-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI US MARKETS ANALYSIS - FED In Focus

MNI US MARKETS ANALYSIS - FED In Focus

HIGHLIGHTS:

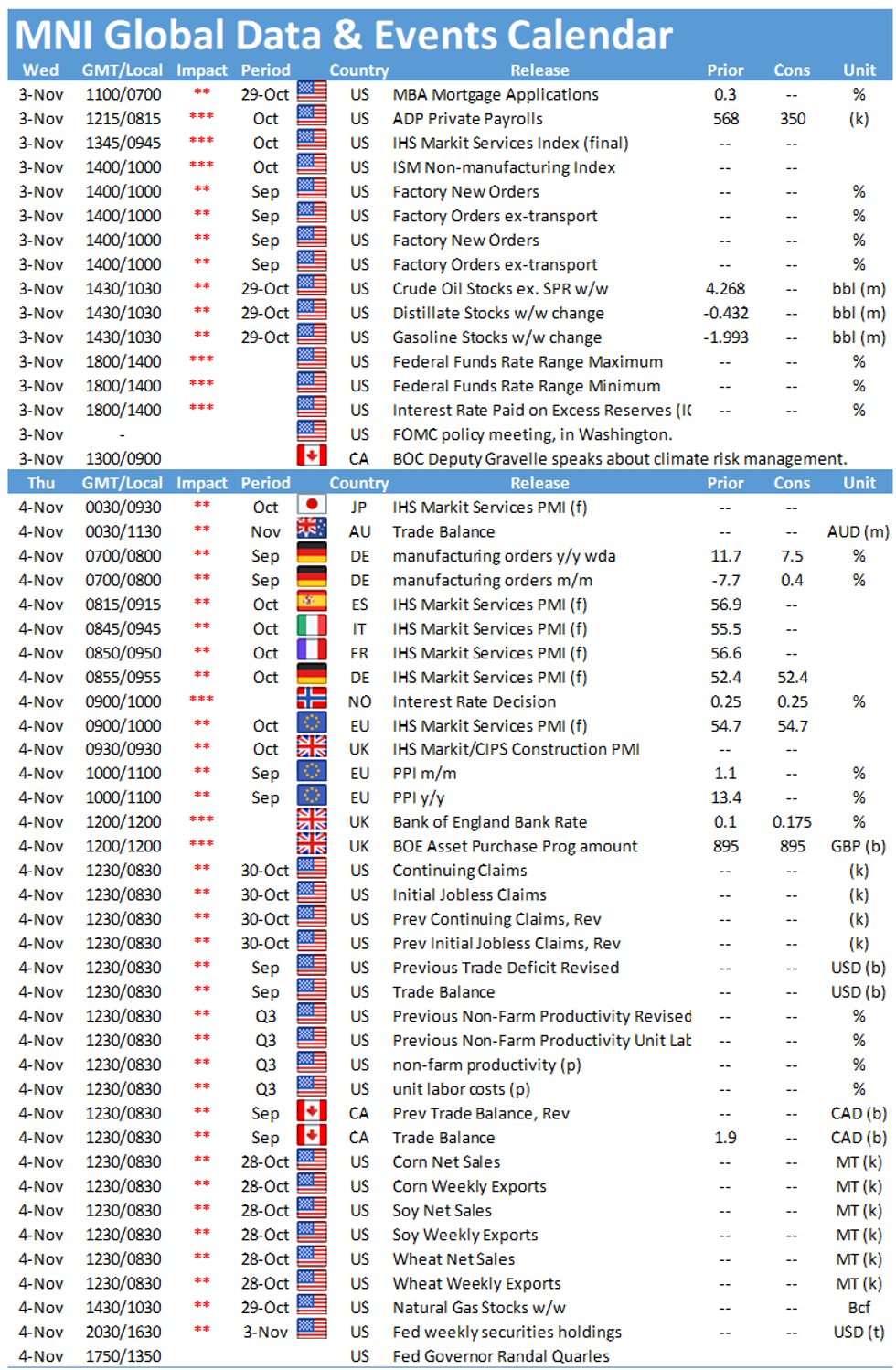

- The FOMC meeting comes into focus later today

- The ECB's Lagarde reiterated that the inflation spike is temporary, although the consensus across the GC is starting to wane

