-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Busy Data Slate Ticks All The Boxes

HIGHLIGHTS:

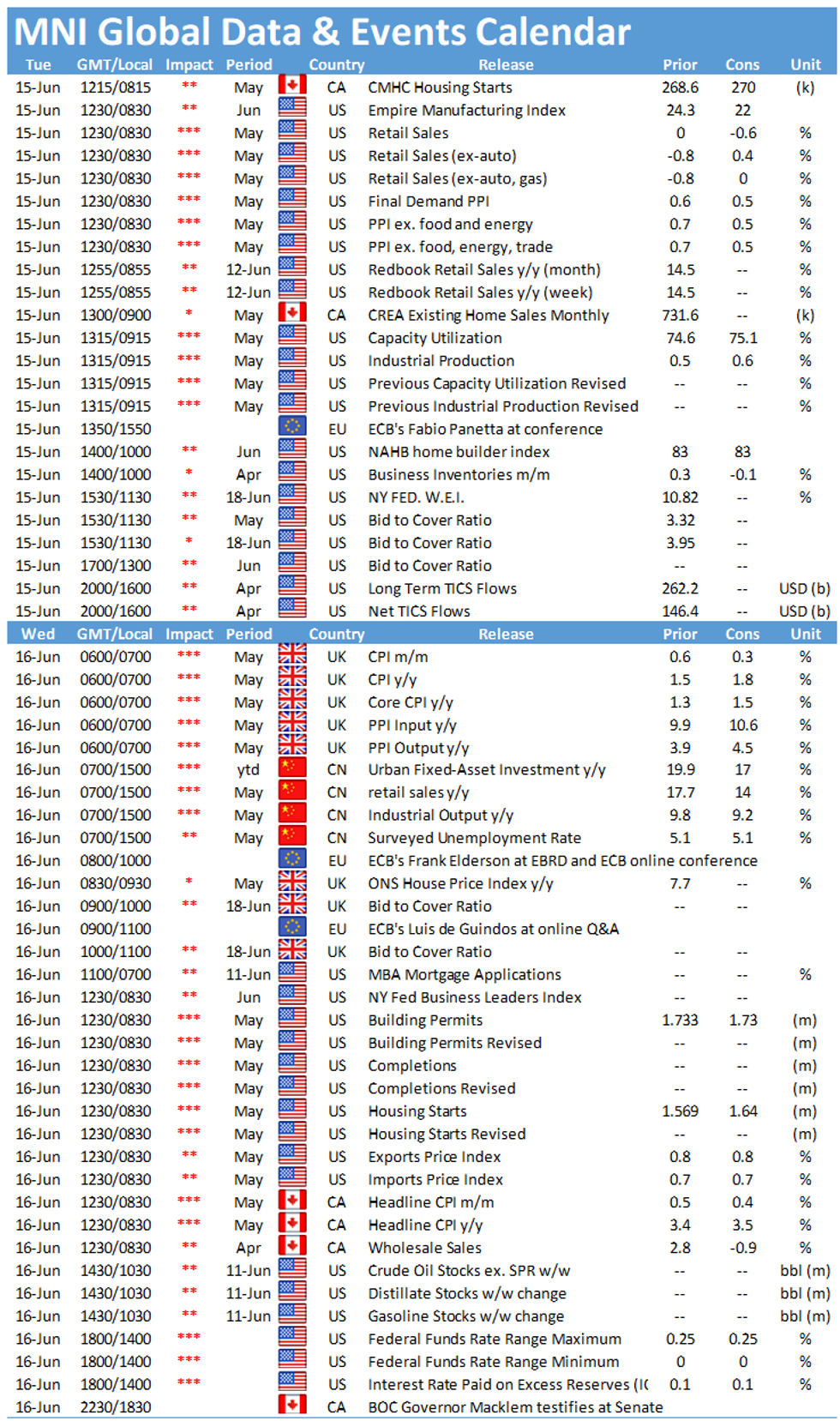

- Heavy U.S. data slate Tuesday to provide an update on the consumer, price pressures, and production bottlenecks

- EU To Raise E20bln in debut NextGenerationEU 10-Yr bond on books >E142bln; Large size pressures Bunds

- Copper prices drop sharply; Oil circles below cycle highs

US TSYS SUMMARY: Busy Data Slate Ticks All The Boxes

A busy data slate highlights Tuesday's session, which has so far seen Tsys edge slightly higher in early Asia-Pac trade (but TYs basically unchanged since around 2100ET).

