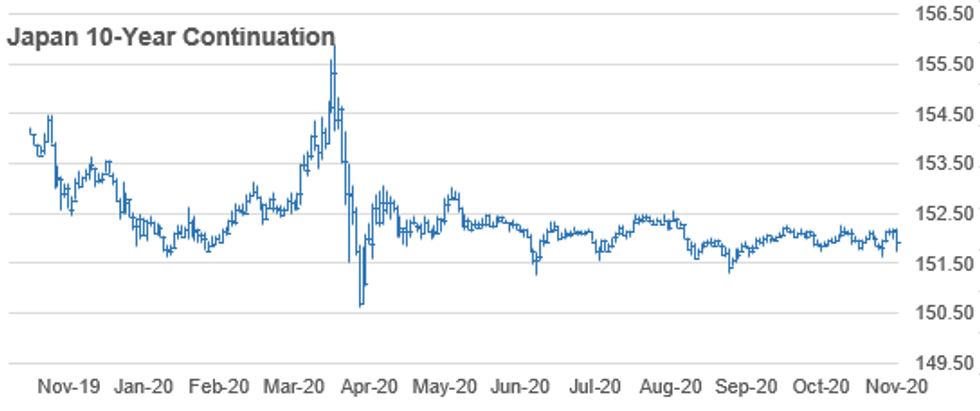

JGB TECHS: (Z0) Stays Weaker

- RES 3: 152.55 - High Aug 5 (cont)

- RES 2: 152.36- 3.0% Upper Bollinger Band

- RES 1: 152.29 - High Sep 24 and the bull trigger

- PRICE: 151.84 @ 16:17 BST Nov 10

- SUP 1: 151.72 - Low Nov 10

- SUP 2: 151.54 - Low Sep 7

- SUP 3: 151.43 - Low Sep 1

JGBs remain weak at the tail-end of the Tuesday session, with global bond markets leading prices lower. New lows of 151.72 were printed, worsening the outlook for the near-term. This opens 151.54 should current weakness extend, levels last seen at the beginning of September. For the outlook to improve, markets need to retake the 152 handle ahead of 152.29, Sep 4 high, a key resistance and the bull trigger.

TSY FUTURES CLOSE: Off Late Lows, Boston Fed Rosengren Favors Longer Duration

Futures bouncing off session lows just after the bell, apparently in reaction to Boston Fed Pres Rosengren comments preferring lengthening of duration after the bell. Volumes heavy again, TYZ>1.925M. Yield curves mostly steeper, update:

- 3M10Y +3.512, 85.978 (L: 80.257 / H: 87.517)

- 2Y10Y +2.249, 77.14 (L: 73.332 / H: 78.879)

- 2Y30Y +2.306, 155.538 (L: 149.997 / H: 157.59)

- 5Y30Y +0.697, 128.626 (L: 124.773 / H: 130.085)

- Current futures levels:

- Dec 2Y down 0.25/32 at 110-11.125 (L: 110-11 / H: 110-12)

- Dec 5Y down 1.25/32 at 125-7.5 (L: 125-06.25 / H: 125-12.75)

- Dec 10Y down 2/32 at 137-16.5 (L: 137-13.5 / H: 137-29.5)

- Dec 30Y up 4/32 at 170-10 (L: 169-30 / H: 171-14)

- Dec Ultra 30Y up 14/32 at 211-4 (L: 210-12 / H: 213-17)

US EURODLR FUTURES CLOSE: Steady To Weaker, Massive Front-End Sellers

Futures trading steady to mildly weaker, at or near session lows after massive selling in Mar'21 through Sep'22. Mar'21 total volume >350k, appr 3.5% 20D avg. Lead quarterly traded weaker since 3M LIBOR set +0.00863 off Mon's all-time low to 0.21363% (+0.00775/wk). Latest levels:

- Dec 20 -0.005 at 99.760

- Mar 21 -0.005 at 99.780

- Jun 21 steady at 99.785

- Sep 21 steady at 99.780

- Red Pack (Dec 21-Sep 22) -0.005 to steady

- Green Pack (Dec 22-Sep 23) -0.005 to steady

- Blue Pack (Dec 23-Sep 24) steady

- Gold Pack (Dec 24-Sep 25) steady

US DOLLAR LIBOR

Latest settles

- O/N +0.00375 at 0.08488% (+0.00225/wk)

- 1 Month +0.01025 to 0.14013% (+0.01238/wk)

