-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Central Bank Comms in Focus

HIGHLIGHTS:

- Central bank comms in focus, with no surprise policy change

- USD dives further, USD Index at new multi-year lows

- Weekly US jobless data, Banxico decision in view

US TSYS SUMMARY: Right Back Where We Were Pre-FOMC

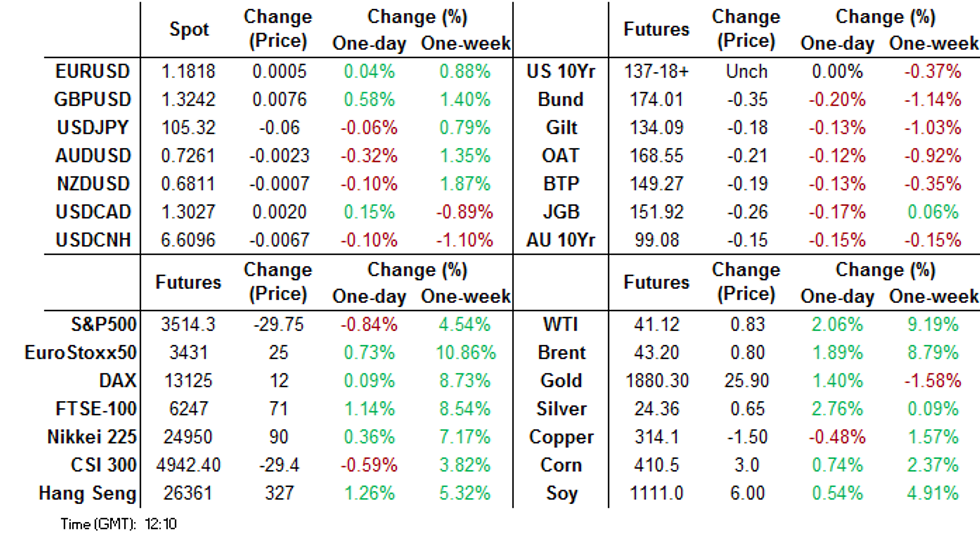

A slow overnight session for Treasuries, with low volumes (<175k) for TYs which are trading within a tick of where they were prior to the FOMC announcement Wednesday.

- The curve is basically unchanged too, having reversed the initial knee-jerk reaction to what was seen as a modestly hawkish Fed decision. (MNI's FOMC review will be out later today.)

- The 2-Yr yield is up 0.2bps at 0.117%, 5-Yr is up 0.6bps at 0.3734%, 10-Yr is up 1bps at 0.9263%, and 30-Yr is up 0.9bps at 1.6642%. Mar 10-Yr futures (TY) down 1.5/32 at 137-27 (L: 137-25.5 / H: 137-30.5).

- The rangebound movement in Tsys contrasts with equity futures and the USD, which are plumbing respectively new highs and lows in European trade.

- We continue to await fiscal news which looks like the major factor to potentially move the needle. Talks on relief down to the 'final details' - expected to be unveiled as soon as today.

