-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS - Equities Indices on Cusp on New Highs

Highlights:

- Norges Bank, SNB paint policy contrast in G10, with respective hold and rate cut

- BoE rate decision expected unchanged, with minimal change to communications

- US equities reopen, with indices again pushing on record highs

US TSYS: 2s10s Close To YtD Lows Ahead Of Jobless Claims and Heavy Bill Issuance

- Treasuries trade cheaper today with cash markets catching up on yesterday’s full closure for the Juneteenth holiday and futures after an early close.

- There is also some potential spillover from heavy EGB supply this morning with EGB yields pushing higher on the day.

- Cash yields sit 2.5-3bp higher, with 2s10s of -48bps only a little above Tuesday’s fresh YtD low of -49.5bps.

- TYU4 has pushed lower to 110-17 (-4+ ticks from the early close and -8+ from Tuesday’s full close) with elevated volumes of 465k.

- Support is seen at 109-21+ (50-day EMA) but the technical backdrop points to a bullish theme with resistance at 111-01 (Jun 14 high).

- The BoE decision at 0700ET offers some potential spillover risk before attention returns to US factors.

- Data: Jobless claims including payrolls reference period for initial (0830ET), Building permits/Housing starts May (0830ET), Current account Q1 (0830ET), Philly Fed mfg index Jun (0830ET)

- Fedspeak: Kashkari (0845ET), Barkin (1600ET), Daly (2215ET) – see STIR bullet.

- Note/bond issuance: US Tsy $21B 5Y TIPS reopen (1300ET)

- Bill issuance: US Tsy $70B each 4- and 8W bill auctions (1130ET), $60B 17W bill auctions (1300ET)

US 2s10sSource: Bloomberg

US 2s10sSource: Bloomberg

STIR: Fed Rate Path Modestly Higher With Jobless Claims In Focus

- Fed Funds implied rates sit up to 2bps higher from Tuesday’s close after the Juneteenth holiday, with the 46bp of cumulative cuts for 2H24 unwinding half of Tuesday’s soft retail sales impact but keeping towards the high end for the past month.

- Cumulative cuts from 5.33% effective: 3bp Jul (unch), 18bp Sep (+0.5bp), 27bp Nov (+1bp), 46bp Dec (+2bp) and 61bp Jan (+2bp).

- Notable STIR flow in early London trade: SFRM4 saw a spike in activity with ~26K lots changing hands across 94.6425 & 94.6450 in a few minutes. Selling at 94.6425 came first, before ~12K lots were lifted at 94.6450 across a few clips.

- Fedspeak is scheduled to end this week on a quiet note, with two of today’s three speakers having already spoken this week (i.e. post FOMC and CPI) and no scheduled speakers tomorrow.

- Today:

- 0845ET - Kashkari (non-voter) in fireside chat at Michigan Bankers Association (just Q&A). He said Sunday that it’s a “reasonable prediction” that the Fed will wait until Dec to cut rates.

- 1600ET – Barkin (’24) on economic outlook (just Q&A). He said on Tue that he was very supportive of last week’s policy decision and needs to see more data before any changes are made to interest rates.

- 2215ET – Daly (’24) in panel discussion on AI (just Q&A). Daly last spoke on May 28 (also on AI – an opportunity to replace, augment and create jobs) whilst her last mon pol comments were May 20 (not yet confident inflation is coming down sustainably to 2%).

Candidates Speak On Economic Plans In Front Of Business Leaders

The Movement of the Enterprises of France, the Confederation of Small and Medium Enterprises, and the Union of Local Businesses are holding a conference quizzing senior officials from the various political parties and alliances ahead of the 30 June legislative elections. Far-right Rassembelement National (National Rally, RN) leader Jordan Bardella has just started his session, set to run to around 1115CET (0515ET, 1015BST). He will be followed by incumbent Economy Minister Bruno Le Maire on behalf the President Emmenuel Macron's centrist Ensemble bloc from 1115-1200CET (0515-0600ET, 1015-1100BST), and then Bruno Retailleau from the conservative Lres Republicains from 1200-1245CET (0600-0645ET, 1100-1145BST). Livestream can be found here.

- Bardella says “France is at a crossroads”, and that he deplores "the budgetary unreason in which we have been plunged since 2017" which "poses a risk of economic decline".