- 3 Month +0.00863 to 0.21363% (+0.00775/wk)

- 6 Month +0.00125 to 0.24300% (-0.00038/wk)

- 1 Year +0.00563 to 0.33813% (+0.00475wk)

US TSY: Short End Rates

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $57

- Daily Overnight Bank Funding Rate: 0.08%, volume: $152

- Secured Overnight Financing Rate (SOFR): 0.10%, $904

- Broad General Collateral Rate (BGCR): 0.08%, $344

- Tri-Party General Collateral Rate (TGCR): 0.08%, $318

- (rate, volume levels reflect prior session)

- Tsy 1Y-7.5Y, $2.399B accepted vs. $4.401B submission

- Next scheduled purchases:

- Thu 11/12 1010-1030ET: Tsys 7Y-20Y, appr $3.625B

- Fri 11/13 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Fri 11/13 Next forward schedule release at 1500ET

OUTLOOK: FI Markets Closed Wednesday

- US Data/Speaker Calendar (prior, estimate)

- 11-Nov ---- Veterans Day Holiday, US markets closed

- 11-Nov 0700 6-Nov MBA Mortgage Applications

- ---------------------------------------------------

- 12-Nov 0830 7-Nov initial jobless claims (751k, 732K)

- 12-Nov 0830 7-Nov continuing claims (7.285M, 6.900M)

- 12-Nov 0830 Oct CPI (0.2, 0.1)

- 12-Nov 0830 Oct CPI Ex Food & Energy (0.2%, 0.2%)

- 12-Nov 1100 6-Nov Distillate stocks w/w change

- 12-Nov 1100 6-Nov Gasoline stocks w/w change

- 12-Nov 1100 6-Nov crude oil stocks ex. SPR w/w

- 12-Nov 1130 US Tsy 4W-Bill auction

- 12-Nov 1130 US Tsy 8W-Bill auction

- 12-Nov 1145 Fed Chair Powell, ECB forum w/ECB Lagarde, BoE Bailey

- 12-Nov 1300 US Tsy $27B 30Y Bond auction (912810SS8)

- 12-Nov 1300 Chicago Fed Pres Evans, Detroit community forum

- 12-Nov 1400 Oct Treasury budget balance (-$124.6B, -$274.0B)

- 12-Nov 1630 11-Nov Fed weekly securities holdings

PIPELINE: $12B Verizon 5Pt Lion's Share Tue's Issuance

As expected, Verizon 5pt jumbo launched after the Tsy 10Y auction

- Date $MM Issuer (Priced *, Launch #)

- 11/10 $12B #Verizon 5pt: $2B 5Y +40, $2.25B +10Y +85, $3B 20Y +115, $2.75B 30Y +115, $2B 40Y +130 (issued $3.5B on March 17: $750M 7Y +215, $1.5B 10Y +225, $1.25B 30Y +250. Verizon still holds record for largest multi-tranche jumbo issuance w/ $49B back in August 2013)

- 11/10 $1.25B #Standard Chartered 15.25NC10.25 +230

- 11/10 $1.25B #Allianz PNC5.4 3.5%

- 11/10 $700M *EUROFIMA 3Y Reg S +10

- 11/10 $650M #L3Harris 10Y +85

EURODOLLAR/TREASURY OPTIONS

Eurodollar Options:

- -50,000 EDU 97p, 2.0

- +40,000 Mar 98/100 call spds, cab

- +10,000 EDZ/EDH 100 call spds, 0.5 Mar over, adds to 29.4k screen

- +8,000 short Mar 97/98 call spds, 0.75 legged

- -5,000 Jun 97 puts, 1.5

- Overnight trade,

- +29,400 EDZ/EDH 100 call spds, 0.5 Mar over

- +4,000 Blue Mar 88/91 put spd, 2.5

- +1,500 Blue Jun 87/90 put strip, 7.5

Tsy Options:

- 5,000 FVZ 125.5 calls, 2/64

- 1,400 FVF 125.25/126 put spds

- Overnight trade

- 2,000 TYZ 138/TYF 137.5 call spds

- 1,500 TYZ 138.5/138.75 call strip, 5-6

- near 14,000 TYZ 137 puts, mostly 5-9, 8 last, some tied to 135/137 2x1 put spd

- total 10,875 TYZ 137.5 puts, 12-18, 18 last

- over 8,100 TYZ 138.5 calls, 5-6

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.