-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Fed Rate Path Little Changed as Media Blackout Begins

Highlights:

- Fed rate path little changed amid FOMC media blackout

- USD stumbles across European morning, but last week's lows hold

- Earnings cycle reaches peak this week

US TSYS: Treasuries Outperform Amidst Subdued Volumes

- Cash Tsys sit modestly richer across the curve with gains mainly coming with the European open and since then holding for modest outperformance to core EU FI.

- Headlines and flow are likely to be main drivers today in a session with very much second tier data (aside from any large surprises in revisions) and the Fed in media blackout. This week’s earnings calendar sees 45.5% of the S&P 500 report but it sees a slow start with only Coca Cola of note today before tomorrow’s string of major corporates.

- 2YY -2.3bp at 4.159%, 5YY -3.3bp at 3.630%, 10YY -3.0bp at 3.541% and 30YY -2.4bp at 3.752%.

- TYM3 trades 7 ticks higher at 114-22 on very subdued volumes of 170k. Recent activity appears to be a bear flag, with focus on support at 113-30+ (Apr 19 low) whilst to the upside sits resistance at 115-00 (Apr 21 high).

- Data: Chicago Fed Nat Activity Index (0830ET), Retail sales and inventory revisions (1000ET), Dallas Fed Manf. Activity (1030ET)

- Bill issuance: US Tsy $57B 13W, $48B 26W bill auctions – 1130ET

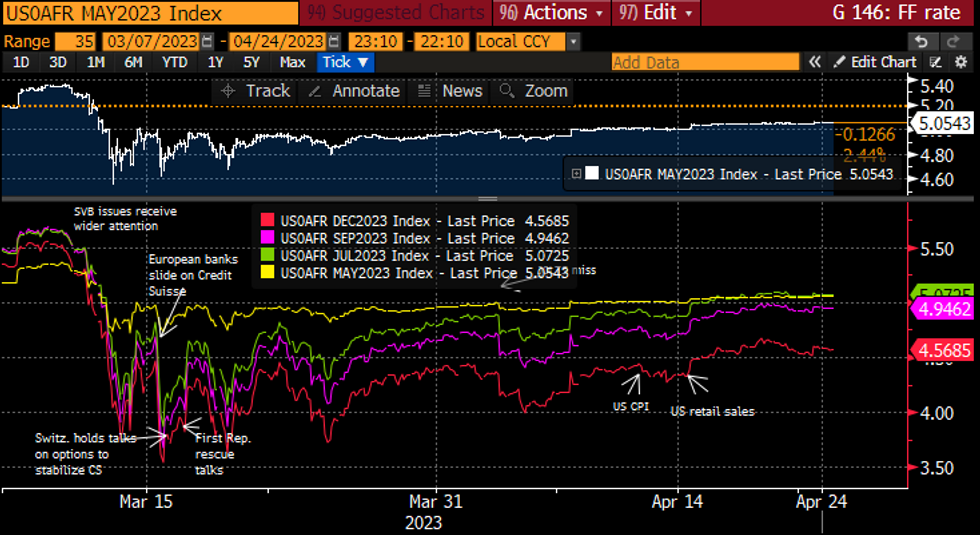

STIR FUTURES: Fed Rate Path Little Changed Over Weekend In Blackout

- Fed Funds implied rates have eased into the week with little change from Friday’s close.

- Holding 22.5bp hike for next week’s FOMC (unch) and a cumulative 29bp of hikes to 5.12% for Jun (+0.5bp), before 6.5bp of cuts from current levels for Nov (unch) and 26bp of cuts from current to 4.57% in Dec (-0.5bp).

- The Dec’23 of 4.57% remains near the upper end of post-SVB fallout levels, off last week’s high of 4.66%.

FOMC_dated Fed Funds implied ratesSource: Bloomberg

FOMC_dated Fed Funds implied ratesSource: Bloomberg

EUROPE ISSUANCE UPDATE

Belgium auction results

- E1.145bln of the 0.80% Jun-28 OLO. Avg yield 2.817% (bid-to-cover 2.55x).

- E1.371bln of the 3.00% Jun-33 OLO. Avg yield 3.134% (bid-to-cover 1.89x).

- E1bln of the 3.30% Jun-54 OLO. Avg yield 3.555% (bid-to-cover 1.9x).

EU-bond syndication:

- A new EU-bond bond maturing 4 October 2038 will be launched tomorrow via syndication, subject to market conditions.