- Earlier, Eric Coquerel a deputy from the far-left La France Insoumise - which will run as party of the broad leftist New Popular Front in the legislative elections - said that should the NFP emerge with a majority it would not seek to take France out of the eurozone. Also said the NFP would not revise plans to build new nuclear power stations - saying that is an issue for the presidency. Claims that the NFP's economic programme would be paid for by increased tax revenues and stronger growth. Coquerel, an economic advisor for the NFP, said that "I think that overall our budget deficit won't be worse than what the current government foresees,"

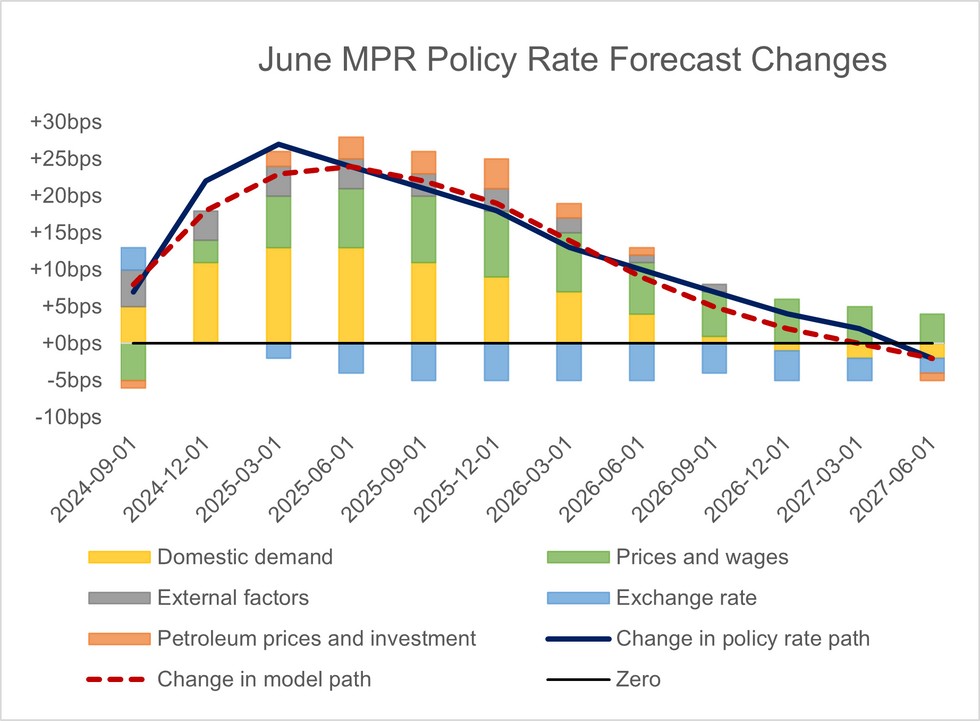

NORGES BANK: All Factors Bar Exchange Rate Pushed Rate Path Higher

Looking at the breakdown of the policy rate path revisions, all components other than the exchange rate contributed to the upward revisions in late 2024, 2025 and 2026.

- In Q1 2025, domestic demand had a +13bps contribution. This is a little higher than we had expected coming into the decision, especially after domestic demand’s large upward contribution in last quarter’s MPR as well.

- Prices and wages contributed +7bps. 2024 wages are projected in line with the wage norm struck by unions, at 5.2% Y/Y (vs 4.9% prior).

- CPI-ATE projections were revised a little lower in 2024, but higher in 2025/2026 as economic activity continues to recover.

- The negative contribution from the exchange rate (-2bps in Q1 2025 but -5bps in Q1 2026) comes as the I-44 index forecast was revised lower through 2025/2026 (indicating a stronger NOK).

SECURITY: Iran Could Be Significantly Expanding Nuclear Programme

The Washington Post reportingthat Iran is undertaking a "major expansion" of its Fordow nuclear facility that could "soon triple the site’s production of enriched uranium and give Tehran new options for quickly assembling a nuclear arsenal if it chooses to."

- According to the Post, "at Fordow alone, the expansion could allow Iran to accumulate several bombs’ worth of nuclear fuel every month... Fordow is regarded as particularly significant because its subterranean setting makes it nearly invulnerable to airstrikes."

- The Bulletin of Atomic Scientists reported on June 13 a survey that found "over 69%" of respondents said they "support Iran pursuing nuclear weapons," reversing a long-held public opinion opposed to Iran developing nuclear weapons.

- The report notes: "Historically, public opinion polls since the mid-2000s have consistently demonstrated that while Iranians favored a peaceful nuclear program, a majority of them opposed developing nuclear weapons."

- The Bulletin notes: "This shift in the opinion of Iranians vis-à-vis nuclear weapons cannot be entirely divorced from recent events in the Iran-Israel conflict, which included an Israeli air strike of an Iranian consulate in Syria on April 1 and direct Iranian drone and missile strikes against Israel in response on April 13."

