-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI US MARKETS ANALYSIS: European natgas lower, but more ECB hikes priced

Highlights:

- German storage progress help European natgas futures 20% lower on the day to E270/MWH from E300/MWH

- STIR futures move lower as markets continue to increase rate hike expectations, particularly for the ECB

- EURUSD reverses earlier losses to move back to close to parity.

US TSYS: Yields Higher in Eco-Summit Aftermath

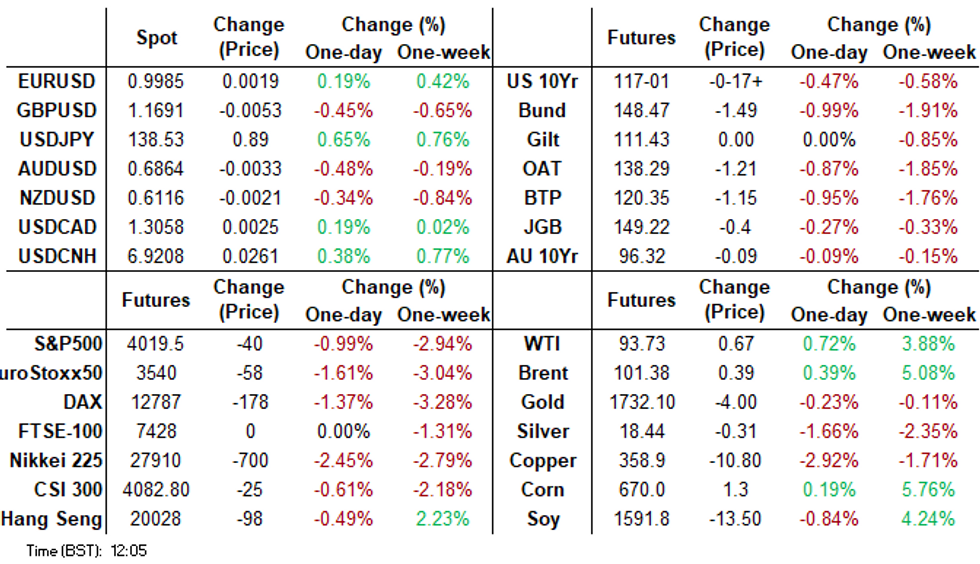

Tsys trading weaker on more modest overnight volumes with London markets closed for bank holiday. Yield curves mixed (2s10s +1.538 at -34.653, 5s30s -2.153 att -3.798), short end steeper following Fri's bear flattening following KC Fed's Jackson Hole economic summit.- Tsy 2YY tapped 3.4804% high - highest since November 2007 as hawkish summit messaging continued through Saturday after Fed Chairman Powell communicated the Fed needs to get restrictive and STAY restrictive for an extended period of time.

- ECB: Governing Council member Martins Kazaks said the ECB needs to act forcefully and raise interest rates by at least a half-point next month to bring inflation back under control.

- Equities trading weaker at the moment, ESU2 -35.25 at 4024.25; US$ index tapped 109.478 high overnight.

- Limited economic data to kick off new week: Dallas Fed Manf. Activity (-22.6 prior, -12.2 est) at 1030. US Tsy $54B 13W and $42B 26W bill auctions at 1130ET.

- Fed speak later this afternoon: Fed VC Brainard Chicago FedNow Workshop, text, no Q&A at 1415ET.

- Currentlyt, the 2-Yr yield is up 4.7bps at 3.4436%, 5-Yr is up 6.7bps at 3.2718%, 10-Yr is up 6.5bps at 3.1061%, and 30-Yr is up 4.5bps at 3.2365%.

EGBs: Looking ahead to Lane

- EGBs are still lower across the board, but 10y yields have moved off their earlier highs as European natgas prices have continued their move lower (with the latter now 20% off the highs).

- Rather than the curve having seen a parallel move, curves are now bull flatter on the day by a couple of basis points.

