-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - BoE Rate Path Still Under Scrutiny

MNI US MARKETS ANALYSIS - BoE Rate Path Still Under Scrutiny

HIGHLIGHTS

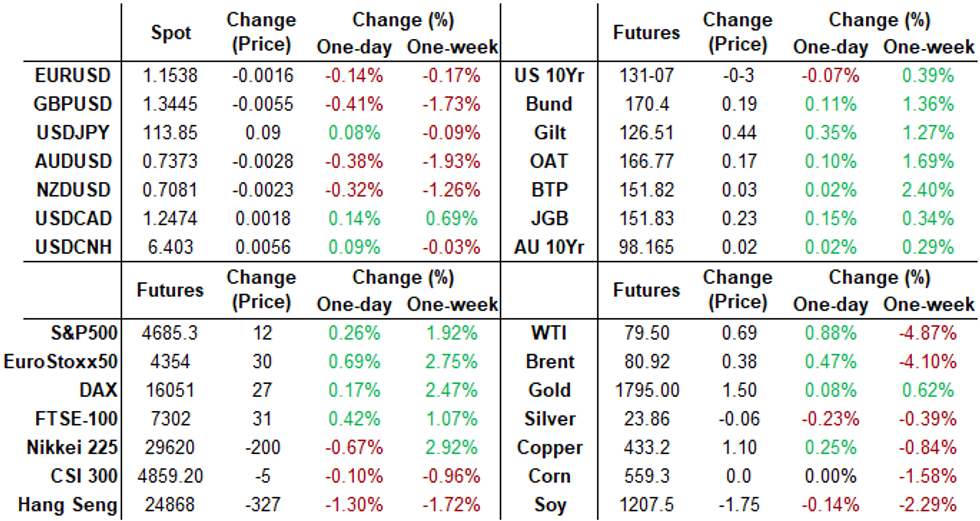

- European bonds have firmed, with gilts leading the way.

- The BoE's Bailey continues to stress that policy rates will need to increase in the coming months

- Comments from the BoE's Ramsden and Pill later today will be closely watched.

- US NFP also comes into focus today.

UST: Short End Weaker Pre-Payrolls

The Tsy curve is a little flatter Friday ahead of nonfarm payrolls.

- The 2-Yr yield is up 1.2bps at 0.4366%, 5-Yr is up 0.8bps at 1.1185%, 10-Yr is up 0.2bps at 1.5281%, and 30-Yr is down 0.6bps at 1.9575%.

- Media reported overnight that Fed's Powell had been seen visiting the White House Thursday (WSJ), and the administration asked Dem senators to meet with him before Thanksgiving (Axios).

- That's raised his implied betting probability of re-nomination to 87% from 75% yesterday (PredictIt) - a possible explanation for short-end underperformance, as the main alternative, Brainard, is seen as more dovish on rate liftoff.

- The main event in Friday's session is October nonfarm payrolls: expected to have risen by 450k, vs 194k in September, per both the MNI Dealer Median / Bloomberg survey median. Unemp rate seen falling 0.1pp to 4.7%. We'll post sell-side commentary shortly. We also get Consumer Credit at 1500ET.

- House planning to meet at 0800ET; looking to vote on $1.75T package today.

- No supply; NY Fed buys ~$8.425B in 2.25-4.5Y Tsys.

EGB/Gilt: Bailey Stresses That Rates Will Head Higher

EGBs have continued to firm this morning with gilts leading the way.

- Despite pulling back from an immediate rate hike, BoE Governor Andrew Bailey has stressed that interest rates will need to rise in the coming months to head of rising inflation.

- Gilts have rallied with yields down 4-7bp. Short sterling futures are 0.5-3.5 ticks lower in whites > blues.

- Speaking earlier today, the ECB's Guindos stated that while transitory price pressures were lasting longer than expected, so far there are no 'important' second round effects.

- Gains in bunds have been more uneven across the curve with clearer direction at the longer end. The curve is 4bp flatter on the day.

- The OAT curve has similarly flattened with the 2s30s spread 4bp narrower.

- BTPs have traded mixed and close to flat on the day.

- US NFP comes in to focus later today alongside scheduled speeches from the ECB's Panetta and Centeno as well as the BoE's Ramsden, Pill and Tenreyro.

EUROPEAN ISSUANCE UPDATE

UK AUCTION RESULTS: 1/3/6-month UKTBs

| Tenor | 1-month | 3-month | 6-month |

| Maturity | Dec 6, 2021 | Feb 7, 2022 | May 9, 2022 |

| Amount | GBP0.5bln | GBP0.5bln | GBP1bln |

| Previous | GBP0.5bln | GBP0.5bln | GBP1.0bln |

| Avg yield | 0.0067% | 0.0054% | 0.1164% |

| Previous | 0.0088% | 0.0189% | 0.2168% |

| Bid-to-cover | 5.3x | 6.85x | 4.63x |

| Previous | 2.91x | 4.33x | 3.36x |

| Next week | GBP0.5bln | GBP0.5bln | GBP1.0bln |

FOREX: It's all about the Pound

- Its all about the Pound this morning given the BoE debacle yesterday.

