-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Equities, Risk Bid Ahead of Yellen

HIGHLIGHTS:

- Incoming Treasury Secretary Yellen urges need to "act big" on fiscal

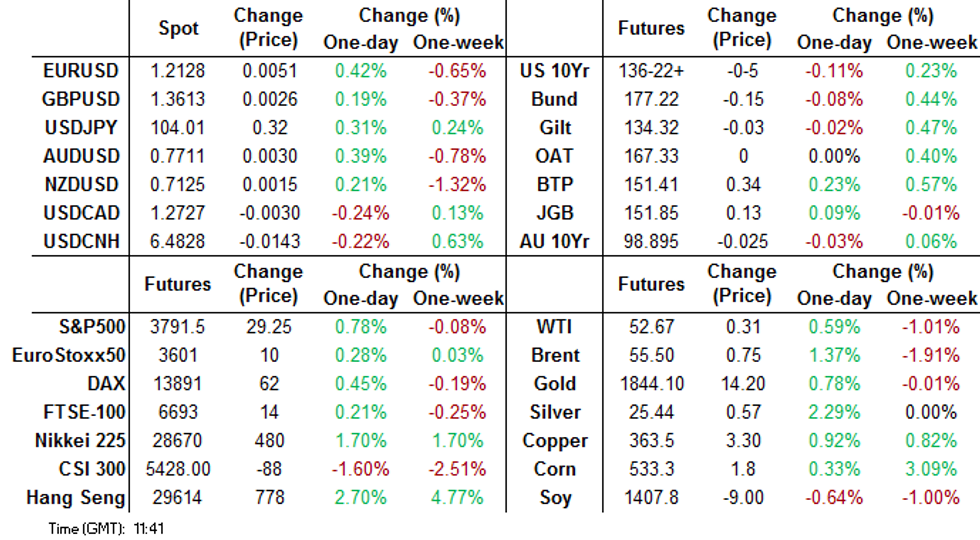

- USD, JPY sold as equities, commodities rise

- US curve bear steepens as Yellen expected to press for wider social security net

US TSYS SUMMARY: Weaker, With Yellen Awaited

Tsys are a little weaker with the curve bear steepening as markets pick up after Monday's holiday, with the dollar under a bit of pressure and equities stronger.

- Mar 10-Yr futures (TY) down 6/32 at 136-21.5 (L: 136-21 / H: 136-31.5). Volumes have picked up following the long weekend, ~470k traded. The 2-Yr yield is up 0.6bps at 0.1391%, 5-Yr is up 2.1bps at 0.471%, 10-Yr is up 3.4bps at 1.1176%, and 30-Yr is up 3bps at 1.8628%.

