-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsy Curves Rise to Mid-June'22 Highs

MNI ASIA MARKETS ANALYSIS: Projected Rate Cuts Gain Momentum

MNI Eurozone Inflation Preview - December 2024

MNI US OPEN - CNH Slippage Puts Rate in Range of Record Lows

MNI US MARKETS ANALYSIS - Equity Recovery Stalls

HIGHLIGHTS:

- Equity recovery stalls, E-mini S&P flat ahead of the bell

- Crude at a new cycle high, WTI touches $73.58/bbl

- Fedspeak again a focus, with Bowman, Bostic & Rosengren due

US TSYS SUMMARY: Off Overnight Lows, 5Y Supply And Fed Speakers Ahead

Tsys have bounced from the lows in European trade, leaving them largely unchanged on the day so far with the curve mildly steeper. Fed speakers (again), 5Y supply and PMI data coming up.

- Sep 10-Yr futures (TY) steady at at 132-11.5 (L: 132-07.5 / H: 132-15), with volumes on the light side (~220k).

- The 2-Yr yield is up 2bps at 0.2484%, 5-Yr is up 0.3bps at 0.8586%, 10-Yr is up 1bps at 1.4733%, and 30-Yr is up 1.7bps at 2.1028%.

- Once again, Fed speakers in the spotlight following Chair Powell's nondescript Congressional testimony yest.Gov Bowman at 0900ET, Atlanta's Bostic at 1100ET, and Boston's Rosengren at 1630ET.

