-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Incremental But Insufficient Progress

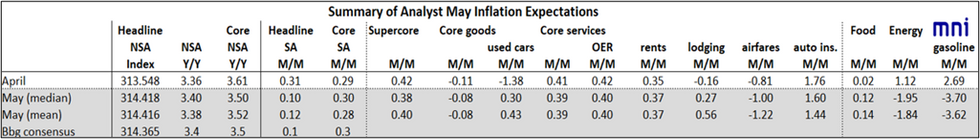

- Sequential core inflation is seen remaining relatively steady in May at 0.3% M/M (median; 0.28% average unrounded) vs 0.29% in April, per MNI’s compilation of sell-side previews.

- Headline CPI is expected to pull back fairly sharply to 0.1% (median; 0.12% average unrounded) vs 0.31% in April, owing largely to a drop in energy/gasoline prices on a seasonally-adjusted basis.

- Both core services and core goods inflation prints are seen relatively steady versus April, with owners’ equivalent rent (OER) and rents at around 0.4% M/M each, used car and lodging prices rebounding, and car insurance inflation cooling slightly but still very high.

- This outcome should likewise keep “supercore” (core services ex-shelter) inflation fairly steady also around 0.4%, albeit with a decent dispersion of analyst expectations (0.36-0.46%).

- With the release coming only hours before the FOMC releases its June decision and updated economic projections, the result could impact the Fed’s messaging, if not the Dot Plot.

- The consensus outcome would provide limited relief for the Committee that at least inflation isn’t reaccelerating in the way nonfarm payrolls did in May, even if it suggests that inflation is stalling out at above-target levels.

- A softer-than-expected reading (particularly if seen translating into PCE terms) would arguably mark a second consecutive month of “confidence”-building that inflation is converging with 2%. An upside miss however could reset the clock on building that confidence, pushing back market cut pricing even further back beyond September.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.