- New lows across the board for the GBP against JPY, USD, EUR.

- The pound is in the red across G10.

- In terms of technical for the currency, GBPJPY next immediate support is now seen at 15.733.

- Cable is through yesterday's low at 1.3471.

- Further downside traction, opens to 1.3423 2.0% 10-dma env

- Next resistance in EURGBP is seen at 0.8598 76.4% retracement of the Sep 29 - Oct 26 sell-off

- Surprisingly, USD is seeing some buying and that's despite the lower US yields and the Risk On tone, so some divergence/dislocation here.

- The USD is up against all majors, beside the Yen and the SEK.

- Most of the attention turns to the BoE speakers, with Pills Ramsden and Tenreyro.

- On the data front, sees the US NFP, but given the spillovers over from the UK, short term focus is on the speakers

FX OPTION EXPIRY

FX OPTION EXPIRY (closest ones)

Of note:

EURUSD 2.68bn between 1.1540/1.1600

USDJPY 1.7bn at 113.70- EURUSD: 1.1540 (523mln), 1.1560 (772mln), 1.1575 (725mln), 1.1600 (657mln)

- USDJPY: 113.70 (1.7bn), 113.80 (290mln), 114.25 (860mln), 114.50 (965mln)

- EURGBP: 0.8550 (538mln), 0.8560 (375mln)

- AUDUSD: 0.7415 (319mln)

- USDCAD; 1.2500 (788mln), 1.2505 (270mln)

Price Signal Summary - Sterling Still Under Pressure

- In the equity space, S&P E-minis continue to defy gravity and have registered another all-time high. The focus is on 4687.32 next, 1.382 projection of Jul 19 - Aug 16 - Aug 19 price swing. {EU} EUROSTOXX 50 futures maintain a bullish tone. Attention is on 4371.00, 1.236 projection of Jul 19-Sep 6-Oct 6 2020 swing (cont)

- In FX, EURUSD remains below recent highs and the outlook is bearish. The move lower on Oct 29 - a bearish engulfing candle - highlights a failure to clear the 50-day EMA and means the bear channel top at 1.1686 today, remains intact. The channel is drawn off the Jun 1 high. The focus is on 1.1524, Oct 12 low and bear trigger. GBPUSD remains under pressure. The deeper pullback has exposed the next key support at 1.3412, Sep 29 low. Yesterday's strong rally in EURGBP and today's follow through has exposed 0.8598, 76.4% retracement of the Sep 29 - Oct 26 sell-off and 0.8658 further out, Sep 29 high. USDJPY remains below recent highs but above support at 113.45-00, the 20-day EMA and Oct 12 low respectively. A break would signal scope for a deeper pullback. The trend for now remains up.

- On the commodity front, Gold reversed course yesterday and has rebounded off Wednesday's low of $1759.0. The turnaround reinstates a potential bullish outlook and exposes resistance at $1813.8, Oct 22 high. This week's sell-off in WTI resulted in a breach of $80.58, Oct 28 low and the contract cleared the 20-day EMA. This has opened the 50-day EMA at $77.17. Key resistance has been defined at $85.41, the Oct 25 high.

- In the FI space, short-term gains in Bund futures traded higher yesterday and breached resistance at 169.83, Oct 27 high. Note too that futures have also probed the 50-day EMA at 170.06. A clear break of both these levels would open 171.14, 50.0% retracement of the Aug - Nov sell-off. Gilts are rallying and the recent double bottom reversal is playing out. The focus is on 127.09 next, 61.8% retracement of the Aug - Oct downleg.

EQUITIES: Asian markets lower, European markets higher

- Japan's NIKKEI down 182.8 pts or -0.61% at 29611.57 and the TOPIX down 14.14 pts or -0.69% at 2041.42.

- China's SHANGHAI closed down 35.298 pts or -1% at 3491.568 and the HANG SENG ended 354.68 pts lower or -1.41% at 24870.51.

- German Dax up 37.47 pts or +0.23% at 16063.77, FTSE 100 up 38.89 pts or +0.53% at 7317.07, CAC 40 up 37.96 pts or +0.54% at 7023.59 and Euro Stoxx 50 up 29.09 pts or +0.67% at 4361.74.

- Dow Jones mini up 12 pts or +0.03% at 36019, S&P 500 mini up 12.5 pts or +0.27% at 4685.25, NASDAQ mini up 59 pts or +0.36% at 16389.5.

COMMODITIES: Crude higher, natgas lower

- WTI Crude up $0.7 or +0.89% at $79.47

- Natural Gas down $0.07 or -1.21% at $5.633

- Gold spot up $1.87 or +0.1% at $1794.2

- Copper up $1.05 or +0.24% at $433.15

- Silver down $0.01 or -0.05% at $23.795

- Platinum up $2.74 or +0.27% at $1031.69

LOOK AHEAD

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.