-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Treasuries Surge On Bessent And Oil

MNI ASIA OPEN: Israel-Hezbollah Ceasefire Cautiously Reached

MNI US MARKETS ANALYSIS - Equities Resume Rally, ATH in View

HIGHLIGHTS:

- Equities resume rally, E-mini S&P within reach of alltime highs

- US curve a touch steeper ahead of Powell speech, November ISM

- Gold reverses Friday's drop

US TSYS SUMMARY: Slight Steepening Ahead Of Powell, ISM

Treasuries have steadied out after turning lower in the European morning, and ahead of Fed speakers including Chair Powell and ISM data.

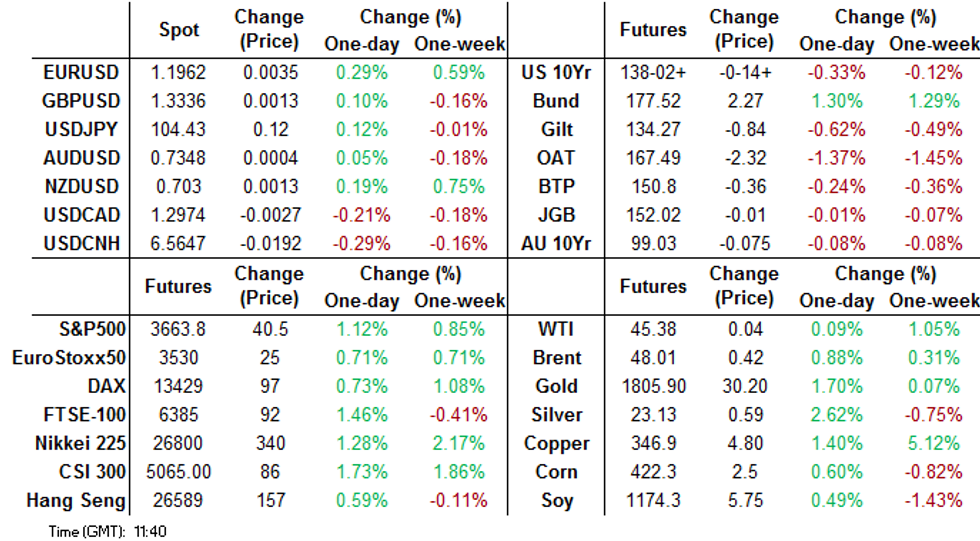

- Curve has steepened (5s30s testing Friday's highs), reversing a bit of overnight flattening: the 2-Yr yield is down 0.2bps at 0.1466%, 5-Yr is up 0.8bps at 0.3687%, 10-Yr is up 1.8bps at 0.8569%, and 30-Yr is up 2.4bps at 1.5914%.

- Mar 10-Yr futures (TY) down 2.5/32 at 138-3 (L: 138-00.5 / H: 138-07.5)

- Dollar weaker (by ~0.4% vs EUR and GBP) and equities gaining following end-Nov profit taking (eminis on the cusp of all-time highs).