- Looking ahead, tomorrow's BoE meeting will be a 'live' event following recent hawkish commentary

UST SUMMARY: Tsys Bid Ahead ADP Employ, Tsy Quarterly Refunding, FOMC Annc

Carry-over support in rates overnight, Tsys steady march higher/near overnight highs on light volumes (TYZ1<200k) with Japan mkts out on holiday. Yield curves back to flattening, 5s30s taps 78.261 low.- Focus on FOMC (1400) and Fed chair Powell presser (1430ET): Fed expected to announce tapering of net Tsy purchases by $10B/m and mortgage securities by $5B/m, ending $120B monthly QE program by mid-2022. Note: decent carry-over short end bid from accts toning down pace of rate-hike bets in 2022-2023.

- Private ADP employment on tap at 0815ET (+400k est vs. +568k prior), US Tsy quarterly refunding at 0830ET: coupon issuance reductions are expected (3Y -$2B to $56B; 10Y -$3B to $38B; 30Y -$2B to $25B), no auctions or Fed buy operations.

- Overnight trade included two-way in 2s-7s with better buying on net from leveraged accts, real$ selling into strength in 10s and 20s.

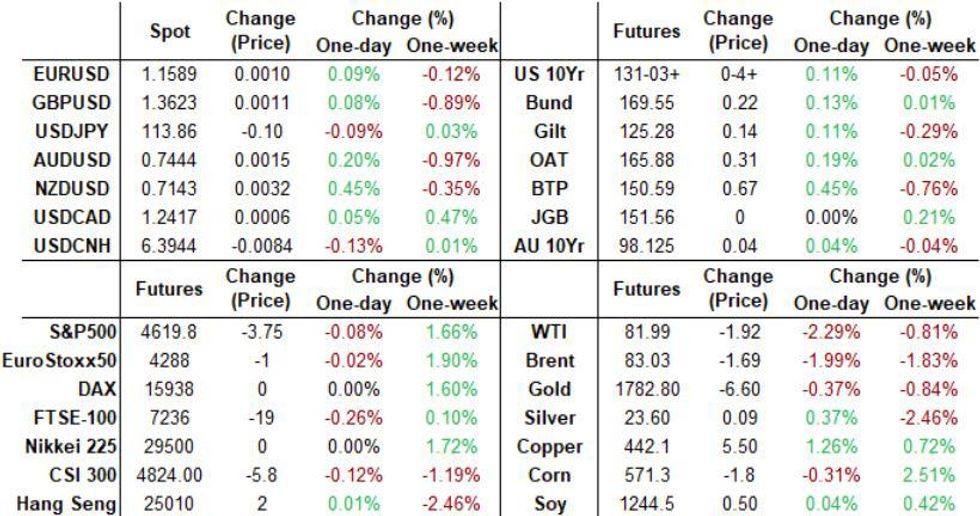

- Currently, 2-Yr yield is up 0.2bps at 0.452%, 5-Yr is down 0.8bps at 1.1395%, 10-Yr is down 1.6bps at 1.5331%, and 30-Yr is down 1.9bps at 1.9403%.

EGB/GILT: ECB Reiterates 'Temporary' Nature of Inflation Spike

European government bonds have rallied this morning while equities are broadly close to flat on the day.

- Bunds have rallied and the curve has bull flattened with the 2s30s spread narrowing 3bp.

- OATs have marginally outperformed bunds at the longer end with the curve flattening by 4bp.

- It is a similar story for BTPs.

- The rally in gilts has been more containged with cash yields 1-2bp lower.

- Speaking earlier today, the ECB's Vasle argued that there is a growing risk that inflation will stay elevated, while Madis Muller reiterated the ECBs official stance that the inflation spike is largely temporary. Meanwhile President Lagarde again stressed that the medium-term inflation outlook is subdued and stated that conditions for a rate hike are unlikely to be met next year.

