-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Focus Shifts To US PMI Data

MNI US MARKETS ANALYSIS - Focus Shifts To US PMI Data

HIGHLIGHTS:

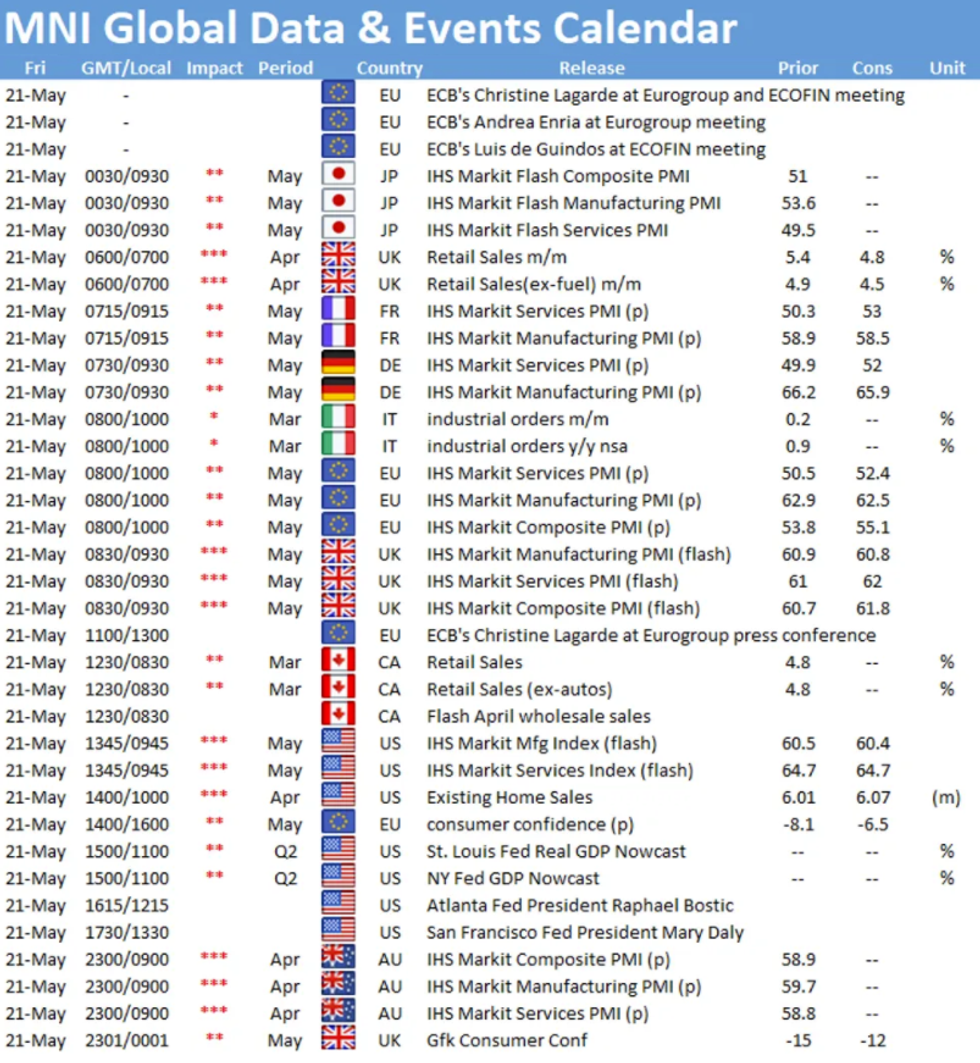

- European PMI data and UK retail sales came in strong.

- Focus now shifts to US preliminary PMI data

- It has been a mixed session so far for FI. EGBs broadly firmer, while gilts have sold off.