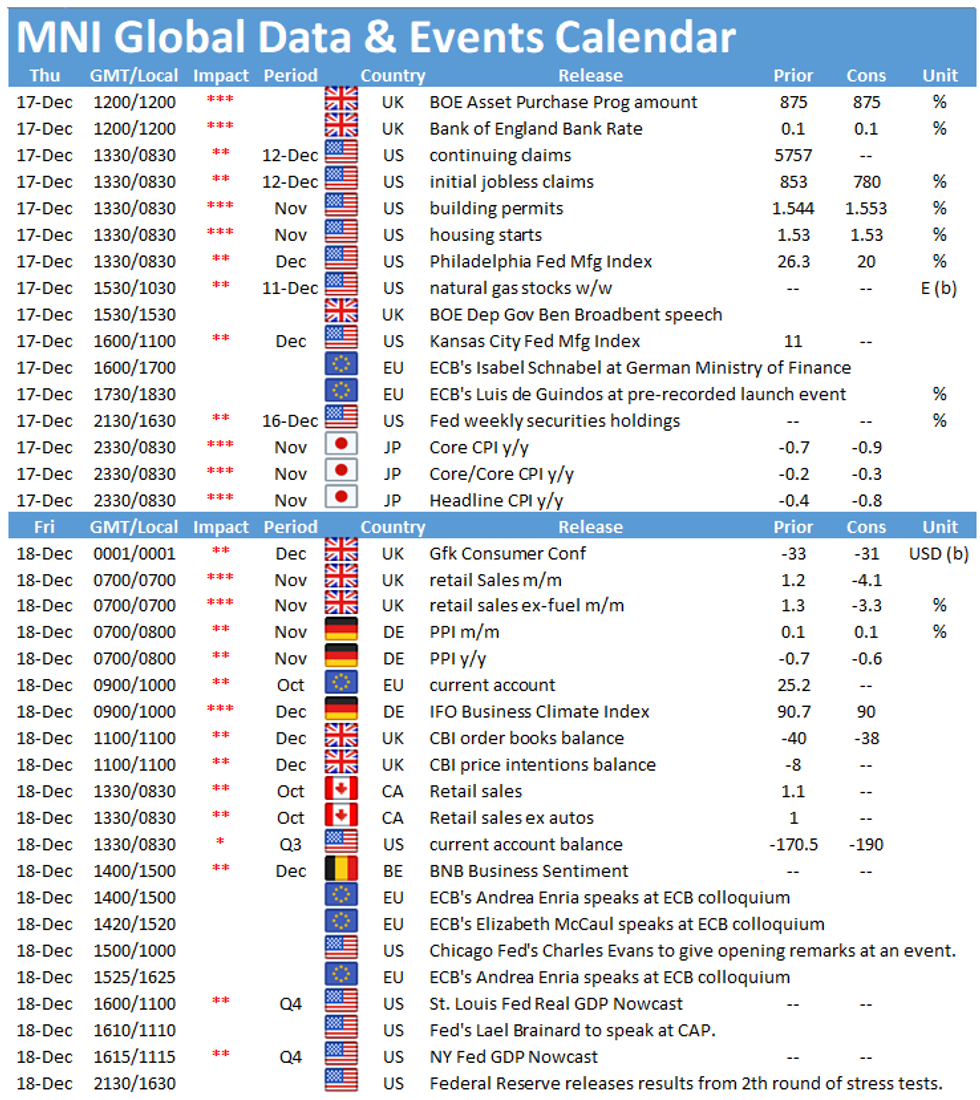

- Today basically concludes the week's data too, and jobless claims and Nov housing starts - both at 0830ET - will be closely watched.

- We also get Philly Fed at 0830ET, then later at 1100ET, KC Fed manufacturing.

- In supply, $65bn in 4-/8-week bills sell at 1130ET, and two NY Fed purchase operations: 20-30Y Tsys for ~$1.750bn and later, 1-7.5Y TIPS, for ~$2.424bn.

EGB/GILT SUMMARY: EGBs Firmed Throughout European Morning

Following a weak start, EGBs have firmed through the morning. European currencies have gained against the US dollar while equities have posted modest gains.

- Gilts trade close to unch on the day. The Mar 21 gilt future trades at 134.60, near the middle of the day's range (L: 134.36 / H: 134.71).

- Bunds are similarly now flat on the day. Last yields: 2-year -0.7364%, 5-year -0.7547%, 10-year -0.5774%, 30-year -0.1715%.

- OATs have firmed with yields edging down 1bp across the curve.

- BTPs have marginally outperformed with yields 1-2bp lower on the day.

- Both Norges Bank and the Swiss National Bank left policy rates unchanged at this morning's monetary policy meetings. Norges Bank indicated that it could begin to raise interest rates earlier than initially thought. Focus now shifts to the BoE at midday.

- UK Chancellor of the Exchequer Rishi Sunak has extended emergence Covid loans for businesses. The move comes shortly after London was placed in tier 3 restrictions.

- The final Eurozone CPI estimate for November matched the initial reading (-0.3% Y/Y)

BoE: Unchanged on Rates, QE at Current Pace with No Change to Buckets

Gilt purchases between 4 January and 3 February will be GBP1.48bln per bucket with buckets of 3-7 years, 7-20 years and 20+ years (unchanged pace and buckets).Wording on pace of potential increases and technical parameters under review

Wording around pace of purchases and potential increases (no real surprise here):

- "The Committee envisaged that the pace of purchases could remain at around its current level initially, with flexibility to slow the pace of purchases later... Should market functioning worsen materially again, the Bank of England stood ready to increase the pace of purchases to ensure the effective transmission of monetary policy."

- And the technical QE parameters might still change in the future, this statement remains in the Minutes. The question is, does the BoE intend to make a change or is this statement in here solely to convince market participants who are concerned about scarcity that the BoE can change its buckets or free float parameters if needed: "The Committee would keep the asset purchase programme under review. If needed, there was scope for the Bank of England to re-evaluate the existing technical parameters of the gilt purchase programme"

NORGES BANK: Vaccine News Prompts Steeper Rate Path

- A steeper path from Norges Bank, most sell-side has seen only minor tweaks but this is more sizeable and brings forward first hike by about six months.