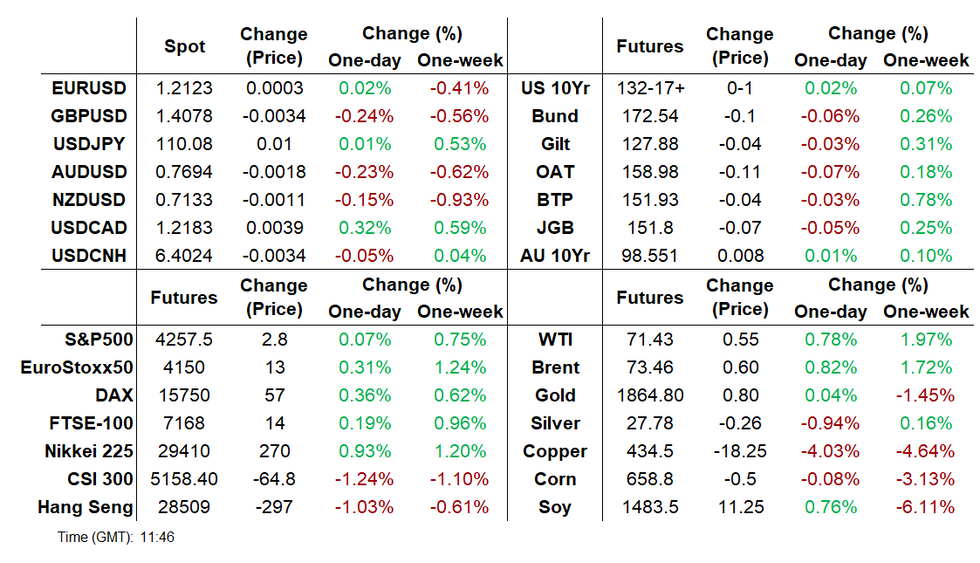

- The 2-Yr yield is unchanged at 0.157%, 5-Yr is down 0.7bps at 0.7757%, 10-Yr is down 0.7bps at 1.4872%, and 30-Yr is down 0.1bps at 2.1808%.

- Sep 10-Yr futures (TY) up 3/32 at 132-19.5 (L: 132-17.5 / H: 132-21); volume <180k.

- May retail sales (0830ET) will help provide another guidepost to consumer health in the re-opening recovery, while May PPI out at the same time is expected to show cooling but still strong pipeline price pressures vs April. Also at 0830ET is Jun Empire State Manufacturing.

- Then at 0915ET we get industrial production, with supply chain bottlenecks in focus.

- 1000ET sees Apr business inventories and 1000ET Jun NAHB housing prices.

- In supply, we have a busy pre-FOMC bill auction schedule, with $40B 42-day bills and $34B 52-wk bills selling at 1130ET, while 1300ET brings $24B 20Y bond re-open.

- NY Fed buys $1.225B in 7.5-30Y TIPS.

- Some attention on Democratic Party infighting on infrastructure; Politico writes Pres Biden's "entire agenda appears to be in jeopardy".

EGB/GILT SUMMARY: Lacking Direction So Far

Price action in EGBs has been relatively contained this morning with a lack of clear direction. Tomorrow's FOMC meeting looms large in the background and may account for some caution.

- Gilts opened stronger and have fluctuated within a narrow band. Cash yields are flat in the short end of the curve and 1bp lower in the belly/long-end.

- Bunds initially firmed and then sold off back to yesterday's closing levels.

- It is a similar story for OATs which are now flat on the day.

- BTPs have firmed slightly in the short-end/belly with yields within 1bp of yesterday's close.

