-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI US MARKETS ANALYSIS - Ouster of Barnier Leaves Little Dent

MNI US MARKETS ANALYSIS - Inflation Concerns Mount

MNI US MARKETS ANALYSIS - Inflation Concerns Mount

HIGHLIGHTS:

- It has been a mixed session so far for government bonds, while equities continue to push lower.

- Following yesterday's US inflation surprise, the UK similarly reported a surge in inflation for June.

US TSYS SUMMARY: Powell And PPI Feature

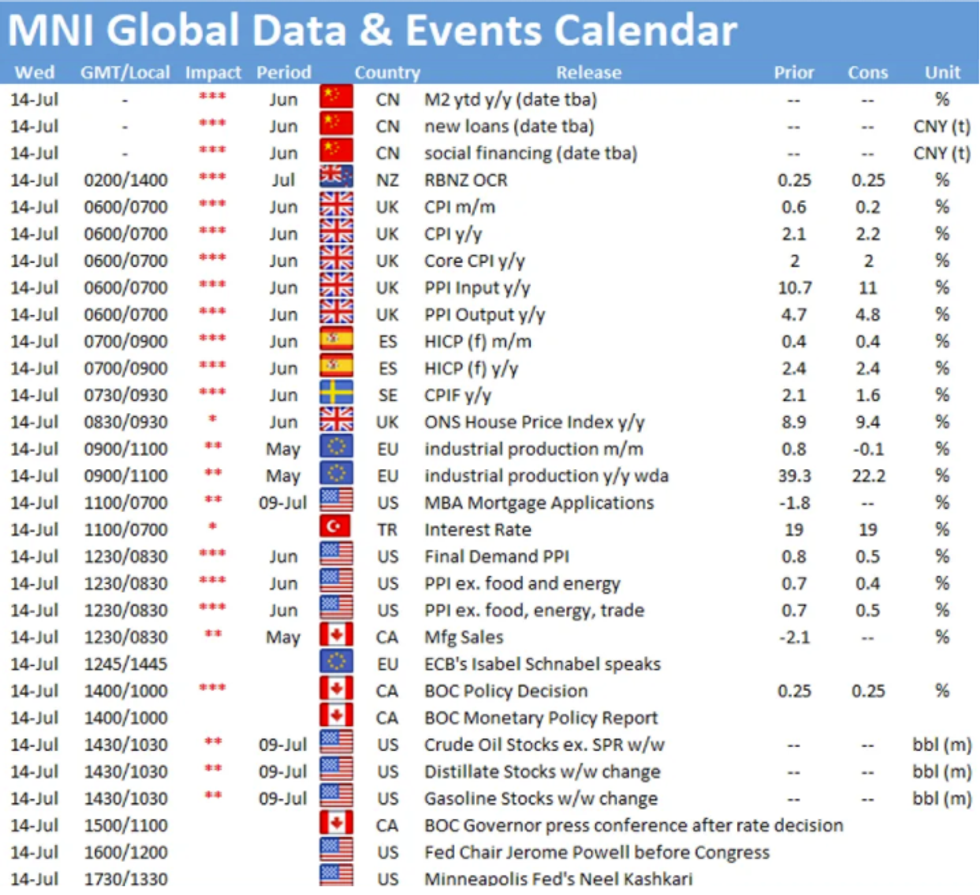

Treasuries have edged higher in overnight trade, bouncing from lows set in Asia-Pac trade. Wednesday's schedule centers around PPI data and Fed Chair Powell's congressional testimony.

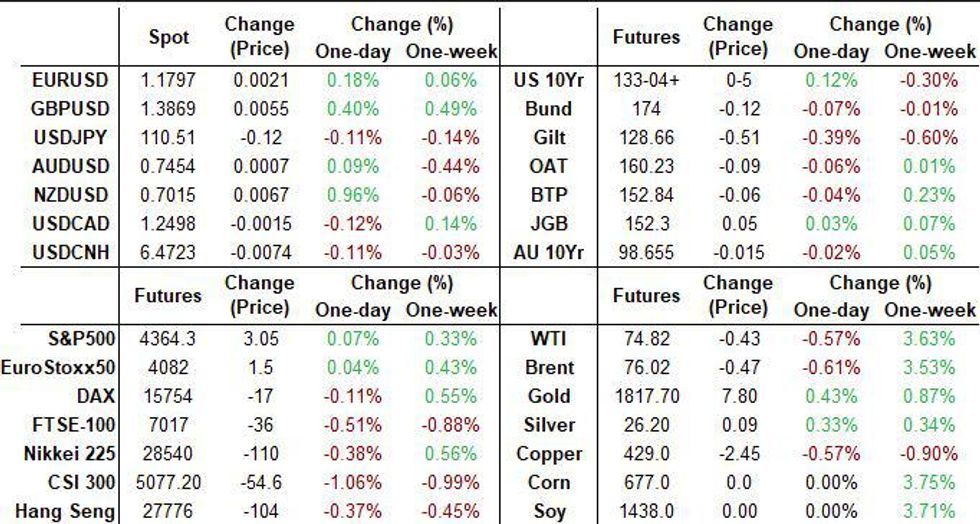

- TYs retraced about half of the losses made following Tuesday's weak 30Y auction: Sep 10-Yr futures up 4.5/32 at 133-04 (L: 132-30 / H: 133-06.5)

- The 2-Yr yield is down 0.8bps at 0.245%, 5-Yr is down 1.1bps at 0.8347%, 10-Yr is down 1.9bps at 1.398%, and 30-Yr is down 2.5bps at 2.0221%.

- Weekly MBA mortgage applications data is out at 0700ET, but the focus is on the PPI release at 0830ET where signs of further pipeline price pressures will be eyed.

