-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Focus on November Jobs Ahead Fed Blackout

MNI ASIA MARKETS ANALYSIS: Consolidation Ahead Nov Jobs Report

MNI US MARKETS ANALYSIS - Equities Wobble on Lockdown Concerns

HIGHLIGHTS:

- Renewed lockdown concerns weigh on European stocks

- USD Index strikes fresh YTD high

- Packed data slate ahead of Thanksgiving break

US TSYS SUMMARY: Huge Pre-Holiday Data (And Fed Minutes) Slate Ahead

Treasuries are a little stronger ahead of a data-heavy pre-holiday session. After making decent gains in Asia-Pac hours, Tsys slipped a bit in early European trading, bouncing briefly just before 0500ET on headlines re European COVID lockdown concerns.

- The 2-Yr yield is down 2bps at 0.5944%, 5-Yr is down 2.3bps at 1.3164%, 10-Yr is down 1.9bps at 1.6462%, and 30-Yr is down 2.4bps at 1.9988%.

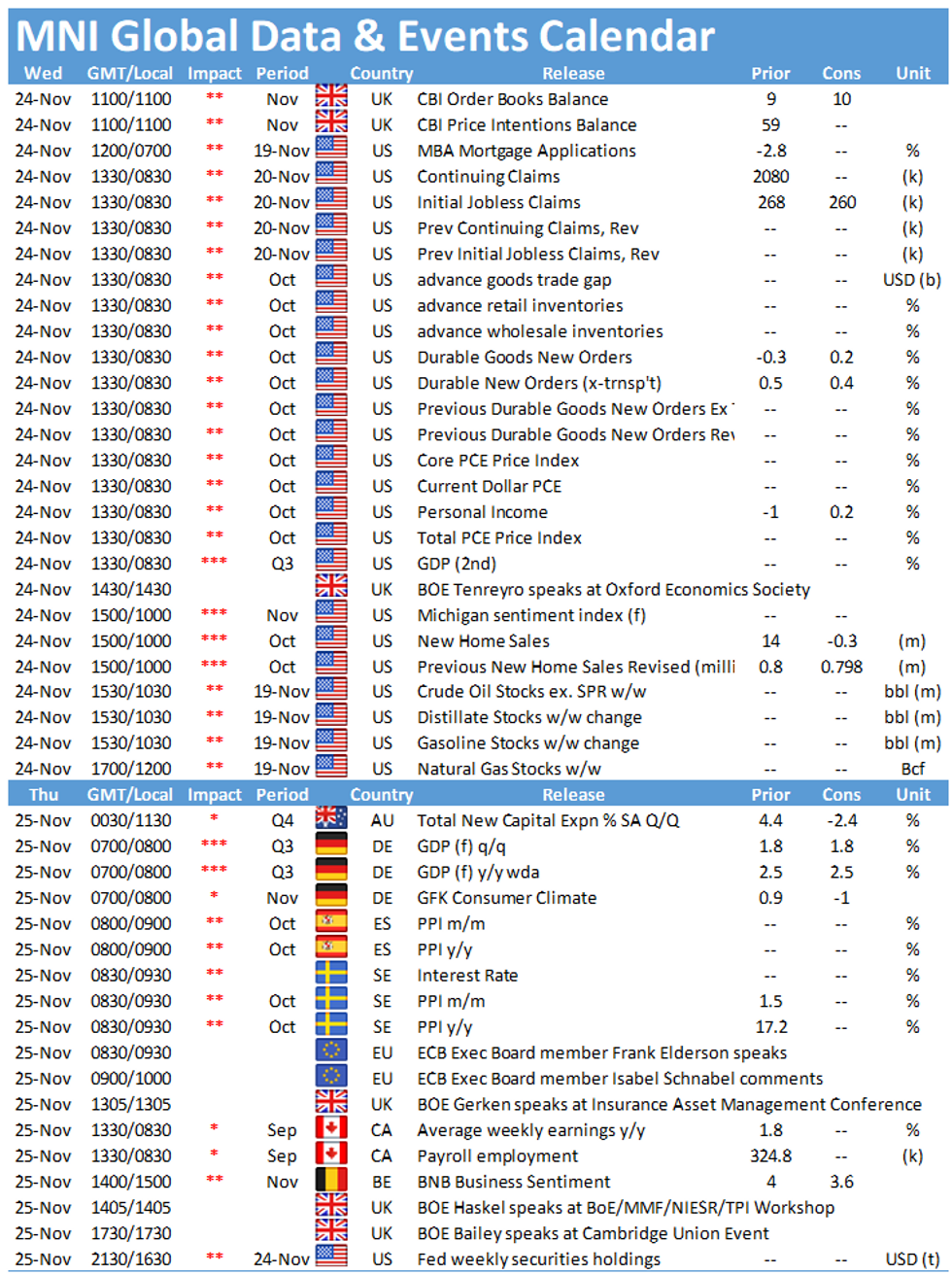

- The data releases start with weekly MBA mortgage apps at 0700ET. At 0830ET is jobless claims alongside durable goods orders, with the 2nd reading of Q3 GDP, advance goods trade balance, and wholesale/retail inventories too.

- The next and final drop is at 1000ET, with the October personal income and outlays report (including the Fed's preferred inflation metric, the PCE price deflator), new home sales, and final Nov UMich sentiment.

- Then at 1400ET, the Nov FOMC meeting minutes rounds out the day's schedule.

- Supply is all bills: $10B 4W / $25B 8W bills at 1000ET, with $60B 14D / $40B 119D bill CMB at 1130ET. Reminder that due to tech difficulties the NY Fed rescheduled Tuesday's operational purchase op to today: TIPS 7.5Y-30Y, appr $1.075B (1100ET).

EGB/GILT SUMMARY: Core FI Firms

Core European sovereign bonds have broadly firmed this morning with price action relatively contained.

- The gilt curve has bull flattened with cash yields 1-3bp lower and the 2s30s spread narrowing 1bp.