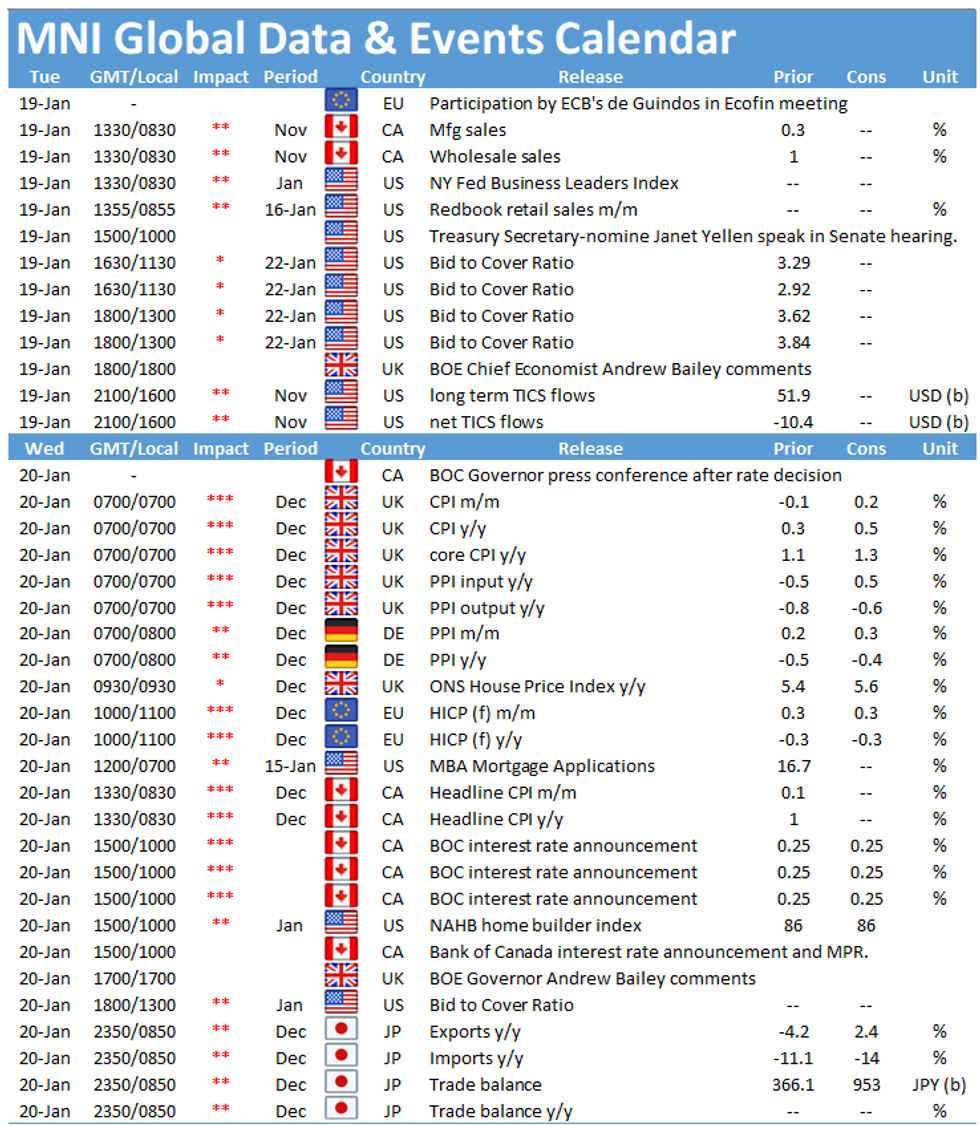

- The main event is Treasury Sec-nominee Yellen's confirmation hearing before the Senate Finance Committee, starting at 1000ET (past Tsy Sec hearings have lasted 4-5+ hours).

- Though prepared remarks have already unofficially made the rounds (to urge need to "act big" on fiscal stimulus), Q&A could see anything from dollar policy to Tsy issuance duration.

- Bank earnings will capture some attention, with BofA (0645ET) and Goldman (0730ET) reporting before the equity bell. Netflix after hours.

- No data of note (Nov TICs at 1600ET), and FOMC blackout in effect.

- In supply, we get some catch-up from Monday's market holiday: $105B in 13-/26-week bills at 1130ET, and $60B in 42-/119-day bills at 1300ET. NY Fed buys ~$1.750B of 20-30Y Tsys.

EGB/GILT SUMMARY: Periphery Outperforms Amid Equity Gains

Core European govies have sold off this morning and the periphery has firmed alongside modest gains for equities.

- Gilts have traded weaker with yields 1-2bp higher on the day and curve trading close to flat overall.

- It is a similar story for bunds. Last yields: 2-year -0.7114%, 5-year -0.7112%, 10-year -0.5145%, 30-year -0.1045%.

- BTPs have made growth with yields 1-2bp lower and the curve marginally bull flattening.

- Supply this morning came from Spain (Letras, EUR6.151bn), Finland (RFGB, EUR1.0bn) and the ESM (Bills, EUR1.5bn).

- The Catalan High Court has provisionally suspended a government decree postponing the Caltan general election from 14 February to 30 May.

- The final German CPI print for December matched the initial estimate (-0.7% Y/Y) while the ZEW survey came in slightly better than expected (Expectations: 61.8 vs 59.4 survey).

FRANCE: New 0.50% May-72 OAT - Launched for E7bln

- Size: E7bln

- Maturity: 25th May 2072

- Settlement: 26th January 2021 (T+5)

- Coupon: 0.5%, annual ACT/ACT, payable each 25th May. Full first coupon on 25th May 2021

- Spread: 1.75% May-66 OAT +7bps

- Bookrunners: BNPP(DM & B&D)/DB/HSBC/JPM/SG

- Timing: Books closed in excess of E75bln including E2.55bln of JLM

AUCTION RESULTS

Finland sells E1.0bln of the 0% Sep-30 RFGB sold

- Average yield -0.395% (-0.474%)

- Bid-to-cover 1.40x (1.53x)

- Price 103.89 (104.79)

- Pre-auction mid-price 103.7415

EUROPE OPTIONS FLOW SUMMARY

Eurozone:

RXH1 179.00c, sold at 16 in 4k

RXH1 177.5/178.5/179.5c fly, bought for 18.5 in 3k

SX7E 12/17/21 P50, sold at 1.95 in 20k

UK:

L G1 100.125c, bought for 0.5 in 7k

US:

TYH1 135.50p/137.50c RR, bought the put for flat in 2k

FOREX: JPY Slips as Markets Buy Risk Ahead of Yellen Speech

The Japanese currency is easily the worst performer so far in G10 as markets adopt a risk-on stance ahead of an appearance from the incoming Treasury Secretary Yellen later today. She speaks in front of the Senate Finance Committee at 1500GMT/1000ET and is expected to underline her plans to "act big" on COVID-19 relief as borrowing costs are close to historic lows.