- Comes after the Biden administration yesterday cancelled a first high-level meeting since 2023, between US and Israeli officials, to discuss Iran's nuclear programme, scheduled to take place today, after Prime Minister Benjamin Netanyahu posted a video on the social media site X criticising the US for withholding weapons from Israel.

EU Agrees On 14th Sanctions Package, Hits LNG For First Time

The Belgian presidency of the Council of the EU posts on X: "EU Ambassadors just agreed on a powerful and substantial 14th package of sanctions in reaction to the Russian aggression against Ukraine. This package provides new targeted measures and maximises the impact of existing sanctions by closing loopholes." For the first time Russian supplies of liquified natural gas (LNG), but the ban is not as comprehensive as that on coal or seaborne oil. Euronews explains: "Instead, EU companies will still be allowed to purchase Russian LNG but be prohibited from re-exporting it to other countries, a practice known as trans-shipment."

- This 14th package of sanctions has been debated among permanent representatives for the past month, with Germany proving a long-term hold out on the so called 'no-Russia clause'. Politico reports: "Previously, the so-called no-Russia clause had only applied to firearms, battlefield items and dual-use goods — which have both a military and civilian application. Germany worried its small businesses would suffer if this was expanded to more civilian products, like chemicals, or machinery for metalworking."

- Reuters reports that there have also been disagreements between the chancellery (under SPD Chancellor Olaf Scholz) and the foreign ministry (under Foreign Minister Annalena Baerbock, from the Greens) over the proposed sanctions. The removal of the no Russia clause appears to have proved sufficient to assuage German concerns, for now at least.

Central Bank Contrast Puts NOK/CHF Higher by 1%

- G10 FX has been defined by the procession of central banks this morning - with NOK leading FX gains on the back of a hawkish Norges Bank decision. While the bank kept rates unchanged, the policy statement and accompanying rate path pointed to unchanged policy through to the end of 2024 - leaning against outside expectations for a rate cut as soon as September. EUR/NOK corrected lower in response, hitting the lowest levels since late January to expose next support at 11.2517 in the short-term, and the December/cycle low of 11.1760 further out.

- CHF is comfortably the poorest performer in G10. Market pricing and expectations were split for the SNB rate decision, and the rate cut prompted aggressive selling pressure in the currency. EUR/CHF's correction higher put the cross briefly back to 0.9550, but a broader rally remains to be seen ahead of resistance at 0.9555/68.

- The USD trades firmer ahead of the NY crossover, with a modest firming in the US 10y yield helping to support the currency. Recent ranges remain respected for now, but a strong session for the USD would expose 105.805 as key resistance, strength through which puts the dollar at the best levels since early May.

- The focus shifts to both the BoE decision and the weekly jobless claims data from the US. Building permits and housing starts are also set to cross. The central bank speaker slate is quieter, with just Fed's Kashkari set to speak ahead of the US cash equity open.

Expiries for Jun20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E1.6bln), $1.0700(E1.9bln), $1.0725(E655mln), $1.0745-50(E812mln), $1.0800(E1.1bln)

- USD/JPY: Y157.00-05($2.4bln), Y158.00($591mln)

- GBP/USD: $1.2700-20(Gbp930mln)

- EUR/GBP: Gbp0.8500(E671mln)

- AUD/USD: $0.6685(A$500mln)

- NZD/USD: $0.6080-00(N$782mln)

- USD/CAD: C$1.3650-65($866mln)

- USD/CNY: Cny7.2790-00($1.3bln), Cny7.3000($1.8bln)

E-Mini S&P Extends Bull Cycle, Trades Above 5500.00

- The trend condition in Eurostoxx 50 futures remains bullish, however, a corrective cycle is in play and this has resulted in a pullback from the May high. Recent weakness has also resulted in a break of 4943.00, the Jun 11 low, highlighting potential for a deeper retracement. A resumption of weakness would open 4762.00, the Apr 19 low and a key support. Firm resistance is at 5046.00, Jun 12 high.

- The uptrend in S&P E-Minis remains intact and the contract has traded higher this week, confirming an extension of the current bull cycle. Price has recently cleared 5430.75, the May 23 high and bull trigger. This confirmed a resumption of the uptrend. Note that MA studies are in a bull-mode position too, highlighting positive market sentiment. Sights are on 5594.66 next, a Fibonacci projection. Initial support lies at 5433.13, the 20-day EMA.