- Conversely, the bund curve has bull steepened on the day with the 2s30s spread widening by 3bp.

- The OAT curve has also steepened sharply on the back of the short end rallying and longer end yields inching higher. The curve is now 4bp steeper at the long end.

- BTPs firmed early into the session before selling off. Yields are now 1-2bp higher.

- Supply this morning came from Germany (Bund, EUR980mn allotted).

- German IFO data for November was broadly in line with expectations.

- Focus this afternoon turns to the second estimate of US Q3 GDP, preliminary durable goods orders for October and PCE for the same month.

EUROPE ISSUANCE UPDATE: Very Weak Bund Auction

Germany sells E980mln 0% May-36 Bund, in a very, very weak auction with a bid-to-cover of just 0.54x (and average price below market). Avg yield -0.06% (Prev. 0.02%), Bid-to-cover 0.54x (Prev. 0.96x), Buba cover 1.10x (Prev. 1.28x)

EUROPE OPTION SUMMARY

Eurozone:

RXF2 160p, bought for 2 in 4k (bought in circa ~14k since yesterday)

OEG2 132.5/133cs bought for 37.5 in 1k

DUF2 112.10/111.90/111.60 broken put fly, bought for 3 in 1.5k

DUG2 112/111.80/11.60 put fly, bought for 2.5 in 4k

IKG2 143/140 ps bough for 32 up to 34 in 2.25k

FOREX: Dollar is up against G10

- EUR has been under pressure this morning, also helped by a stronger USD.

- EUR test session low, against AUD, CNH, CAD, USD,

- EURUSD broke below t 1.1222 1.618 proj of the Jan 6 - Mar 31 - May 25 price swing.

- And the break of that levels opens s to 1.1185 Low Jul 1, 2020.

- Cable has also traded lower this morning, more a function of the USD, with DXY at session high.

- USD test best levels against the SEK, CHF, GBP, SGD, ILS.

- Initial support for Cable is still at 1.3343 Low Nov 23.

- Looking ahead, we have a session packed with data, ahead of the US holiday.

- This will include some second reading for the US.

- Most notable one, will be US PCE core deflator for October.