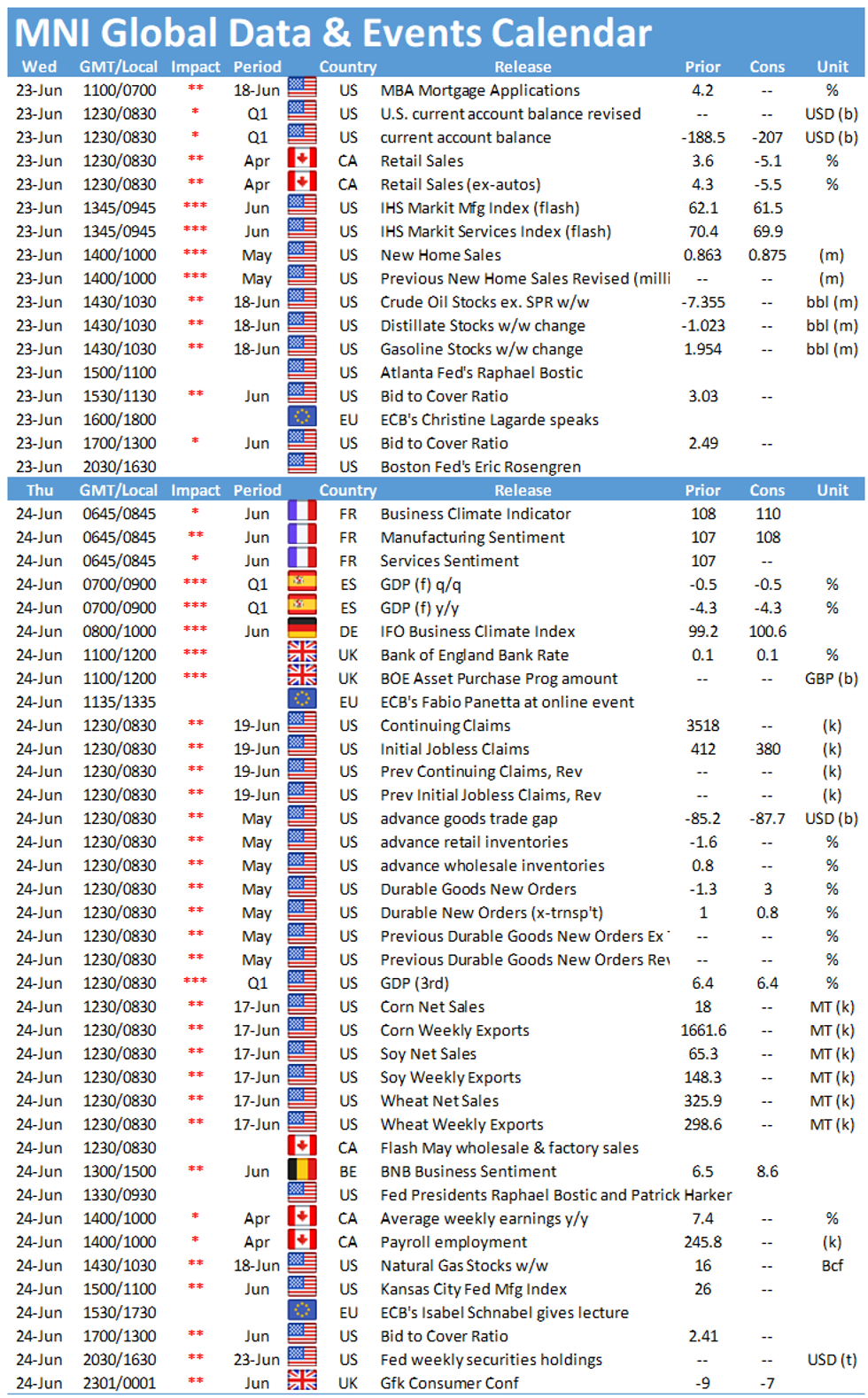

- Data focus is prelim Jun PMIs at 0945ET and May new home sales at 1000ET; we also get weekly MBA mortgage apps at 0700ET and 1Q current account balance at 0830ET.

- Following Tuesday's decent 2Y auction, we get $61B 5Y Note auction at 1300ET. Also $26B 2Y FRN alongside $40B 119-day bill sale at 1130ET. NY Fed buys ~$6.025B of 4.5-7Y Tsys.

- In D.C., infrastructure talks are expected to continue (Pelosi / Schumer at the White House), Tsy Sec Yellen appears before the Senate Appropriations committee on the 2022 budget at 1400ET.

EGB/GILT SUMMARY: PMIs Still Strong, EGBs Firm

EGBs have firmed through the morning while gilts continue to trade on a soft note.

- Bunds initially sold off soon after the open before reclaiming losses to now trade above yesterday's close. This morning's bund supply was easily absorbed.

- OATs have similarly firmed with cash yields broadly 1bp lower on the day and the curve marginally flatter.

- BTPs have slightly outperformed with cash yields 1-3bp lower

- While the short end of the curve has firmed, the rest of the gilt curve has lacked direction and trade just below closing levels.

- This morning's PMI data was mixed relative to consensus while still pointing to a strong recovery in economic activity. The preliminary prints for June surpassed expectations for Germany and the wider euro area, while coming in weaker than expected for France. The UK services print was a touch weaker than consensus, while manufacturing surprised.

- Supply this morning came from the UK (Linker, GBP400mn), Germany (Bund, EUR2.063bn allotted) and Slovenia (Sustainable 10y bond, EUR1bn being placed today via syndication).

- We published our BoE preview earlier today, which is available online and by email.

EUROPE ISSUANCE UPDATE

UK DMO sells GBP400mln 0.125% Nov-65 linker, Avg yield -2.042% (Prev. -1.981%), Bid-to-cover 2.37x (Prev. 2.35x)

Germany allots E2.063bln 0% May-36 Bund, Avg yield 0.08% (Prev. 0.11%), Bid-to-cover 1.03x (Prev. 0.73x), Buba cover 1.24x (Prev. 1.06x)

Slovenia syndicates Sustainable 10y:

Spread set at MS+7bps (from initial MS+15bps area which was revised to MS+10bps area)

Books in excess of E10.0bln (inc E550mln JLM interest)

Size: E1.0bln WNG (announced yesterday)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXN1 172c, bought for 27/30 in 2k

DUU1 112.10/20/30c fly vs 112.00/90 ps, bought the fly for 1.25 and 1.5 in 5k

ERZ1 100.37/25 ps, sold at 0.25 in 20k

UK:

2LZ1 99.37c vs 3LZ1 99.25c, bought the 2yr for -0.75 (recieve) in 5k

US:

TYN1 131p, bought for 1 in 10k

FOREX: USD/JPY Narrows In On Year's High

- The recovery from the post-Fed low in global equity markets remains the pervasive driver of asset prices, with the e-mini S&P now 120 points above the Jun21 low. This has filtered solidly into currencies, resulting in USD/JPY narrowing the gap with the 2021 highs of 110.97. A break and close above here would be a solidly bullish development, opening initially the 1.0% 10-dma envelope of 111.19 and the Mar 26 2020 high of 111.30.