- ECB Chief Economist Philip Lane will appear on a panel at 14:00BST / 15:00CET entitled "High Inflation and Other Challenges for Monetary Policy." His comments will be closely watched after the ECB sources story from Reuters on Friday afternoon that stated some policymakers want to discuss a 75bp hike at the upcoming September monpol meeting.

- Bund futures are down -1.42 today at 148.54 with 10y Bund yields up 10.8bp at 1.494% and Schatz yields up 12.5bp at 1.093%.

- BTP futures are down -1.03 today at 120.47 with 10y yields up 9.5bp at 3.786% and 2y yields up 13.9bp at 2.046%.

- OAT futures are down -1.13 today at 138.37 with 10y yields up 10.0bp at 2.114% and 2y yields up 11.9bp at 0.913%.

EUROPE OPTIONS FLOW SUMMARY: Downside structures dominate

- XV2 141.00/137.00ps 1x1.5, bought for 30 in 6k

- RXV2 143/140ps, bought for 53 in 2k

- RXX2 135/133ps, bought for 11.5 in 15k

- RXX2 139/135/131p fly, bought for 23 in 5k

- OEV2 126/127cs, sold at 10 in 3k

- ERU2 99.12/99.00ps, sold at 5 in 5kERZ2 97.75/97.25ps, bought for 8.75 in 15k (ref 98.16, -15 del)

FOREX: A busy start for the week

- It's all about the Dollar, with the currency once again in the green across the board, against all the majors.

- Price action has been a continuation from the Hawkish Fed Powell on Friday, pushing Yield higher, and Equities lower.

- The Greenback leads against the Yen, but the pair is off its best level at the time of typing.

- Yen is the worst performer across the board, but USDJPY failed to break 139.00, printed a 139.00 high, and now trading at 138.61 at the time of typing.

- The EUR is fairing better, and has extended broader base gains, on the Back of European Gas falling over 20%. Germany’s Habeck sees October target being reached soon, filling up faster than planned

- Overall the EUR is up against all the majors.

- The Pound is in the red in G10s on a UK bank holiday weekend, flat versus the Yen, and Cable continues to drift to its lowest level since 25/03/20.

- Next support in GBPUSD will be seen at 1.1600 (round number), so far printed a 1.1649 low this morning.

- Looking ahead, there's no tier 1 data for today, but it is a packed week for data this week, starting as of tomorrow and ending with US NFP and AHE on Friday.

- Speakers for today, includes ECB Lane and Fed Brainard.

COMMODITIES: LEVELS UPDATE: European natgas down 20% as German storage exceeds exp

- WTI Crude up $0.51 or +0.55% at $93.56

- Natural Gas (NYM) up $0.15 or +1.6% at $9.445

- Natural Gas (ICE Dutch TTF) down $65.28 or -19.24% at $273.92

- Gold spot down $8.98 or -0.52% at $1729.1

- Copper down $11.15 or -3.02% at $358.55

- Silver down $0.2 or -1.08% at $18.6926

- Platinum down $5.4 or -0.62% at $861.57

EQUITIES: LEVELS UPDATE: Lower led by Europe

- Japan's NIKKEI down 762.42 pts or -2.66% at 27878.96 and the TOPIX down 35.49 pts or -1.79% at 1944.1.

- China's SHANGHAI closed up 4.505 pts or +0.14% at 3240.728 and the HANG SENG ended 146.82 pts lower or -0.73% at 20023.22.

- German Dax down 196.42 pts or -1.51% at 12779.77, FTSE 100 down pts or at , CAC 40 down 95.53 pts or -1.52% at 6180.78 and Euro Stoxx 50 down 60.28 pts or -1.67% at 3544.54.

- Dow Jones mini down 214 pts or -0.66% at 32055, S&P 500 mini down 39.75 pts or -0.98% at 4021.25, NASDAQ mini down 162.5 pts or -1.29% at 12464.25.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.