- This will be followed by the FOMC minutes,

- Speakers include, ECB Panetta, Schnabel BoE Tenreyro,

Expiries for Nov24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1195-00(E1.3bln), $1.1225-35(E775mln), $1.1300(E999mln), $1.1330(E799mln), $1.1400(E1.8bln), $1.1500(E4.2bln)

- USD/JPY: Y113.50($1bln), Y113.67-70($647mln), Y113.95-15($2.2bln), Y114.40-50($554mln), Y115.00-10($1.5bln), Y115.50-60($1.4bln)

- AUD/USD: $0.7200-15(A$568mln), $0.7270-75(A$819mln)

Price Signal Summary - S&P E-Minis Bearish Shooting Star Candle

- In the equity space, charts are highlighting some short-term bearish threats. S&P E-minis failed to hold onto Monday's high. In pattern terms, the candle formation on this day is a shooting star and does highlight a potential short-term top. If correct, this leaves support at 4625.25 exposed, the Nov 10 low. Key resistance is Monday's high of 4740.50. The recent sell-off has been steeper in EUROSTOXX 50 futures. The contract has traded through the 20-day EMA and this exposes the 50-day EMA at 4233.80. This average is a key support parameter.

- In FX, trend conditions are unchanged in the USD and the uptrend remains firmly intact. EURUSD remains in a downtrend. The pair is trading below the base of its bear channel drawn from the Jun 1 high. The focus is on 1.1185 next, the Jul 1, 2020 low. Resistance is at 1.1374, the Nov 18 high. GBPUSD probed support at 1.3353, the Nov 12 low. The focus is on 1.3334, 1.00 projection of the Sep 14 - 29 - Oct 20 price swing. Resistance is at 1.3514, the Nov 18 high. USDJPY has cleared last week's high and breached the 115.00 handle. This confirms a resumption of the underlying uptrend with attention on 115.51 next, the Mar 10, 2017 high. Support has been defined at 113.59, the Nov 19 low.

- On the commodity front, Gold remains vulnerable following this week's move lower. The yellow metal has cleared the 20- and 50-day EMAs and this opens the base of a bull channel at $1755.4. The channel is drawn off the Aug 9 low. WTI futures have rebounded off recent lows. Further gains would open $80.68, Nov 16 high where a break would strengthen short-term conditions for bulls. Key short-term support has been defined at $74.76, Nov 22 low.

- In the FI space, Bund futures have pulled back from recent highs. A deeper pullback would expose the key support at 170.06, Nov 5 low. Gilts maintain a bullish tone. Watch key support at 125.40, Nov 17 low. A break would alter the picture.

EQUITIES: Futures Retreat As German Lockdown Rumours Swirl

- Asian markets closed mixed, with Japan's NIKKEI down 471.45 pts or at 29302.66 and the TOPIX down 23.7 pts or at 2019.12. China's SHANGHAI closed up 3.613 pts or +0.1% at 3592.702 and the HANG SENG ended 33.92 pts higher or +0.14% at 24685.5

- European equities retreated just before 1000BST on a (as yet unsubstantiated) headline that Germany was set to impose a full COVID lockdown, with the German Dax down 52.1 pts or -0.33% at 15959.08, FTSE 100 up 6.81 pts or +0.09% at 7301.67, CAC 40 down 8.08 pts or -0.11% at 7080.01 and Euro Stoxx 50 down 9.05 pts or -0.21% at 4301.61.

- U.S. futures are also weaker, with the Dow Jones mini down 122 pts or -0.34% at 35644, S&P 500 mini down 13 pts or -0.28% at 4675.5, NASDAQ mini down 37 pts or -0.23% at 16275.

COMMODITIES: Oil Slips On Europe Lockdown Concerns

- WTI Crude down $0.18 or -0.23% at $78.9

- Natural Gas down $0.04 or -0.83% at $4.96

- Gold spot up $1.63 or +0.09% at $1793.23

- Copper up $3.55 or +0.8% at $445.05

- Silver down $0.06 or -0.26% at $23.6348

- Platinum up $12.3 or +1.27% at $982.2

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.