-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS - EUR/USD Circling Key Support

HIGHLIGHTS:

- EUR/USD circling $1.18 and key support

- Few new catalysts ahead of Thursday open, 7-yr supply a focus for Treasuries

- Weekly jobless claims, US GDP due

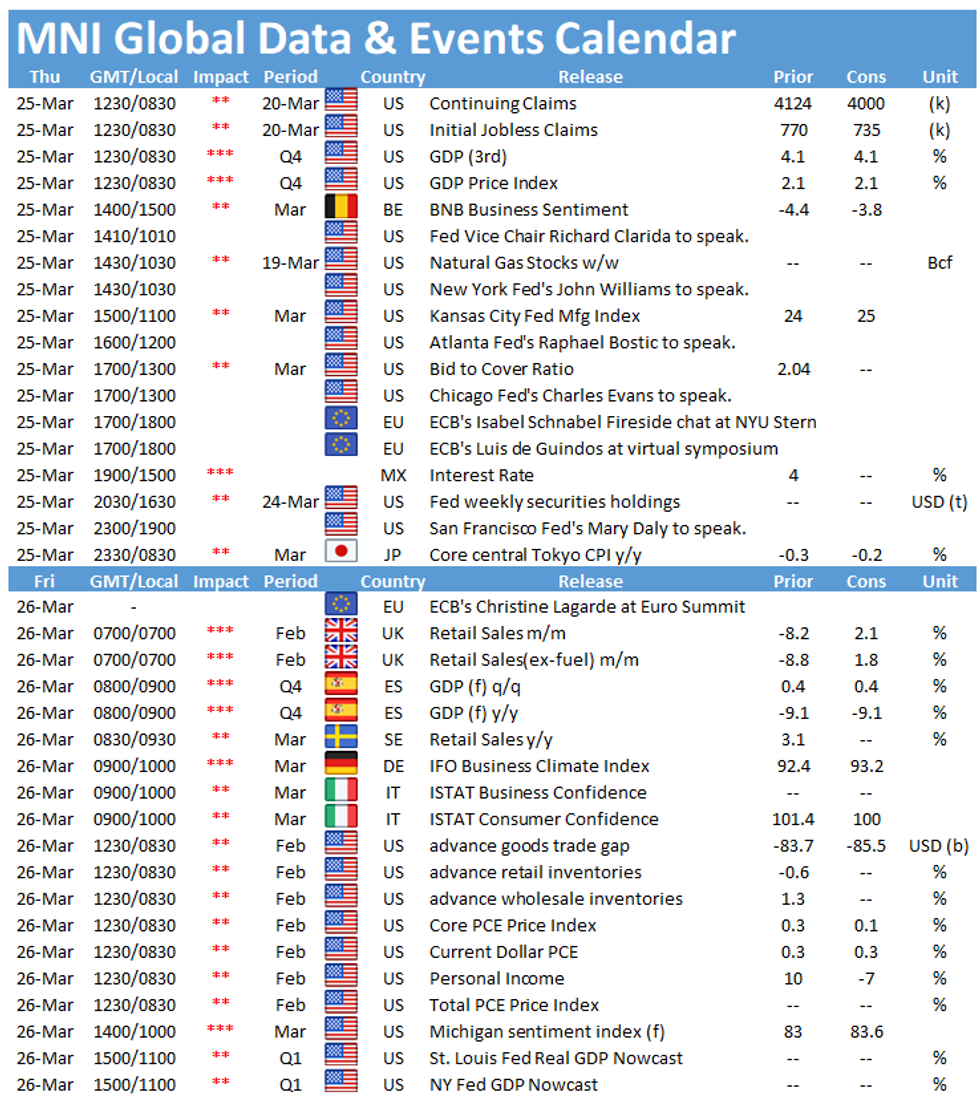

US TSYS SUMMARY: Attn On 7-Yr Supply, Fed's Clarida And Biden Presser

Treasuries have traded sideways with few catalysts overnight, within Wednesday's ranges and on unspectacular volumes (TY ~290k). Weekly jobs data, Fed speakers and 7-Yr supply ahead.

- Stocks have steadied after Wed's late risk-off; USD a little higher. Risk appetite picked up in Asia Pac overnight, leading Tsys to session lows, but that's moderated since with sideways trade.