In response, JPY, USD and haven currencies are weaker - EUR/JPY has snapped a seven-session losing streak to bounce back above the 50-dma at 125.66, with commodities, equities and EM currencies all trading well.

Scandi currencies are strong, with SEK and NOK the best performers in G10.

While the Yellen speech will take focus, BoE's Haldane is also due, but the data docket is thin. The Italian PM faces a senate confidence vote with unclear timing, but if the vote in the Chamber of Deputies is anything to go by, we may see results at around 2000GMT/1500ET.

TECHS: Price Signal Summary - USDJPY Channel Top Appears Exposed

- In FX, EURUSD is firmer this morning but is seen maintaining a bearish short-term theme. Support levels to watch are:

- 1.2054, the 50-day EMA where a break would open 1.2011, Sep 1 high.

- Resistance is at 1.2175 20-day EM

- USDJPY attention remains on key resistance at 104.16, the bear channel top drawn off the Mar 24 high. A break would highlight a reversal. 104.40, the Nov 11 high is the bull trigger.

- Watch support too at 103.53, Jan 13 low. A break would represent a bearish development.

- EURGBP focus is on:

- 0.8867/66, Nov 23 and Jan 15 low and a key support. A clear break would open 0.8800 and below.

- On the commodity front, Gold remains vulnerable despite yesterday's recovery. Watch support at $1804.7, yesterday's low and resistance at $1871.1, the 50-day EMA. Oil contracts are off recent highs. Brent (H1) support to watch is at $53.53, the 20-day EMA and WTI (G1) support lies at $51.50 Low Jan 11

- In the FI space:

- Bunds (H1) are off recent highs. The outlook remains bullish. Support is at 176.96, 61.8% retracement of the rally between Jan 12 - 14.

- Gilts (H1) - resistance is seen at 134.60/66, the 20- and 50-day EMAs. A bearish outlook dominates while activity remains below these EMA levels.

FX OPTIONS: Expiries for Jan19 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1900(E575mln), $1.2000(E1.1bln), $1.2100(E567mln), $1.2150-60(E730mln-EUR puts), $1.2175-80(E769mln-EUR puts), $1.2190-1.2210(E4.7bln-EUR puts), $1.2250(E1.2bln-EUR puts), $1.2300(E1.4bln-EUR puts), $1.2350-55(E1.1bln-EUR puts)

USD/JPY: Y102.50-55($568mln), Y103.00($1.4bln), Y103.25($735mln), Y103.50-55($787mln), Y103.65-75($775mln), Y103.90-104.00($1.1bln), Y105.00($638mln)

GBP/USD: $1.3525-35(Gbp512mln), $1.3600-13(Gbp510mln)

EUR/GBP: Gbp0.9020-25(E648mln)

AUD/USD: $0.7450(A$1.2bln), $0.7625(A$573mln), $0.7650-55(A$618mln), $0.7700(A$1.2bln)

AUD/NZD: N$1.0700(A$655mln)

EQUITIES: Eyes Turn to Earnings

European indices trade well, with core continental markets higher for a second session. US futures are playing catch-up, adding around 30 points so far today and indicating a higher open on Wall Street later today. In Europe, healthcare and utilities are the firmest sectors, with consumer discretionary and financials the only laggards.

Earnings from Bank of America, State Street, Charles Schwab, Netflix and Goldman Sachs take focus Tuesday, with earnings season resuming after yesterday's public holiday.

COMMODITIES: Oil Bounces on USD Pullback, Risk-On

Both WTI and Brent crude futures trade higher early Tuesday, with Brent slightly outperforming to boost the WTI-Brent spread to over $2.50/bbl. Broad-based greenback weakness has helped the commodity complex, with a general risk-on feel adding to the bid.

Market sentiment is firm, with focus turning to incoming Treasury Secretary Yellen's speech in front of the Senate Finance Committee later today. She's expected to press for the need to "act big" with COVID-19 fiscal aid, with historically low borrowing costs worth taking advantage of.

Precious metals markets are hovering slightly higher, but well within recent ranges. Spot gold looks to close back above the 200-dma at $1844.81 after two consecutive finishes below the mark.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.