- The ECB's Elderson, de Cos and Villeroy are due to speak later today.

- The final UK services and composite PMIs for October came in a touch higher than expected (59.1 vs 58.0 and 57.8 vs 56.8, respectively),

- The UK sold GBP2.5bn of the 0.50% Jan-29 gilt and Germany allotted EUR3.27bn of the 0% Oct-26 Bobl, the EU will sell EUR1.5bn of 3m bills and Greece will sell EUR625mn of 13-week bills.

EUROPEAN ISSUANCE UPDATE

GILT AUCTION RESULTS: 0.50% Jan-29 Gilt

| 0.50% Jan-29 Gilt | Previous | |

| Amount | GBP2.50bln | GBP2.50bln |

| Avg yield | 0.887% | 0.948% |

| Bid-to-cover | 2.40x | 2.21x |

| Tail | 0.5bp | 0.3bp |

| Avg price | 97.290 | 96.844 |

| Pre-auction mid | 97.283 | 96.797 |

| Previous date | 06-Oct-21 |

GERMAN AUCTION RESULTS: 0% Oct-26 Bobl

| 0% Oct-26 Bobl | Previous | |

| ISIN | DE0001141844 | |

| Allotted | E3.27bln | E3.235bln |

| Avg yield | -0.50% | -0.54% |

| Bid-to-cover | 1.09x | 1.02x |

| Buba cover | 1.33x | 1.26x |

| Price | 102.510 | 102.750 |

| Pre-auction mid | 102.500 | 102.754 |

| Previous date | 06-Oct-21 | |

| Total sold | E4bln | E4bln |

FOREX: Weaker Dollar ahead of Fed later

- The Dollar has seen better selling in early European trade, but we trade well within past ranges, with attention turning towards the Fed later today.

- The Greenback tested session low against the EUR, CHF, AUD, CNH, NOK, SEK, NZD.

- The Kiwi remains the best performer against the USD up 0.32%, after New Zealand unemployment rate fell to the lowest level in 14 years.

- There has been limited impact in Petro currencies so far today, after Oil gave back some gains.

- We have OPEC meeting tomorrow, which could be interesting, given Biden's latest comment blaming the Cartel for inflationary pressures.

- Looking ahead, on the data front will be on ISM services. Durable good is final reading, while US ADP has no real proven correlation with NFP and the NFP isn't an "all eyes" this week, with short term focus squarely on inflationary risk.

- Most of the attention is on Fed Powell, other speakers include ECB Lagarde, Muller, Elderson, de Cos, Villeroy, abd BoE Bailey

FX OPTION EXPIRY

FX OPTION EXPIRY (closest ones)

Of note:

GBPUSD: 822mln at 1.3615.

EURUSD 1bn at 1.1555, but for tomorrow expiry.

USDCNY 1.28bn at 6.40, for tomorrow also- EURUSD: 1.1585 (311mln), 1.1600 (533mln), 1.1625 (365mln)

- GBPUSD 1.3550 (545mln), 1.3615 (822mln), 1.3650 (675mln)

- USDJPY: 113.75 (750mln), 114 (485mln), 114.30 (580mln)

- USDCAD; 1.2425 (296mln), 1.2450 (920mln)

EQUITIES: Crude off the highs

- WTI Crude down $1.93 or -2.3% at $81.99

- Natural Gas down $0.04 or -0.78% at $5.501

- Gold spot down $5.16 or -0.29% at $1782.18

- Copper up $5.45 or +1.25% at $442.1

- Silver up $0.03 or +0.14% at $23.5567

- Platinum up $5.07 or +0.49% at $1046.23

COMMODITIES: Crude off the highs

- WTI Crude down $1.93 or -2.3% at $81.99

- Natural Gas down $0.04 or -0.78% at $5.501

- Gold spot down $5.16 or -0.29% at $1782.18

- Copper up $5.45 or +1.25% at $442.1

- Silver up $0.03 or +0.14% at $23.5567

- Platinum up $5.07 or +0.49% at $1046.23

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.