WTI Futures Hold Onto This Week's Gains

- WTI futures have traded higher this week, extending the current bull phase. The climb has resulted in a break of $80.11, the May 29 high and a key resistance. A clear breach of this hurdle would cancel a recent bearish theme and pave the way for $82.24, a Fibonacci retracement point. Initial firm support to watch is $77.74, the 20-day EMA. A break would be seen as an early potential reversal signal.

- Gold is in consolidation mode and trades closer to its recent lows. A sharp sell-off on Jun 7 reinforced a S/T bearish theme. The yellow metal has pierced the 50-day EMA, at 2315.7. A clear break would confirm a resumption of the reversal from May 20 and open $2277.4, the May 3 low. Clearance of this price point would also strengthen a bearish theme. Initial firm resistance is $2387.8, the Jun 7 high.

| Date | GMT/Local | Impact | Country | Event |

| 20/06/2024 | 1100/1200 | *** | Bank Of England Interest Rate | |

| 20/06/2024 | 1100/1200 | *** | Bank Of England Interest Rate | |

| 20/06/2024 | 1230/0830 | *** | Jobless Claims | |

| 20/06/2024 | 1230/0830 | * | Current Account Balance | |

| 20/06/2024 | 1230/0830 | *** | Housing Starts | |

| 20/06/2024 | 1230/0830 | ** | Philadelphia Fed Manufacturing Index | |

| 20/06/2024 | 1245/0845 | Minneapolis Fed's Neel Kashkari | ||

| 20/06/2024 | 1400/1600 | ** | Consumer Confidence Indicator (p) | |

| 20/06/2024 | 1430/1030 | ** | Natural Gas Stocks | |

| 20/06/2024 | 1500/1100 | ** | DOE Weekly Crude Oil Stocks | |

| 20/06/2024 | 1530/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 20/06/2024 | 1530/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 20/06/2024 | 1700/1300 | ** | US Treasury Auction Result for TIPS 5 Year Note | |

| 20/06/2024 | 1900/2000 | Question Time Leaders' Special | ||

| 20/06/2024 | 2000/1600 | Richmond Fed's Tom Barkin | ||

| 21/06/2024 | 2300/0900 | *** | Judo Bank Flash Australia PMI | |

| 21/06/2024 | 2301/0001 | ** | Gfk Monthly Consumer Confidence | |

| 21/06/2024 | 2330/0830 | *** | CPI | |

| 21/06/2024 | 0030/0930 | ** | Jibun Bank Flash Japan PMI | |

| 20/06/2024 | 0215/2215 | San Francisco Fed's Mary Daly | ||

| 21/06/2024 | 0600/0700 | *** | Retail Sales | |

| 21/06/2024 | 0600/0700 | *** | Public Sector Finances | |

| 21/06/2024 | 0645/0845 | ** | Manufacturing Sentiment | |

| 21/06/2024 | 0700/0900 | ECB's De Guindos participates in ECONFIN meeting | ||

| 21/06/2024 | 0715/0915 | ** | S&P Global Services PMI (p) | |

| 21/06/2024 | 0715/0915 | ** | S&P Global Manufacturing PMI (p) | |

| 21/06/2024 | 0730/0930 | ** | S&P Global Services PMI (p) | |

| 21/06/2024 | 0730/0930 | ** | S&P Global Manufacturing PMI (p) | |

| 21/06/2024 | 0800/1000 | ** | S&P Global Services PMI (p) | |

| 21/06/2024 | 0800/1000 | ** | S&P Global Manufacturing PMI (p) | |

| 21/06/2024 | 0800/1000 | ** | S&P Global Composite PMI (p) | |

| 21/06/2024 | 0830/0930 | *** | S&P Global Manufacturing PMI flash | |

| 21/06/2024 | 0830/0930 | *** | S&P Global Services PMI flash | |

| 21/06/2024 | 0830/0930 | *** | S&P Global Composite PMI flash | |

| 21/06/2024 | 1230/0830 | * | Industrial Product and Raw Material Price Index | |

| 21/06/2024 | 1230/0830 | ** | Retail Trade | |

| 21/06/2024 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 21/06/2024 | 1345/0945 | *** | S&P Global Manufacturing Index (Flash) | |

| 21/06/2024 | 1345/0945 | *** | S&P Global Services Index (flash) | |

| 21/06/2024 | 1400/1000 | *** | NAR existing home sales | |

| 21/06/2024 | 1530/1630 | BoE APF Sales Schedule for Q3 | ||

| 21/06/2024 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.