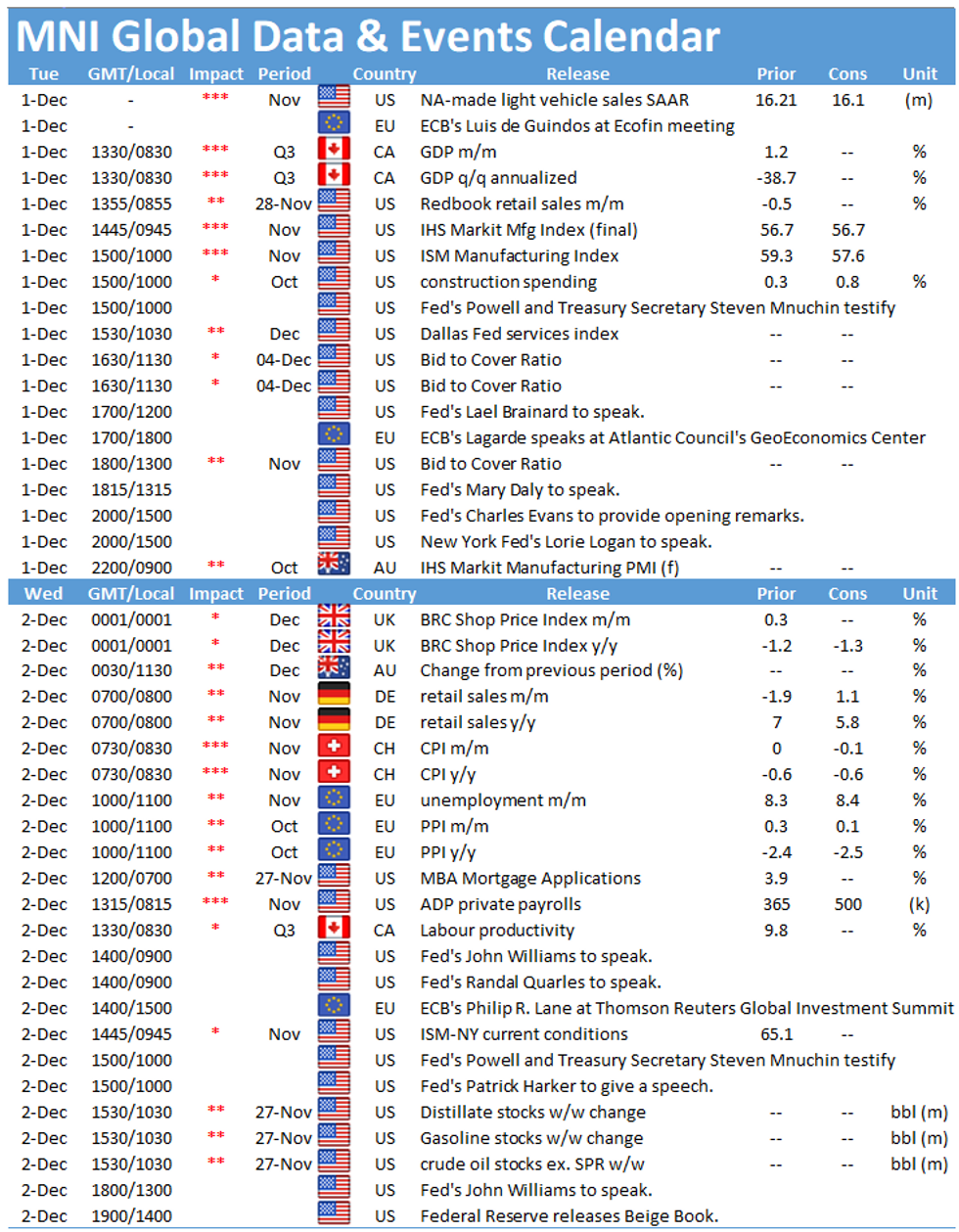

- Fed's Powell appears before the Senate Banking Committee (alongside Tsy Sec Mnuchin) at 1000ET, with the obvious point of interest being the non-extension of various Tsy/Fed lending facilities beyond end-year.

- Gov Brainard speaks at 1200ET, SF's Daly at 1315ET, and Chicago's Evans at 1500ET.

- Final Nov PMI at 0945ET ahead of ISM Manufacturing and Oct Construction spending at 1000ET.

- Another slate of bill auctions today, with $60B in 42-/112-days at 1130ET, and $34B in 52--wk at 1300ET. NY Fed (which released its updated forward schedule yesterday) buys ~6.025B of 4.5-7Y Tsys.

EGB/GILT SUMMARY: Narrative Steered by Strong Equity Rally

The market narrative has been steered by the strong equity rally this morning.

- Gilts have incrementally firmed with the curve a touch flatter. Last yields: 2-year -0.0323%, 5-year 0.0027%, 10-year 0.2976%, 30-year 0.8413%.

