-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - China FX Firms Further

HIGHLIGHTS:

- Equities in a range, support intact

- Chinese FX continues to surge, fresh multi-year highs for CNY

- Data picks up with jobless claims, durable goods and pending home sales data

US TSYS SUMMARY: A Little Weaker Ahead Of Data, 7-Yr Supply

Treasuries have weakened marginally in overnight trade Thursday with a bit of bear steepening, ahead of a decent slate of data and 7-Yr supply.

- The 2-Yr yield is down 0.4bps at 0.1446%, 5-Yr is up 2bps at 0.8027%, 10-Yr is up 0.8bps at 1.5841%, and 30-Yr is up 1.2bps at 2.2682%.

- Jun-Sep rolls are all but complete. The active Bloomberg ticker still shows June, but TYU1 clearly ahead in volume (~280k vs ~210k TYM1): down 2.5 ticks at 131-30+ (L: 131-28+, H:132-02).

- Equities and USD marginally weaker.

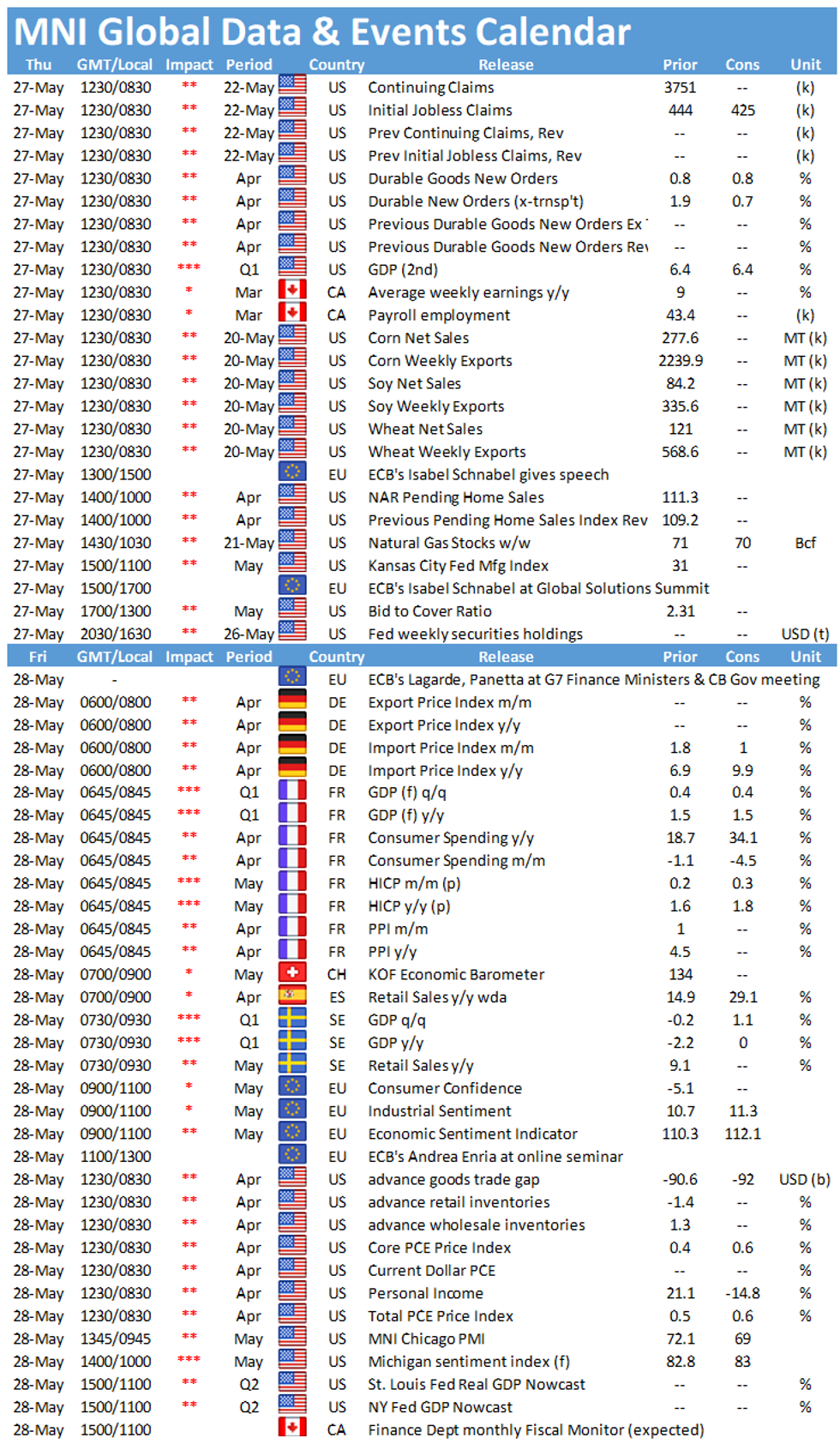

- The data flow picks up today: jobless claims alongside durable /capital goods orders and 2nd reading of Q1 GDP at 0830ET. Then pending home sales at 1000ET, and KC Fed manufacturing at 1100ET.

- Supply today sees $62B 7-Yr Note auction at 1300ET; we also get 4-/8-week bills at 1130 ($80B total). NY Fed buys ~$2.025B of 22.5-30Y Tsys.

- Latest GOP offer for an infra package unveiled at a news conference at 0905ET; Pres Biden delivers remarks on the economy at 1420ET.

EGB/GILT SUMMARY: Focus Shifts To US Data

Core European govies sold off this morning, while periphery EGBs subsequently recovered the early losses. Equities trade mixed, while the dollar is on the backfoot against G10 FX.

