-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Further Evidence of Increasing Inflation Risks

MNI US MARKETS ANALYSIS - Further Evidence of Increasing Inflation Risks

HIGHLGHTS

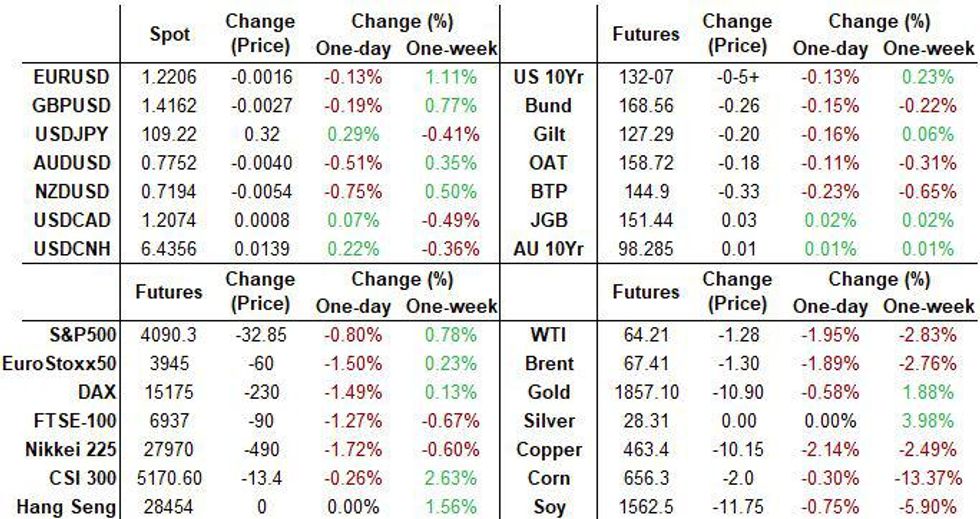

- Bonds and equities trade weaker again, while the dollar gains

- UK CPI and house price data further stoke inflation concerns

- EU car registrations post 219% Y/Y surve in April

US TSYS SUMMARY: Off Lows, Fed Communications Eyed

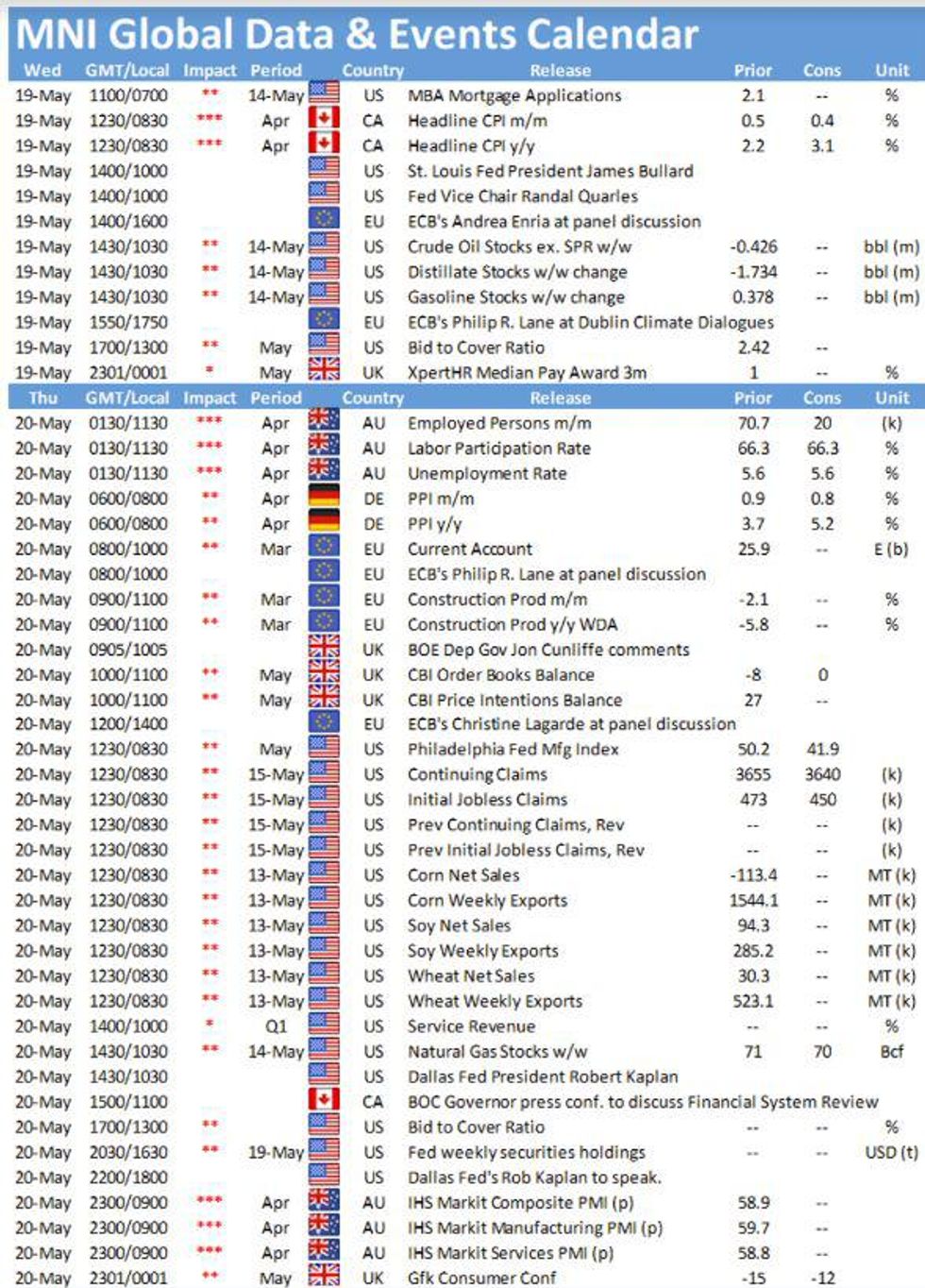

Treasuries weakened overnight but have bounced off session lows (at levels last seen late last Thursday). A bare data slate (weekly MBA mortgage applications at 0700ET aside) puts the focus firmly on supply and Fed communications.

- The 2-Yr yield is up 0.2bps at 0.1511%, 5-Yr up 1.5bps at 0.8324%, 10-Yr up 1.9bps at 1.6557%, 30-Yr up 1.7bps at 2.3765%. Jun 10-Yr futures (TY) down 4.5/32 at 132-08 (L: 132-05 / H: 132-14).

- Not much newsflow driving the weakness, so worth noting the price action outside of Tsys: Bunds have broken key support with 10-Yr yields rising to two-year highs, while equities are firmly lower (led by NASDAQ futs amid further cryptocurrency weakness). Dollar bouncing too.

- The FOMC minutes (1400ET) are the focus, though judging from analysts' previews, seems like expectations are pretty low for new revelations, particularly given the developments in data since the April FOMC.

- We hear from St Louis Fed's Bullard (1000ET) and at the same time but separately VC Quarles testimony before House Financial Services Committee; Atlanta's Bostic at 1135ET.

