-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Focus On US Claims & GDP Data

MNI US MARKETS ANALYSIS - Focus On US Claims & GDP Data

HIGHLIGHTS:

- Bear Steepening Themes Continues Alongside Weaker Equities

- US Claims and Q2 GDP (2nd Est.) Come Into Focus Today

US TSYS SUMMARY - KC Fed George Cracks the Seal

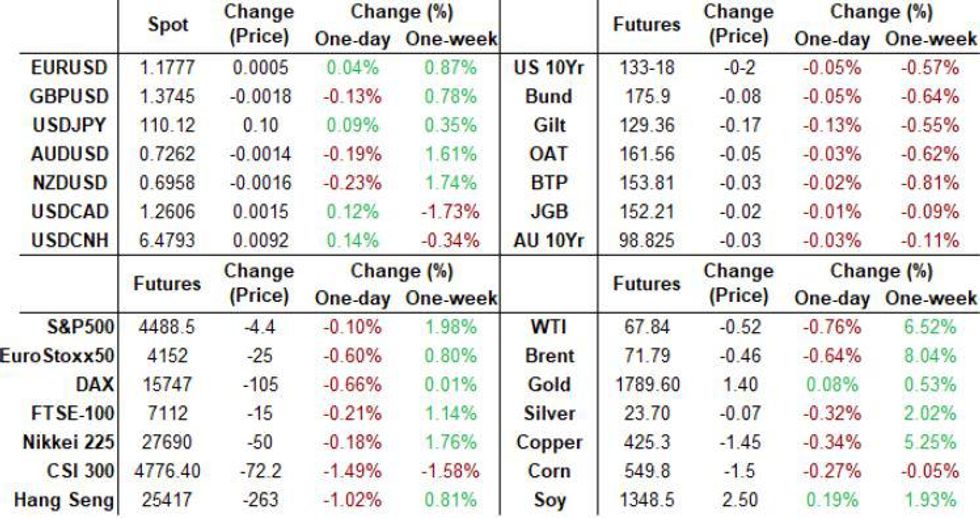

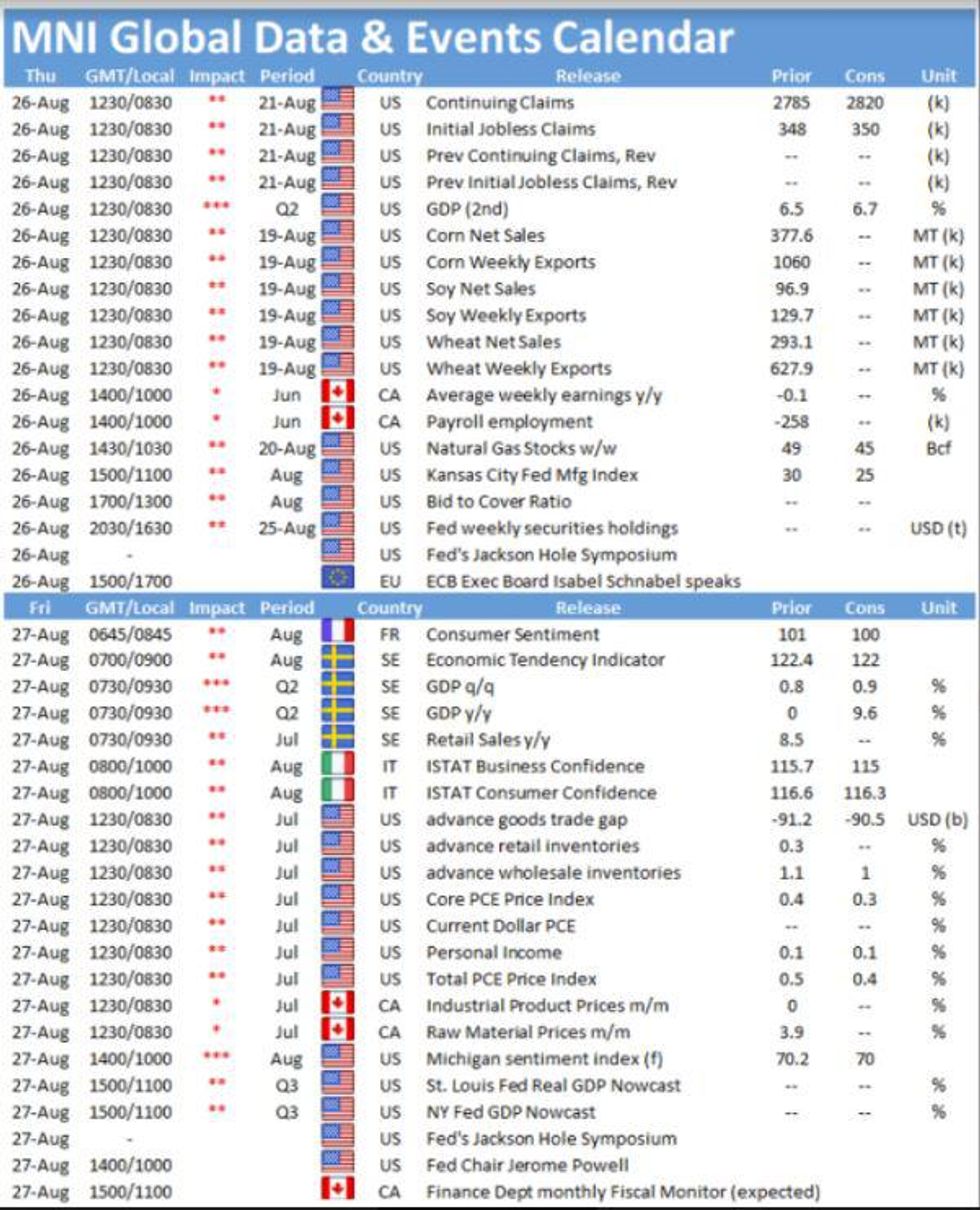

Rates trading marginally weaker overnight, Tsys 30Y Bonds off early London lows ahead the NY open. Volumes remain quite healthy (TYU >730k) due to carry-over Sep/Dec futures roll efforts ahead next Tue' "first notice" when Dec futures take lead quarterly. Yield curves nominally steeper. Equities little weaker (ESU1 -3.25), US$ small gains.- EGBs mildly weaker as well with continuation of bear steepening theme on muted data. Italy 10Y vs. Bunds narrowing slightly. Focus on US data.

- Aside from weekly claims and Q2 GDP -- anticipation builds ahead Fri's economic symposium hosted by KC Fed in Jackson Hole, WY. While the symposium agenda will be released tonight at 2000ET, Fed chairman Powell scheduled for 1000ET. However, multiple Fed speaker interviews : KC Fed George kicks off with BBG TV spot at 0730ET. CNBC interviews: StL Fed Bullard at 0800ET, Dallas Fed Kaplan at 1030ET.

- Half a dozen Fed speakers scheduled Friday BEFORE the Fed chair speaks. Expect to hear Powell repeat many recent talking points, and provide more clarity on some issues surrounding policy normalization.

- NY Fed buy-operation: 0Y-2.25Y, appr $12.425B. US Tsy auctions $30B each: 4W and 8W bills (1130ET) followed by $62B 7Y Note at 1300ET.