- Jun 10-Yr futures (TY) down 1/32 at 132-02 (L: 131-30 / H: 132-05.5). 2-Yr yield is down 0.4bps at 0.1426%, 10-Yr is up 0.5bps at 1.6138%, and 30-Yr is up 0.5bps at 2.3141%.

- Another day with plenty of Fed speakers: Vice Chair Clarida at 1010ET probably the highlight. The rest, we've heard from already since the March FOMC meeting: NY Fed's Williams at 1030ET; Atlanta's Bostic at 1200ET; Chicago's Evans at 1300ET; and SF's Daly at 1900ET.

- Of note: Pres Biden holds his first formal press conference at 1315ET.

- In data, jobless claims and 3rd reading of Q4 GDP at 0830ET, with KC Fed Manufacturing at 1000ET.

- Supply concludes for the week with $80B in 4-/8-week bills at 1130ET, with $62B 7-Yr Note auction at 1300ET. Last NY Fed buy operation of the week too: ~$1.750B of 20-30Y Tsys (1030ET).

EGB/GILT SUMMARY: Risk On Theme Lingers

The risk-on theme prevails this morning with sovereign bonds trading firmer and equities posting fresh losses.

- The gilt curve has bull flattened with cash yields 1-3bp lower.

- Bunds opened on a strong footing and have made incremental gains through the morning. The curve is 1bp flatter on the day.

- OAT yields are 1-2bp lower with the curve similarly marginally flatter.

- BTP yields have slightly underperformed core EGBs. Last yields: 2-year -0.4152%, 5-year -0.0626%, 10-year 0.5826%, 30-year 1.5722%.

- Italy sold E4.00bn of the 0% Nov-22 BTP and EUR1.249bn of the 0.40% May-30 BTPei.

- The SNB left interest rates unchanged at today's monetary policy meeting while toning down the rhetoric on currency intervention.

EUROPE ISSUANCE SUMMARY: Italy Auction, UK Sukuk Syndication

Italy sells:

- E4.000bln 0% Nov-22 BTP Short Term, Avg yield -0.390%, Bid-to-cover 1.42x

- E1.249bln 0.40% May-30 BTPei, Avg yield -0.600%, Bid-to-cover 1.31x

- Deal Size set GBP500mln

- Spread Set: Flat to 1.50% Jul-26 gilt (IPT was +1bps)

- Maturity: 22 July 2026

- Book > GBP600mln

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXJ1 172p, bought for 11.5 in 5k

RXK1 172/171/170p ladder, bought for 15 in 1.65k

DUK1 112.10/112.00/111.90p fly, bought for 1.5 in 2k

2RU1 100.37/100.50cs 1x2, bought the 1 for 2.75 in 2k

3RZ1 100/99.87ps vs 100.50/100.62cs, bought the ps for flat in 2k

UK:

2LZ1 99.50/62/75c ladder, bought for 0.25 in 3.5k

2LZ1 99.12/98.75ps + 3LZ1 98.87/98.50ps strip, bought for 15.25 in 4k

FOREX: EUR/USD Circling Key Support

- Currency markets are in flux early Thursday, with most major pairs trading within recent ranges amid a lack of major macro or news catalysts. EUR/USD is a slight stand-out, with the pair circling, but not quite breaking, the 1.18 handle. A break through here would be a considerable bearish signal, opening initially 1.1752, the 1.236 projection of the Jan 6 - Feb 5 - Feb - 25 price swing.

- Antipodean currencies modestly outperform, with AUD and NZD higher, reflecting a minor bounce after recent slides. AUD/USD continues to trade on either side of the $0.76 handle, with yesterday's lows at $0.7580 needing to give way before the recent downleg resumes.

- Focus turns to the data slate Thursday, with initial jobless claims and tertiary GDP data crossing from the US. Central bank speak also a highlight, with Fed's Clarida, Bostic, Evans and Daly all due as well as ECB's Schnabel & de Guindos and BoE's Bailey.

- Central bank decisions also cross from the South African and Mexican central banks.

