-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - August Drawing To A Close

MNI US MARKETS ANALYSIS - August Drawing To A Close

HIGHLIGHTS:

- Mixed trading in sovereign bonds as August draws to a close.

- The ECB's Villeroy indicating that there was no urgency to make a decision on PEPP in September

US TSYS SUMMARY: Final Days of August

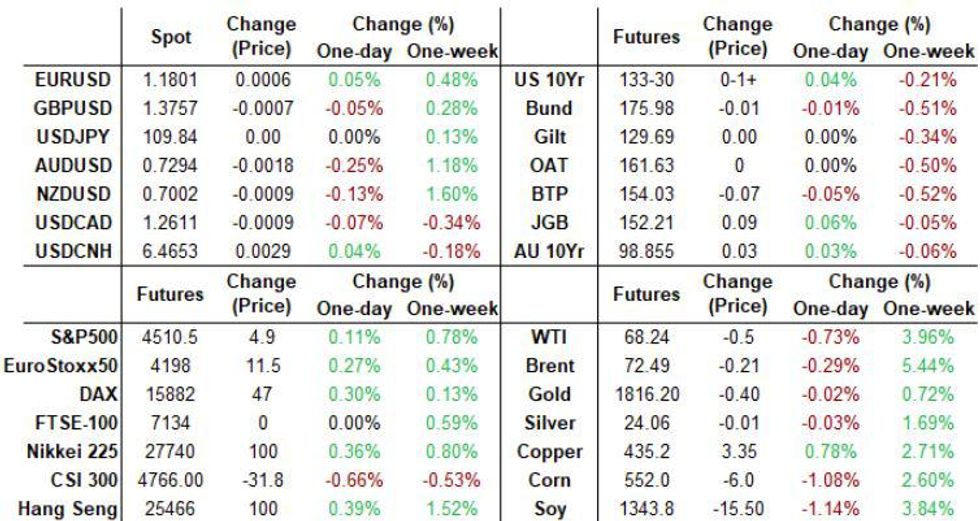

Tsys trading weaker in the wings, nominally higher in the intermediates as August draws to a close. Modest volumes as Sep/Dec quarterly futures roll winds down ahead Tue's first notice (Dec takes lead; Sep won't expire until late Sep).

- EGB's steady/mixed (Bunds firmer, BTP little weaker); Italy 10Y vs. Bund little wider (+1.2 at 106.8), otherwise sovereigns mildly tighter.

- US$ off early overnight lows, initial carry-over weakness fades after Fed Chair Powell comments from Fri's remote Jackson Hole eco-summit event: modest pace of tapering, hikes on hold, inflation transitory.

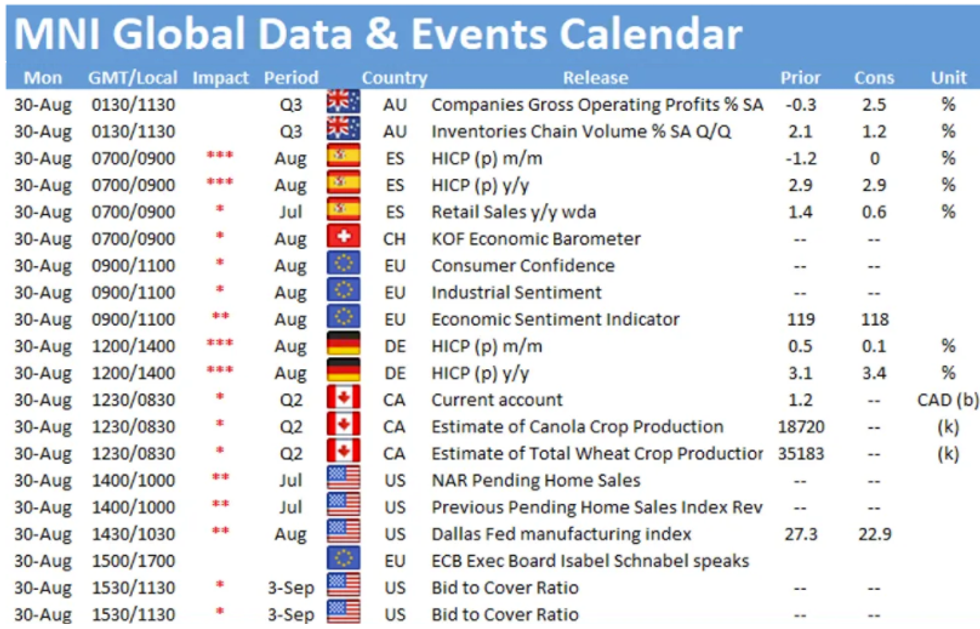

- Limited data to kick off the week: Pending Home Sales MoM (0.5% est), Dallas Fed Mfg Activity (23.0 est). Focus on Fri's employ data for Aug (NFP +703k est vs. +700k prior).