- At 1300ET we get a $27B 20-Yr Bond auction (also a $35B 119-day bill auction at 1130ET). NY Fed buys ~$6.025B of 4.5-7Y Tsys.

EGB/GILT SUMMARY: Inflation Bites

The inflation narrative is again taking centre stage with government bonds, equities and currencies taking a hit. The dollar has been the only obvious winner this morning.

- The gilt curve has bear steepened with the 2s30s spread 2bp wider.

- German bond yields are broadly 1bp higher.

- OATs recovered early losses to now trade close to flat on the day.

- BTPs have slightly underperformed core EGBs with cash yields 2bp higher.

- EU27 new car registrations surged 218.6% Y/Y in April from 87.3% the previous month.

- Elsewhere, UK CPI doubled to 1.5% Y/Y in April from 0.7% in March and matched the consensus estimate. Further signs of inflationary pressure come from the housing market where prices increased 10.2% Y/Y in March from 8.6% in February according to Land Registry data.

- Supply this morning came from the UK (Gilts, GBP2.5bn), Germany (Bunds, EUR3.36bn allotted), Portugal (BTs, EUR1.75bn) and the EFSF (Bond, EUR1bn).

EUROPEAN ISSUANCE UPDATE

DMO sells GBP2.5bln of the 0.625% Jul-35 gilt

| 0.625% Jul-35 Gilt | Previous | |

| Amount | GBP2.5bln | GBP2.5bln |

| Avg yield | 1.264% | 1.105% |

| Bid-to-cover | 2.53x | 2.46x |

| Tail | 0.2bp | 0.2bp |

| Avg price | 91.718 | 93.680 |

| Pre-auction mid | 91.648 | |

| Previous date | 21-Apr-21 |

GERMAN AUCTION RESULTS: 0% Feb-31 Bund

Relatively weak 10-year Bund auction.