- Supply this morning came from the UK (Gilts, GBP7.75bn), Germany (Schatz, EUR4.068bn allotted) Spain (Letras, EUR1.94bn) and Finland (RFGBs, EUR1.417bn). In addition the EU issued EUR20bn on inaugural 10-year NGEU bond.

EUROPE BOND SUPPLY: NGEU Syndication Update: To Raise E20bln In 10-Yr

Final terms on debut NGEU 10-Yr (Jul 4, 2031) bond syndication:

- E20bln fixed at MS-2

- Books above E142bln

- ISIN: EU000A3KSXE1

- Source: BBG

GERMAN AUCTION RESULT: Technically uncovered Schatz auction (again)

| 0% Jun-23 Schatz | Previous | |

| Allotted | E4.068bln | E4.849bln |

| Avg yield | -0.68% | -0.66% |

| Bid-to-cover | 0.97x | 0.91x |

| Buba cover | 1.19x | 1.13x |

| Price | 101.373 | 101.379 |

| Pre-auction mid | 101.373 | |

| Previous date | 18-May-21 | |

| Total sold | E5bln | E6bln |

GILT AUCTION RESULT: DMO sells GBP2.75bln of the 0.125% Jan-28 gilt

| 0.125% Jan-28 Gilt | Previous | |

| Amount | GBP2.75bln | GBP3.00bln |

| Avg yield | 0.531% | 0.176% |

| Bid-to-cover | 2.50x | 2.75x |

| Tail | 0.1bp | 0.2bp |

| Avg price | 97.360 | 99.640 |

| Pre-auction mid | 97.317 | |

| Previous date | 13-Jan-21 |

GILT AUCTION RESULT: DMO sells GBP2bln of the 1.25% Jul-51 Gilt

| 1.25% Jul-51 Gilt | Previous synd | |

| Amount | GBP2.00bln | GBP6.00bln |

| Avg yield | 1.274% | 1.312% |

| Bid-to-cover | 2.24x | |

| Tail | 0.2bp | |

| Avg price | 99.391 | 98.469 |

| Pre-auction mid | 99.261 | |

| Previous date | 27-Apr-21 |

FINLAND AUCTION RESULTS: 7/10-year RFGB

| 0.50% Sep-28 RFGB* | 0.125% Sep-31 RFGB | |

| Amount | E443mln | E974mln |

| Previous | E3bln | |

| Avg yield | -0.304% | -0.015% |

| Previous | 0.163% | |

| Bid-to-cover | 1.53x | 1.77x |

| Price | 105.90 | 101.44 |

| Previous | 99.61 | |

| Pre-auction mid | 105.797 | 101.169 |

| Previous date | 19-May-21 |

OPTIONS: Morning Summary: Summertime Bund And Tsy Calls

Europe:

- RXN1 172.50 call bought for 58.5 in 5k

- RXQ1 171.00/172.50/174.00 1x1.5x1 call fly bought for 87.5 in 2k (2k x 3k x 2k)

US:

- TYQ1 133.00 calls 2.0K given at 0-31

FOREX: GBP/USD Nearing Key Support and Monthly Lows

- The greenback is modestly stronger headed into NY hours, but price action is thin and recent ranges are largely being respected. EUR/USD ran up higher in early Europe, boosting EUR/USD to 1.2147 before the rate faded back to flat at the crossover.

- GBP is softer for a second session, with the currency on the back foot after the UK delayed its economic reopening by four weeks to July 19th. Yesterday's lows at 1.4071 mark first support and a break through here opens the 50-day EMA at 1.4041 initially ahead of 1.4010 and the lowest level since mid-May.

- AUD, CAD are the poorest performers in G10, while the USD and SEK are firmer.

- US retail sales are the highlight Tuesday, with the advance reading seen dropping 0.7% against last month's flat figure. PPI data also crosses - both of which will be in focus ahead of tomorrow's Fed decision. There are plentiful ECB speakers, with de Cos, Lane, Panetta and Holzmann all due. Bailey of the BoE is also on the docket.