- The 2-Yr yield is up 0.4bps at 0.2425%, 5-Yr is up 1.9bps at 0.8363%, 10-Yr is up 0.5bps at 1.3441%, and 30-Yr is up 0.2bps at 1.9502%.

EGB/GILT SUMMARY - Impressive Volume Session for Bund

Although EGBs have somewhat been limited in terms of big ranges, this has been a busy session in terms of volumes.

- Bund trading circa 100k lots per hour, is what we call a standout session in liquidity.

- Bund have stayed under pressure in early trading, but we are fading off the lows as the US starts to come in.

- Risk remains tilted to the downside.

- Peripheral are mostly mixed, but Greece is sticking out, with the Greek/German 10yr spread 4.5bps wider.

- Gilts sees December now front month, with the majority of the rolls done, 83% complete.

- Looking ahead, US, sees GDP and Core PCE, but these are second readings, so unlikely to move the needle.

- Today's speakers include, ECB Rhen, Villeroy and Schnabel.

- ECB also publish their minutes from the 21-22 July meeting.

- Fed speakers appear on Network TV, 0730ET KC's George (Bloomberg), 0800ET Bullard (CNBC), 1030ET Dallas' Kaplan (CNBC).

- 2000ET Full Jackson Hole Agenda Released

EUROPEAN ISSUANCE UPDATE

ITALY AUCTION RESULTS: 0% Jan-24 BTP Short Term / 0.65% May-26 BTPei

| 0% Jan-24 BTP Short Term | 0.65% May-26 BTPei | |

| Amount | E2.75bln | E1bln |

| Previous | E3.75bln | E1bln |

| Avg yield | -0.29% | -1.20% |

| Previous | -0.29% | -0.92% |

| Bid-to-cover | 1.51x | 1.55x |

| Previous | 1.37x | 1.57x |

| Price | 100.70 | 109.01 |

| Previous | 100.74 | 108.13 |

| Pre-auction mid | 100.677 | 108.989 |

| Previous | 108.104 | |

| Previous date | 27-Jul-21 | 27-Apr-21 |

FOREX: USD Bid On Rising US Yields

Still fairly subdued session for FX so far this morning.