- US Tsy $51B 13W, $48B 26W bill auctions; NY Fed buy-op appr $1.225B TIPS 7.5Y-30Y.

- Currently, the 2-Yr yield is unchanged at 0.2151%, 5-Yr is down 0.5bps at 0.7947%, 10-Yr is down 0.2bps at 1.3054%, and 30-Yr is up 0.2bps at 1.9188%.

EGB SUMMARY - Trade Close To Flat During Morning European Session

- A fairly subdued overnight session for Bund and similar price action during our early morning European session.

- Volumes have been on the low side, as the UK are out on a Bank holiday Monday.

- And most desk are on the sideline ahead of ISM services and US NFP on Friday.

- Contracts remains underpinned, following the Dovish Powell Friday, on light volumes.

- Peripheral trade close to flat against the German 10yr, but Italy sits 1.1bp wider

- Looking at this afternoon, German regional and National CPI.

- Also, rolling position into December should start to pick up this week, with expiry next week

- Bund futures are up 0.09 today at 176.08 with 10y Bund yields up 0.1bp at -0.424% and Schatz yields up 0.3bp at -0.740%

- BTP futures are unch today at 154.10 with 10y yields up 1.3bp at 0.644% and 2y yields up 0.4bp at -0.497%.

- OAT futures are up 0.07 today at 161.70 with 10y yields up 0.2bp at -0.68% and 2y yields up 0.1bp at -0.718%.

FOREX: Mixed USD

A calmer start for FX, with the UK on a Bank holiday, and all the focus on Friday's NFP and ISM.

USD trades mixed in G10, up 0.45% versus the Swissy, while down 0.30% against the NOK.

EUR still lead in G10 versus the Swissy, extending gains and now up 0.44% on the session.

Risk (Equity) is doing very little, with prices anchored at current levels.

Market participants will look at Friday's high 1.07973 as initial resistance.

Looking ahead, German CPI is the only notable data. Out of the US, sees pending home sales, but won't move markets.

FX OPTION EXPIRY

- EURUSD: 1.1750 (457mln), 1.1800 (674mln)

- USDJPY: 109.80 (405mln), 110 (490mln), 110.50 (711mln)

- AUDUSD:; 0.7250 (323mln).

- USDCNY: 6.45 (450mln),

Price Signal Summary - Another ATH In S&P E-Minis

- On the equity front, S&P E-minis outlook remains bullish. The contract has traded to a fresh all-time high of 4513.25 today and the move higher confirms a resumption of the uptrend. The focus is on 4542.58, 1.236 projection of the Jun 21 - Jul 14 - 19 price swing. EUROSTOXX 50 key support has been defined at 4078.00, Aug 19 low. The outlook is bullish while this level holds.

- In the FX space, the USD remains in an uptrend and recent weakness is still considered corrective. The recent move below 1.1704, Mar 31 low in EURUSD opens 1.1621 next, 1.00 projection of the Jan 6 - Mar 31 - May 25 price swing. Resistance at 1.1805, Aug 13 high has been probed. Further gains would open 1.1829, the 50-day EMA. GBPUSD remains vulnerable despite last week's bounce. The focus is on the bear trigger at 1.3572, Jul 20 low. Resistance is at 1.3786, Aug 18 high. The Aug 20 price pattern in USDCAD was a bearish shooting star candle and the Aug 23 weak close reinforces the current bearish theme An extension would expose 1.2526, the 50-day EMA.

- On the commodity front, Gold maintains a bullish tone following last week's breach of the 50-day EMA. The break signals scope for a climb towards $1834.1, Jul 15 high and a bull trigger. WTI futures support has been defined at $61.74, Aug 23 low and conditions remain bullish. Further gains would open $70.74, 764.% retracement of the Jul 30 - Aug 23 sell-off. Support is seen at $66.92, the Aug 25 low.

- In FI, Bunds support at 176.21, Aug 11 low was cleared on Aug 25, highlighting a short-term bearish theme. The focus is on 175.41, the 50-day EMA.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.