-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS - Europe Risk-Off On Italian Political Wrangling

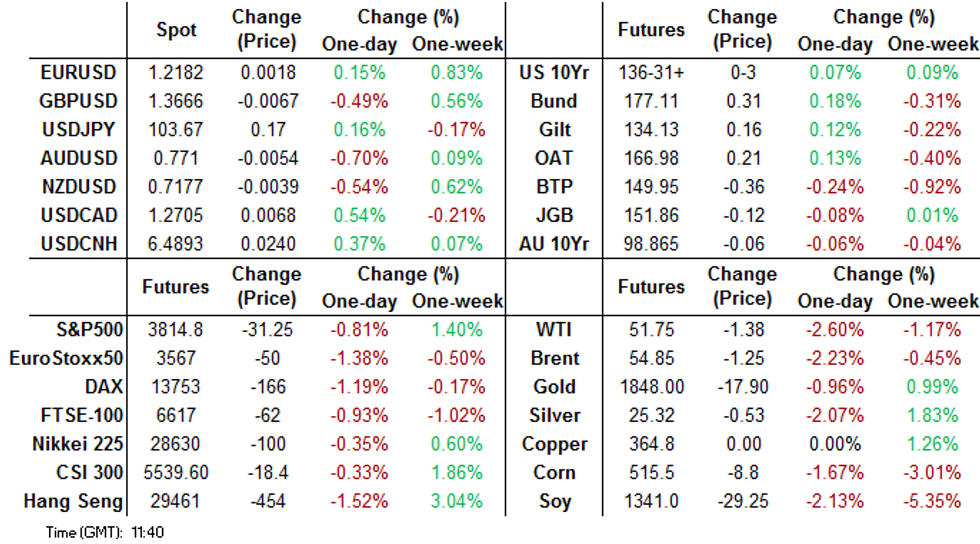

HIGHLIGHTS:

- Equities soften, open gap with alltime highs

- Italian political wrangling leads to risk-off in Europe

- PMIs paint mixed picture in Europe

US TSYS SUMMARY: Modest Gains Ahead Of PMIs

Tsys have seen modest overnight gains, with a continued bounce from Thursday's lows on Italian political risk / broad equity retracement.

- Mar 10-Yr futures (TY) up 2.5/32 at 136-31 (L: 136-26 / H: 137-00) All within yesterday's ranges, and on avg volume (~240k).

- Some bull flattening: the 2-Yr yield is up 0.4bps at 0.123%, 5-Yr is down 0.3bps at 0.4423%, 10-Yr is down 1.2bps at 1.094%, and 30-Yr is down 2.2bps at 1.8473%.

- Attention will be on Jan prelimiary PMIs (0945ET) after middling-at-best numbers out of Europe overnight. Existing home sales at 1000ET rounds out the week's data.

- Otherwise, little on the schedule today. Senate Finance Committee meets at 1000ET to decide on putting forward Yellen's nomination for Treas Sec; full Senate could vote later in the day per some reports.

- No supply; NY Fed buys ~$8.825B of 2.25-4.5Y Tsys.

EGBs/GILT SUMMARY: Weak PMIs Fuel Risk Off Shift

Markets have pivoted to a more characteristic risk-off position this morning with core European sovereign curves bull flattening, periphery EGB selling off, equities pushing lower and G10 FX vs the USD broadly weaker.

- Gilts have firmed with cash yields 1-2bp lower on the day and the curve marginally flatter.

- Bund yields have similarly edged down ~1bp.

- The OAT curve has flattened slightly, mainly on the back of the longer end firming.

- BTPs have sold off sharply with yields up 3-4bp and the curve 1bp steeper on the day.

- The Eurozone manufacturing and services flash PMI prints were a touch better than expected, while still weaker than the previous month and reflecting the impact of tighter mobility restrictions. The UK flash services PMI missed by a relatively wide margin (38.8 vs 45.0 survey).

- The UK DMO earlier sold GBP5.0bn of 1-/3-/6-month T-bills.

- Focus will shift to this afternoon's US preliminary PMI prints for January.

EUROPEAN OPTION FLOW SUMMARY

Eurozone:

RXH1 117.5/176.5/176p ladder, sold at 13 in 1k

RXH1 174/173ps, bought for 4 in 3k

RXH1 175/173ps 1x2, sold at 7.5 in 4.5k

OEH1 134.50/134.00ps, bought for 3.5 in 2k

DUG1 112.40/112.30/112.20p fly sold at 5.5 in 5.25k

UK:

L Z1 99.875/100.00/100.12c fly, bought for 4 in 4k

3LU1 99.37p vs 99.75/99.875cs, bought the put for 0.25 in 5k

FOREX: EUR Firm as Jan PMIs Hold Up Well

Following an uneventful conclusion to the ECB rate decision yesterday, the EUR has made further progress this morning - rallying to touch 1.2190 against the USD as prelim January PMI data held up well for Germany and France. This helped nudge the Eurozone-wide manufacturing PMI further into positive territory and helped services beat expectations (albeit still below the 50 mark). EUR is the strongest currency in G10 so far, with EUR/USD narrowing the gap with 1.22.