- USD has extended small gains and is in the green versus all majors, but ranges have been limited, with most of the early action happening in Govies, as yield rises.

- This has helped keep the USD underpinned, and the Greenback leads versus the Kiwi, up 0.36%.

- Ranges are tight, EURUSD 18 pips (1.1757/1.1775), while other crosses trade in circa 30 pips range.

- The pound is mixed in G10, down 0.21% against the USD, and up 0.15% versus the Kiwi.

- There's a notable large Option expiry in EURGBP, with 1.16bn at 0.8600, although the pair is still a little far, now at 0.8562 at the time of typing.

- The EUR is faring better on the margin, up versus most G10s, albeit small down with the USD and NOK.

- Looking ahead, US, sees GDP and Core PCE, but these are second readings, so unlikely to move the needle.

- Plenty of speakers are scheduled, ECB Rhen, Villeroy and Schnabel. ECB also publish their minutes from the 21-22 July meeting.

- And few Fed speakers appear on Network TV, 0730ET KC's George (Bloomberg), 0800ET Bullard (CNBC), 1030ET Dallas' Kaplan (CNBC).

- 2000ET Full Jackson Hole Agenda Released

FX OPTION EXPIRY

FX OPTION EXPIRY (updated, closest ones)

Of note: Recall we had decent EURUSD expiry at 1.1700, but we now look a little too far.Tomorrow 1.1700 has now 1.52bn

- EURUSD: 1.1700 (1.38bn), 1.1785 (204mln), 1.1800 (210mln).

- EURGBP: 0.8600 (1.16bn)

- USDCNY: 6.48 (640mln)

Price Signal Summary - Interest Rates Climb

- On the equity front, S&P E-minis are consolidating at recent highs. This week's climb to a fresh all-time high confirms a resumption of the uptrend and attention turns to the 4500.00 handle. EUROSTOXX 50 key support has been defined at 4078.00, Aug 19 low. The outlook is bullish while this level holds.

- In the FX space, the USD remains in an uptrend and this week's weakness is still considered corrective. EURUSD last week cleared 1.1704, Mar 31 low. This opens 1.1621 next, 1.00 projection of the Jan 6 - Mar 31 - May 25 price swing. Firm resistance to watch is 1.1805, Aug 13 high. GBPUSD remains vulnerable despite Monday's strong bounce. The focus is on the bear trigger at 1.3572, Jul 20 low. Resistance is at 1.3786, Aug 18 high. The Aug 20 price pattern in USDCAD was a bearish shooting star candle and Monday's weak close reinforces the bearish pattern. An extension would expose 1.2515, the 50-day EMA.

- On the commodity front, Gold maintains a bullish tone following this week's breach of its 50-day EMA. The break signals scope for a climb towards $1834.1, Jul 15 high and a bull trigger. WTI futures support has been defined at $61.74, Aug 23 low. Note, Monday's price action was a bullish engulfing reversal candle, highlighting a positive short-term theme. Further gains would open $69.39. Aug 12 high.

- In FI, Bunds support at 176.21, Aug 11 low was cleared yesterday highlighting a short-term bearish theme. The focus is on 175.37, the 50-day EMA. Gilt futures appear vulnerable following yesterday's sell-off. An extension lower would open 128.03, Jul 6 low (cont).

EQUITIES: European Stocks Move Lower But US Equity Futures Largely Unch

- Japan's NIKKEI up 17.49 pts or +0.06% at 27742.29 and the TOPIX down 0.31 pts or -0.02% at 1935.35

- China's SHANGHAI closed down 38.72 pts or -1.09% at 3501.664 and the HANG SENG ended 278.26 pts lower or -1.08% at 25415.69

- with the German Dax down 93.3 pts or -0.59% at 15766.94, FTSE 100 down 31.77 pts or -0.44% at 7118.29, CAC 40 down 30.18 pts or -0.45% at 6645.92 and Euro Stoxx 50 down 21.17 pts or -0.51% at 4159.7.

- Dow Jones mini up 12 pts or +0.03% at 35372, S&P 500 mini down 2.75 pts or -0.06% at 4490.5, NASDAQ mini down 25.25 pts or -0.16% at 15339.75.

COMMODITIES: Crude leading commodities lower

- WTI Crude down $0.59 or -0.86% at $67.81

- Natural Gas up $0.02 or +0.62% at $3.921

- Gold spot down $3.14 or -0.18% at $1787.83

- Copper down $1.65 or -0.39% at $426.05

- Silver down $0.15 or -0.63% at $23.6958

- Platinum down $3.98 or -0.4% at $995.35

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.