- Bank pins the rate path tweak largely on vaccine news: "Vaccine availability will likely speed up the recovery through 2021 compared with that projected in the September Report."

| Sept. Projections | Dec. Projections | Change (bps) | |

| 31/12/2020 | 0.00 | 0.00 | - |

| 31/03/2021 | 0.00 | 0.00 | - |

| 30/06/2021 | 0.00 | 0.00 | - |

| 30/09/2021 | 0.00 | 0.00 | - |

| 31/12/2021 | 0.00 | 0.00 | - |

| 31/03/2022 | 0.02 | 0.09 | +7bps |

| 30/06/2022 | 0.06 | 0.21 | +15bps |

| 30/09/2022 | 0.12 | 0.36 | +24bps |

| 31/12/2022 | 0.21 | 0.51 | +30bps |

| 31/03/2023 | 0.32 | 0.66 | +34bps |

| 30/06/2023 | 0.42 | 0.77 | +35bps |

| 30/09/2023 | 0.50 | 0.86 | +36bps |

| 31/12/2023 | 0.57 | 0.93 | +36bps |

German Issuance for 2021

- Germany plans to raise E469-471bln through auctions in 2021 with two syndications in addition (2020 saw E406.5bln issued).

- Capital markets issuance E216bln and bill issuance E241bln

- Schatz: 12 auctions E64bln. 4 new issues. Launch auctions of E6ln and reopenings of E4-6bln.

- Bobls: 12 auctions E48bln. 2 new issues. Launch auctions of E5bln and reopenings of E3-4bln.

- 7-year Bund: 8 auctions (monthly from April) with E22bln of new Nov-28 Bund. Launch auction E4bln and reopenings of E3bln.

- 10-year Bund: 12 auctions E48bln. 2 new issues. Launch auctions of E5bln and reopenings of E3-4bln.

- 15-year Bund: 9 auctions with E23bln of new May-36 Bund. Launch auction of E3bln and reopenings of E2.5bln.

- 30-year Bund: 9 auctions with E11bln through 2048, 2050 and new 2052 Bunds. Auctions of E1.0-1.5bln. New Aug-52 Bund to launch via syndication in September 2021.

- Green issuance expected to be similar volumes to 2020.

- Green 30-year Aug-50 to launch via syndication in May.

- Green 10-year new issue Aug-31 to launch via auction on 16 June.

- Linker issuance with nominal value of E6-8bln to be issued.

- Monthly auctions planned with the exception of August and December but details will only be announced the preceding Thursday (i.e. no formal calendar released now).

- A new 10-year linker is expected to be launched in early 2021.

- Any further updates on planned issuance will be published next in March.

FOREX: NOK Shoots Higher as Norges Bank Steepen Path

A busy FX session, with plenty of early CB decisions.

- USD inderperforms once again, with better buying interest in Equities.

- Bank Indonesia left their reverse repo rate unchanged as expected at 3.75%

- BSP also left their rate unchanged at 2%, as expected.

- SNB were next on the heavy CB calendar, and have also left their Rate unchanged at -0.75%.

- Norway left their rates unchanged but moved forward the rate hike path.

- As such, NOK continued to extend gains, versus the USD. Highest since 2019. Rate path brought forward, and broader USD weakness as well as higher Oil on the decline in US stockpile are all benefiting the NOK.

- AUD is the second best performing currency against the Greenback, up 0.75% and tested resistance at 0.7638 38.2% retracement of the 2013-2020 downtrend (printed 0.7640 high)

- GBP stays on the front foot, with market participants positioning for a Brexit deal.

- Talks here continues, with progress progress noted, but same sticking points remains (no change)

EQUITIES: European Stocks Generally Higher

Stocks across the continent are broadly higher, although UK's FTSE-100 and Spain's IBEX-35 lag slightly to trade flat. The materials, tech and utilities sectors are leading the gains, with consumer staples and communication services names at the bottom of the table.

US equity futures are mirroring the gains, with the e-mini S&P higher by close to 20 points ahead of the open. The index crested at a new alltime high of 3724.75 in Asia-Pac hours.

COMMODITIES: Test on $50/bbl Looks Likely for WTI

WTI and Brent crude futures are notching up further gains pre-NY hours, with WTI hitting new multi-month highs of $48.59 as pervading USD weakness and generally firm risk sentiment globally continues to buoy oil. Similarly, industrial metals are in the green, with Copper futures returning to test the multi-decade highs printed in early December.

Gold is a touch firmer, but psychological resistance at $1900/oz remains in tact, with firmer equities globally providing a decent headwind.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.