- Bunds trade close to unch on the day with the curve flat overall.

- The BTP curve has bear steepened with cash yields 1-3bp higher.

- Supply this morning came from the UK (Gilts, GBP5.25bn), Spain (Letras, EUR2.647bn) and the ESM (Bills, EUR1.5bn).

- The Italian and Spanish PMI prints for November came in lower than expectations. The Eurozone flash CPI estimate for November was similarly a touch weaker at -0.3% Y/Y vs -0.2% survey.

- Adding to the gloom on the UK retail front and providing a glimpse of the risks to the economic recovery, department chain store Debenhams is set to enter liquidation after rescue talks with JD sports failed. This follows quickly on the heels of the collapse of Arcadia with combined potential job losses of 25,000.

UK AUCTION RESULTS:

DMO sells GBP3.00bln nominal of the 0.125% Jan-26 Gilt, Avg yld 0.072% (0.000%), bid-to-cover 2.06x (2.41x), tail 0.3bp (0.3bp) price 100.272 (100.652).

DMO sells GBP2.25bln nominal of 1.25% Oct-41 Gilt, Avg yld 0.802% (0.771%), bid-to-cover 2.22x (2.42x), tail 0.1bp (0.1bp), price 108.607 (109.256)

GILTS: DMO Consultation Highlights:

Shorts:

GEMMs and investors both favoured continued focus on building benchmarks with re-openings of the 0.125% Jan-24 and 0.125% Jan-26 gilts. There was also "widely expressed" support from GEMMs and "the possibility" of a new 5-year gilt.

Mediums:

Investors and GEMMs both look for continued build up of the benchmarks 0.125% Jul-31 and 0.625% Jul-35.

Long syndications:

Investors were split between 2046 or 2051 but there was more support for a 2046 maturity. GEMMs also were split between 2046 or 2051 but noted "the absence of any current coupon bonds in the 25-year maturity area of the curve."

Long auctions:

GEMMs also noted that "there was sufficient demand and richness in the ultra-long sector to justify two or more auctions of the longest gilts."

Linkers:

There was support among both investors and GEMMs for a linker syndication with GEMMs noting this should be in place of one of the scheduled linker auctions.

FOREX: Dollar Offered as Markets Reverse Late Monday Move

Asia-Pac markets took the opportunity to sell into USD strength in the early hours Tuesday - a trend that Europe's been happy to extend as EUR/USD inches back towards the week's best levels and closer to the psychologically important 1.20 handle. This has pressured the greenback throughout, resulting the USD being the worst performing currency (as was the case yesterday morning) in G10.

The single currency is (modestly) outperforming, rising against most others while peripheral European government bond yields widen vs. Germany - moves accelerated following a speech from ECB's Schnabel, who stated that the ECB is not obliged to do what the markets expect from the central bank, pouring some cold water on expectations of a blow-out stimulus package at December's meeting.

The USD index is yet to slip through yesterday's multi-year lows at 91.506, but this will remain a focus headed into NY hours.

Focus turns to Canadian GDP, and US November ISM manufacturing numbers. Speakers include ECB's Lagarde, Fed's Powell and BoE's Bailey.

Expiries for Dec1 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-20(E1.2bln), $1.1850-60(E545mln), $1.1900(E509mln), $1.1950(E642mln), $1.2000-10(E995mln)

- USD/JPY: Y103.00($504mln), Y104.85-00($1.0bln)

- GBP/USD: $1.2800(Gbp511mln), $1.3215-30(Gbp545mln)

- EUR/GBP: Gbp0.8900(E630mln)

- USD/CNY: Cny6.6275($574mln-USD puts)