US EARNINGS SCHEDULE

MNI US EARNINGS SCHEDULE - Quarterly Cycle Reaches Crescendo

The quarterly earnings cycle hits a crescendo in the coming week, with 45% of the S&P500’s total market cap set to report. Reports are persistent across the week, but Tuesday is likely the most notable session for the index, as Alphabet, McDonald’s, Microsoft, PepsiCo and Visa are all due. Earnings season so far has been relatively solid, with the average firm tending to beat on EPS and revenues – although EPS metrics have held up well relative to sales.

FOREX: USD Fades Despite Steady Start

- After a steadier start to the week, the USD has faded through to the NY crossover, putting the USD lower against most others in G10. Resultingly, the USD Index is south of Friday's lows, with last Monday's 101.531 the next level of support.

- The state of US-China trade relations remains a market focus after weekend reports from the FT that the USA are pressing South Korea to resist boosting microchip sales to China should Beijing move to ban Micron Technology from the territory. The South Korean President is set to visit the US later today for a state visit.

- JPY is the sole currency to underperform the USD so far Monday, with focus resting on the BoJ rate decision later this week - at which they're expected to retain their ultra-easy policy.

- CHF is among the better performers so far, however price action has been relatively muted. Nonetheless, USD/CHF is within range of cycle lows printed earlier this month at 0.8860. Slippage below here would put the pair at the lowest level since Q1 2021.

- With the FOMC inside the Fed's pre-meeting media blackout period, markets continue to look to glean any further signals from the regional Fed indices today, with both Chicago Fed and Dallas Fed activity indices on the docket. ECB speak is plentiful Monday, with ECB's Vujcic, Villeroy and Panetta already making appearances. Both Vujcic and Panetta are set to speak again.

FX OPTIONS: Expiries for Apr24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0930-35(E737mln), $1.1000(E574mln)

EQUITIES: Eurostoxx 50 Futures Trade Close to Recent Highs; Uptrend Remains Intact

- The Eurostoxx 50 futures uptrend remains intact and the contract is trading closer to its recent highs. The recent extension higher has reinforced the bullish significance of the break of 4268.00, Mar 6 high and a former key resistance. The move confirmed a resumption of the uptrend and maintains the price sequence of higher highs and higher lows. Sights are on 4381.50, Jan 5 2022 high (cont). Initial firm support lies at 4266.00, the 20-day EMA.

- The trend outlook in S&P E-minis remains bullish and the latest move lower (from last Tuesday’s high) is considered corrective. Support to watch lies at 4125.73, the 20-day EMA where a break is required to suggest scope for a deeper pullback - this would expose 4083.76, the 50-day EMA. Attention is on the 4200.00 handle where a breach would resume the uptrend and open 4205.50, Feb 16 high ahead of 4244.00, the Feb 2 high and key resistance.

COMMODITIES: WTI Futures Rebound After Matching Friday Low; $75.83 Marks Support to Watch

- WTI futures traded lower last week. This resulted in a breach of support at $79.04, the Apr 3 low and the gap high on the daily chart. The continuation lower has also resulted in a break of both the 20- and 50-day EMAs and this has opened $75.83, the Mar 31 high and a gap low on the daily chart. On the upside, key short-term resistance has been defined at $83.38, the Apr 12 high. A break would resume the recent uptrend.

- Trend conditions in Gold remain bullish, however, the yellow metal has entered a short-term corrective cycle and is trading below recent highs. Price has breached a firm support at $1986.9, the 20-day EMA, highlighting potential for a deeper retracement. This has opened $1949.7, Apr 3 low. Key short-term resistance has been defined at $2048.7, the Apr 5 high. A break of this level would confirm a resumption of the uptrend.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/04/2023 | 0900/1100 |  | EU | ECB Panetta Panels Event by Bruegel Think Tank | |

| 24/04/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 24/04/2023 | 1330/1530 |  | EU | ECB Panetta Into at ECON Hearing on Digital Euro | |

| 24/04/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 24/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 25/04/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 25/04/2023 | 0600/0800 | ** |  | SE | PPI |

| 25/04/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/04/2023 | 0800/1000 |  | EU | ECB Supervisory Board Chair Andrea Enria and MNI event | |

| 25/04/2023 | 0900/1000 |  | UK | BOE Broadbent Speech at NIESR | |

| 25/04/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/04/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/04/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/04/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/04/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/04/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 25/04/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/04/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 25/04/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 25/04/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.