GBP is softer following a raft of disappointing releases. The always volatile retail sales series missed forecast, with December sales growing only 0.4% on the month despite the proximity to Christmas. November was also revised sharply lower. PMIs followed suit, with both manufacturing and services metrics missing expectations. GBP/USD trades well below 1.37 again, but the week's lows of 1.3520 are still well away.

EUR is the strongest, alongside the USD and CHF this morning, while AUD, NOK and GBP perform poorly.

Focus turns to Canadian retail sales for November, prelim US PMI data and the existing home sales release for December. There are no central bank speakers of note.

FX OPTIONS: Expiries for Jan22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100(E758mln), $1.2160-70(E432mln-EUR puts), $1.2275(E1.95bln)

- USD/JPY: Y103.25-30($801mln), Y103.40-50($1.0bln-USD puts), Y103.80-00($666mln)

- USD/NOK: Nok8.50($660mln-USD puts), Nok8.90($600mln)

- AUD/USD: $0.7630-35(A$820mln-AUD puts), $0.7765-80(A$770mln-AUD puts)

- AUD/JPY: Y78.75(A$660mln-AUD calls), Y79.00(A$456mln-AUD calls)

- USD/CAD: C$1.2600($569mln), C$1.2700($672mln-USD puts), C$1.2900-10($644mln)

- USD/CNY: Cny6.50($655mln-USD puts)

TECHS: Price Signal Summary - EURGBP Corrective Bounce

- E-mini S&P futures are softer this morning however the underlying uptrend remains intact. This follows this week's breach of resistance at 3824.50, Jan 8 high that opens 3900.00 next. Key s/t trend support is 3740.50.

- In FX, EURGBP remains bearish but is firmer today. This week's key development has been the breach of 0.8867 and 0.8861, the Nov 23 and Nov 11 lows. Resistance to watch is 0.8925, Jan 18 high

- EURUSD maintains a bearish short-term theme despite this week's recovery. Levels to watch are:

- Support at 1.2054, Jan 18 low and trigger for 1.2011, Sep 1 high.

- Resistance is at 1.2230, Jan 11 high.

- USDJPY remains below the bear channel top drawn off the Mar 24 high that intersects at 104.06 today. A break is required to signal a reversal.

- This week's move lower has exposed 103.28 and 103.02, 61.8% and 76.4 % of the Jan 6 - 11 rally.

- On the commodity front, Gold is firmer and Wednesday's rally signals a potential reversal of the recent Jan 6 - 18 sell-off. Price has tested the 20- and 50-day EMAs where a clear break would open $1900.3, 76.4% of the Jan 6 - 11 rally. Clearance of support at $1832.6, Jan 20 low would expose recent lows. Oil contracts remain above support. Brent (H1) support to watch is at $53.97, the 20-day EMA and WTI (H1) support is $51.81, Jan 19 low.

- In the FI space:

- Key support is Bunds (H1) is 176.34, Jan 12 low.

- Gilts (H1) resistance is 134.50/62, the 20- and 50-day EMAs. The outlook is bearish below this zone.

EQUITIES: Stocks Lower, E-mini S&P ~40 Points Off ATH

European markets are uniformly lower, with mainland indices off 1% apiece or more. Losses are led by Italian, Spanish and German markets, which are slipping on reports of further Italian political unrest, with current PM Conte supposedly approaching lawmakers from Berlusconi's Forza Italia party in an attempt to bolster support for the government.

In Europe, energy and materials are leading the decline, with the sectors off 2.3% and 1.5% respectively. Defensive names aren't spared from the declines, with consumer staples and healthcare at the top of the pile, but still lower on the day.

US stock futures are similarly lower. The e-mini S&P has opened a 40 point gap with yesterday's alltime highs, with focus remaining on the digestion of earnings. Intel, IBM both trade sharply lower after disappointing updates after the bell Thursday.

COMMODITIES: Crude Oil Off ~2.5% As Risk Rally Fades

Both WTI and Brent crude futures trade lower by around 2.5% apiece early Friday, with the recent risk rally fading a little further. Fundamental newsflow behind the move is thin on the ground, but a firming USD and lower equity markets are weighing on commodities more broadly.

Monday's MLK public holiday delayed the release of DoE inventories and the EIA NatGas storage change figures to today. Markets expect a draw of near 2mln barrels for headline crude inventories, and a draw of 175 BCF for Nat Gas.

Despite softer risk sentiment this morning, precious metals are failing to garner any support, with gold and silver slipping alongside stocks. Wednesday's lows in silver undercut at 25.04, with the 50- and 100-dmas also providing some support at 25.02 and 24.89 respectively.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.