- Powell delivers semi-annual testimony to the House Financial Services Committee at 1200ET. It would be a surprise to hear anything new in the prepared testimony; the Q&A with lawmakers likely to be more interesting.

- Minn's Kashkari appears at 1330ET, while the latest Beige Book is out at 1400ET.

- Supply cools down a little after a busy couple of days, with 1130ET seeing $75B total of 4-/8-week bill sales. NY Fed buys ~$1.425B of 10-22.5Y Tsys, and releases new schedule at 1500ET.

- Pres Biden attends the Senate Democrats' lunch meeting (1245ET) to discuss $3.5T budget resolution, with agreement reached late yesterday by Senate Budget Committee Dems.

EGB/GILT SUMMARY: Further Signs of Inflationary Pressure

Trading in European government bond has been relatively mixed this morning while equities continue to head lower.

- Following closely on the heels of yesterday's US inflation surprise (5.4% Y/Y in June vs 4.9% expected), the UK has similarly reported a consensus-beating inflation print of 2.5% Y/Y vs 2.2% for June.

- Gilts have sold off sharply with yields 2-4bp higher on the day and the long end of the curve under performing.

- Elsewhere, the final Spanish CPI print for June was revised up to 2.7% Y/Y from an initial print of 2.6%.

- Having traded lower soon after the open, bunds have reclaimed lost ground and now trade inline with yesterday's close.

- OATs similarly clawed back early losses to now trade marginally above closing levels.

- Supply this morning came from Germany (Bund, EUR3.392bn allotted) and Portugal (OTs, EUR914mn).

EUROPEAN ISSUANCE UPDATE

GERMAN AUCTION RESULTS: 0% Aug-31 Bund

Relatively strong auction (compared to recent).

| 0% Aug-31 Bund | Previous | |

| Allotted | E3.392bln | E4.085bln |

| Avg yield | -0.30% | -0.19% |

| Bid-to-cover | 1.20x | 1.08x |

| Buba cover | 1.42x | 1.33x |

| Price | 103.030 | 101.990 |

| Pre-auction mid | 103.014 | 101.975 |

| Previous date | 16-Jun-21 | |

| Total sold | E4bln | E5bln |

PORTUGAL AUCTION RESULTS: 10/15-year OTs

| 0.475% Oct-30 OT | 4.10% Apr-37 OT | |

| Amount | E622mln | E292mln |

| Previous | E625mln | E346mln |

| Avg yield | 0.13% | 0.61% |

| Previous | 0.24% | 0.47% |

| Bid-to-cover | 2.29x | 2.49x |

| Previous | 2.32x | 2.29x |

| Price | 103.20 | 152.26 |

| Previous | 102.26 | 157.45 |

| Pre-auction mid | 102.968 | 151.868 |

| Previous | 102.019 | |

| Previous date | 10-Mar-21 | 14-Oct-20 |

FX SUMMARY - USD stays offered

- Main early price action during the morning European session, has been a continuation of the overnight trade.

- USD stays offered and in the red against all G10s.

- NZD is still in the lead, following the hawkish RNBZ overnight, but NZDUSD has faded somewhat off its best levels at the time of typing.

- GBP has gained, after a decent beat on the Inflation data release.

- This has pushed EURGBP back towards the 0.8500 figure, printed 0.85069 low.

- Most other G10 FX have mostly traded range bound, with market participants awaiting on Fed Powell this afternoon.

- Looking ahead, BoE Cummings will be on CNBC, EU's VDL presser on climate package.

- Other speakers include ECB Schnabel, BoE Ramsden and Fed Kashkari

FX OPTION EXPIRY

FX OPTION EXPIRY:- EURUSD: 1.1775 (342mln), 1.1800 (230mln), 1.1810 (761mln), 1.1850 (513mln)

- USDJPY: 110 (415mln), 110.50 (293mln), 110.75 (489mln)

Price Signal Summary - EURUSD Remains Vulnerable

- In the equity space, bullish conditions remain intact in S&P E-minis and price continues to deliver fresh all-time highs. Attention is on 4400.00 next. EUROSTOXX 50 futures remain above last week's low of 3951.50. The contract is approaching initial resistance at 4101.50, Jul 1 high where a break would neutralise recent bearish price signals and signal scope for a stronger recovery.

- In FX, the USD outlook remains bullish. EURUSD resumed its downtrend yesterday, breaching the recent low of 1.1782, Jul 7 low. The focus is on 1.1704, Mar 31 low. The GBPUSD outlook remains bearish despite this morning's gains. The focus is on the support and bear trigger at 1.3733, Jul 2 low. Resistance is at 1.3941, the 50-day EMA. USDJPY remains above 109.53, Jul 8 low. The recent bear leg is considered corrective and a bullish theme remains intact. Initial resistance to watch is 110.82, Jul 7 high, a break would be bullish.

- On the commodity front, Gold continues to challenge the 50-day EMA, today at $1813.4. A clear break of the average is required to confirm the next leg higher and open $1833.7, 50.0% of the Jun 1 - 29 decline. Brent (U1) futures have recovered from last week's lows. Key resistance is defined at $77.84, Jul 6 high with key support initially at $72.11, Jul 8 low. WTI (Q1) key resistance is at $76.98, Jul 6 high and the bull trigger. Initial firm support lies at 70.76, Jul 8 low.

- Within FI, Bund futures are lower and remain below last week's highs. Price has recently cleared key resistance at 173.16, Jun 11 high and this highlights a bullish theme. The focus is on 174.97, Mar 3 high (cont). Support is at 173.16, Jun 11 high and a recent breakout level. Gilt futures are weaker this morning and are extending the pullback from last week's high of 129.92 on Jul 8. Broader conditions are bullish and the pullback is considered corrective. Next support is at 128.39, Jun 11 high and a recent breakout level.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.