| 0% Feb-31 Bund | Previous | |

| Allotted | E3.360bln | E3.417bln |

| Avg yield | -0.09% | -0.25% |

| Bid-to-cover | 1.08x | 1.43x |

| Buba cover | 1.28x | 1.68x |

| Price | 100.900 | 102.510 |

| Pre-auction mid | 100.859 | |

| Previous date | 21-Apr-21 | |

| Total sold | E4.0bln | E4.0bln |

PORTUGAL AUCTION RESULTS: 6/12-month BTs

| Type | 6-month BT | 12-month BT |

| Maturity | Nov 19, 2021 | May 20, 2022 |

| Amount | E0.75bln | E1bln |

| Target | E1.50-1.75bln | Shared |

| Previous | E0.5bln | E0.8bln |

| Avg yield | -0.571% | -0.536% |

| Previous | -0.552% | -0.558% |

| Bid-to-cover | 1.96x | 1.75x |

| Previous | 3.38x | 3.04x |

| Previous date | Mar 17, 2021 | Apr 21, 2021 |

EFSF AUCTION RESULTS: E1bln of the 0% Oct-25 sold via auction

| 0% Oct-25 EFSF | Previous syndication | |

| Amount | E1bln | E4bln |

| Avg yield | -0.30% | -0.426% |

| Bid-to-cover | 7.07x | |

| Price | 100.35 | 102.27 |

| Pre-auction mid | 101.281 | |

| Previous date | 07-Jul-20 |

EUROPEAN OPTIONS FLOW SUMMARY

RXN1 169.50/168.50/167.50/166.50p condor, bought for 24 in 35k

2LV1 99.00/98.75/98.62 broken put fly, bought for 2.5 in 2.5k

3LU1 98.62/98.37/98.25 broken put fly, bought for 1.75 in 2.5k3LU1 99.00/98.875/98.75p fly, bought for 1.25 in 5k

FOREX

A more steady session in FX, with most of the action seen in Govies and Equities.

- USD was mostly mixed in G10 in early trading, but we soon reversed after Bund fell lower dragging other Bond lower and in turn pushing yield higher.

- EURUSD tested key initial resistance at 1.2243 High Feb 25 (printed 1.2245 high today).

- But the pair has since faded from best levels as yields drifts a touch lower.

- USD is now moving into green territory in G10s,

- DXY hover at session high.

- The Dollar leads versus the Kiwi, now up 0.61%, and testing next small initial support in NZDUSD at 0.7203 (did print 0.7199 low).

- Looking ahead, notable data will be the Canadian CPI, while we still have plenty of speakers for the rest of the day.

- ECB de Cos, Lane, and Fed Bullard, Quarles, Bostic.

- FOMC minutes will be the last event for the session, but likely to be a non event, with focus already turning towards Fed, ECB and BoE June meetings

Price Signal Summary - Equities Pull back

- In the equity space, S&P E-minis are pulling away from yesterday's high print of 4179.50. Futures are approaching the 50-day EMA at 4072.74 which represents an important support area. Last week's low of 4029.25 however marks the key short-term support.

- In the FX space, EURUSD traded higher earlier today and probed key resistance at 1.2243, Feb 25 high. An extension higher would open 1.2285, Jan 8 high. GBPUSD remains bullish following last week's gains. Attention is on 1.4237, Feb 24 high and this year's high. USDJPY support has been defined at 108.34, May 7 low. A bullish theme remains intact while it holds and attention is on 109.79, May 13 high. A break of support would highlight a trendline break drawn off the Jan 6 low and risk a deeper pullback.

- On the commodity front, Gold remains bullish. The focus is on $1875.7, Jan 29 high. Oil is off recent highs. Brent (N1) focus is on the psychological $70.00 level that was probed yesterday. A clear break would open and $71.75, Jan 8 2020 high (cont). Key short-term support is $66.48, May 13 low. WTI bulls are eyeing the key resistance at $67.29, Mar 8 high despite the recent pullback. Key near-term support is at $63.09, May 3 low

- In the FI space, Bunds (M1) have traded lower this morning and cleared support at 168.59, May 13 low. This confirms a resumption of the underlying downtrend and opens 168.09, 0.764 projection of the Jan 27 - Feb 25 - Mar 25 price swing. Near-term risk in Gilts (M1) is still skewed to the downside. The key support and bear trigger is 126.79, Mar 18 low. {IT} BTPs (M1) remain in a clear downtrend. The focus is on 144.16, 1.236 projection of the Feb 12 - 26 - Mar 11 price swing.

EQUITIES: Lower across the board

- Japan's NIKKEI down 362.39 pts or -1.28% at 28044.45 and the TOPIX down 12.5 pts or -0.66% at 1895.24

- China's SHANGHAI closed down 18.049 pts or -0.51% at 3510.965

- German Dax down 204.13 pts or -1.33% at 15184.71, FTSE 100 down 76.4 pts or -1.09% at 6959.53, CAC 40 down 65.82 pts or -1.04% at 6290.28 and Euro Stoxx 50 down 51.97 pts or -1.3% at 3954.25.

- Dow Jones mini down 220 pts or -0.65% at 33780, S&P 500 mini down 33.25 pts or -0.81% at 4090.75, NASDAQ mini down 153 pts or -1.16% at 13061.

COMMODITIES: Levels update: Copper and oil lead the falls

- WTI Crude down $1.27 or -1.94% at $64.21

- Natural Gas down $0.02 or -0.53% at $2.996

- Gold spot down $11.75 or -0.63% at $1857.68

- Copper down $10.8 or -2.29% at $462

- Silver down $0.5 or -1.79% at $27.6949

- Platinum down $12.78 or -1.05% at $1210.42

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.