- Israel-Hamas call a truce, further bolstering the risk backdrop

US TSYS SUMMARY: Paring Early London-Hours Gains

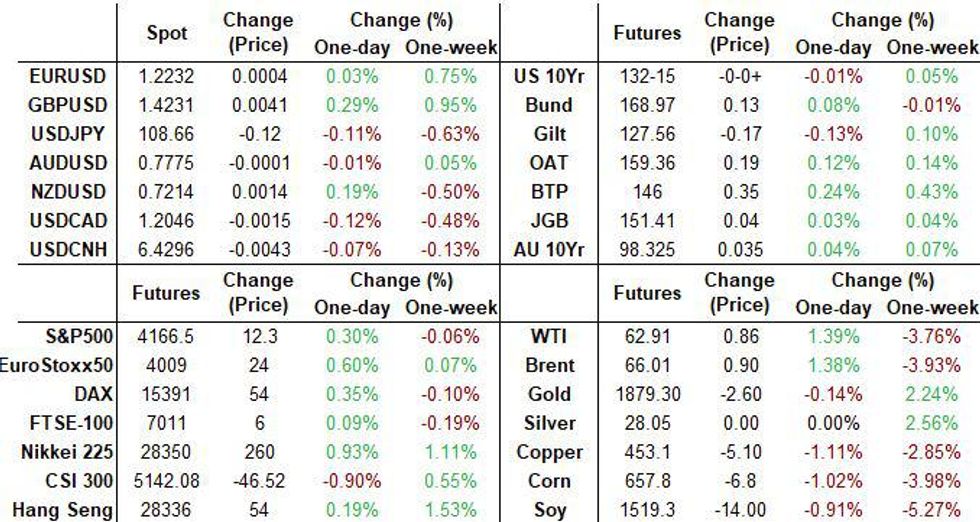

Tsy futures mildly mixed at the moment, near early overnight lows after posting moderate gains in early London hours. Apparently similar price action to Thu's Tsys in Euro FI: disappointing German PMI had mkt discounting taper talk, with rates moving higher in turn.- Tsy yld curves have bent mildly steeper over last couple hours as support proved ephemeral (2s10s, 2s30s and 5s30s appr .2-.5bps steeper at the moment). The 2-Yr yield is up 0.6bps at 0.1513%, 5-Yr is up 0.7bps at 0.818%, 10-Yr is up 1bps at 1.6352%, and 30-Yr is up 1.2bps at 2.3422%.

- Jun 10Y futures 1/32 weaker at 132-14.5 (132-13L / 132-18.5H) on moderate volumes: 330k, supported by early roll volumes (TYM/TYU near 40k already).

- Equities off recent modest highs, inside overnight range with eminis near THu's highs at 4165.0. US$ index a little weaker DXY -.119.

- Data focus on Markit PMIs: Mfg 60.1 est vs. 60.5 prior, Services 64.4 est vs. 64.7 prior. Existing Home Sales (6.08M est), MoM (1.1%)

- Fed presidents Barkin, Bostic and Kaplan round out the week speaking at tech conf

- NY Fed buy-op: Tsy 7Y-10Y, appr $3.225B

EGB/GILT SUMMARY: - Strong Showing For European Data

It has been a mixed session so far for European government bonds, while equities have broadly pushed higher and G10 FX have posted gains against the USD.

- Gilts have sold off with yields 1-2bp higher and the curve close to flat overall. UK retail sales data for April surprised sharply higher, while the preliminary manufacturing PMI for May similarly beat expectations (66.1 vs 60.8).

- Bunds rallied early into the session before giving back most of the gains and now trading marginally above yesterday's close.

- OAT yields are broadly 1bp lower on the day with the curve 1bp flatter.

- BTPs have outperformed with yields 1-4bp lower and the curve bull flattening.

- European preliminary PMI data was generally in line, to a touch better than expected, and points to continued robust expansion in activity.

- The UK DMO earlier sold GBP3.5bn of 1/3/6-month UKTBs.

EUROPEAN ISSUANCE UPDATE

UK T-BILL AUCTION RESULTS: DMO sells GBP3.5bln 1/3/6-month UKTBs

| Tenor | 1-month | 3-month | 6-month |

| Maturity | Jun 21, 2021 | Aug 23, 2021 | Nov 22, 2021 |

| Amount | GBP0.5bln | GBP1bln | GBP2bln |

| Previous | GBP0.5bln | GBP1bln | GBP2bln |

| Avg yield | 0.0261% | 0.0400% | 0.0612% |

| Previous | 0.0265% | 0.0452% | 0.0559% |

| Bid-to-cover | 3.16x | 3.67x | 2.05x |

| Previous | 3.76x | 3.43x | 2.59x |

| Next week | GBP0.5bln | GBP1.0bln | GBP1.5bln |

FOREX - RANGE BOUND

A more range bound session so far in FX and most cross assets.

- Initial price action was led by European PMIs.