- PMI numbers across Europe have been mixed, with more solid German activity numbers countered by a weaker than expected French turnout. EUR has edged lower throughout the morning, softening against all others in G10.

- Further strength in crude prices is working in favour of CAD and NOK, with USD/CAD now eyeing first key support at the 1.2224 50-dma.

- Focus turns to Canadian retail sales, prelim June US PMI numbers and the new home sales release for May. Speakers due Wednesday include ECB's Lagarde and Fed's Bowman, Bostic & Rosengren.

FX OPTIONS: Expiries for Jun23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1885-00(E681mln)

- USD/JPY: Y108.15($760mln), Y109.50-73($1.6bln), Y110.00($691mln), Y110.95-00($655mln)

- GBP/USD: $1.4000(Gbp599mln)

- EUR/GBP: Gbp0.8600(E510mln)

- EUR/JPY: Y131.75(E830mln)

- USD/CHF: Chf0.8900($1.3bln)

- USD/MXN: Mxn19.93($1.1bln)

Price Signal Summary - Gold Bear Flag and USDJPY Approaches 2021 High

- In the equity space, S&P E-minis are firmer having this week recovered from support around the 50-day EMA. Key support has been defined at 4126.75, Jun 21 low. This level also represents a key short-term pivot support. The bull trigger is 4258.25, last week's high.

- In FX, the EURUSD outlook remains bearish following last week's sharp sell-off and recent gains are considered corrective. The focus is on 1.1837 next, 76.4% of the Mar 31 - May 25 rally. GBPUSD remains vulnerable following last week's bearish pressure and recent gains are considered corrective. Attention is on 1.3717 next, Apr 16 low. USDJPY is firmer and approaching this year's high print of 110.97 on Mar 31.A break would confirm a resumption of the underlying uptrend and open 111.30, Mar 26, 2020 high. Support to watch is at 109.72, Monday's low.

- On the commodity front, Gold is consolidating. The outlook remains weak and the current consolidation appears to be a bear flag. This reinforces the current bear theme and the focus is on $1756.2, low Apr 29. The Oil market remains firm and is trending higher. Brent (Q1) is at fresh trend highs having cleared $74.96, Jun 16 high. The focus is on the $76.00 handle. WTI (Q1) is pushing higher too and attention is on $74.00. .

- Within FI, Bund futures traded lower yesterday and probed support at 171.80, Jun 17 low. A stronger pullback would expose 171.37, Jun 3 low and 170.99, Mar 31 low and a key short-term support. Key support to watch in Gilt futures is unchanged at 126.70, Jun 3 low.

EQUITIES: Stocks Extend Bounce Off Post-Fed Lows, Within 20 Points of ATH

- Stock markets extended their bounce from the post-Fed lows early Wednesday, with US futures indicating a modestly higher open on Wall Street later today. Markets initially first resistance at the Jun 16 high of 4258.25 ahead of the 4264.41 level, marking the 1.618 proj of the Mar 25 - May 10 - 13 price swing.

- Across the continent, markets are moderating, with mainland indices off 0.3-0.7%. The EuroStoxx50 and German DAX are underperforming, while UK's FTSE-100 was spared the bulk of the losses, lower by 0.1% at pixel time.

- Europe's energy firms are the sole sector in the green Wednesday, thanks to new cycle highs in WTI crude futures, with the August contract rising to touch $73.58/bbl. All other sectors are in the red, with consumer discretionary and utilities leading losses.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.