- The gilt curve has bear steepened with the 2s30s spread 1bp wider.

- German bond yields have inched higher with the curve similarly 1bp steeper.

- It is a similar story for OATs where yields are broadly 1bp higher on the day.

- Following the initial sell off, BTPs have recovered ground and now trade marginally above yesterday's close.

- Supply this morning came from Italy (BOTs, EUR6bn).

- UK Health Secretary Matt Hancock has warned that it is too early to determine whether the planned removal of Covid-related restrictions on June 21 will go ahead or not.

- Focus now shifts to US data with initial jobless claims for May and the second estimate of Q1 GDP.

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXN1 170.5/169ps 1x2, bought for 14.5 in 5k

2RH2 100.12/100ps, bought in 14k vs 100.37/100.50cs sold in 7k for 0.25 for the package

UK:

0LZ1 99.50/99.625/99.75c fly, bought for 2.25 in 3k

0LU1 99.87/100cs, bought for 0.75 in 5k

Equities:

SX7E Aug 21, 92.5p, trades at 3.05 in 40k (this was bought for 3.35/3.40 in 40k yesterday)

US:

TYN1 131p, sold at 15 in 10k

FOREX: China FX Firms Further, USD/CNY at Fresh Multi-Year Low

- Currencies markets are steady early Thursday, with most major pairs respecting recent ranges and not troubling any nearby support/resistance levels.

- Strength in China FX remains a focus, with both CNY and CNH pressing higher in European hours to trade at the best levels against the USD since mid-2018. The strength in Chinese currencies come despite repeated reports throughout the week of state-run banks looking to buy USD in order to curb the rally in the Chinese currency.

- Data picks up Thursday, with weekly US jobless claims, prelim durable goods orders numbers and the secondary reading for Q1 US GDP. Pending home sales data could also take some focus given the miss on expectations for new home sales earlier in the week.

- Central bank speak picks up further, with BoE's Vlieghe and ECB's de Guindos, Weidmann & Schnabel all scheduled.

FX OPTIONS: Expiries for May27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100(E501mln), $1.2200-02(E600mln)

- USD/JPY: Y108.95-109.05($533mln)

- EUR/CHF: Chf1.1000(E440mln-EUR puts)

- EUR/NOK: Nok9.9550(E700mln-EUR puts)

- AUD/USD: $0.7770-80(A$654mln-AUD puts)

- NZD/USD: $0.7250-60(N$594mln-NZD puts)

- USD/CAD: C$1.2100-10($977m-USD puts), C$1.2125($797mln), C$1.2155($442mln-USD puts), C$1.2195-1.2205($1.4bln)

Price Signal Summary - Bunds Approach The 50-Day EMA

- In the equity space, S&P E-minis are drifting off the week's highs, but major supports remain intact and the outlook remains bullish. This keeps nearby resistance at the 4238.25 May 10 high in sight. Key trend support is unchanged at 4029.25, May 13 low. EUROSTOXX 50 futures are flat on the week. Trend conditions remain bullish and the modest uptrend is still in play with the focus on 4099.00,1.00 projection of the Mar - Jul - Oct 2020 price swing.

- In the FX space, EURUSD continues to trade inside the April-May uptrend, maintaining a bullish tone. The pair this week cleared 1.2245 with sights set on 1.2285 next, Jan 8 high. Watch support at 1.2160, May 19 low. The GBPUSD outlook remains bullish. The focus is on 1.4237, Feb 24 high and this year's high print. A break would confirm a resumption of the broader uptrend. USDJPY has traded higher and is holding above initial support at 108.56, May 25 low. Key support lies at 108.34, May 7 low where a break is required to threaten the bullish theme. Attention is on resistance at 109.79, may 13 high and the bull trigger.

- On the commodity front, Gold traded higher again yesterday, cementing the bullish theme. The yellow metal has topped $1,900 this week and this opens the Jan 8 high of $1917.6. Trend conditions remain overbought, with the 14-day RSI at its highest level since August last year. $1872.8/52.3, May 25 low is first support. Oil contracts are trading near recent highs. Brent (N1) key resistance is at $70.24, May 18 high and this marks the bull trigger. WTI (N1) bulls are eyeing $67.02, May 18 high.

- Within FI, Bunds (M1) continue to climb and are through the 20-day EMA. The next resistance is the 170.49, 50-day EMA. Gilts (U1) initial resistance is 127.74, May 7 and 26 high. Recent gains are considered corrective.

EQUITIES: Stocks Mixed, Non-Directional For Now

- Stocks across the continent are mixed, with gains in Italian, French stocks tempered by weakness in German markets. Europe's real estate sector is outperforming, with industrials and materials not far behind. Thursday's early laggards include consumer staples, the technology sector and healthcare stocks.

- In futures space, the e-mini S&P is slightly lower, edging further off the May 25 high, but directional parameters are, for now, unchanged. Nearby support rests at the 20-day EMA of 4154.69

COMMODITIES: Energy, Metals Generally Lower, But No Signs of Reversal Yet

- Precious metals markets trade modestly lower, with spot gold dipping back below the $1900/oz level. Prices have so far held well above the week's lows however, with the modest pause in the gold rally alleviating some of the recent increase in the RSI.

- The energy complex has found little solace in the pullback in the dollar this morning, with WTI and Brent crude futures both lower by just shy of 1% apiece. WTI futures hold above the Wednesday lows of $65.25, with keeping directional parameters unchanged for now.

- EIA NatGas storage change numbers cross later today, with markets expecting a build of over 105 BCF.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.