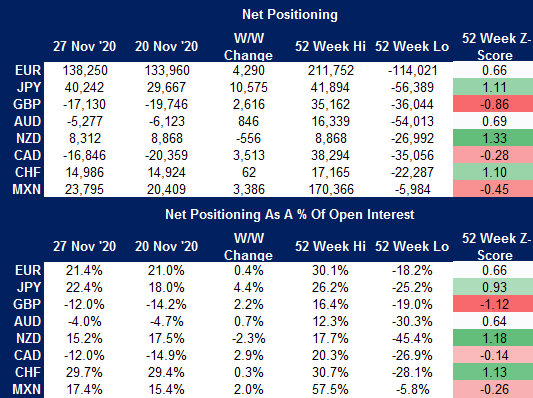

CFTC: Markets Built Net JPY Position in Most Recent Week of CFTC Data

Latest CFTC report out yesterday (delayed due to last week's Thanksgiving holiday) showed markets built the net JPY position most convincingly, with the net position as a % of open interest rising to 22.4% from 18.0%, nearing the 52w high of 26.2%.

Markets were also net buyers of CAD, GBP and MXN, while reducing the NZD net position by over 500 contracts, pulling away from the 52w high position in the currency.

Full table here:

TECHS: Key Price Signal Summary - E-Mini S&P Bulls Close In On Key Resistance

- Gold remains vulnerable. The focus is on $1763.5, 50.0% of the Mar - Aug rally and $1747.6, Jun 26 low. Resistance is seen at $1818.3, Nov 26 low. Oil markets focus: Support to watch in Brent (G1) is $45.87, Nov 27 low and in WTI (F1) at $43.33, Nov 11 high and $42.82, Nov 24 low.

- In the FX space, EURUSD remains positive and is closing in on this year's 1.2011 high from Sep 1. USDJPY key support lies at 103.18, Nov 11 low. Initial support is 103.65, Nov 18 low. Key EURGBP trendline resistance drawn off the Sep 11 high, intersects at 0.8990. The trendline capped gains Friday and Monday. It remains a pivotal resistance. The major monthly based resistance in Cable is 1.3372 (for December), a multi-year trendline drawn off the Nov 2007 high and is a key trend reference.

- FI focus: Bund fut: are under pressure and have probed support at 174.96, Nov 25 low. A break would open 174.45, Nov 16 low. Gilts (H1) support lies at 134.07, Nov 26 low and 133.81, Nov 25 low. BTPs are lower, the next firm support is at 150.39, Nov 18 low. Treasuries (H1) resistance is at 138-09+, the 20-day EMA.

- E-Mini S&P risk seeking bulls eye the key 3668.00 resistance, Nov 9 high. EUROSTOXX50 focus is on 3553.05, Feb 27 high.

EQUITIES: US Futures Narrow Gap With Alltime Highs

Despite a wave of profit-taking into the November close, European equities enjoyed a stellar November, with numerous indices on the continent enjoying their best month for decades, if not ever. December has started well, with gains of 0.3-2.0% seen across Europe, with UK stocks outperforming, while peripheral European markets trade well, but with shallower gains.

Energy names are outperforming (after being the poorest performer yesterday) with financials and materials not far behind. Defensive healthcare and utilities sectors lag so far today.

In US futures space, all three major US markets are higher, with E-mini S&P extending the recovery off Monday's low of 3592.25 to trade within five points of the alltime highs printed on November 9th at 3668.00.

COMMODITIES: Oil Flat as Market Awaits OPEC+ Cues

Oil trades largely flat as markets await further cues from the ongoing OPEC+ deliberations. The latest reports suggest talks have been delayed by a further two days in order to allow for out-of-meeting negotiations so an agreement could be struck by end-of-week.

The squeeze in copper markets continued Tuesday, with copper futures keeping yesterday's multi-decade high under pressure in early Tuesday trade. A break above $348.45 would mark the highest price since 2013.

Despite firmer equities this morning (the e-mini S&P has added around 70 points from yesterday's lows), gold is recovering, benefiting slightly from the resumption of greenback weakness. The 200-dma had worked as a decent resistance level, crossing today at $1801.25, but prices are looking more comfortable above here in recent trade.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.