FX OPTIONS: Expiries for Mar25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-10(E1.2bln), $1.1800(E1.56bln), $1.1900(E610mln), $1.2000(E587mln)

- USD/JPY: Y108.00($615mln), Y108.80($560mln), Y109.25-30($1.5bln), Y109.40-50($688mln), Y110.00($691mln)

- EUR/GBP: Gbp0.8525(E525mln), Gbp0.8550(E800mln), Gbp0.8600(E1.1bln), Gbp0.8615(E589mln-EUR puts),Gbp0.8625-30(E816mln-EUR puts)

- AUD/USD: $0.7400(A$555mln)

- AUD/NZD: N$1.0745(A$576mln)

- USD/CAD: C$1.2505($700mln), C$1.2550($500mln)

- USD/MXN: Mxn20.83($480mln-USD puts)

Tech Focus: Price Signal Summary - USD Trend Outlook Remains Bullish

- In the equity space, S&P E-minis continue to consolidate but remain vulnerable following last week's selling pressure from 3978.50, Mar 18 high. The support to watch is 3875.00, Mar 19 low. A break would confirm a move through the 20-day EMA and reinforce short-term bearish conditions.

- In the FX space, EURUSD maintains a weaker tone following this week's breach of support at 1.1836, Mar 19 low. This opens 1.1800 next, the Nov 23 low and 1.1752, 1.236 projection of the Jan 6 - Feb 5 - Feb 25 price swing. The GBPUSD outlook remains bearish. The pair has this week cleared 1.3779, Mar 5 low and a bear trigger. Note this has also confirmed a breach of the 50-day EMA and a bull channel base drawn off the Nov 2 low. The focus is on 1.3641, 38.2% of the Sep 23 - Feb 24 bull cycle. USDJPY remains in an uptrend. Attention is on 109.56, 76.4% of the Mar 2020 - Jan downleg and an important pivot resistance. Watch support at 108.34 Mar 10 low.

- On the commodity front, a bullish theme in Gold remains in place following the recovery that started Mar 8. The focus is on $1777.6, the 50-day EMA. Support is at $1719.3, Mar 18 low. Oil contracts remain in bear mode despite yesterday's strong gains. Recent weakness in Brent (K1) opens $58.56, 38.2% of the Nov 2 - Mar 8 rally. Resistance is at $65.12, Mar 22 high. In WTI (K1), scope is for a move to $55.65, also 38.2% of the Nov 2 - Mar 8 rally. Resistance is at $62.04, Mar 22 high.

- In the FI space:

- Bunds (M1) have probed resistance at 172.20, Mar 11 high. A clear break would open 172.51, Feb 16 high.

- Gilts (M1) have cleared resistance at 128.33, Mar 16 high, suggesting scope for an extension higher. The next key resistance is at 129.27, Mar 2 high.

- Treasuries (M1) remain in a downtrend and gains are considered corrective. Resistance is at 132-09, Mar 17 / 24 high.

EQUITIES: Ticking Higher, Tech Leading

- Asian stock markets closed mixed, with Japan's NIKKEI up 324.36 pts or +1.14% at 28729.88 and the TOPIX up 26.97 pts or +1.4% at 1955.55. China's SHANGHAI closed down 3.469 pts or -0.1% at 3363.592 and the HANG SENG ended 18.53 pts lower or -0.07% at 27899.61.

- European equities are mixed, with the German Dax down 25.54 pts or -0.17% at 14592.97, FTSE 100 up 10.25 pts or +0.15% at 6707.33, CAC 40 down 7.94 pts or -0.13% at 5926.1 and Euro Stoxx 50 down 8.5 pts or -0.22% at 3826.49.

- U.S. futures are up slightly, with the Dow Jones mini up 73 pts or +0.23% at 32392, S&P 500 mini up 9.5 pts or +0.24% at 3890.25, NASDAQ mini up 45 pts or +0.35% at 12839.

COMMODITIES: Oil Slips As Suez Blockage Continues

- WTI Crude down $1.01 or -1.65% at $60.19

- Natural Gas down $0 or -0.16% at $2.518

- Gold spot down $3.08 or -0.18% at $1733.04

- Copper down $9.75 or -2.4% at $396.55

- Silver down $0.16 or -0.63% at $24.9544

- Platinum down $4.01 or -0.34% at $1168.97

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.