FX OPTIONS: Expiries for Jun15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1950-55(E552mln), $1.2075-80(E646mln-EUR puts), $1.2150-60(E590mln), $1.2200(E706mln), $1.2240-50(E870mln-EUR puts), $1.2300(E584mln-EUR puts)

- USD/JPY: Y109.00-15($620mln-USD puts), Y109.50-60($665mln-USD puts), Y110.00-11($1.45bln-USD puts), Y111.50($799mln)

- EUR/GBP: Gbp0.8600-10(E1.1bln-EUR puts)

- USD/NOK: Nok7.99($500mln), Nok8.15($400mln)

- AUD/USD: $0.7700-15(A$880mln, A$724mln-AUD puts), $0.7725-40(A$1.4bln-AUD puts), $0.7940-50(A$574mln)

- USD/MXN: Mxn19.82($635mln)

Price Signal Summary - EURUSD Appears Vulnerable

- In the equity space, sentiment remains bullish and the E-mini S&P (U1) continues to grind higher, confirming again that the path of least resistance remains up. The focus is on 4264.41, a Fibonacci projection. Further out, the recent break higher also exposes 4300.00. Initial firm support is at 4155.00, Jun 3 low.

- In the FX space, EURUSD still appears vulnerable following Friday's move low that saw the pair breach 1.2111 50-day EMA and probe the 1.2104 Jun 4 low. These levels represent a key short-term support and a clear break would signal scope for a deeper sell-off. This would open 1.2052, May 13 low. GBPUSD attention remains on the key support at 1.4006, May 13 low. The 50-day EMA is just above at 1.4039 and also represents a key support. The outlook is bullish while these levels hold. A break of 1.4006 though would suggest scope for a deeper pullback. Recent USDJPY remains above support at 109.19, Jun 7 low. Gains yesterday and today refocus attention on resistance and the near-term bull trigger at 110.33, Jun 4 high.

- On the commodity front, Gold yesterday probed support at $1856.2, Jun 4 low. A deeper sell-off would open $1842.6, the 50-day EMA. Trend conditions in oil remain bullish and price continues to trend higher. The Brent (Q1) focus is on $74.20, Apr 26, 2019 high (cont). WTI (N1) traded higher yesterday as the uptrend extends. The focus is on $72.06, 3.00 projection of Mar 23 - 30 - Apr 5 price swing

- Within FI, Bunds (U1) maintain a bullish tone with the focus on 173.32 next, 76.4% of the Mar 25 - May 19 sell-off. Gilts (U1) cleared 127.74/82 last week, the highs between Apr 20 and May 26. This opens 128.50, 1.00 projection of the May 13 - 26 - Jun 3 price swing.

COMMODITIES: WTI, Brent Circling Below Cycle Highs

- Both Brent and WTI crude benchmarks are higher ahead of Tuesday's NYMEX open, although both contracts hold just below the cycle highs printed earlier in the week.

- Oil benchmarks are facing further mixed messages out of Iran as the self-imposed deadline for nuclear talks looms large. Reports that Iran have produced over 100kg of 20% enriched uranium will have been a cause for concern, directly running against US sanctions agreements and lessening the likelihood of a return to international energy markets for Iranian crude supply. In contrast, one of the more moderate candidates for this weekend's Presidential election has urged closer ties with the West, a sure signal that a centrist victory in Iran would lead to more sanctions adherence.

- Brent directional parameters are as follows: $74.00/bbl psychological resistance and the $70.51/bbl 20-day EMA as support.

EQUITIES: Stocks Mixed, With European Core Outperforming Periphery

- European equity markets are mixed, with core Europe outperforming the periphery at the midpoint. EuroStoxx50 and DAX higher by 0.4% while Italian, Spanish headline indices shed 0.4-0.6%.

- Weakness in European energy names is countering strength across industrials and consumer staples, as a moderation in the crude oil rally sees oil & gas exploration names top out slightly.

- In futures space, US indices are mainly higher, indicating a positive open on Wall Street later today. Gains are modest, however, with the e-mini S&P only a few points about water at pixel time.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.