- France beat expectation, and EURUSD went bid to print 1.2240 high.

- But a miss for Germany saw EURUSD pushing to session low at 1.2210.

- This was followed by decent PMIs for the EU, which in turn brought back the pair at mid range 1.2222.

- AUD and NZD are the poorer performers against the Greenback, on lower Commodities.

- But the NZD is been over taken in the raking by the NOK, as WTI extend losses in the early European session.

- WTI has now lost just over 8% from May's high, albeit trading flat today, after bouncing off the lows.

- UK Retail Sales was a big beat, providing a 15 pips spike for the Cable, testing the 1.4200 figure, to trade 0.05% versus the Dollar (pretty much flat).

- UK PMI saw a beat for Manufacturing and Composite, and slight miss for services.

- GBP trades in the green against most G10s, besides the SEK and JPY, buoyed by the data.

- Looking ahead, US PMI and Canadian retail sales are the notable releases.

- On the speaker front, ECB Lagarde, Fed Bostic, Kaplan, Barkin, Daly

- After market, Moddy rating on Greece

FX OPTION EXPIRY

FX OPTION EXPIRY (updated)

Of note: EURUSD 1.02bn at 1.2200- EURUSD: 1.2150 (739mln), 1.2160 (327mln), 1.2170 (928mln), 1.2200 (1.02bn), 1.2225 (301mln)

- GBPUSD; 1.4200 (301mln), 1.4225 (285mln)

- AUDUSD:; 0.7760 (336mln0< 0.7780 (235mln)

Price Signal Summary - Equities Remain Above Support

- In the equity space, S&P E-minis remain below Tuesday's high print of 4179.50. Futures have also tested the 50-day EMA and the average continues to provide support. Last week's low of 4029.25 marks the key short-term support. The outlook remains bullish.

- In the FX space, EURUSD traded higher this week and probed key resistance at 1.2243, Feb 25 high. An extension of gains would open 1.2285, Jan 8 high. GBPUSD remains bullish. Attention is on 1.4237, Feb 24 high and this year's high. USDJPY support has been defined at 108.34, May 7 low. A bullish theme remains intact while support holds and attention is on 109.79, May 13 high. A break of 108.34 however would highlight a trendline break drawn off the Jan 6 low and risk a deeper pullback.

- On the commodity front, Gold remains bullish. The focus is on $1892.7, 76.4% retracement of the Jan 6 - Mar 8 sell-off. Oil has entered a corrective cycle. Brent (N1) has breached its 50-day EMA. The focus is on support at $63.93 Apr 26 low. WTI is softer. The focus is on $60.61, Apr 22 low.

- In the FI space, Bunds (M1) traded lower Wednesday and cleared support at 168.59, May 13 low. This confirms a resumption of the underlying downtrend and opens 168.09, 0.764 projection of the Jan 27 - Feb 25 - Mar 25 price swing. Near-term risk in Gilts (M1) is still skewed to the downside. The key support and bear trigger is 126.79, Mar 18 low.

EQUITIES: Most stocks higher (although FTSE flat and China down)

- Japan's NIKKEI up 219.58 pts or +0.78% at 28317.83 and the TOPIX up 8.77 pts or +0.46% at 1904.69

- China's SHANGHAI closed down 20.387 pts or -0.58% at 3486.557 and the HANG SENG ended 8.15 pts higher or +0.03% at 28458.44

- German Dax up 36.4 pts or +0.24% at 15410.19, FTSE 100 down 4.41 pts or -0.06% at 7015.16, CAC 40 up 29.52 pts or +0.47% at 6373.1 and Euro Stoxx 50 up 20.43 pts or +0.51% at 4020.34.

- Dow Jones mini up 106 pts or +0.31% at 34133, S&P 500 mini up 13.75 pts or +0.33% at 4168.5, NASDAQ mini up 36.5 pts or +0.27% at 13524.5.

COMMODITIES: Copper down as most other commodities higher

- WTI Crude up $1.04 or +1.68% at $62.88

- Natural Gas up $0.04 or +1.3% at $2.963

- Gold spot up $2.54 or +0.14% at $1879.31

- Copper down $1.30 or -0.28% at $455.4

- Silver up $0.08 or +0.29% at $27.8305

- Platinum up $1.44 or +0.12% at $1201.81

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.